Liquid investments are financial assets that can be readily bought or sold in the market without causing significant price fluctuations. These investments offer investors the ability to access their funds quickly and with minimal loss in value, which can be particularly beneficial during periods of market uncertainty or personal financial needs. Liquidity plays a crucial role in investing, as it allows investors to move funds between investments, meet unexpected expenses, or take advantage of new investment opportunities. By including liquid investments in a portfolio, investors can better manage their cash flow, reduce risk, and create a more balanced and diversified investment strategy. Liquid investments serve several purposes in a portfolio, including providing income, capital preservation, and diversification. These assets can also act as a buffer against market volatility and economic downturns, helping to stabilize a portfolio's overall performance. When choosing liquid investments, factors such as risk tolerance, time horizon, financial goals, and overall investment strategy should be taken into account. It's essential to carefully evaluate the potential risks and returns associated with each asset class to determine the most appropriate investments for your specific needs. There are several types of liquid investments that investors can consider incorporating into their portfolios: Savings accounts are among the most liquid investments available. They typically offer a modest interest rate and are insured by the Federal Deposit Insurance Corporation (FDIC) up to a certain limit, making them a safe option for storing cash. Money market accounts are similar to savings accounts but typically offer slightly higher interest rates. These accounts invest in short-term, low-risk securities and are also insured by the FDIC up to a certain limit. Certificates of Deposit (CDs) are time deposits that pay a fixed interest rate over a specified term. While less liquid than savings and money market accounts due to early withdrawal penalties, they can still be considered relatively liquid investments if the term is short. Treasury bills are short-term debt securities issued by the U.S. government. They are considered low-risk investments due to their backing by the federal government and offer a modest return. Commercial paper is a short-term debt instrument issued by corporations to finance their short-term obligations. These investments are typically low-risk but may be subject to credit risk depending on the issuer's financial stability. Short-term municipal bonds are debt securities issued by state and local governments. These investments are generally low-risk and offer the added benefit of being exempt from federal income taxes. Equity Exchange-Traded Funds (ETFs) invest in a diversified portfolio of stocks and provide investors with exposure to various sectors, industries, and market capitalizations. These investments offer liquidity through the ease of trading on stock exchanges. Fixed-income ETFs invest in bonds and other debt securities, providing investors with exposure to different types of fixed-income assets. These investments offer liquidity through their ability to be traded on stock exchanges. Commodity ETFs provide investors with exposure to various commodities, such as precious metals, energy, and agriculture products. These investments offer liquidity through their ability to be traded on stock exchanges. Blue-chip stocks are shares of well-established, financially stable companies with a proven profitability and reliability track record. These stocks tend to be highly liquid due to their broad market acceptance and significant trading volume. Dividend-paying stocks are shares of companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. These stocks provide income to investors and are generally considered liquid investments due to their popularity among income-seeking investors. Money market mutual funds invest in short-term, high-quality debt securities, such as treasury bills, commercial paper, and repurchase agreements. These funds aim to maintain a stable net asset value (NAV) and provide investors with liquidity and capital preservation. Short-term bond funds invest in fixed-income securities with maturities typically ranging from one to three years. These funds offer liquidity and a higher yield than money market funds while maintaining a relatively low-risk profile. Real Estate Investment Trusts (REITs) are companies that own, operate or finance income-producing real estate properties. They trade on stock exchanges, offering investors liquidity and the potential for income through dividend payments. Several factors can impact the liquidity of investments, including: Market conditions, such as economic growth, interest rates, and investor sentiment, can affect specific investments' demand for and liquidity. Higher trading volumes typically indicate increased liquidity, as buying or selling an asset is easier without significantly impacting its price. Investments in economically stable regions or industries are generally more liquid due to their lower risk profile and more predictable performance. Certain investments may be subject to regulatory restrictions or limitations that can impact their liquidity. Investments with shorter time horizons tend to be more liquid, as investors can more easily access their funds without significant penalties or losses in value. Liquid investments offer several advantages, including: Investors can quickly and easily convert liquid investments into cash to meet financial needs or take advantage of new investment opportunities. Including various liquid investments in a portfolio can help spread risk and minimize the impact of market fluctuations on overall performance. Liquid investments tend to have a lower risk profile compared to illiquid assets, making them suitable for conservative investors or those seeking to preserve capital. Liquid investments can provide a cushion during market volatility periods, helping stabilize a portfolio's overall performance. Some liquid investments, such as dividend-paying stocks and fixed-income ETFs, can provide investors with a steady stream of income. Liquid investments offer flexibility, allowing investors to easily adjust their investment strategies and adapt to changing market conditions or personal financial circumstances. Despite their benefits, liquid investments also have some drawbacks: Liquid investments generally offer lower returns compared to illiquid assets, such as real estate or private equity, which can limit the growth potential of a portfolio. The returns on some liquid investments, such as cash and cash equivalents, may need to catch up with inflation, eroding the purchasing power of the invested capital over time. Focusing primarily on liquid investments may result in a short-term investment mindset, potentially causing investors to miss out on long-term growth opportunities. Liquid investments may not provide exposure to high-growth sectors or asset classes, which can limit the potential for significant capital appreciation within a portfolio. To effectively incorporate liquid investments into a portfolio, investors should consider the following factors: Understanding one's financial goals, such as retirement planning, saving for a home, or funding education, can help determine the appropriate allocation to liquid investments. An investor's risk tolerance will play a significant role in deciding the proportion of liquid investments within a portfolio. Conservative investors may prefer a higher allocation to liquid assets, while more aggressive investors may choose to allocate a smaller portion to these investments. The investment time horizon, or the length of time an investor plans to hold an investment, will influence the allocation to liquid investments. Shorter time horizons require a higher allocation to liquid assets, while longer time horizons may allow for a greater focus on illiquid investments with higher growth potential. A well-diversified portfolio should include a mix of liquid and illiquid investments to optimize risk-adjusted returns. Allocating a portion of the portfolio to liquid investments can help provide stability and reduce overall portfolio risk. Periodically reviewing and adjusting the allocation of liquid investments in a portfolio can help ensure that the investment strategy remains aligned with an investor's financial goals, risk tolerance, and time horizon. To make the most of liquid investments, investors should follow these best practices: Investors should carefully research and analyze various liquid investment options to determine their suitability based on financial goals, risk tolerance, and investment strategy. Diversifying within liquid asset classes can help spread risk and enhance the overall performance of a portfolio. Regularly monitoring liquid investments can help investors stay informed about market conditions and make timely adjustments to their investment strategies as needed. An emergency fund should be separate from the main investment portfolio and consist of highly liquid assets, such as cash and cash equivalents, to provide quick access to funds in case of unforeseen financial needs. Investors should periodically review and adjust their liquid investment allocation to ensure it remains aligned with their financial goals, risk tolerance, and time horizon. Consulting with a financial advisor or investment professional can help investors make informed decisions about the most appropriate liquid investments for their unique financial situation. In conclusion, liquid investments play a crucial role in investment portfolios as they offer easy access to funds, diversification, lower risk profile, stability during market volatility, income generation, and flexibility in investment strategies. There are various types of liquid investments such as cash and cash equivalents, marketable securities, exchange-traded funds, stocks, mutual funds, and real estate investment trusts. However, there are also some disadvantages to liquid investments such as lower returns compared to illiquid assets, inflation risk, short-term investment focus, limited exposure to high-growth opportunities, and the need for careful assessment of individual financial goals, risk tolerance, and time horizon. To make the most of liquid investments, investors should conduct thorough research, diversify within asset classes, monitor investments regularly, keep an emergency fund separate, periodically review and adjust allocation, and seek professional advice if necessary. By taking these factors into consideration, investors can incorporate liquid investments into their portfolios effectively and optimize risk-adjusted returns.What Are Liquid Investments?

