An equity fund is a type of mutual fund or exchange-traded fund (ETF) that primarily invests in stocks of publicly traded companies. These funds pool money from multiple investors and use professional management to build a diversified portfolio, aiming to generate returns through capital appreciation, dividends, or both. Equity funds offer investors the opportunity to participate in the performance of a broad range of companies across various industries and sectors. They are managed by professional fund managers who conduct research and analysis to select stocks that they believe have the potential for growth and value appreciation. Large-cap equity funds primarily invest in stocks of large, well-established companies with a market capitalization typically above $10 billion. These companies are generally leaders in their respective industries and have a history of stable earnings and dividend payments. Large-cap equity funds tend to offer lower volatility and more stability compared to mid-cap and small-cap funds, as larger companies are better equipped to withstand economic downturns. They often provide consistent dividend payments, making them attractive to income-seeking investors. However, large-cap funds may experience slower growth and lower capital appreciation potential compared to their smaller counterparts. Mid-cap equity funds invest in companies with a market capitalization typically between $2 billion and $10 billion. These companies are often in the growth phase of their business cycle and have the potential for higher capital appreciation compared to large-cap companies. Mid-cap equity funds can offer higher growth potential and capital appreciation compared to large-cap funds, as they invest in companies with more room for expansion. However, they can also come with higher volatility and risk, as these companies may be more sensitive to economic fluctuations and have less-established track records. Small-cap equity funds invest in companies with a market capitalization typically below $2 billion. These companies are often in the early stages of their business cycle and have the potential for significant growth. Small-cap equity funds can offer the highest growth potential among the three market capitalization categories as they invest in companies with significant room for expansion. However, they also come with the highest risk and volatility, as these companies are more susceptible to economic downturns and may have unproven business models. Sector-specific equity funds focus on a particular industry or sector, such as technology, healthcare, or financial services. These funds allow investors to gain targeted exposure to specific industries they believe will outperform the broader market. Sector-specific equity funds can offer higher growth potential if the targeted sector outperforms the broader market. However, they come with higher risk and volatility, as they lack the diversification benefits of broader market funds. Dividend-paying equity funds primarily invest in stocks of companies that have a history of paying regular dividends. These funds seek to generate income through dividend payments while also aiming for capital appreciation. Dividend-paying equity funds can provide a steady stream of income for investors, making them attractive to those seeking regular payouts. They can also offer lower volatility compared to growth-focused funds, as dividend-paying companies are often more stable and mature. However, these funds may experience lower capital appreciation potential compared to growth-oriented funds, as their focus on income generation might limit their investment in high-growth companies. International equity funds invest in stocks of companies located outside the investor's home country, while global equity funds invest in stocks of companies from around the world, including the investor's home country. These funds offer geographic diversification and exposure to different economies, industries, and market conditions. International and global equity funds can offer diversification benefits and the potential for higher returns as they provide exposure to different economies and growth opportunities. They can also help to mitigate country-specific risks. However, these funds come with additional risks, such as currency risk, political risk, and regulatory risk, which can affect their performance. Growth investing is an investment strategy that focuses on companies with a high potential for capital appreciation. Growth investors seek companies with strong revenue and earnings growth, innovative products or services, and competitive advantages within their industries. Growth investing in equity funds can offer significant capital appreciation potential as it targets companies with high growth prospects. However, this strategy also comes with higher risk and volatility, as growth stocks tend to be more sensitive to market fluctuations and economic conditions. Additionally, growth stocks may have higher valuations, increasing the risk of overpaying for these investments. Value investing is an investment strategy that focuses on companies that are undervalued relative to their intrinsic value. Value investors seek stocks that are trading at a discount to their true worth based on factors such as earnings, cash flow, and asset values. Value investing in equity funds can offer the potential for capital appreciation and lower risk compared to growth investing, as it targets undervalued companies with strong fundamentals. However, value stocks may remain undervalued for extended periods, and the market may not recognize their true worth, leading to underperformance. Additionally, value investing can be less exciting and may require more patience compared to growth investing. Blend investing is an investment strategy that combines elements of both growth and value investing. Blend investors seek companies with a mix of growth and value characteristics, aiming to balance the potential for capital appreciation with the stability of undervalued investments. Blend investing in equity funds can offer a balanced approach to investing, providing a mix of growth potential and value opportunities. This strategy can help to mitigate the risks and volatility associated with growth or value investing alone while still offering capital appreciation potential. However, blend funds may underperform pure growth or value funds in certain market conditions, as their diversified approach may dilute the benefits of either strategy. Active management involves a professional portfolio manager or management team making investment decisions for an equity fund. These decisions include selecting individual stocks, timing market entry and exit, and adjusting the portfolio's composition based on market conditions and research. Active managers aim to outperform a designated benchmark index by exploiting market inefficiencies and identifying mispriced securities. Pros of active management include the potential for outperformance, as skilled managers can capitalize on market inefficiencies and generate higher returns than the benchmark index. Active managers can also adjust their portfolios in response to changing market conditions, mitigating risks and seizing opportunities. Cons of active