Systematic risk is an essential aspect of investing that every investor should understand. It refers to the inherent risks that affect the entire market or a broad segment of it and cannot be eliminated through diversification. Systematic risk, also known as market risk, refers to the potential for an investor to experience losses due to factors that affect the overall performance of financial markets. This type of risk is inherent in all investments and cannot be mitigated through diversification alone. Systematic risk impacts the entire market or a broad segment of it, making it an essential consideration for all investors. Understanding and managing systematic risk is critical for investors because it can have a significant impact on investment returns. Systematic risk is distinct from unsystematic risk, which refers to the risks specific to individual investments or sectors. Unsystematic risk can be reduced or eliminated through diversification, while systematic risk remains present even in a well-diversified portfolio. Systematic risk arises from various factors that affect financial markets as a whole. These factors can be broadly categorized into economic, political, and market factors. Each category comprises several specific sources of risk that investors should be aware of when assessing their exposure to systematic risk. Economic factors are a significant source of systematic risk, as they can impact the overall health and growth of the economy, leading to widespread effects on financial markets. Interest rates significantly impact the cost of borrowing and the attractiveness of various investment options. Changes in interest rates can affect the performance of stocks, bonds, and other investments, thereby impacting the broader financial market. Inflation is the rate at which the general level of prices for goods and services is rising, eroding purchasing power over time. High inflation can adversely affect financial markets by reducing the real return on investments and influencing interest rate decisions by central banks. Gross Domestic Product (GDP) growth is a measure of economic expansion or contraction. Changes in GDP growth can have widespread implications for financial markets, as they can affect corporate earnings, consumer spending, and investment decisions. Political factors are another source of systematic risk, as they can influence financial markets through various channels, such as government policies, regulatory changes, and political instability. Government policies, such as fiscal and monetary policies, can significantly impact financial markets. Tax rates, government spending, and monetary policy changes can influence market conditions and the performance of various investments. Changes in regulations can also impact financial markets by altering the business environment for various industries and sectors. Regulatory changes can create uncertainties and additional costs for businesses, potentially affecting their profitability and investment attractiveness. Political instability, such as social unrest, changes in leadership, or geopolitical conflicts, can create uncertainties in financial markets. These uncertainties can lead to market volatility and negatively impact investment performance. Market factors are another source of systematic risk, encompassing aspects of the financial markets themselves that can impact investment performance. Market volatility refers to fluctuations in asset prices and can be a significant source of systematic risk. Market sentiment refers to the overall attitude of investors toward a particular market or asset class. It can be influenced by various factors, such as economic data, news events, and investor psychology. Market sentiment can drive market trends and contribute to systematic risk, as positive or negative sentiment can lead to widespread buying or selling pressure. Market concentration refers to the degree to which a small number of companies or sectors dominate a market or index. High market concentration can increase systematic risk, as it can lead to a more significant impact on the overall market if the dominant companies or sectors underperform. To manage systematic risk effectively, it is essential to measure it accurately. Several methods quantify systematic risk, including the beta coefficient, value at risk (VaR), and conditional value at risk (CVaR). Each method provides a different perspective on the potential impact of systematic risk on an investment portfolio. The beta coefficient is a widely used measure of systematic risk that compares an individual security or portfolio's volatility to the broader market's volatility. A beta greater than 1 indicates that the security or portfolio is more sensitive to market movements, while a beta less than 1 suggests lower sensitivity. The beta coefficient can help investors gauge their exposure to market risk and make adjustments to their portfolios accordingly. Value at risk (VaR) is a statistical measure that estimates the maximum loss an investment portfolio could incur over a specified period with a given probability. VaR is widely used by financial institutions and investment managers to quantify their exposure to market risk and set appropriate risk limits. VaR provides a single number that captures the potential impact of various systematic risk factors on a portfolio. Conditional value at risk (CVaR), also known as expected shortfall, is an extension of VaR that measures the expected loss in the worst-case scenarios beyond the VaR threshold. CVaR provides a more comprehensive assessment of the tail risk associated with extreme market events. It can be useful for investors seeking to manage their exposure to systematic risk more effectively. While systematic risk cannot be entirely eliminated, there are several strategies investors can employ to manage it effectively. These strategies include diversification, hedging, and the use of risk-adjusted performance measures. Diversification is a key strategy for managing systematic risk in portfolio construction. It involves spreading investments across various asset classes, geographic regions, and sectors to reduce the impact of any single source of risk. Asset allocation involves dividing a portfolio's investments among different asset classes, such as stocks, bonds, and cash. A well-balanced asset allocation can help manage systematic risk by reducing the portfolio's sensitivity to market fluctuations. Geographic diversification involves investing in assets from different countries or regions. This strategy can help mitigate systematic risk by reducing the portfolio's exposure to risks specific to a particular geographic area, such as political instability or economic downturns. Sector diversification entails spreading investments