Tax-free income refers to income that is exempt from federal and/or state income taxes, allowing recipients to retain the entire amount without any tax deductions. This type of income offers significant financial benefits by reducing individuals' and families' overall tax obligations. There are various sources of tax-free income, including interest earned from certain municipal bonds issued by state and local governments. This interest is generally free from federal income tax and may also be exempt from state and local taxes if the bond is issued in the investor's state of residence. Another source of tax-free income is qualified distributions from a Roth IRA, which are tax-free if specific conditions are met, such as the account is open for at least five years and the account holder being at least 59½ years old. Additionally, life insurance proceeds paid to beneficiaries are typically tax-free, although cashing out a policy before the insured's death may have tax implications. Some government benefits, including certain veterans' benefits and Supplemental Security Income (SSI), are not subject to income tax. Furthermore, gifts and inheritances received by an individual are generally not considered taxable income, although the giver or estate may face gift or estate tax implications. Individuals need to consult with tax professionals or financial advisors to understand the complexities of tax laws, which are subject to change, and to benefit from tax-free income opportunities fully. Municipal bonds are debt securities issued by state, local, or municipal governments to finance public projects, such as infrastructure or schools. These bonds are typically exempt from federal income taxes and often state and local taxes as well. There are two main types of municipal bonds: general obligation bonds, which are backed by the full faith and credit of the issuer, and revenue bonds, which are secured by a specific revenue source. Municipal bonds can be attractive for those in high tax brackets seeking to generate tax-free income. However, weighing the benefits against potential risks, such as interest rate fluctuations, credit risk, and liquidity risk is essential. It's crucial to research the financial health of the issuing government and the specific bond's credit rating before investing. Roth Individual Retirement Accounts (IRAs) are retirement savings vehicles that allow individuals to contribute after-tax dollars, with earnings growing tax-free. Contributions can be withdrawn tax-free and penalty-free at any time, while qualified withdrawals of earnings are also tax-free after age 59½ and once the account has been open for at least five years. Roth IRAs offer several benefits, including tax-free growth, no required minimum distributions (RMDs), and flexibility in withdrawal timing. However, contribution limits and income restrictions may limit their accessibility for some individuals. Understanding eligibility requirements and contribution limits is essential to make the most of a Roth IRA's tax-free benefits. Life insurance policies provide financial protection to beneficiaries upon the policyholder's death. There are two primary types of life insurance policies: term life, which provides coverage for a specific period, and permanent life, which combines a death benefit with a savings component. The death benefit from a life insurance policy is generally tax-free for beneficiaries, and the cash value of a permanent life policy grows tax-deferred. While life insurance policies can offer tax benefits, it's important to select the right type of policy based on individual needs and financial goals. Term life policies may be more affordable and straightforward, while permanent life policies offer more flexibility and potential for cash value growth. Consulting a financial professional can help determine the most suitable policy for your needs. Health Savings Accounts (HSAs) are tax-advantaged accounts designed to save for qualified medical expenses for individuals with high-deductible health plans (HDHPs). Contributions to HSAs are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. These accounts provide a triple tax advantage, making them an attractive savings vehicle for healthcare costs. To maximize the tax benefits of an HSA, it's crucial to understand the contribution limits and eligibility requirements. Additionally, maintaining records of qualified medical expenses and being mindful of non-qualified withdrawals can help ensure the full tax advantage is utilized. 529 plans are tax-advantaged investment vehicles designed to encourage saving for future education expenses. These plans offer tax-deferred growth and tax-free withdrawals for qualified education expenses, such as tuition, fees, books, and room and board. Each state sponsors its 529 plan, with some states offering additional tax benefits for residents who invest in their state's plan. When considering a 529 plan, it's essential to research the investment options, fees, and tax implications of various state-sponsored plans. Additionally, remember that non-qualified withdrawals may be subject to taxes and penalties, making it important to plan for the appropriate use of funds to maximize tax benefits. Coverdell Education Savings Accounts (ESAs) are another tax-advantaged savings vehicle designed for education expenses. Similar to 529 plans, contributions to ESAs grow tax-deferred, and withdrawals for qualified education expenses are tax-free. However, unlike 529 plans, ESAs can be used for both K-12 and post-secondary education expenses. It's important to understand the contribution limits and eligibility requirements for ESAs, which differ from 529 plans. Furthermore, comparing the benefits and restrictions of both 529 plans and ESAs can help determine the most suitable education savings vehicle for your specific needs. Gifts and inheritances generally do not count as taxable income for the recipient. However, there are specific limits and guidelines surrounding gift taxes, which may apply to the giver. Understanding the annual exclusion amount for gifts is essential and being aware of any potential tax implications for the giver. Inheritances are generally not subject to income tax, but certain assets, such as retirement