management include higher fees and expenses compared to passive management, as active management requires more research, analysis, and trading. Additionally, active management comes with the risk of underperformance, as not all active managers can consistently outperform their benchmarks. Passive management involves tracking a specific benchmark index, such as the S&P 500 or MSCI World Index, with the goal of replicating its performance. Passive equity funds, such as index funds and ETFs, seek to hold the same securities and weights as their benchmark index with minimal trading and portfolio adjustments. Pros of passive management include lower fees and expenses compared to active management, as passive funds require less research and trading. Passive management also offers more transparency, as investors can easily identify the holdings and performance of the benchmark index. Cons of passive management include the inability to outperform the benchmark index, as passive funds simply track the index's performance. Additionally, passive management offers no protection during market downturns, as the fund will decline in value along with the index. Equity funds offer numerous benefits for investors, making them an attractive investment option for many individuals. Equity funds are managed by professional fund managers who have the expertise and resources to conduct in-depth research, and analysis, and make informed investment decisions on behalf of investors. Investing in equity funds provides exposure to a diversified portfolio of stocks across various sectors, industries, and geographical regions. This diversification can help reduce overall portfolio risk and volatility, as the performance of individual investments may offset one another. Equity funds are generally highly liquid investments, meaning investors can easily buy and sell their fund shares on the market. This liquidity allows for easy access to funds when needed and enables investors to adjust their portfolios as their financial goals or market conditions change. Over the long term, equity funds have the potential to generate significant capital appreciation as the underlying stocks grow in value. This appreciation can help investors build wealth and achieve their financial goals. Although equity funds come with benefits, it is essential also to understand the associated risks and carefully consider personal financial goals and risk tolerance before investing in these funds. Equity funds are subject to market fluctuations, and their value can be affected by various factors, including economic conditions, political events, and company-specific news. This volatility can lead to fluctuations in the fund's net asset value (NAV), impacting investor returns. The performance of equity funds is dependent on the skill and expertise of the fund manager. A poorly managed fund may underperform the market or its benchmark, leading to disappointing returns for investors. While equity funds offer the potential for significant capital appreciation, they also carry the risk of capital loss. If the underlying stocks in the fund decline in value, investors may experience losses, particularly in the short term. Some equity funds may have a high concentration in specific sectors or regions, increasing the risk of underperformance if those areas experience negative events or underperform the broader market. Returns are a crucial performance indicator for equity funds, measuring the change in the fund's NAV over time. Returns can be expressed as absolute returns, annualized returns, or total returns, which include both capital appreciation and dividend payments. Risk-adjusted performance measures the returns of an equity fund relative to its level of risk. Common risk-adjusted performance indicators include the Sharpe ratio, which compares a fund's excess returns to its volatility, and the Sortino ratio, which focuses on downside risk. Benchmark comparisons involve assessing the performance of an equity fund against a designated benchmark index, such as the S&P 500 for large-cap U.S. equity funds. These comparisons help investors evaluate whether the fund has outperformed or underperformed its benchmark and gauge the effectiveness of the fund's investment strategy and management. Equity funds can play a significant role in portfolio diversification, providing exposure to various sectors, industries, and geographical regions. By investing in a mix of equity funds, investors can reduce portfolio risk and volatility, as different funds may perform differently under various market conditions. Investors should consider their investment objectives when selecting an equity fund, such as capital appreciation, income generation, or a combination of both. Investors should assess their risk tolerance before investing in an equity fund, as different types of funds come with varying levels of risk and volatility. The investment time horizon plays a crucial role in fund selection, as longer time horizons may allow investors to take on higher risks for potentially greater returns. Investors should consider the costs and fees associated with an equity fund, such as management fees, trading costs, and other expenses, as these can significantly impact overall returns. Investors should conduct thorough research and analysis of potential equity funds, examining factors such as past performance, management track record, investment strategy, and fees. Based on their research and analysis, investors should select one or more equity funds that align with their investment objectives, risk tolerance, and time horizon. Once investors have selected their equity funds, they should construct a diversified portfolio, allocating assets according to their risk tolerance and investment goals. Regular portfolio rebalancing is essential to maintain the desired asset allocation and manage risk. Investors should continuously monitor and assess the performance of their equity funds, comparing them to their designated benchmarks and evaluating their risk-adjusted returns. Periodic reviews of the fund's holdings, management, and fees are also essential to ensure alignment with the investor's goals and risk tolerance. Equity funds are professionally managed investment vehicles that pool investors' money to purchase a diversified portfolio of stocks. They come in various types, including large-cap, mid-cap, small-cap, sector-specific, dividend-paying, and international and global equity funds, each offering unique characteristics, risks, and potential returns. Investment strategies for equity funds include growth investing, value investing, and blend investing, which balance the potential for capital appreciation with the stability of undervalued investments. By understanding these strategies and selecting the right type of equity fund, investors can create a well-diversified portfolio tailored to their investment objectives, risk tolerance, and time horizon. As you consider incorporating equity funds into your investment strategy, we encourage you to seek professional wealth management services. A skilled advisor can help you navigate the complex world of equity funds, providing personalized guidance and recommendations to help you achieve your financial goals.What Are Equity Funds?

