A 403(b) account, also known as a tax-sheltered annuity (TSA) plan, is a retirement plan for specific employees of public schools, tax-exempt organizations, and certain ministers. It allows employees to contribute part of their salary, which grows until withdrawal in retirement. Like most defined-contribution plans, you contribute pre-tax dollars into a 403(b). These contributions and any earnings grow tax-deferred. At retirement, you pay taxes on withdrawals as ordinary income. Also, some plans allow for Roth contributions, which are made with after-tax dollars and withdrawn tax-free in retirement. 403(b) accounts can be a vital part of a public service employee’s retirement strategy. The ability to make pre-tax contributions reduces taxable income in the contribution year, providing a significant tax benefit. In addition, because contributions grow tax-deferred, they compound over time, providing the potential for a larger retirement nest egg. The sooner you start contributing to your 403(b) plan, the more time your money will have to grow through compounding. This principle, often referred to as the time value of money, suggests that a dollar invested today has the potential to be worth more in the future due to its earning capacity. Beginning your contributions early in your career not only allows you to accumulate a significant amount over time, but it also lessens the financial strain as you won't need to set aside as large a percentage of your income in later years to reach your retirement goals. The more money you can invest into your 403(b) account, the greater your potential return. Every year, the Internal Revenue Service (IRS) sets a limit on the amount you can contribute. For 2024, the limit is $23,000. If you're aged 50 or over, you can make additional catch-up contributions of up to $7,500. If possible, aim to contribute the maximum amount each year. This not only boosts your savings but also provides you with a greater tax deduction. However, it's important to balance your contributions with your current financial needs. Always ensure you have enough to cover living expenses and any other financial commitments. With Roth 403(b) options, contributions are made with after-tax dollars, which means you don't receive a tax deduction when you contribute. On the upside, all withdrawals in retirement, including the earnings, are generally tax-free, providing a valuable source of tax-free income in retirement. This can be particularly beneficial if you anticipate being in a higher tax bracket in retirement or if tax rates are expected to increase. When selecting your investments, it's crucial to consider your risk tolerance, financial goals, and the time until you retire. If you're earlier in your career and have a high risk tolerance, you might lean towards more aggressive options like stock funds. As you near retirement, it may be prudent to shift towards more conservative investments, like bond funds or stable value funds. Market fluctuations can cause the actual allocation of your 403(b) account to drift from your original investment strategy. Rebalancing is the process of realigning the weights of your portfolio of assets to maintain your desired asset allocation. By monitoring your account and rebalancing periodically, you can ensure your portfolio continues to reflect your investment strategy and risk tolerance. This not only helps protect against overexposure to risk but can also lead to better long-term financial outcomes. While 403(b) plans do allow for loans and early withdrawals in certain circumstances, they can have significant impacts on your account. Loans must be repaid with interest, and if you leave your job, the loan often becomes due much sooner. Early withdrawals before age 59 ½ are not only taxed as ordinary income but are also subject to a 10% early withdrawal penalty. Furthermore, money withdrawn is money that is no longer growing tax-deferred in your account. Therefore, it's important to consider these factors and avoid taking loans or making early withdrawals unless absolutely necessary. Estimate the amount of income you would need during retirement to maintain your desired lifestyle. Considerations such as expected living expenses, healthcare costs, travel, and other personal goals should be taken into account. A well-articulated vision of your retirement lifestyle can guide your contribution and investment strategies, helping you achieve the financial security you aspire to in your later years. Risk tolerance is an individual's capacity to endure market volatility without it causing significant distress or negatively impacting their financial goals. Individuals with a high risk tolerance may feel comfortable investing a larger portion of their 403(b) in equities, which can offer higher potential returns but also higher volatility. Those with low risk tolerance, on the other hand, may prefer a higher allocation to bonds and other lower-risk investments. It's important to strike a balance between saving for the future and addressing current financial needs. If you have high-interest credit card debt, for example, it might be more beneficial to pay off that debt before increasing your 403(b) contributions. Other factors like your emergency fund, housing situation, and whether you have dependents also affect your saving and investing decisions. It's important to take a holistic view of your finances when strategizing how to optimize your 403(b) account. 