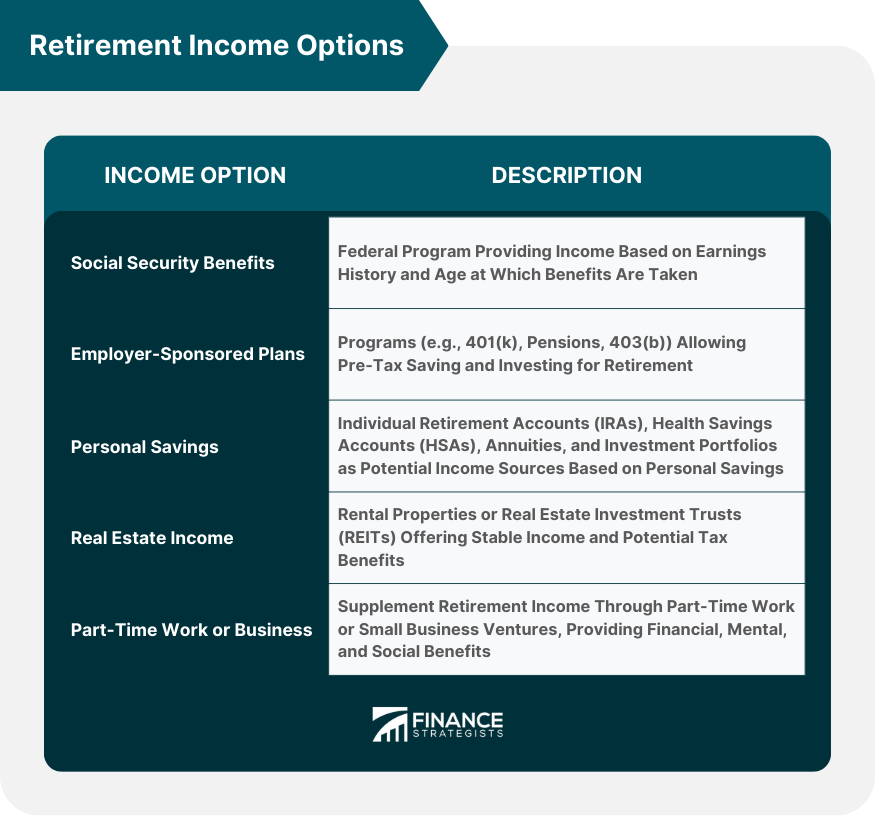

Retirement income is the financial resource a person has access to during the retirement years, derived from several possible sources like social security benefits, personal savings, and investments. The amount of retirement income one can depend on varies based on individual circumstances, the types of retirement accounts utilized, and investment performance. Retirement income is crucial for maintaining one's quality of life post-employment. Planning for retirement income is a critical aspect of financial planning. The goal is to ensure that your income during retirement is sufficient to cover your living costs and fulfill your lifestyle goals. Without proper planning, you risk outliving your savings and facing financial hardship in the later years of life. Therefore, understanding different retirement income options and strategic planning is a non-negotiable aspect of personal finance. Social Security retirement benefits are based on your lifetime earnings. Generally, to qualify, you need to have earned at least 40 credits (approximately 10 years of work). Your benefit amount is calculated based on your 35 highest-earning years in the workforce. If you worked less than 35 years, zeros are included in the calculation, which can lower your overall benefit. Strategies to maximize your Social Security benefits include delaying the claim until the age of 70 to get the highest possible monthly payout and claiming spousal benefits, which can be up to 50% of the higher earner's benefit. A 401(k) plan is a tax-advantaged plan that allows employees to save for retirement directly from their paycheck. Some employers offer a match up to a certain percentage. Pension plans, or defined benefit plans, promise a specified monthly benefit at retirement, often based on salary and years of service. 403(b) plans, similar to 401(k) plans, are tax-advantaged retirement savings plans for specific employees of public schools, tax-exempt organizations, and certain ministers. A SEP IRA is a type of traditional IRA for self-employed individuals or small business owners. Contributions are tax-deductible, and earnings grow tax-deferred until withdrawal. A solo 401(k) plan, designed for self-employed individuals with no employees, offers the same tax benefits as a traditional 401(k) but with higher contribution limits. IRAs allow you to make tax-advantaged contributions to save for retirement. There are several types, including traditional, Roth, and SEP IRAs. HSAs are tax-exempt accounts established to pay or reimburse certain medical expenses. Funds can be invested and potentially used for healthcare costs in retirement. Annuities are insurance products that provide a steady income stream in retirement. They come in various forms, including immediate, deferred, fixed, and variable annuities. These investment vehicles can help grow wealth over the long term. They can provide income through dividends (stocks), interest payments (bonds), or capital gains. Investing in rental properties can provide a steady stream of income. However, it also involves responsibilities like property management and dealing with tenants. REITs allow individuals to invest in portfolios of real estate assets. They provide a way to earn income from real estate without having to buy, manage, or finance properties yourself. Part-time work or running a business in retirement can provide income and personal fulfillment. However, it can also entail stress and time commitment. Opportunities could include consulting in your previous field, turning a hobby into a business, or working a part-time job that aligns with your interests. The age at which you choose to retire directly impacts your