Types of Equity Funds

Large-Cap Equity Funds

Characteristics

Advantages and Disadvantages

Mid-Cap Equity Funds

Characteristics

Advantages and Disadvantages

Small-Cap Equity Funds

Characteristics

Advantages and Disadvantages

Sector-specific Equity Funds

Characteristics

Advantages and Disadvantages

Dividend-Paying Equity Funds

Characteristics

Advantages and Disadvantages

International and Global Equity Funds

Characteristics

Advantages and Disadvantages

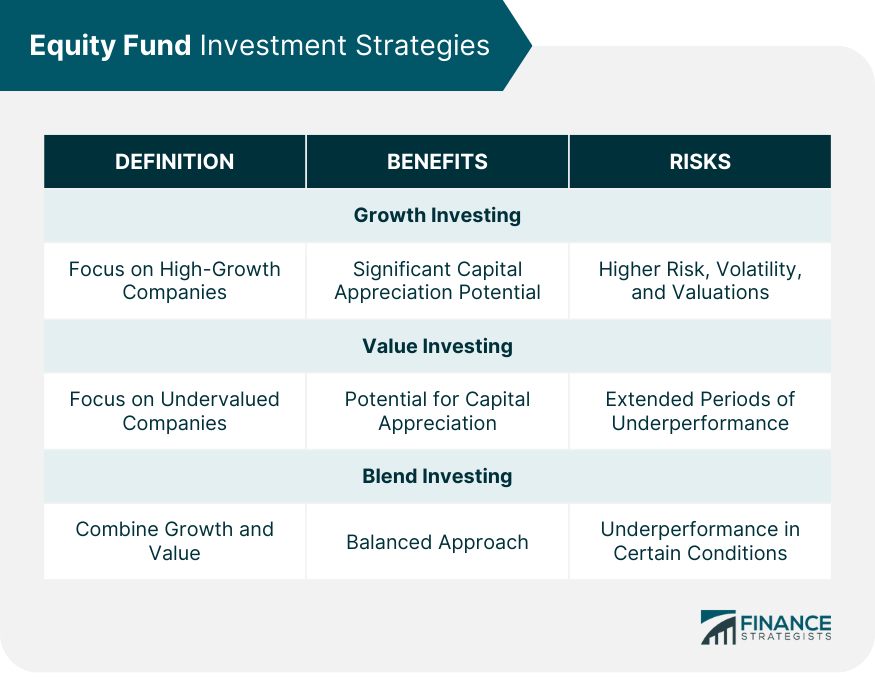

Equity Fund Investment Strategies

Growth Investing in Equity Funds

Definition and Approach

Benefits and Risks

Value Investing in Equity Funds

Definition and Approach

Benefits and Risks

Blend Investing in Equity Funds

Definition and Approach

Benefits and Risks

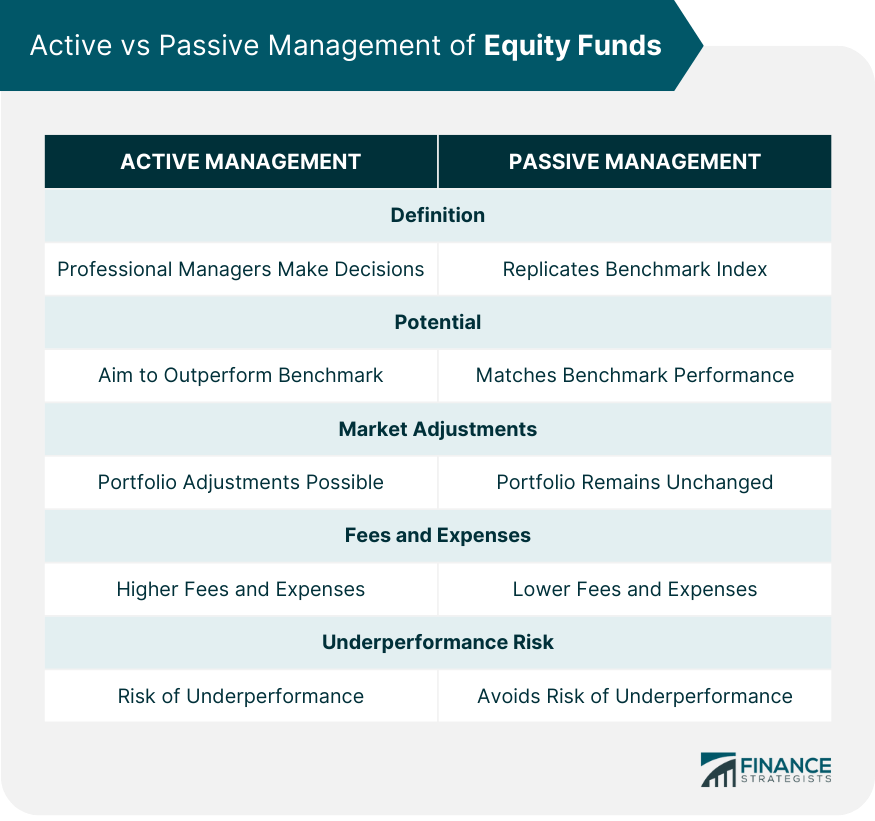

Active vs Passive Management of Equity Funds

Active Management of Equity Funds

Definition and Approach

Pros and Cons

Passive Management of Equity Funds

Definition and Approach

Pros and Cons

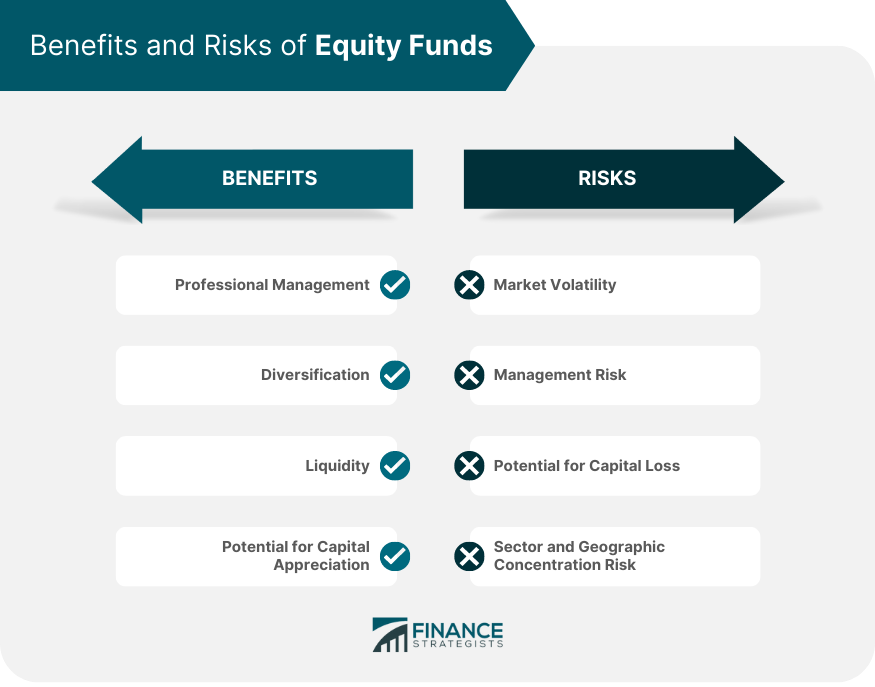

Benefits of Equity Funds

Professional Management

Diversification

Liquidity

Potential for Capital Appreciation

Risks of Equity Funds

