A Depositary Receipt (DR) is a negotiable financial instrument that is issued by a bank and represents a specific number of shares in a foreign company that is traded on a domestic stock exchange. The DR enables investors to invest in foreign companies without having to deal with cross-border trading complexities. The primary purpose of a Depositary Receipt is to simplify international investing and provide a mechanism for investors and companies to access and benefit from markets outside their home country. DRs serve as an alternative to directly purchasing the underlying securities in the foreign market and provide a useful means of raising capital for companies. They allow foreign companies to list their shares in other markets and gain exposure to foreign investment. The process of creating a Depositary Receipt involves multiple parties - the company whose shares are being represented, a domestic bank in the company's home country, and a depositary bank in the market where the DR will be listed. The depositary bank purchases shares of the company from the home market, then issues DRs representing these shares in the foreign market. These DRs can then be bought, sold, and traded like any other stock. Depositary banks are responsible for issuing and canceling the DRs. They act as a bridge between the home and foreign markets, dealing with the logistical aspects of the transaction, including regulatory compliance, transaction processing, and record-keeping. They also provide services such as dividend payments in the investor's home currency, corporate actions, and annual reports. American Depositary Receipts are a type of DR that allows companies from outside the U.S. to list their shares on U.S. exchanges or over-the-counter (OTC) market. ADRs allow U.S. investors to invest in these foreign companies without the complications of dealing with foreign currencies and foreign stock exchanges. Global Depositary Receipts are commonly issued by international banks and are often listed on exchanges in Europe, like the London Stock Exchange. GDRs allow a company to access investors in several different markets simultaneously, providing an efficient way for companies to raise capital globally. Primarily issued by banks based in Europe, EDRs signify a fixed number of shares belonging to a company outside Europe. They find their place on European exchanges, simplifying the process for European investors to place funds in foreign companies without needing to navigate the intricate workings of overseas equity markets. Investing in DRs enables investors to gain exposure to foreign markets without dealing with cross-border transactions or currency exchange complexities. This opens up new opportunities for diversification. DRs simplify the process of buying, holding, and selling shares in foreign companies, as they eliminate the need to understand foreign trading practices or deal with time zone differences. Investors receive dividends from the foreign company in their home currency, which are converted by the depositary bank. This removes the hassle of currency conversion for the investor. DRs are subject to the regulatory requirements of the market in which they are traded. This provides a level of transparency and protection for investors that may not exist in the foreign company's home market. While trading in the currency of the investor's home country simplifies transactions, it does not entirely remove the currency risk. If the foreign currency weakens against the investor's home currency, the value of the DR can decline. This foreign exchange risk is inherent in any international investment. Investing in a foreign company means exposure to the political and economic conditions of that country. Political instability, regulatory changes, or economic downturns in the foreign country can negatively affect the value of the DR. Typically, investors in DRs do not have voting rights in the foreign company, or if they do, these rights might be limited. This lack of control over corporate decisions can be a downside for some investors. Some countries withhold taxes on dividends before they are paid out to the investor. While some or all of this tax may be recoverable, the process can be complicated and time-consuming. Changes in regulations both in the home country and the foreign country can impact the DR. For example, the foreign country might impose new restrictions on capital outflows, or the home country might tighten rules around foreign investments. While many DRs have good liquidity, some may be less frequently traded, especially those of smaller or less well-known companies. This can make it harder to buy or sell the DR without impacting its price. There may be additional fees associated with investing in DRs. These can include depositary bank fees, foreign transaction fees, and others, which can eat into the overall return on investment. Before investing, it's crucial to understand what DRs are, how they work, and the associated risks. This includes knowing how DRs are priced, traded, and how dividends are paid out. Thoroughly research the company issuing the DR and its home country. This involves evaluating the company's financial performance, growth potential, competitive positioning, and governance standards. The political, economic, and regulatory environment of the home country should also be assessed, as these factors can significantly impact the company's performance and, hence, the DR's value. Investing in DRs introduces additional risks, including currency risk and country-specific risk. Ensure that these align with your risk tolerance and investment goals. Currency risk is a significant factor when investing in DRs. Keep an eye on foreign exchange rates, as changes can affect the value of your investments. The performance of DRs can be influenced by various factors, including changes in the issuing company's financial performance, geopolitical events, and fluctuations in exchange rates. Regularly monitor these factors and be ready to adjust your investment strategy as needed. If you're new to international investing, consider seeking advice from a financial advisor. They can guide you through the process, help you understand the risks involved, and ensure your investments align with your financial goals. Depositary Receipts serve as a valuable tool for investors and companies to access foreign markets and simplify international investing. They provide a means for investors to gain exposure to foreign companies without dealing with the complexities of cross-border trading, foreign currencies, and foreign stock exchanges. They also offer a convenient way for companies to raise capital globally by listing their shares in other markets. DRs, such as American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), and European Depositary Receipts (EDRs), cater to specific market needs and allow investors to diversify their portfolios. While there are several benefits associated with investing in DRs, it is important to consider the drawbacks and associated risks. Foreign exchange risk, political risk, lack of voting rights, dividend withholding tax, regulatory risk, lower liquidity, and additional fees are factors that investors should be aware of. It is crucial for investors to understand the basics of DRs, conduct thorough research on the issuing company and its home country, assess their risk tolerance, monitor investments regularly, and seek professional advice if needed.What Is a Depositary Receipt?