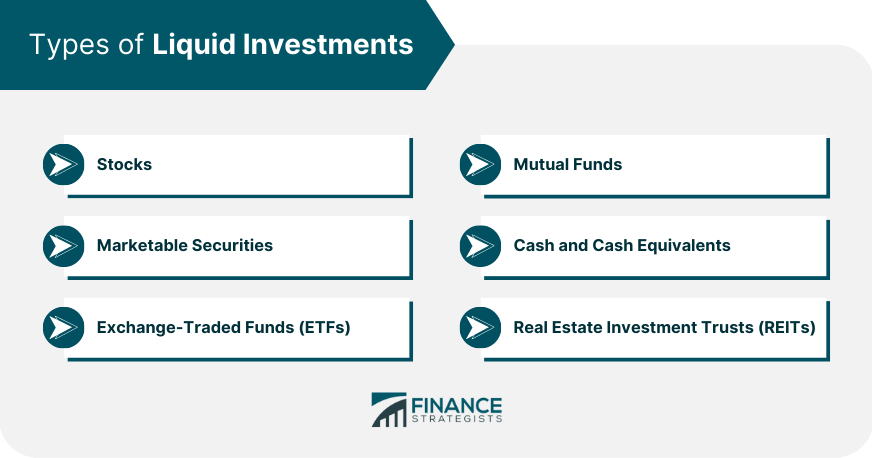

Types of Liquid Investments

Cash and Cash Equivalents

Savings Accounts

Money Market Accounts

Certificates of Deposit (CDs)