403(b) plans often involve various fees, including administrative fees, investment fees, and possibly surrender charges. These fees can significantly impact your retirement savings over the long term. Some 403(b) plans, especially those sold by insurance companies, can have higher costs compared to other types of retirement plans. You should consider whether the services provided justify the fees. It might be worth seeking lower-cost alternatives if the fees are too high. An IRA is a tax-advantaged account that individuals can open independently, regardless of their employer. Traditional IRAs, like 403(b) and 401(k) accounts, allow you to make pre-tax contributions. Your money grows tax-deferred, and you pay income tax on your withdrawals in retirement. However, contribution limits for IRAs are significantly lower than for 403(b) plans. As of 2024, the maximum you can contribute to an IRA is $7,000 per year, or $8,000 if you're age 50 or older. Despite this lower limit, an IRA can be an excellent supplementary tool for retirement savings, especially if you're already maxing out your 403(b) contributions. A Roth IRA is a special type of IRA where you make contributions with after-tax dollars. While you don't get a tax deduction for your contributions, you get a significant benefit down the line: your money grows tax-free, and you don't owe any taxes when you make withdrawals in retirement. Like a traditional IRA, a Roth IRA has the same contribution limit. However, there are income limits to be eligible to contribute to a Roth IRA. For individuals with a high income, a backdoor Roth IRA—an approach where you contribute to a traditional IRA and then convert it to a Roth IRA—may be a feasible option. While they lack the tax advantages of retirement accounts like a 403(b) or IRA, taxable investment accounts offer a lot of flexibility. There are no limits on contributions, no restrictions on withdrawals, and a potentially unlimited choice of investments. Income from a taxable investment account, including dividends and capital gains, is subject to taxes in the year it's received. However, the tax rate on long-term capital gains is typically lower than the ordinary income tax rate, which applies to withdrawals from a 403(b) or IRA. If you find yourself struggling to understand the various investment options in your 403(b), or if the thought of tax implications, rebalancing portfolios, and retirement planning causes you stress, it might be time to consider hiring a financial advisor. Other indicators could be a significant change in your financial situation such as a job change, receiving an inheritance, or nearing retirement. It's crucial to ensure your advisor has the necessary qualifications and a clean ethical record. Look for credentials such as Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC). Moreover, consider the advisor's experience, particularly with 403(b) accounts and clients similar to you in terms of career stage and financial goals. A good financial advisor will ask about your goals, risk tolerance, and retirement plans before offering advice. Understanding how the advisor is compensated is also crucial. Financial advisors are typically paid through commissions, a flat fee, or a percentage of assets under management. Each method has its pros and cons, and it's essential to understand how they might influence the advisor's recommendations. Finally, ensure the advisor communicates clearly and is available to answer questions. You should feel comfortable discussing your financial situation with them, and they should be responsive to your needs and concerns. A 403(b) account is a valuable retirement plan for employees of public schools, tax-exempt organizations, and certain ministers. It offers the advantage of contributing pre-tax dollars and allowing tax-deferred growth. Strategies to optimize your 403(b) account include starting contributions early to benefit from compounding, maximizing contributions up to the IRS limit, and considering Roth 403(b) options for tax-free withdrawals in retirement. It also includes selecting investments carefully, regularly monitoring and rebalancing your account, and being cautious with loans and early withdrawals due to potential tax implications and loss of growth. When optimizing your 403(b) account, consider factors such as retirement goals, risk tolerance, current financial situation, and plan fees. Additionally, other retirement savings options like IRAs and taxable investment accounts can complement a 403(b) account. Consult a financial advisor, especially if you require guidance in navigating the complexities of your 403(b) investments or experience significant changes in your financial situation.Overview of 403(b) Accounts

