A fiduciary is someone who is legally and ethically bound to make decisions in the client's best interest. Fiduciaries can be found in many different relationships, such as investment advisors to an investor, corporate board members to shareholders, a guardian to a ward, and a few others.

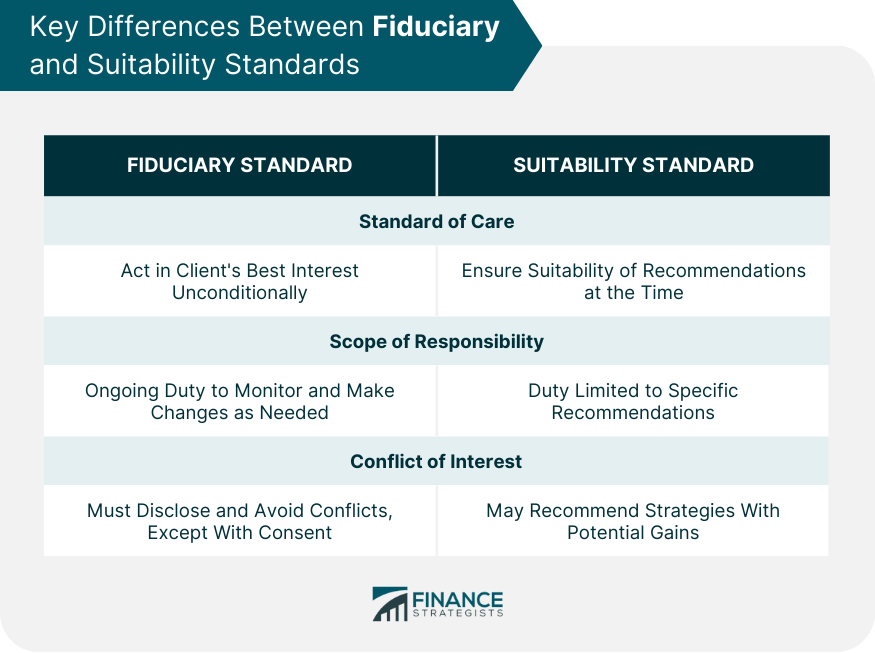

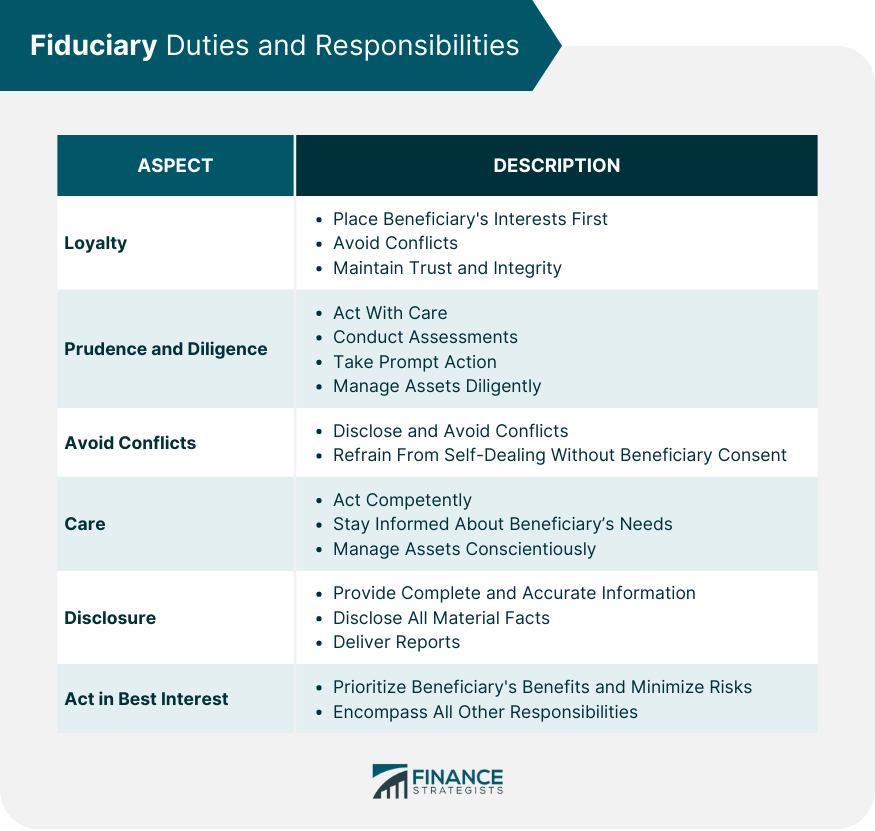

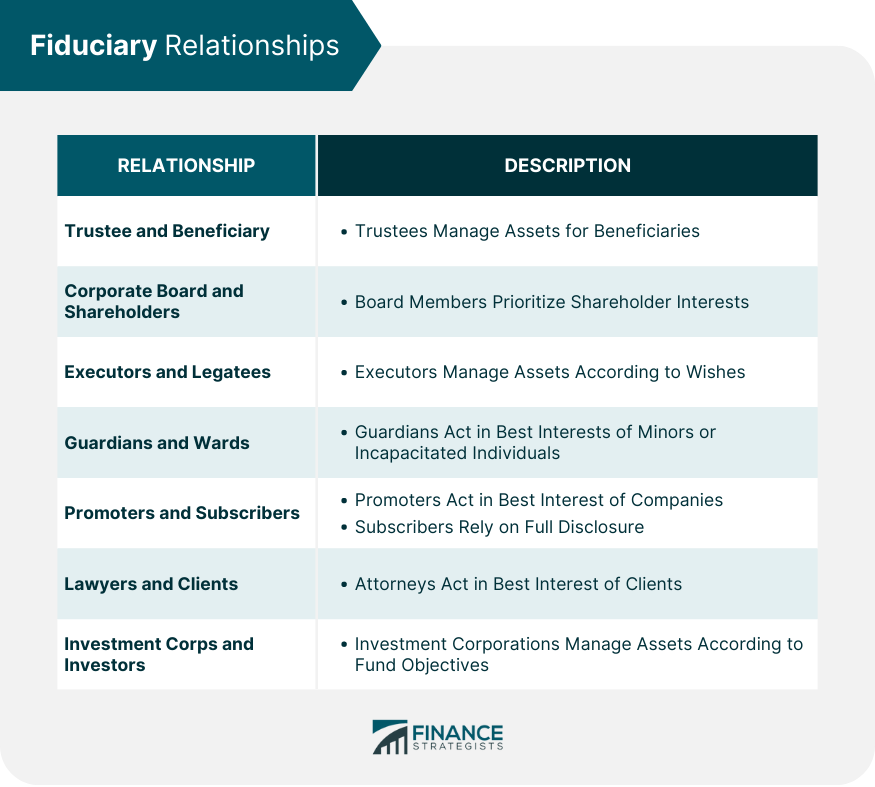

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I recall guiding a client who favored speculative stocks. While I might have directed them towards high-risk investments for rapid profits, I instead chose to safeguard their financial health. My advice was to embrace a diversified investment approach. As a fiduciary, I am legally bound to act in the best interest of my clients. In contrast, other advisors may only be required to adhere to the "suitability" standard, which mandates that their recommendations merely need to be suitable for the client. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation This dynamic necessitates the highest standard of care, as fiduciaries become custodians of other people's financial futures or welfare. These individuals, with a fiduciary responsibility, meet what is known as the "Fiduciary Standard," which requires advisors to operate in "good faith, "disclose any possible conflicts of interest, and advise solely in the client's best interest. In the Financial Industry, there are two standards: The Suitability Standard and the Fiduciary Standard. 1. The Suitability Standard does not require an advisor to advise in the best interest of the client, but rather only insure that it is suitable for the client. This means that someone only under the suitability standard may be able to sell products not in the client's best interest. 2. The Fiduciary Standard, however, is a legally and ethically bound contract where they must act in the best interest for you, the client. Traditionally, broker-dealers are only required to work under the Suitability Standard, whereas RIA's (or Registered Investment Advisors) are required to work under the Fiduciary standard. Get Expert Fiduciary Advice From a Vetted Financial Advisor. Click here. Fiduciaries are held to a higher standard, as they must act in the best interest of their client, regardless of their own interests or potential gains. On the contrary, under the suitability standard, professionals only need to ensure that recommendations are suitable for the client's needs at the time of the advice, not necessarily the best available option. This difference in the standard of care can lead to different outcomes for clients. A fiduciary advisor, for instance, might recommend an investment with lower fees that provides the same benefits as a more expensive option. An advisor operating under the suitability standard might recommend the higher-fee investment if it's deemed suitable. Fiduciaries have an ongoing duty to their clients. They are required to continually monitor the client's situation and make changes as necessary. This can include managing investments, reviewing accounts, and adjusting strategies based on changes in the client's life or financial goals. In contrast, professionals following the suitability standard only have a duty at the time of the specific recommendation. They are not obligated to monitor changes in the client's situation or adjust strategies over time. This can lead to less comprehensive care and potentially less optimal outcomes for the client. Fiduciaries are required to disclose all potential conflicts of interest and must avoid them where possible. They cannot benefit personally from their recommendations without explicit client approval. Under the suitability standard, professionals are not necessarily required to avoid conflicts of interest. While they must disclose significant conflicts, they can still recommend products or strategies that may lead to a personal gain as long as they believe the recommendation is suitable for the client. First and foremost, a fiduciary owes undivided loyalty to their beneficiary. They must place the