Retirement marks a significant transition in life, where the reliance on a steady paycheck gives way to the need for a sustainable income stream. The importance of generating income during retirement cannot be overstated, as it directly impacts your financial security, independence, and ability to enjoy the lifestyle you desire. While retirement may be seen as a time to relax and enjoy the fruits of your labor, it is crucial to remain proactive in generating income to ensure a stable and fulfilling retirement experience. Generating income during retirement empowers you to navigate the challenges of rising costs, inflation, and unexpected expenses while preserving your financial independence. By proactively planning for and implementing income generation strategies, you can enjoy a fulfilling and worry-free retirement, focusing on the experiences and opportunities that bring you joy and fulfillment. Social Security serves as the backbone of income for many retirees. This government program provides a monthly payment based on your earnings history and the age you choose to start receiving benefits. The decisions surrounding when to claim can significantly impact the amount of income you receive. Retirement savings accounts like 401(k)s and IRAs offer a tax-advantaged way to save for retirement. Contributions often come directly from your paycheck, pre-tax, growing tax-free until withdrawal. In retirement, these accounts can provide a significant income stream. Pensions are less common now, but for those lucky enough to have one, they provide a steady income during retirement. The amount you receive typically depends on your salary history and years of service. Annuities are insurance products that can provide a regular income stream in retirement. In exchange for an upfront payment, an insurance company promises to pay you a certain amount of income for a specified period. Real estate can be a reliable source of income in retirement, whether through rental properties or investments in real estate investment trusts (REITs). Investments in the stock and bond markets can provide both growth and income potential. Dividend-paying stocks and interest-paying bonds can add to your retirement income. The age you choose to start claiming Social Security can significantly affect your benefits. Waiting until your full retirement age or later can increase your monthly payment. If you're married, you may be entitled to benefits based on your spouse's work record, which could provide additional income. Creating a smart withdrawal strategy can help your savings last longer. The IRS mandates minimum required distributions (RMDs) starting at age 73, but you may want to strategize withdrawals before this point. Roth and traditional IRAs offer different tax advantages. Roth IRAs can provide tax-free withdrawals in retirement, which can help increase your income. Immediate annuities start paying out immediately after purchase, while deferred annuities allow your investment to grow before payouts begin. Fixed annuities provide a guaranteed payout, while variable annuities offer a potential for growth (or loss) based on market performance. Owning rental properties can provide a steady income. However, property management can be labor-intensive, so consider a property management company. REITs allow investors to pool their money to invest in real estate. They provide a way to earn rental income without having to manage properties yourself. Investing in dividend-paying stocks can provide regular income even as the stock appreciates in value. This strategy involves buying a series of bonds with staggered maturity dates. This provides a consistent income stream and minimizes the impact of interest rate fluctuations. Part-time work can provide income and engagement. Opportunities may include roles in retail, tutoring, or roles related to your previous career. Using your skills and experience, you could consult or freelance. This can provide flexible income and allow you to continue doing what you love. Crafting, writing, gardening – your hobby could become a source of income. Online platforms make it easy to sell goods or services. Freelancing, blogging, and online tutoring are among the online activities that can generate income. Dividend Investing: Investing in dividend-paying stocks or mutual funds can provide regular income. Peer-To-Peer Lending: Online platforms allow you to lend money directly to individuals or small businesses, earning interest over time. Affiliate Marketing: Promoting products or services for a commission can be done through a blog or social media. Renting Out Unused Space: Platforms like Airbnb allow you to rent out a room or property, providing a steady income source. Reducing Housing Costs: Downsizing, relocating, or refinancing can significantly cut housing costs. Saving on Healthcare: Medicare, supplemental insurance, and preventative care can help control healthcare costs. Minimizing Transportation Expenses: Consider downsizing to one car, using public transportation, or carpooling. Budgeting and Financial Planning: Budgeting can help ensure your income meets your needs. You might consider working with a financial planner. Inflation: Can erode purchasing power. Investing in assets that grow over time can help protect against this risk. Market Volatility: Investing always comes with risk. Diversifying your portfolio can help protect against market fluctuations. Longevity Risk: As lifespans increase, so does the potential for outliving your assets. Annuities, pensions, and other lifetime income sources can help mitigate this risk. Healthcare Costs: The cost of healthcare often increases as we age. Proper planning and insurance can help mitigate these costs. When to Seek Financial Advice: Consider seeking advice when making big decisions, such as when to claim Social Security or how to invest your assets. Finding a Trusted Financial Advisor: Look for an advisor who is a fiduciary, meaning they are required to act in your best interest. Making a Retirement Income Plan With a Financial Planner: A financial planner can help you create a comprehensive income plan for retirement, taking into account all potential income sources. Securing a steady income in retirement involves strategic decisions across various potential income sources. Maximize Social Security benefits by making informed decisions about when to claim. Make the most of your retirement savings accounts, like 401(k)s and IRAs, using withdrawal strategies that align with your lifestyle needs and tax situation. Investing in annuities, real estate, stocks, and bonds can provide additional revenue streams, and passive income opportunities like peer-to-peer lending, affiliate marketing, and property rental can bolster your income further. Simultaneously, seek ways to minimize expenses to ensure your retirement income meets your needs. Be proactive in managing potential risks such as inflation, market volatility, and rising healthcare costs. Seeking professional financial advice can be beneficial, particularly when making significant decisions or planning for the long term. By understanding and leveraging these avenues, you can foster financial stability and peace of mind in your golden years.Importance of Generating Income During Retirement