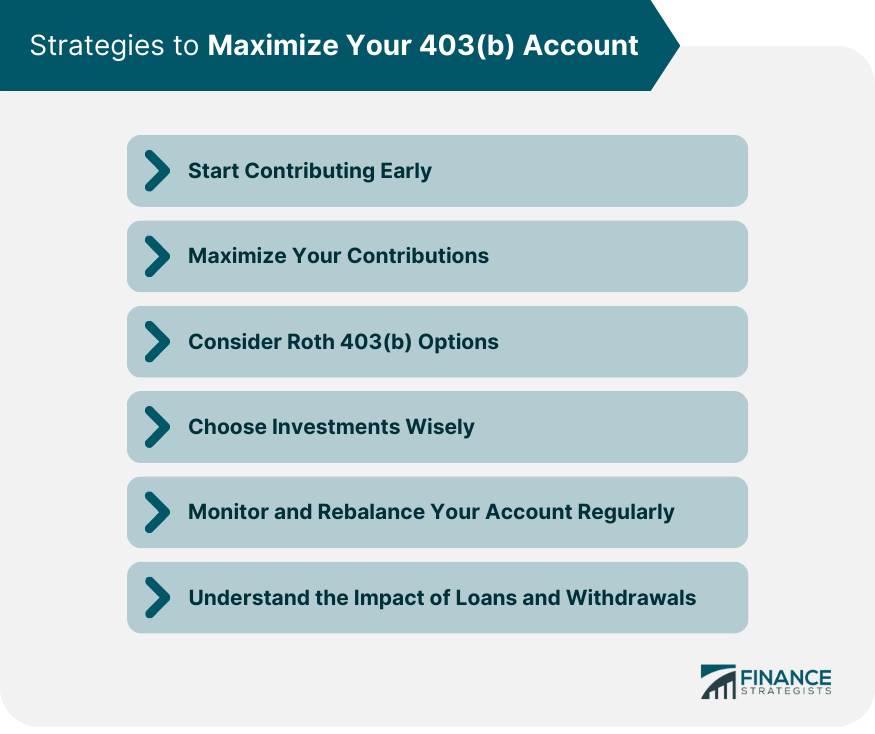

Strategies to Maximize Your 403(b) Account

Start Contributing Early

Maximize Your Contributions

Consider Roth 403(b) Options

Choose Investments Wisely

Monitor and Rebalance Your Account Regularly

Understand the Impact of Loans and Withdrawals

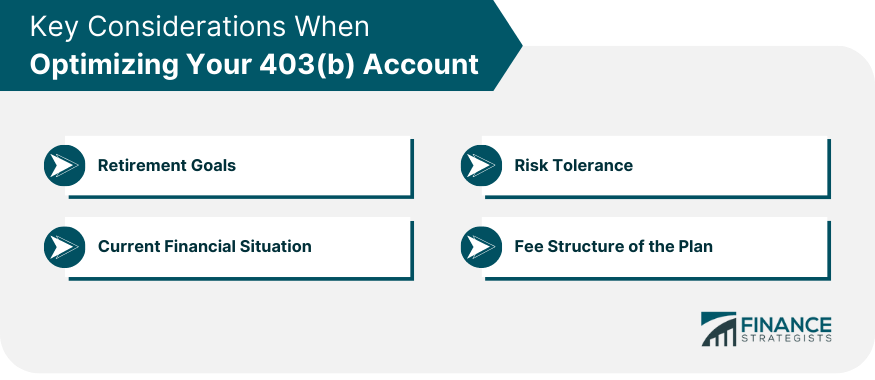

Key Considerations When Optimizing Your 403(b) Account

Retirement Goals

Risk Tolerance

Current Financial Situation

Fee Structure of the Plan

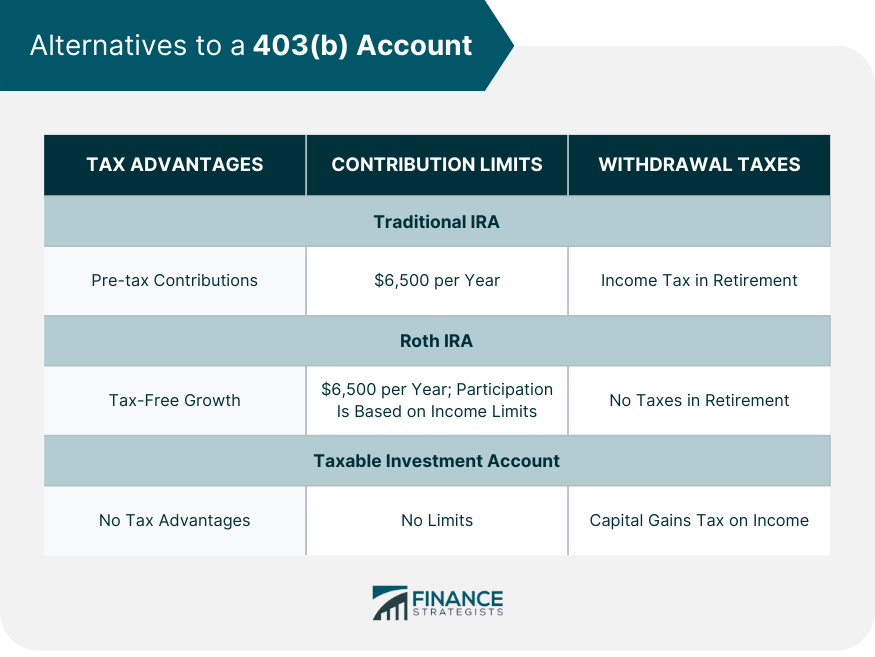

Alternatives to a 403(b) Account

Individual Retirement Accounts (IRAs)

Roth IRAs

Taxable Investment Accounts

Financial Advisors and 403(b) Account Management

When to Consider Hiring a Financial Advisor

Choosing the Right Financial Advisor

Final Thoughts

How to Make the Most of Your 403(b) Account FAQs

A 403(b) account is a retirement plan available to employees of public schools, tax-exempt organizations, and certain ministers. It allows employees to contribute part of their salary on a pre-tax basis, with the funds growing tax-deferred until retirement.

Withdrawing funds from your 403(b) account before reaching age 59 ½ may result in both ordinary income tax and a 10% early withdrawal penalty. It's generally recommended to avoid early withdrawals unless absolutely necessary to preserve your retirement savings and minimize tax consequences.

The Roth 403(b) option allows you to make after-tax contributions, meaning you won't receive a tax deduction upfront. However, qualified withdrawals, including earnings, are tax-free in retirement. This can be beneficial if you anticipate being in a higher tax bracket in the future or if you expect tax rates to increase.

Yes, 403(b) plans may allow for loans under certain circumstances. However, it's important to understand that loans must be repaid with interest, and if you leave your job, the loan may become due sooner. It's generally advisable to consider loans as a last resort and carefully evaluate the impact on your long-term retirement savings.

When selecting investments, consider your risk tolerance, financial goals, and time until retirement. If you have a longer time horizon and higher risk tolerance, you may opt for more aggressive options like stock funds. As you approach retirement, it's typically wise to shift towards more conservative investments, such as bond funds or stable value funds, to help preserve your savings. Consulting a financial advisor can provide personalized guidance based on your specific circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.