beneficiary's interests above their own and ensure that no personal advantage is obtained at the beneficiary's expense. It means that the fiduciary should be solely guided by the best interest of their client when making decisions and should refrain from any behavior that might compromise their impartiality. Further, a fiduciary's loyalty implies a duty not to act for the benefit of third parties or to allow any conflicts of interest to interfere with the fiduciary's ability to serve the beneficiary. This requirement maintains the trust and integrity that are foundational to the fiduciary relationship. They must conduct their responsibilities with the same degree of care, skill, and diligence that a prudent person would under the same circumstances. This involves a thorough assessment of potential investments or decisions, regular review and rebalancing of investment portfolios, and keeping up to date with relevant financial news and trends. In addition, this duty encompasses the expectation that fiduciaries will take prompt action when necessary. They are expected to act diligently to preserve and protect the beneficiary's assets, including monitoring the investments and taking action to correct issues that could lead to potential losses. Fiduciaries are required to avoid conflicts of interest to ensure the beneficiary's best interest is the sole driver of decision-making. This involves fully disclosing any potential conflicts and taking steps to manage or eliminate them. For instance, a fiduciary should not invest in an asset where they have a personal interest without explicit permission from the beneficiary. Additionally, fiduciaries are prohibited from self-dealing, or benefiting personally from their fiduciary status, unless the beneficiary consents after full disclosure. This ensures that decisions are made impartially, further cementing the trust that the beneficiary places in the fiduciary. The duty of care, often intertwined with the principles of prudence and diligence, requires a fiduciary to act competently and conscientiously on behalf of the beneficiary. They must apply their knowledge and skills to the best of their ability when managing the beneficiary's assets. This entails, among other things, staying informed about the beneficiary's needs and circumstances, as well as keeping abreast of changes and trends in relevant fields. In essence, the duty of care means that a fiduciary should act in a way that a prudent person would act on behalf of themselves. Inaction, incorrect action, or reckless action can all be considered breaches of this duty. To maintain transparency in the fiduciary relationship, fiduciaries are mandated to provide complete and accurate information to the beneficiary. This duty of disclosure means that fiduciaries must inform beneficiaries about all material facts related to the assets or interests in question. In addition, fiduciaries should provide regular reports on the performance and management of the assets they control. This promotes informed decision-making and gives the beneficiary a clear understanding of the actions and decisions made on their behalf. Whether it's making investment decisions, providing advice, or executing legal tasks, a fiduciary's primary objective should always be to maximize the benefits and minimize the risks for the beneficiary. This broad duty to act in the beneficiary's best interest encompasses all the other fiduciary responsibilities. When these duties are properly carried out, they collectively serve to protect the beneficiary and ensure that the fiduciary relationship functions as intended. Trustees are tasked with managing assets or property for the benefit of the beneficiaries, adhering to the terms specified in the trust agreement. Corporate board members and shareholders also share a fiduciary relationship, with the former obligated to prioritize the interests of the shareholders and the long-term success of the company. Executors have the responsibility to manage and distribute the assets according to the deceased's wishes, ensuring that the legatees receive their rightful