How Depositary Receipts Work

Creation Process

Role of Depositary Banks

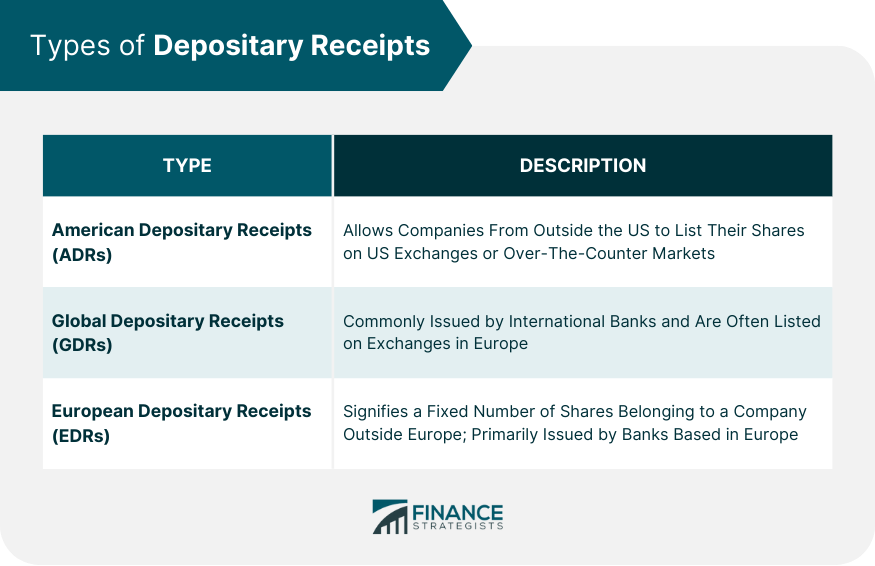

Types of Depositary Receipts

American Depositary Receipts (ADRs)

Global Depositary Receipts (GDRs)

European Depositary Receipts (EDRs)

Benefits of Investing in Depositary Receipts

Access to Foreign Markets

Simplified Transactions

Dividend Payments

Transparency

Drawbacks of Depositary Receipts

Foreign Exchange Risk

Political Risk

Lack of Voting Rights

Dividend Withholding Tax

Regulatory Risk

Lower Liquidity

Additional Fees

Tips for Investing in Depositary Receipts

Understand the Basics

Research the Company and Home Country

Assess Your Risk Tolerance

Keep an Eye on Foreign Exchange Rates

Monitor Your Investments Regularly

Seek Professional Advice

Final Thoughts

Depositary Receipt FAQs

The primary purpose of a Depositary Receipt is to simplify international investing and provide a mechanism for investors and companies to access and benefit from markets outside their home country.

Depositary Receipts are created through a process involving multiple parties, including the company whose shares are being represented, a domestic bank in the company's home country, and a depositary bank in the market where the DR will be listed. The depositary bank purchases shares of the company from the home market and then issues DRs representing these shares in the foreign market. These DRs can be bought, sold, and traded like any other stock in the foreign market.

There are different types of Depositary Receipts, including American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), and European Depositary Receipts (EDRs). ADRs allow foreign companies to list their shares on U.S. exchanges, GDRs are commonly issued by international banks and listed on European exchanges, and EDRs are issued by European banks to represent shares in non-European companies traded on European stock exchanges.

Investing in DRs offers several benefits, including access to foreign markets without cross-border complexities, simplified transactions in foreign companies, dividend payments in the investor's home currency, increased transparency through adherence to regulatory requirements, and opportunities for portfolio diversification.

Some risks associated with investing in DRs include foreign exchange risk due to fluctuations in currency values, political risk related to the stability of the foreign country, limited or no voting rights for investors, potential dividend withholding tax imposed by some countries, regulatory risk arising from changes in regulations, lower liquidity for certain DRs, and additional fees that can impact the overall return on investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.