across various industry sectors. This approach can help manage systematic risk by reducing the impact of sector-specific risks on the portfolio, such as regulatory changes or technological disruptions. Hedging strategies can be employed to protect a portfolio against specific sources of systematic risk. Common hedging instruments include derivatives, options, and futures. Derivatives are financial instruments derived from an underlying asset's value, such as stocks, bonds, or commodities. Derivatives can be used to hedge against various types of risk, including interest rate, currency, and market risk. By entering into a derivative contract, investors can mitigate the potential impact of systematic risk factors on their portfolios. Options are a type of derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. Options can be used to hedge against market risk by providing a level of protection against adverse price movements in the underlying asset. Futures are standardized contracts to buy or sell a specific asset at a predetermined price on a future date. Futures can be used to hedge against various systematic risks, such as commodity price fluctuations or interest rate changes. By entering into a futures contract, investors can lock in a price for the underlying asset, reducing their exposure to market volatility. Risk-adjusted performance measures, such as the Sharpe Ratio, Sortino Ratio, and Treynor Ratio, can help investors assess the effectiveness of their systematic risk management strategies. These measures compare the risk-adjusted return of a portfolio to a benchmark, providing valuable insights into the portfolio's performance relative to its level of risk. The Sharpe Ratio is a widely used risk-adjusted performance measure that evaluates a portfolio's excess return per unit of risk, as measured by standard deviation. A higher Sharpe Ratio indicates better risk-adjusted performance and suggests that the portfolio's systematic risk management strategies have been effective. The Sortino Ratio is similar to the Sharpe Ratio but focuses on downside risk, as measured by the standard deviation of negative returns. This measure is particularly useful for investors concerned about the potential for large losses in their portfolios. It assesses the effectiveness of systematic risk management strategies in minimizing downside risk. The Treynor Ratio evaluates a portfolio's excess return per unit of systematic risk, as measured by the beta coefficient. Like the Sharpe and Sortino Ratios, a higher Treynor Ratio indicates better risk-adjusted performance and suggests that the portfolio's systematic risk management strategies have been successful. Different investment strategies may have varying levels of exposure to systematic risk. These strategies include passive investing, active investing, and alternative investments. Passive investing involves tracking a market index or a specific segment of the market, usually through index funds or exchange-traded funds (ETFs). Passive investing can provide broad exposure to systematic risk as it seeks to replicate the overall market's performance or a market segment. Index funds are mutual funds that aim to replicate the performance of a specific market index. Investing in index funds can gain diversified exposure to a broad range of assets, which can help manage systematic risk. Exchange-traded funds (ETFs) are similar to index funds but trade on stock exchanges like individual stocks. ETFs provide investors with a convenient way to access diversified portfolios and manage systematic risk. Active investing involves selecting individual securities or actively managed funds to outperform the market. Active investing strategies can have varying degrees of exposure to systematic risk, depending on the investment approach and the specific securities chosen. Security selection involves identifying individual stocks, bonds, or other assets that are expected to outperform the market. By carefully selecting securities, active investors can potentially mitigate some sources of systematic risk. Market timing is an active investing strategy that involves attempting to predict market movements and making investment decisions accordingly. This approach can be risky, as it may expose investors to additional systematic risk if market predictions prove to be incorrect. Alternative investments, such as real estate, private equity, and hedge funds, can offer additional diversification and potential risk mitigation benefits. These investments can have different risk-return profiles than traditional investments, potentially helping manage systematic risk. Real estate investments can provide diversification benefits and a potential hedge against inflation. Investing in real estate, either directly or through real estate investment trusts (REITs), can potentially reduce their exposure to systematic risk factors affecting traditional financial markets. Private equity investments involve investing in privately held companies or buying out public companies and taking them private. These investments can offer diversification benefits and the potential for higher returns, as they are not directly correlated with public markets. However, private equity investments can also carry higher risks and illiquidity compared to public market investments. Hedge funds are investment vehicles that employ a range of strategies to generate returns, often using leverage, derivatives, and short-selling techniques. Some hedge fund strategies aim to minimize exposure to systematic risk, providing investors with a potential risk-mitigation tool. However, hedge funds can also carry significant risks, fees, and liquidity constraints. Understanding systematic risk is essential for investors, as it can significantly impact investment performance and long-term financial success. Being aware of the various sources of systematic risks, such as economic, political, and market factors, enables investors to make more informed decisions and better manage their exposure to these risks. Incorporating systematic risk management strategies into investment decisions is crucial for achieving a well-balanced portfolio. By employing techniques such as diversification, hedging, and risk-adjusted performance measurement, investors can effectively mitigate the potential impact of systematic risk on their portfolios and enhance their overall investment performance. Navigating the complexities of systematic risk management can be challenging for individual investors. Consider seeking wealth management professionals' expertise to help you better understand systematic risk, implement effective risk management strategies, and build a robust investment portfolio tailored to your unique financial goals and risk tolerance.What Is Systematic Risk?