bequests. During the probate process, executors act as fiduciaries, diligently settling debts and handling estate matters with transparency and impartiality. A court appoints a guardian to act in the best interests of a minor or an incapacitated person. Guardians are granted legal authority and are entrusted to make decisions regarding the ward's personal well-being, education, and medical care, ensuring they are provided with a safe and nurturing environment. Promoters are responsible for conceiving and initiating business ventures, owing a fiduciary duty to act in the best interest of the companies they promote. Stock subscribers, often early investors, rely on the promoters' full disclosure of information and fair dealing when pledging to purchase shares in the new venture. Attorneys are bound to act in the best interest of their clients, maintaining confidentiality and providing competent representation and sound legal advice throughout the legal process. Clients rely on their lawyers' expertise to protect their rights and achieve favorable outcomes while ensuring that the lawyers avoid any conflicts of interest. Investors trust these corporations to manage their assets and make investment decisions that align with the fund's objectives, providing potential returns while adhering to the fund's stated investment strategy. Investment corporations must disclose relevant information to investors, avoid self-dealing, and maintain transparency to fulfill their fiduciary duties. When a fiduciary fails to uphold their obligations, the implications can be severe. They span legal ramifications, financial penalties, and reputational damage. When a beneficiary believes their fiduciary has failed to act in their best interest, they can take legal action to remedy the situation. This can result in the fiduciary being held liable for any losses the beneficiary incurs as a result of the breach. In extreme cases, fiduciaries may face criminal charges, especially if they engaged in fraudulent activities or theft. The legal ramifications serve to protect beneficiaries and uphold the integrity of fiduciary relationships. These can include repayment of profits earned through the breach, compensatory damages to cover losses incurred by the beneficiary, and, in some cases, punitive damages meant to discourage similar behavior in the future. The financial consequences of a breach of fiduciary duty can be significant and can further emphasize the importance of fiduciaries upholding their responsibilities. A fiduciary found guilty of misconduct may lose their credibility and professional reputation. This can lead to loss of current clients or beneficiaries and difficulty in attracting new ones. Reputational damage can have long-lasting effects on a fiduciary's career or business, serving as a powerful deterrent against breaches of duty. It underscores the need for fiduciaries to act with integrity, transparency, and in the best interests of their beneficiaries at all times. A fiduciary is someone legally and ethically bound to make decisions in the client's best interest, plays a critical role in various relationships, including investment advising, corporate governance, guardianship, and legal representation. The fiduciary standard demands the highest level of care and loyalty, requiring these individuals to act solely in the best interests of their clients or beneficiaries. In contrast, the suitability standard may permit professionals to offer advice that is merely suitable for the client at a specific time, without necessarily being in their best interest. Fiduciaries are held to a more stringent standard, requiring ongoing monitoring and proactive decision-making, while adhering to strict guidelines to avoid any conflicts. They owe undivided loyalty to their beneficiaries, must act with prudence and diligence, avoid conflicts of interest, provide full disclosure, and always act in the beneficiary's best interest. Breaching fiduciary duties can lead to severe consequences, including legal ramifications, financial penalties, and reputational damage. Fiduciary Definition