accounts and appreciated property, may have tax implications for the beneficiary. Understanding the tax treatment of inherited assets and working with a tax services professional to minimize potential tax liabilities is important. Some of their Social Security benefits may be tax-free for many retirees, depending on their income level and filing status. Understanding the provisional income formula and how it affects the taxation of Social Security benefits can help retirees plan their income sources to minimize taxes on their benefits. Certain types of disability income, such as benefits received through workers' compensation or specific disability insurance policies, may be tax-free. However, the tax treatment of disability income depends on the source of the benefits and the individual's circumstances. It's essential to understand the tax implications of disability income and consult a tax professional for guidance. U.S. citizens or residents working abroad may qualify for the foreign-earned income exclusion, which allows them to exclude a certain amount of their foreign income from U.S. taxation. Individuals must meet specific requirements to qualify for the exclusion, such as the physical presence test or the bona fide residence test. Understanding the eligibility criteria and tax implications of the foreign earned income exclusion can help minimize tax liabilities for those working abroad. The Internal Revenue Service (IRS) provides guidelines and regulations governing tax-free income sources, including contribution limits, eligibility requirements, and tax treatment of various income types. It's essential to stay up-to-date with IRS guidelines and ensure compliance to avoid potential tax penalties. The Tax Cuts and Jobs Act (TCJA) of 2017 introduced several changes to the tax code, impacting the tax treatment of various income sources. Understanding how the TCJA affects tax-free income, such as changes to the standard deduction or the introduction of the qualified business income (QBI) deduction, can help individuals plan their finances and maximize tax benefits. State tax laws and regulations vary and can impact the tax treatment of various income sources. Understanding the specific tax laws in your state of residence and considering their implications on your tax-free income strategies is important. Tax laws and regulations are subject to change as new legislation is enacted or existing laws are amended. Staying informed about recent changes and potential future amendments can help individuals adapt their financial strategies and make the most of available tax-free income opportunities. Diversifying income sources by investing in different types of tax-free investments, such as municipal bonds, Roth IRAs, and 529 plans, can help individuals maximize their tax-free income while reducing risk. A well-diversified portfolio with a mix of tax-free and taxable investments can provide growth potential and tax efficiency. Incorporating tax-free income sources into retirement planning can significantly impact an individual's financial well-being during retirement. Understanding the tax implications of different retirement savings vehicles, such as Roth IRAs, traditional IRAs, and 401(k)s, can help individuals make informed decisions about their retirement savings strategy. Adopting long-term investment strategies prioritizing tax-free income sources, such as investing in municipal bonds or contributing to a Roth IRA, can help individuals minimize their tax liability and maximize their financial returns over time. A long-term perspective allows investors to take advantage of the compounding growth potential of tax-free investments. Developing tax-efficient withdrawal strategies during retirement can help individuals minimize their tax liability and extend the longevity of their retirement savings. This may involve strategically withdrawing from tax-deferred accounts, such as traditional IRAs and 401(k)s, and tax-free accounts, such as Roth IRAs and municipal bonds, to minimize taxable income in retirement. Incorporating tax-free income sources into an individual's overall financial plan can help achieve financial goals more efficiently by minimizing tax liability and maximizing after-tax returns. A comprehensive financial plan should consider an individual's specific needs, goals, and risk tolerance while incorporating a mix of taxable and tax-free income sources. Working with professional financial planners and tax advisors can provide valuable guidance and insight into maximizing tax-free income opportunities. These professionals can help individuals develop personalized financial plans that align with their specific goals and circumstances while taking advantage of available tax-free income sources. Understanding one's personal financial goals and objectives is crucial in determining the most appropriate tax-free income sources and strategies. Individuals can make informed decisions about their investments and financial planning by evaluating their short-term and long-term goals, risk tolerance, and financial needs. A solid grasp of tax-free income sources is crucial for individuals aiming to minimize their tax liability and maximize financial returns. A thorough understanding of the various tax-free income types, such as municipal bonds, Roth IRAs, life insurance policies, HSAs, educational savings plans, and other tax-free income sources, enables individuals to make well-informed investment decisions. Additionally, staying aware of governing tax laws and regulations is essential for compliance and optimizing tax benefits. Developing and implementing strategies for maximizing tax-free income, such as diversification of income sources, retirement planning considerations, long-term investment strategies, and tax-efficient withdrawal methods, can greatly contribute to one's financial well-being. Incorporating tax-free income sources into a comprehensive financial plan that considers personal goals, risk tolerance, and financial needs is vital. Finally, consulting professionals, such as financial planners and tax advisors, and regularly evaluating personal financial objectives can ensure that the most suitable tax-free income strategies are implemented.What Is Tax-Free Income?