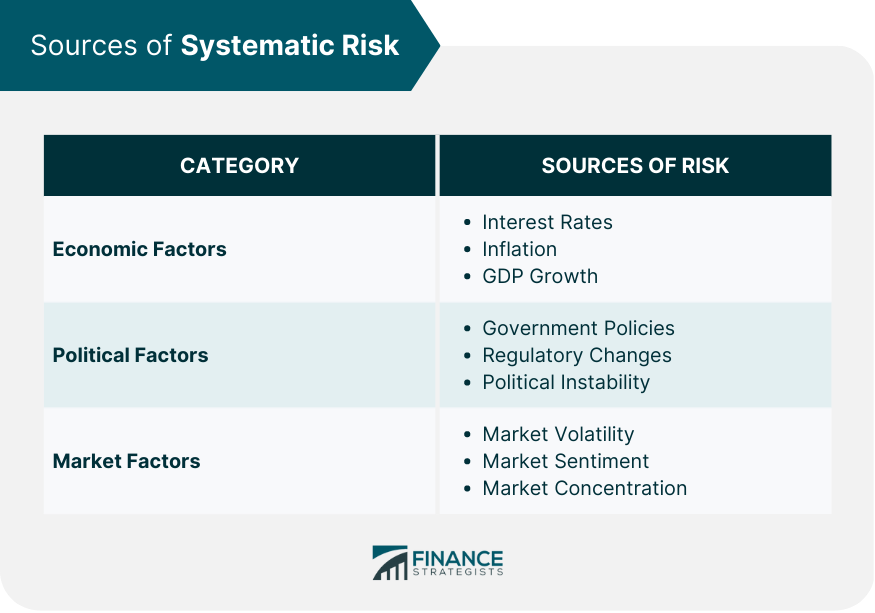

Sources of Systematic Risk

Economic Factors

Interest Rates

Inflation

GDP Growth

Political Factors

Government Policies

Regulatory Changes

Political Instability

Market Factors

Market Volatility

Market Sentiment

Market Concentration

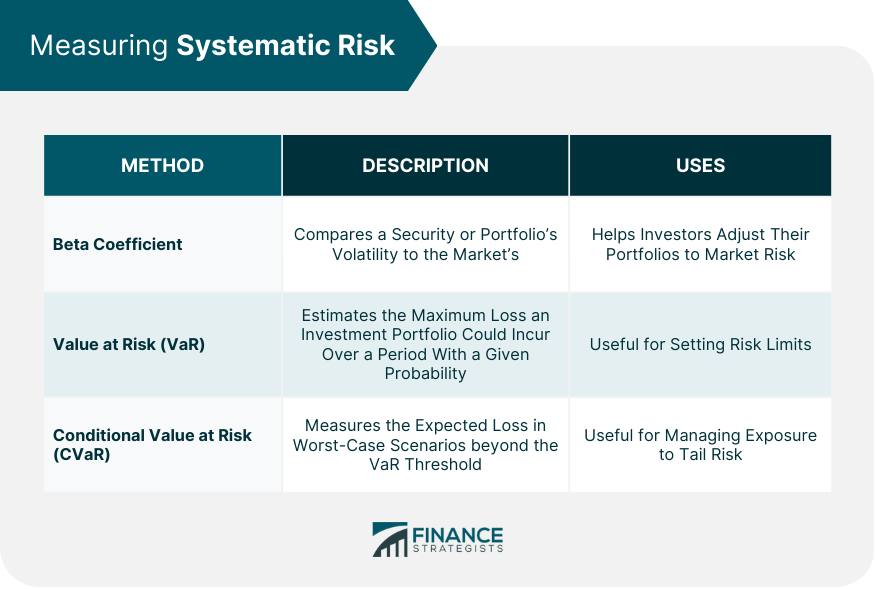

Measuring Systematic Risk

Beta Coefficient

Value at Risk (VaR)

Conditional Value at Risk (CVaR)

