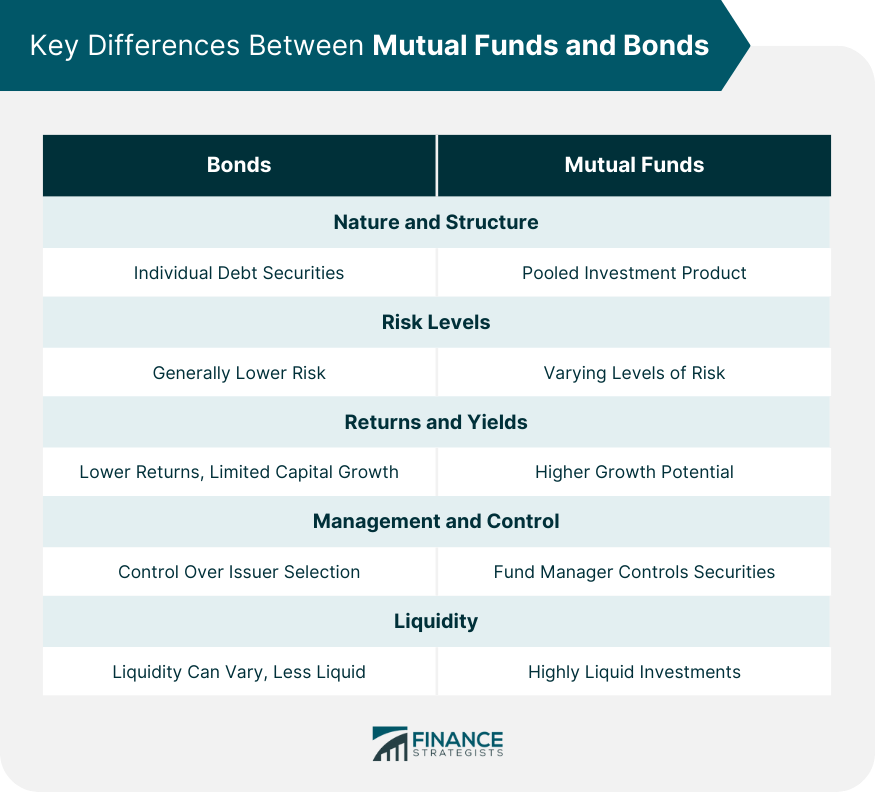

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, money market instruments, and other assets. They are administered by professional managers who make investment decisions based on the fund's objectives. On the other hand, bonds are fixed-income instruments that represent a loan made by an investor to a borrower, typically corporations or governments. Bonds are used for operations and to finance projects. Owners of bonds are debtholders, or creditors, of the issuer. Bonds are typically part of assets held within a mutual fund. Mutual funds and bonds play significant roles in a well-rounded investment strategy. Mutual funds, due to their innate diversification, allow investors to mitigate risk while participating in a wide array of market sectors. Bonds, on the other hand, offer a steady income stream and are considered lower risk than equities, making them an excellent tool for conservative investors or those nearing retirement. Bonds are individual debt securities, with the investor effectively loaning money to the bond issuer in return for regular interest payments and the return of the principal amount at maturity. Conversely, a mutual fund is a pooled investment product that can contain hundreds or thousands of different securities, potentially including bonds. Bonds are generally considered lower risk than mutual funds. The risk in bond investing is that the issuer will default and not make the scheduled interest or principal payments. However, this risk is typically quite low, especially for government and high-grade corporate bonds. Mutual funds, on the other hand, carry varying levels of risk depending on their holdings. A fund specializing in high-growth stocks will be riskier than one focused on government bonds. Still, even a conservative mutual fund will usually be more risky than an individual bond due to the potential for broader market fluctuations. The returns from bonds are typically lower than those from mutual funds. Bondholders receive regular interest payments, and the return of the principal upon maturity, but there is limited scope for capital growth. Mutual funds, particularly those focused on stocks, have higher growth potential. While they may also deliver income through dividends, the primary source of returns for many mutual funds is capital appreciation. When you buy a bond, you have control over which issuer you lend to and, thus, can manage your exposure to different types of risk. However, in a mutual fund, the fund manager controls which securities to buy or sell. While this means you have less control, it also means you can leverage the expertise of professional managers. Mutual funds can generally be bought or sold on any business day at the current net asset value, making them highly liquid investments. In contrast, while bonds can be sold before maturity, their liquidity can vary greatly depending on the type of bond, the issuer, the time to maturity, and market conditions. Selling a bond before maturity may result in a price higher or lower than the purchase price. Are you investing for long-term growth to perhaps fund a child's education or your retirement, or are you more focused on generating income now? Mutual funds can be an excellent vehicle for long-term growth. Certain mutual funds, particularly those focusing on stocks, have the potential to deliver robust returns over an extended period. However, these may also come with increased volatility, meaning that your investment's value may fluctuate significantly over the short term. On the other hand, if your objective is to generate regular income, bonds may be a more suitable choice. When you invest in bonds, you are essentially lending money to the bond issuer. In return, you receive interest payments over the life of the bond, providing a steady income stream. The certainty of this income can be especially appealing if you're in or nearing retirement, or if you rely on your investments for current income. All investments carry some level of risk, but the degree varies substantially between different types of investments. Mutual funds carry a range of risk levels, depending largely on their underlying investments. A mutual fund investing primarily in high-growth but volatile stocks will carry more risk than a fund investing mainly in stable, blue-chip companies. However, even the most conservative mutual funds are likely to be more risky than most bonds, simply because they are exposed to market fluctuations. Bonds, in contrast, are generally considered safer investments. There is a risk that the bond issuer may default on its debt, but this is relatively rare, especially for government and high-quality corporate bonds. Nonetheless, bonds are not entirely without risk. They are sensitive to interest rate changes—when rates rise, bond prices typically fall. If your investment horizon is long, you may be able to tolerate more risk in the hope of achieving higher returns. In such a scenario, mutual funds (especially stock-focused funds) could potentially provide substantial growth over time. In case you have a shorter investment horizon, or if you know that you will need a specific amount of money at a particular future