retirement income. If you retire early, you might have to wait to access certain income sources, like Social Security or retirement accounts, without penalties. Additionally, an early retirement means your savings need to last longer. Your current income level affects how much you can save and invest for retirement. Higher-income often allows for higher savings rates and more robust investment opportunities. Your desired lifestyle in retirement significantly impacts how much income you'll need. Travel, hobbies, and entertainment costs will affect the amount of income necessary for maintaining your preferred standard of living. Health status and projected healthcare costs can significantly impact retirement income. If you anticipate high healthcare costs, you may need to save more or consider insurance products that can help cover these expenses. Investments in stocks, bonds, or real estate can fluctuate with market conditions. Downward movements can decrease the value of your savings and potentially reduce your retirement income. Longevity risk refers to the possibility of outliving your savings. As life expectancies increase, you must plan for a longer retirement and ensure you have enough income to last. Inflation reduces the purchasing power of your income. Over time, the cost of living will likely increase, meaning your retirement income will need to keep pace. Unexpected health issues can lead to significant medical costs and reduced ability to work, potentially threatening your retirement income. Having multiple sources of retirement income can help ensure a steady cash flow and reduce the impact of poor performance in any one investment. Working for a few more years can increase your savings, lead to higher Social Security benefits, and reduce the number of years you'll need to draw on your retirement income. Employing tax-efficient strategies can help maximize retirement income. These strategies might include strategic withdrawal plans, utilizing Roth accounts, and taking advantage of tax credits and deductions. A financial advisor can provide personalized advice for maximizing retirement income based on your unique circumstances. They can help create a comprehensive plan and navigate complex decisions around investment strategies, tax planning, and income withdrawal strategies. Retirement income options can be diverse, ranging from Social Security benefits, employer-sponsored retirement plans, and personal savings and investments to real estate income and part-time work or business income. Each option has its own set of benefits and drawbacks, and it's important to understand these fully as you plan your retirement strategy. Retirement income planning is a crucial part of ensuring financial security and the lifestyle you want in your later years. Considering various factors like your age of retirement, current income level, lifestyle expectations, and health considerations and strategizing accordingly can help you make the most of your retirement income options. Early planning for retirement income is paramount to maximizing your financial resources in the retirement years. Seeking the guidance of retirement planning services can provide tailored strategies to meet your retirement goals and navigate potential risks and challenges.Retirement Income Overview

Detailed Analysis of Retirement Income Options

Understanding Social Security Benefits

Eligibility

Benefits Calculation

Strategy for Maximizing Benefits

Employer-Sponsored Retirement Plans

401(k) Plans

Pension Plans

403(b) Plans for Nonprofit Employees

Simplified Employee Pension (SEP) IRA

Solo 401(k) Plan

Personal Savings and Investments

Individual Retirement Accounts (IRAs)

Health Savings Accounts (HSAs)

