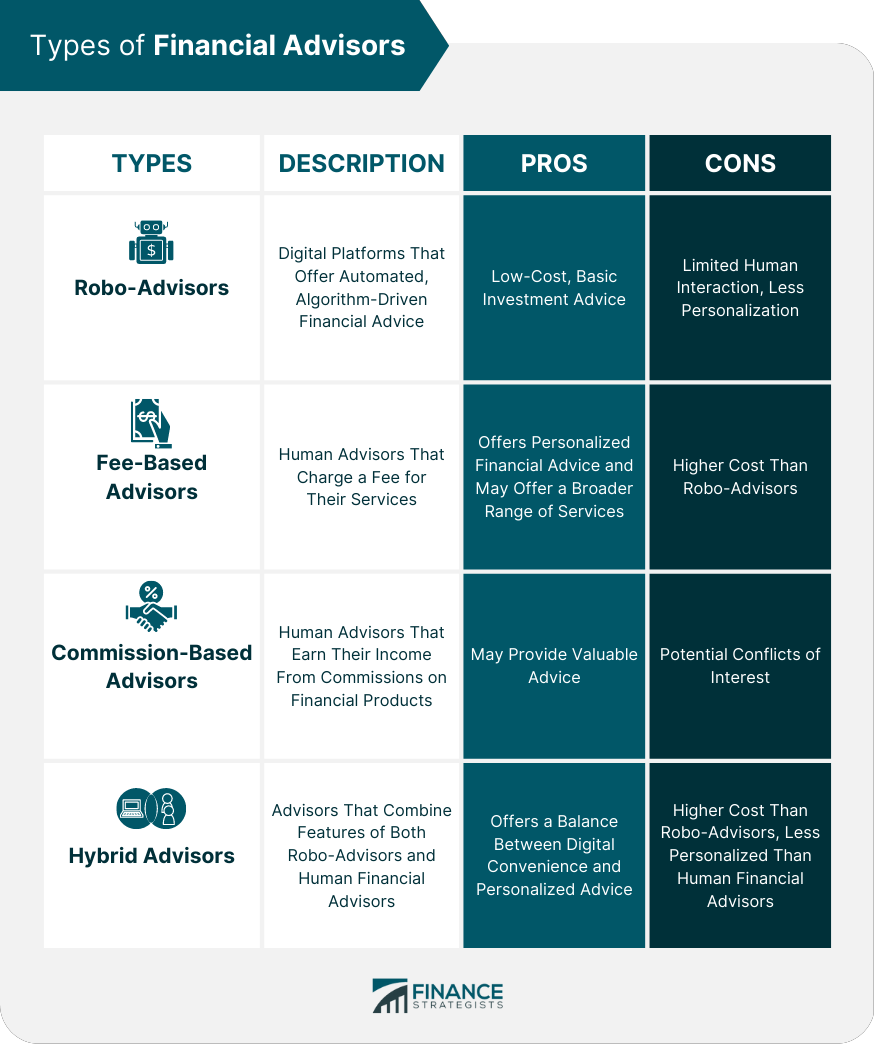

Financial advice is professional guidance that helps individuals and businesses make informed decisions about managing their money. It covers a broad range of topics, such as budgeting, investing, retirement planning, tax planning, and more. It is important because managing money can be complicated, and making poor decisions can lead to financial difficulties in the future. Seeking financial advice from a qualified professional can provide valuable insights, help you avoid costly mistakes, and create a personalized plan that aligns with your goals and values. It can also help you navigate complex financial situations and achieve your financial objectives, such as saving for retirement, buying a home, or starting a business. Robo-advisors are digital platforms that offer automated, algorithm-driven financial advice with minimal human intervention. They are ideal for those looking for low-cost, basic investment advice. Fee-based advisors charge a flat fee, hourly rate, or a percentage of assets under management for their services. They provide personalized financial advice and may offer a broader range of services than robo-advisors. Commission-based advisors earn their income from commissions on the financial products they recommend or sell. While they can provide valuable advice, it's essential to be aware of any potential conflicts of interest. Hybrid advisors combine the features of both robo-advisors and human financial advisors, offering a balance between digital convenience and personalized advice. A well-structured budget helps individuals manage their finances by tracking income, expenses, and savings. Financial advisors can assist in creating a realistic budget tailored to clients' financial goals. Financial advisors can recommend various savings and investment options, including stocks, bonds, mutual funds, and real estate, depending on clients' risk tolerance, time horizon, and objectives. Managing debt is essential for financial health. Financial advisors can help clients develop strategies to pay off debt, consolidate loans, or negotiate better repayment terms. Financial advisors help clients plan for retirement by assessing their financial needs, estimating future expenses, and recommending appropriate savings and investment strategies. Tax planning involves developing strategies to minimize tax liabilities and maximize savings. Financial advisors can provide guidance on tax-efficient investment options and deductions. Financial advisors can help clients identify potential risks and recommend appropriate insurance policies, such as life, health, and property insurance, to protect against unforeseen events. Estate planning involves preparing for the distribution of assets upon death. Financial advisors can assist with wills, trusts, and other legal arrangements to ensure a client's wishes are carried out. Before seeking a financial advisor, individuals should evaluate their financial situation, needs, and long-term objectives. Researching potential advisors involves gathering information on their background, experience, credentials, and reputation. Comparing fees and services offered by different advisors helps clients determine which advisor best fits their needs and budget. Ensure that potential advisors have the appropriate qualifications, certifications, and licenses to provide financial advice. Interviewing potential advisors allows clients to gauge their compatibility, communication style, and approach to financial planning. Maintaining open and honest communication with a financial advisor is crucial for achieving financial goals. Regularly reviewing financial progress with an advisor helps clients stay on track and make adjustments as needed. Financial advisors can help clients adapt their financial strategies to life changes such as job loss, marriage, or the birth of a child. Addressing conflicts and concerns promptly helps maintain a productive and trusting relationship with a financial advisor. Contrary to popular belief, financial advisors can provide valuable guidance for individuals at all income levels and stages of life. While many financial advisors prioritize their clients' best interests, it's essential