Marketable Securities

Treasury Bills

Commercial Paper

Short-term Municipal Bonds

Exchange-Traded Funds (ETFs)

Equity ETFs

Fixed-Income ETFs

Commodity ETFs

Stocks

Blue-Chip Stocks

Dividend-Paying Stocks

Mutual Funds

Money Market Mutual Funds

Short-Term Bond Funds

Real Estate Investment Trusts (REITs)

Factors Affecting Liquidity of Investments

Market Conditions

Trading Volume

Economic Stability

Regulations and Restrictions

Time Horizon

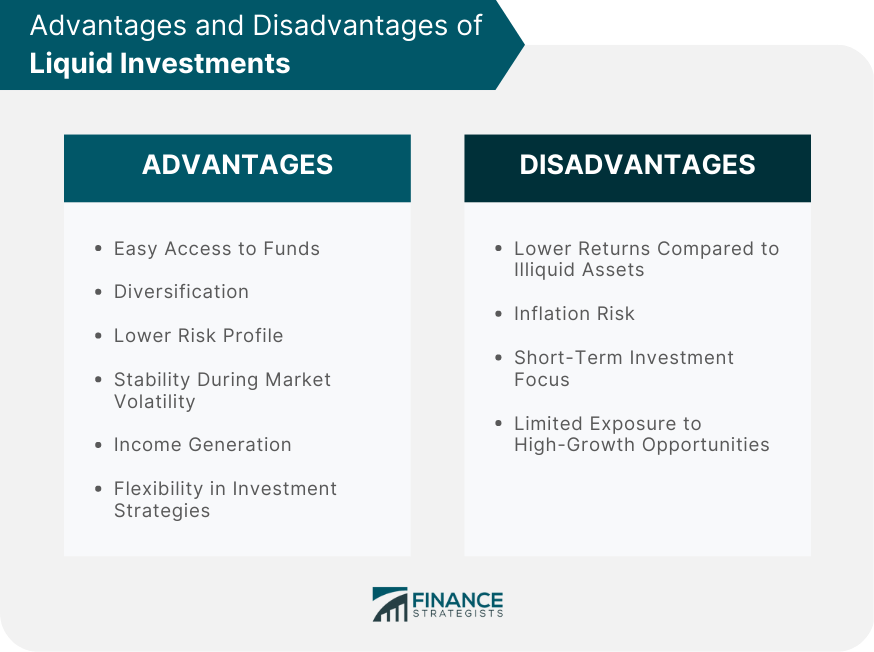

Advantages of Liquid Investments

Easy Access to Funds

Diversification

Lower Risk Profile

Stability During Market Volatility

Income Generation

Flexibility in Investment Strategies

Disadvantages of Liquid Investments

Lower Returns Compared to Illiquid Assets

Inflation Risk

Short-Term Investment Focus

Limited Exposure to High-Growth Opportunities

Assessing the Role of Liquid Investments in a Portfolio

Evaluating Individual Financial Goals

Determining Risk Tolerance

Assessing Time Horizon

Portfolio Diversification Strategies

Rebalancing and Adjusting Allocations

Best Practices for Investing in Liquid Assets

Conduct Thorough Research

Diversify Within Asset Classes

Monitor the Investment Regularly

Keep an Emergency Fund Separate

Review and Adjust Allocation Periodically

Seek Professional Advice, If Necessary

Conclusion

Liquid Investments FAQs

Liquid investments refer to assets that can be easily converted to cash without significant loss of value. Examples include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Liquid investments allow investors to quickly access cash when needed without having to sell assets at a loss or incur significant transaction fees. They also provide a way to diversify a portfolio and manage risk.

Liquid investments are typically actively traded in a public market and have a high trading volume. They are also usually easy to buy and sell, with low transaction costs and minimal restrictions on when or how they can be traded.

Some best practices for investing in liquid assets include conducting thorough research, diversifying within asset classes, monitoring the investment regularly, keeping an emergency fund separate, reviewing and adjusting the allocation periodically. Seeking professional advice is also advisable, if necessary.

No, not all liquid investments are low-risk. While they may be easily traded and converted to cash, the value of liquid investments can still fluctuate widely depending on market conditions and other factors. It's important for investors to carefully consider their risk tolerance and investment objectives when selecting liquid investments for their portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.