Different Income Sources in Retirement

Social Security Benefits

Retirement Savings Accounts: 401(k), IRA

Pensions

Annuities

Real Estate Investments

Stocks and Bonds

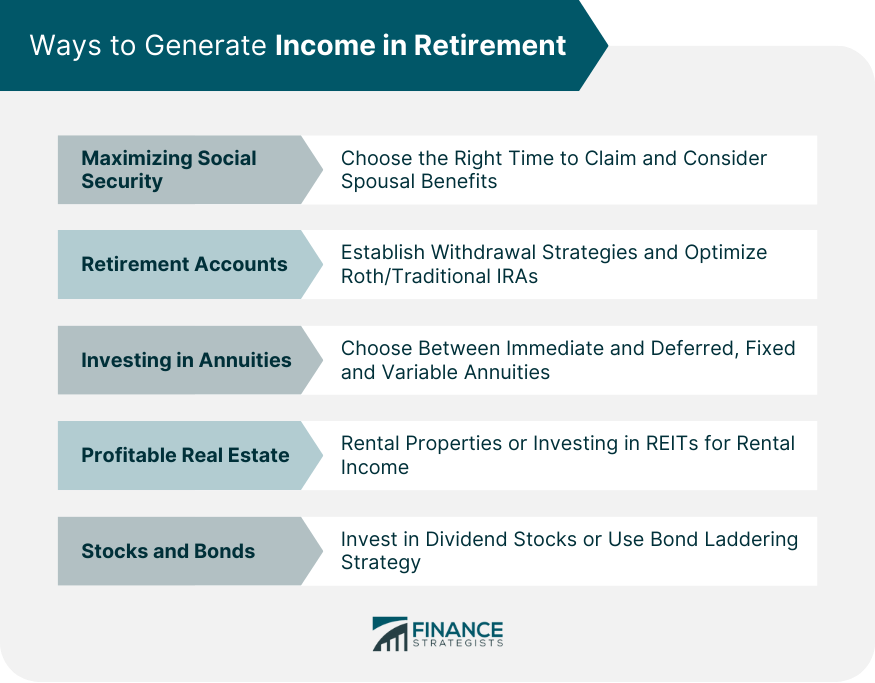

How to Generate Income in Retirement

Maximizing Social Security Benefits

Choosing the Right Time to Claim

Understanding Spousal Benefits

Making the Most of Your Retirement Accounts

Establishing Withdrawal Strategies

Optimal Use of Roth and Traditional IRAs

Investing in Annuities

Immediate vs Deferred Annuities

Fixed vs Variable Annuities

Profitable Investing in Real Estate

Rental Properties

Real Estate Investment Trusts (REITs)

Buying and Selling Stocks and Bonds

Dividend Stocks

Bond Laddering

Part-Time Work and Self-Employment in Retirement

Finding Part-Time Work That Suits Your Interests

Starting a Consultancy Business in Your Expertise Area

Making Money From Hobbies

Online Opportunities

Passive Income Opportunities in Retirement

Minimizing Expenses in Retirement

Navigating Potential Risks and Obstacles

Getting Professional Financial Advice

Conclusion

How to Generate Income in Retirement FAQs

Primary ways to generate income in retirement include maximizing Social Security benefits, investing in annuities, utilizing retirement savings accounts like 401(k)s and IRAs, investing in real estate, and buying and selling stocks and bonds. Additionally, retirees may consider part-time work or self-employment in a field of their interest.

You can use your retirement savings accounts, such as 401(k)s and IRAs, to generate retirement income by establishing withdrawal strategies. These might involve a combination of required minimum distributions (RMDs) and strategic withdrawals. Proper management of Roth and traditional IRAs can also optimize the tax benefits of your withdrawals, thus maximizing your income.

Real estate can be a lucrative way to generate income in retirement. You can rent out properties you own, with the rent serving as a steady source of income. Alternatively, investing in real estate investment trusts (REITs) can allow you to earn rental income without the need for direct property management.

Absolutely. Part-time work or self-employment can significantly contribute to your retirement income. You can find part-time work that aligns with your interests or use your skills to start a consultancy business. Additionally, you could turn a hobby into a source of income or take advantage of various online opportunities, such as freelancing or online tutoring.

Minimizing expenses is a critical component of maintaining your lifestyle when you're figuring out how to generate an income in retirement. By reducing housing costs, saving on healthcare, minimizing transportation expenses, and budgeting wisely, you can ensure that your income meets your needs and lasts throughout your retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.