Annuities

Stocks, Bonds, and Mutual Funds

Real Estate Income

Rental Properties

Real Estate Investment Trusts (REITs)

Part-Time Work or Business Income

Pros and Cons

Potential Opportunities

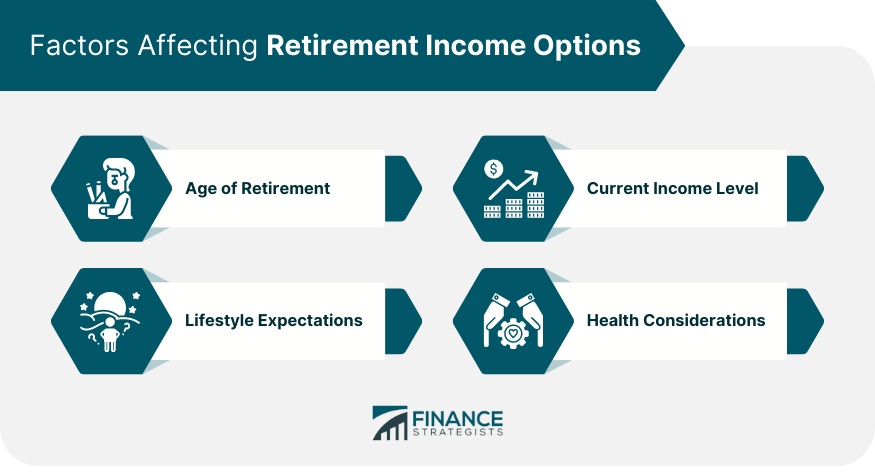

Factors Affecting Retirement Income Options

Age of Retirement

Current Income Level

Lifestyle Expectations

Health Considerations

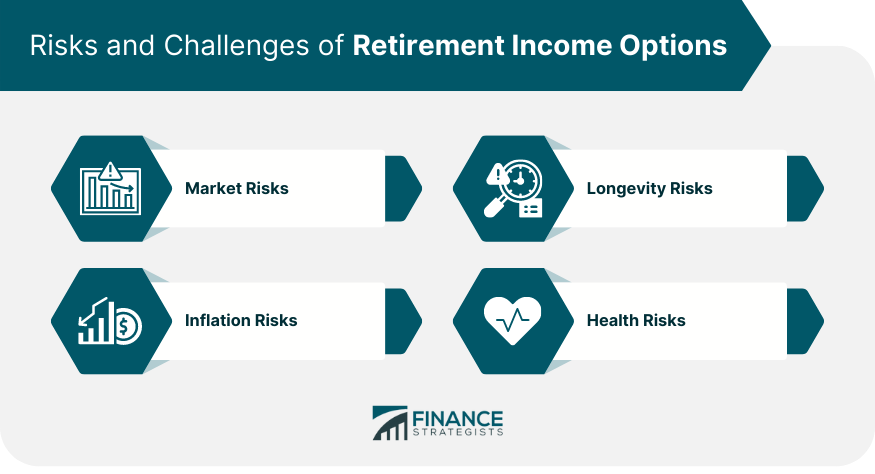

Risks and Challenges of Retirement Income Options

Market Risks

Longevity Risks

Inflation Risks

Health Risks

Strategies for Maximizing Retirement Income

Diversify Income Streams

Delay Retirement

Minimize Taxes

Work With a Financial Advisor

Bottom Line

Retirement Income Options FAQs

There are numerous retirement income options available, including social security benefits, employer-sponsored retirement plans, personal savings and investments, real estate income, and part-time work or business income.

Strategies for maximizing retirement income include diversifying your income streams, delaying retirement, minimizing taxes, and working with a financial advisor.

Health status and projected healthcare costs can significantly impact retirement income. High healthcare costs may require additional savings or insurance products to cover these expenses.

The risks include market fluctuations, longevity (outliving your savings), inflation, and unexpected health issues leading to high costs.

Your desired lifestyle in retirement significantly impacts how much income you'll need. Costs related to travel, hobbies, and entertainment will affect the amount of income necessary to maintain your preferred standard of living.