to be aware of potential conflicts of interest, particularly with commission-based advisors. Although some individuals may prefer managing their finances independently, professional financial advice can provide valuable insights, particularly for complex situations or long-term planning. Financial planning is an ongoing process that requires regular review and adjustments to adapt to life changes and market conditions. The internet offers a wealth of financial tools and resources, including calculators, educational materials, and comparison websites, that can supplement professional advice. Financial management apps can help individuals track their income, expenses, and investments, making it easier to manage their finances. Artificial intelligence (AI) and machine learning are transforming the financial advice industry, enabling more sophisticated analysis, personalized recommendations, and increased efficiency. Financial advice plays a crucial role in helping individuals and businesses achieve their financial goals. By understanding the different types of financial advisors, key components of financial advice, and the importance of building a strong relationship with an advisor, individuals can make informed decisions and stay proactive in their financial journey. Additionally, embracing technology and staying informed about financial trends can further enhance one's financial decision-making.What Is Financial Advice?

Types of Financial Advisors

Robo-Advisors

Human Financial Advisors

Fee-Based Advisors

Commission-Based Advisors

Hybrid Advisors

Key Components of Financial Advice

Budgeting

Saving and Investing

Debt Management

Retirement Planning

Tax Planning

Insurance and Risk Management

Estate Planning

Selecting the Right Financial Advisor

Assessing Your Financial Needs and Goals

Researching Potential Advisors

Comparing Fees and Services

Checking Qualifications and Credentials

Conducting Interviews and Asking the Right Questions

Building a Strong Relationship With Your Financial Advisor

Open and Honest Communication

Regular Review of Financial Progress

Adjusting Strategies Based on Life Changes

Resolving Conflicts and Addressing Concerns

Common Financial Advice Misconceptions

Financial Advisors Are Only for the Wealthy

All Financial Advisors Provide Unbiased Advice

DIY Investing Is Always Better

Financial Planning Is a One-Time Event

The Role of Technology in Financial Advice

Online Tools and Resources

Financial Management Apps

The Impact of AI and Machine Learning

Conclusion

Financial Advice FAQs

Financial advice is professional guidance that helps individuals and businesses make informed decisions about managing their money. It can cover a broad range of topics, such as budgeting, investing, retirement planning, tax planning, and more.

It is a good idea to seek financial advice whenever you are facing a major financial decision or life event, such as buying a house, starting a business, getting married, having children, or planning for retirement. You can also seek advice if you're struggling to manage your finances or want to improve your financial situation.

Financial advice can be provided by a variety of professionals, such as financial advisors, financial planners, investment managers, accountants, and lawyers. It's important to choose a professional who is qualified and experienced in the areas that you need help with.

The cost of financial advice varies depending on the type of advice you need, the complexity of your financial situation, and the professional you choose. Some advisors charge a flat fee, while others charge a percentage of the assets they manage. It's important to understand the fees upfront and to make sure you're comfortable with the cost.

Seeking financial advice can be a valuable investment in your financial future, especially if you are facing complex or unfamiliar financial situations. A professional advisor can provide objective guidance, help you avoid costly mistakes, and create a personalized plan that aligns with your goals and values. However, it's important to do your research and choose an advisor who is trustworthy and compatible with your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.