date (for example, to pay for college tuition), bonds may be a more appropriate choice. Bonds have set maturity dates when the principal amount invested is returned. Planning your bond investments so that they mature when you need the funds can be an effective strategy. The interest income from bonds is usually taxed as ordinary income, potentially at a high rate. However, certain types of bonds, such as municipal bonds, may be exempt from federal and possibly state and local income tax, making them particularly attractive to investors in high tax brackets. On the other hand, mutual funds can potentially offer more opportunities for tax-efficient investing. If the fund invests in stocks that pay qualified dividends, or if it sells a stock that it has held for more than a year at a profit, the income will be eligible for a lower tax rate. In addition, mutual funds offer the ability to use strategies such as tax-loss harvesting to offset gains in other parts of your portfolio. However, it's important to be aware that you'll owe taxes on any distributions you receive, even if you reinvest them in additional shares. In terms of mutual funds and bonds, diversification means not only investing in both but also diversifying within each asset class. For instance, mutual funds can be diversified by investing in different types of funds—such as equity funds, bond funds, sector funds, and index funds—to spread the risk associated with different market segments. Similarly, bond investments can be diversified by investing in different types of bonds, including government bonds, corporate bonds, and municipal bonds, each of which has a different risk level and return potential. It's also essential to consider international diversification, investing in both domestic and international mutual funds and bonds. This strategy can help cushion your portfolio against regional or country-specific economic downturns. Investing is not a set-it-and-forget-it activity. The financial markets are dynamic, with asset values constantly changing in response to various factors. As such, it's important to regularly review and adjust your portfolio as needed. For instance, if the mutual funds in your portfolio have performed well, you might find that they now make up a higher percentage of your portfolio than you initially intended, exposing you to more risk. In this case, you would need to rebalance your portfolio by selling some of your mutual fund shares and buying bonds, bringing you back to your intended asset allocation. Conversely, if the value of your bond investments has increased relative to your mutual funds, you might find that your portfolio has become overly conservative, potentially limiting your growth. In this case, you would need to rebalance by selling some bonds and buying mutual funds. Regular monitoring also involves staying informed about market trends and changes in the broader economic environment, as these can affect the performance of your investments. If significant changes occur, you may need to adjust your investment strategy accordingly. Financial advisors bring expertise and experience to the table, providing guidance on asset allocation, risk management, tax planning, and other critical aspects of investment management. When incorporating mutual funds and bonds into your investments, a financial advisor can help you assess your financial goals, risk tolerance, and investment horizon, and design a portfolio that aligns with these parameters. They can also provide valuable insights into market trends, the performance of different mutual funds and bonds, and the potential impacts of economic developments on your investments. Moreover, they can take on the task of regularly reviewing and adjusting your portfolio, freeing you from the need to monitor the markets continuously. However, it's essential to remember that financial advisors charge for their services, and the fees can vary widely. It's crucial to understand the fee structure and ensure that the benefits you receive outweigh the costs. Mutual funds and bonds are both important components of an investment strategy, offering distinct features and benefits. Mutual funds provide diversification and potential for higher returns through capital appreciation, making them suitable for long-term growth goals. Bonds, on the other hand, offer steady income streams and lower risk, making them ideal for generating regular income, especially for conservative investors or those nearing retirement. The key differences between the two lie in their nature and structure, risk levels, returns and yields, management and control, liquidity, and tax considerations. When deciding between mutual funds and bonds, investors should consider their financial goals, risk tolerance, investment time horizon, and tax implications. Additionally, investors should diversify their portfolio by investing in different types of funds and bonds, regularly monitor and adjust their investments, and consider seeking professional financial advice to optimize their investment strategy. By carefully evaluating these factors, investors can make informed decisions to build a balanced and tailored investment portfolio.Overview of Mutual Funds and Bonds