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

What Is a Fiduciary Standard?

Key Differences Between Fiduciary and Suitability Standards

Standard of Care

Scope of Responsibility

Conflict of Interest Handling

Fiduciary Duties and Responsibilities

Loyalty

Prudence and Diligence

Avoid Conflicts of Interest

Care

Disclosure

Act in the Best Interest of the Beneficiary

Fiduciary Relationships

Trustee and Beneficiary (The Most Common Type)

Corporate Board Members and Shareholders

Executors and Legatees

Guardians and Wards

Promoters and Stock Subscribers

Lawyers and Clients

Investment Corporations and Investors

Consequences of Breach of Fiduciary Duty

Legal Ramifications

Financial Penalties

Reputational Damage

Conclusion

Fiduciary FAQs

A fiduciary is simply someone who is legally and ethically bound to make decisions in the best interest of the client.

Fiduciaries can be found in many different relationships, such as an investment advisor to an investor, a corporate board member to the shareholders, a guardian to a ward, and a few others.

Individuals with fiduciary responsibility meet what is known as the “Fiduciary Standard,” which requires advisors to operate in “good faith,” disclose any possible conflicts of interest, and advise solely in the client’s best interest.

The suitability standard does not require an advisor to advise in the best interest of the client, but rather only insure that it is suitable for the client. This means that someone only under the suitability standard may be able to sell products not in the client’s best interest.

The Fiduciary Rule is the legal underpinning that defines fiduciary duty. This rule was issued by the Department of Labor and later overturned by Fifth Circuit Court of Appeals in 2018. The DOJ has hopes of finding a compromise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.