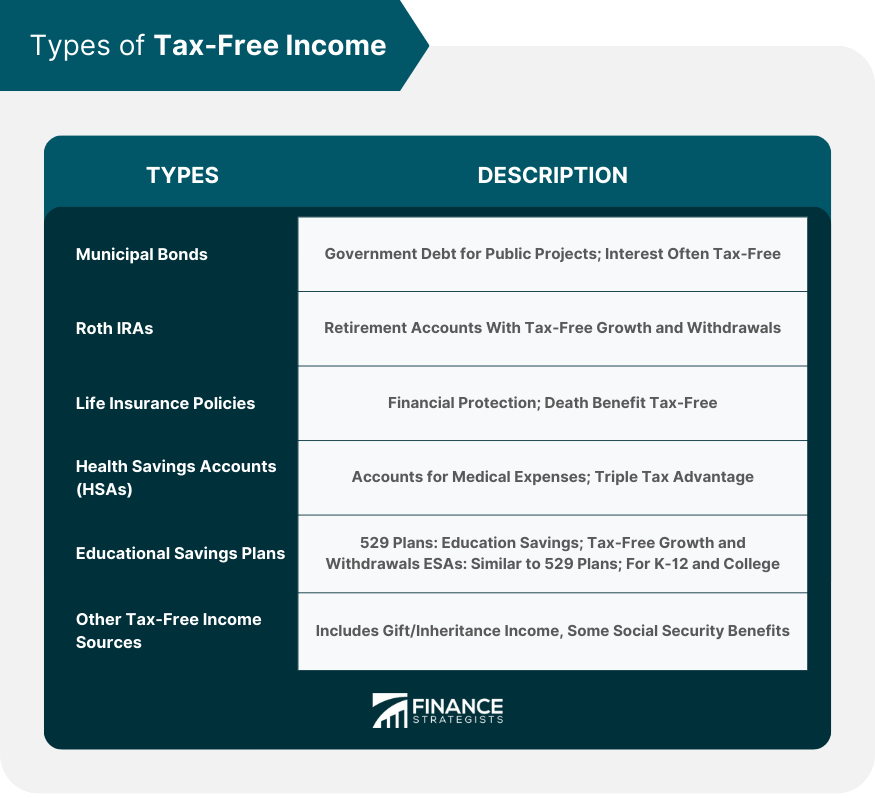

Types of Tax-Free Income

Municipal Bonds

Roth IRAs

Life Insurance Policies

Health Savings Accounts (HSAs)

Educational Savings Plans

529 Plans

Coverdell Education Savings Accounts (ESAs)

Other Tax-Free Income Sources

Gift and Inheritance Income

Social Security Benefits

Disability Income

Foreign Earned Income Exclusion

Tax Laws and Regulations Governing Tax-Free Income

Internal Revenue Service (IRS) Guidelines

Tax Cuts and Jobs Act (TCJA) Implications

State-Level Tax Laws and Regulations

Recent Changes and Potential Future Amendments

Strategies for Maximizing Tax-Free Income

Diversification of Income Sources

Retirement Planning Considerations

Long-Term Investment Strategies

Tax-Efficient Withdrawal Strategies

Tax-Free Income and Financial Planning

Incorporating Tax-Free Income Into a Financial Plan

Professional Assistance: Financial Planners and Tax Advisors

Evaluating Personal Financial Goals and Objectives

Conclusion

Tax-Free Income FAQs

Tax-free income is a type of income that is not subject to income tax, meaning that the recipient does not have to pay taxes on it. In contrast, taxable income is subject to income tax based on the individual's tax bracket. Tax-free income includes certain municipal bond interest, qualified Roth IRA distributions, and certain types of life insurance proceeds.

Sources of tax-free income can include municipal bonds, Roth IRAs, certain types of life insurance policies, and specific government benefits. It's important to consult with a financial advisor or tax professional to identify the best tax-free income options for your individual financial situation and goals.

While tax-free income can provide tax advantages, there may be limits or restrictions based on the type of income and the individual's circumstances. For example, contributions to a Roth IRA are subject to annual limits, and tax-free municipal bond interest may be subject to alternative minimum

Tax-free income may or may not affect eligibility for government benefits, depending on the specific benefit program and the type of tax-free income. Some programs consider tax-free income when determining eligibility, while others do not. It's important to review the eligibility criteria for each program and consult with a benefits specialist if you have questions.

While tax-free income can offer tax advantages, there are potential downsides to consider. For example, the interest rates on municipal bonds may be lower than those of taxable bonds, and there may be liquidity and credit risk associated with certain investments. Additionally, tax laws can change, potentially affecting the tax treatment of certain income sources. Investors should carefully evaluate their investment options and consider their overall financial goals and risk tolerance before making investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.