Key Differences Between Mutual Funds and Bonds

Nature and Structure

Risk Levels

Returns and Yields

Management and Control

Liquidity

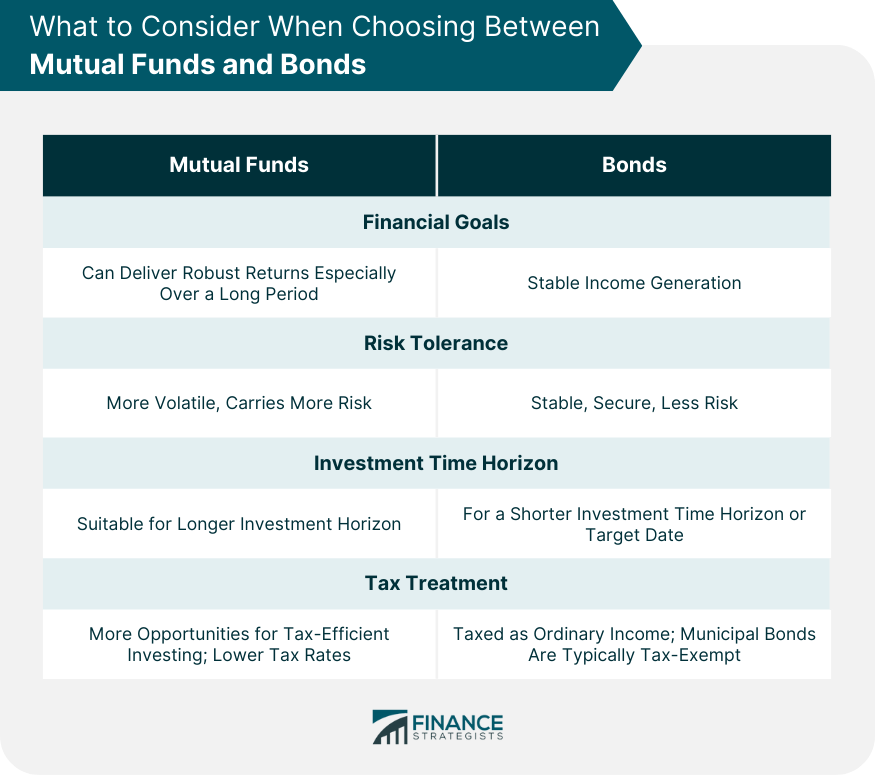

What to Consider When Choosing Between Mutual Funds and Bonds

Financial Goals

Risk Tolerance

Investment Time Horizon

Tax Treatment

Tips for Including Mutual Funds and Bonds Into Your Portfolio

Diversification

Regular Monitoring and Adjustments

Seeking Professional Financial Advice

Final Thoughts

Mutual Funds vs Bonds FAQs

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or both. Bonds, on the other hand, are fixed-income securities that represent loans made by investors to the issuer, typically governments or corporations.

Mutual funds, especially those focused on stocks, have the potential to deliver higher returns over the long term due to market fluctuations. Bonds, on the other hand, provide fixed interest payments and a return of the principal amount at maturity, offering a more predictable but generally lower return compared to stocks.

Bonds are generally considered safer investments compared to mutual funds. While bonds carry a risk of default by the issuer, government and high-quality corporate bonds have a relatively low default risk. Mutual funds, however, are exposed to market fluctuations and carry varying levels of risk depending on their underlying investments.

Bonds are typically more suitable for generating regular income. When you invest in bonds, you receive interest payments over the life of the bond, providing a steady income stream. Mutual funds, especially those focused on growth stocks, may not provide consistent income as their returns depend on market performance.

The interest income from bonds is usually taxed as ordinary income, potentially at a high rate. However, certain types of bonds, such as municipal bonds, may be exempt from federal and possibly state and local income tax. Mutual funds can offer tax advantages such as lower tax rates on qualified dividends and the ability to use strategies like tax-loss harvesting. Distributions from mutual funds, even if reinvested, are subject to taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.