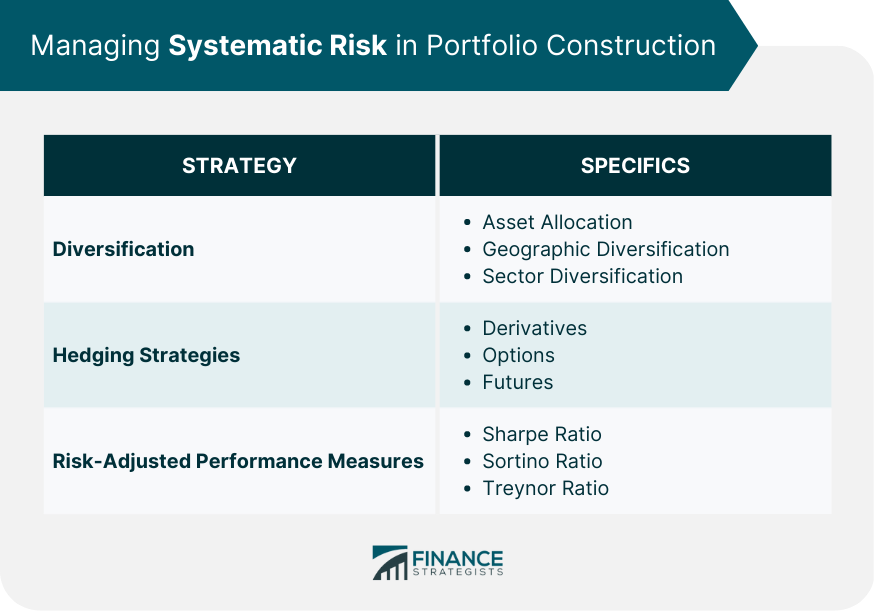

Managing Systematic Risk in Portfolio Construction

Diversification

Asset Allocation

Geographic Diversification

Sector Diversification

Hedging Strategies

Derivatives

Options

Futures

Risk-Adjusted Performance Measures

Sharpe Ratio

Sortino Ratio

Treynor Ratio

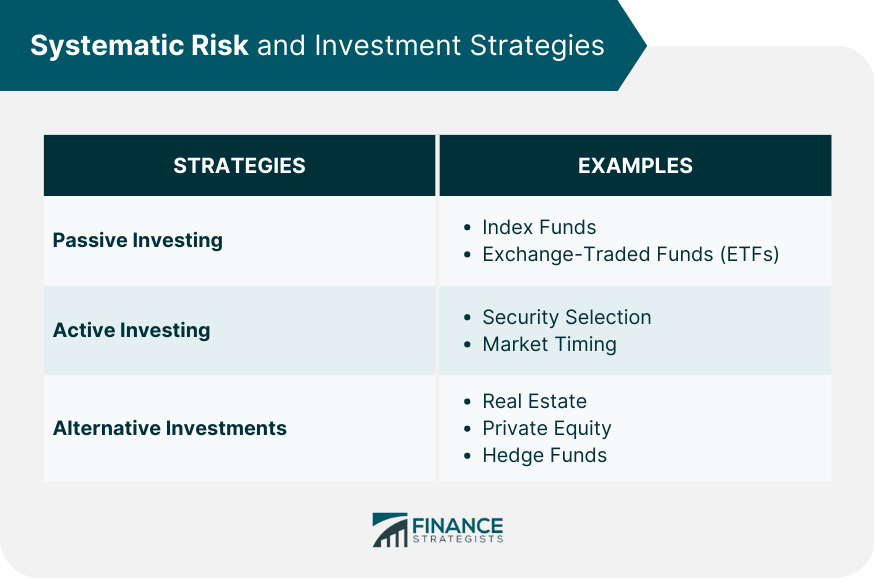

Systematic Risk and Investment Strategies

Passive Investing

Index Funds

Exchange-Traded Funds (ETFs)

Active Investing

Security Selection

Market Timing

Alternative Investments

Real Estate

Private Equity

Hedge Funds

Final Thoughts

Systematic Risk FAQs

Systematic risk refers to the inherent risk that affects the entire market or a broad segment of it due to factors such as economic, political, or market conditions. Understanding systematic risk is crucial for investors because it can significantly impact their investment performance and long-term financial success.

Diversification helps manage systematic risk by spreading investments across various asset classes, geographic regions, and industry sectors. This reduces the impact of any single source of risk on the portfolio, making it more resilient to market fluctuations and potential downturns.

Common techniques used to measure systematic risk include the beta coefficient, value at risk (VaR), and conditional value at risk (CVaR). These methods help quantify the potential impact of systematic risk on an investment portfolio, allowing investors to assess their exposure and adjust their risk management strategies accordingly.

Alternative investments, such as real estate, private equity, and hedge funds, can provide additional diversification benefits and potentially help manage systematic risk. These investments often have different risk-return profiles compared to traditional investments, which can reduce the overall portfolio's exposure to systematic risk factors affecting financial markets.

Systematic risk cannot be entirely eliminated, as it represents the inherent risk that affects the entire market or a broad segment of it. However, investors can employ various strategies, such as diversification, hedging, and risk-adjusted performance measurement, to manage their exposure to systematic risk effectively and improve their overall investment performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.