Market Volatility

Management Risk

Potential for Capital Loss

Sector and Geographic Concentration Risk

Equity Fund Performance Measurement and Evaluation

Key Performance Indicators for Equity Funds

Returns

Risk-adjusted Performance

Benchmark Comparisons for Equity Funds

Portfolio Diversification With Equity Funds

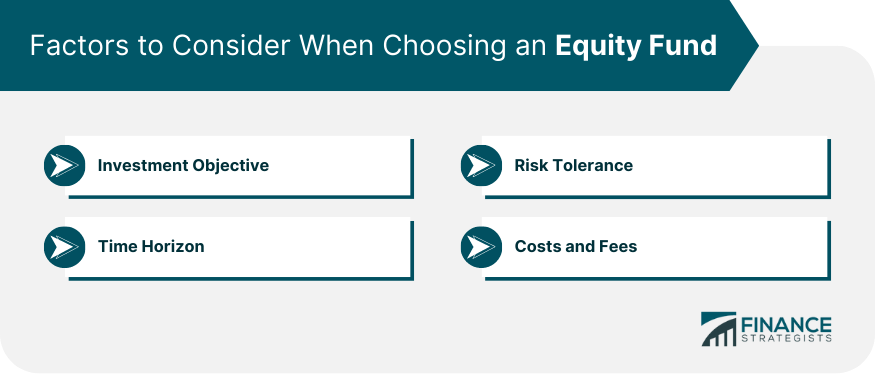

Selecting and Investing in an Equity Fund

Factors to Consider When Choosing an Equity Fund

Investment Objective

Risk Tolerance

Time Horizon

Costs and Fees

Equity Fund Investment Process

Research and Analysis

Fund Selection

Portfolio Construction and Rebalancing

Ongoing Monitoring and Assessment of Equity Funds

Final Thoughts

Equity Funds FAQs

Equity funds are pooled investment vehicles that primarily invest in stocks of various companies. They aim to generate returns through capital appreciation and, in some cases, dividend income. Equity funds offer investors exposure to a diversified portfolio of stocks managed by professional fund managers.

There are several types of equity funds, including large-cap, mid-cap, and small-cap funds, which invest in companies based on their market capitalization. Other types include sector-specific funds, dividend-paying funds, and international and global equity funds, which provide exposure to stocks from different geographical regions.

Equity funds typically employ one of three main investment strategies: growth investing, which focuses on companies with high potential for capital appreciation; value investing, which targets undervalued companies with strong fundamentals; and blend investing, which combines elements of both growth and value investing.

Equity funds can play a significant role in portfolio diversification by providing exposure to various sectors, industries, and geographical regions. Investing in a mix of equity funds can help reduce portfolio risk and volatility, as different funds may perform differently under various market conditions.

When selecting equity funds, investors should consider factors such as their investment objectives (capital appreciation, income generation, or both), risk tolerance, time horizon, and the costs and fees associated with the fund. Additionally, investors should research and analyze the fund's past performance, management track record, and investment strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.