Yes, military retirement income is generally considered taxable. On the federal level, the Internal Revenue Service treats military retirement pay as taxable income. However, there are certain exceptions where military retirement pay may not be fully taxable. For instance, if you have a disability related to your service, a portion of your retirement pay could be exempt from taxable income. Likewise, if you're above 62 years old with a modified adjusted gross income of less than $40,000, you may exclude some of your military retirement income from taxation. At the state level, the taxability of military retirement income varies. Some states have no income tax. Therefore, military retirement income is not taxed at the state level. Other states fully or partially exempt military retirement pay from taxes, while some tax it fully. Tax laws can be complex and change frequently, so it is always a good idea to consult with a tax professional or your state's taxation department for the most accurate information. At a federal level, military retirees are expected to pay income tax on their retirement benefits, barring a few exceptions. Certain benefits are not subject to federal income tax. These include disability pensions and Survivor Benefit Plan (SBP) payments made due to death from injury or disease caused by active service. State taxation of military retirement income varies significantly from one state to another. Some states do not tax military retirement pay, while others tax part or all of it. States like Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have a state income tax, hence military retirement income is not taxed. States like Alabama, Hawaii, Illinois, and others provide full exemptions for military retirement pay. However, there are states that partially or fully tax military retirement pay, like California and Vermont, which fully tax this form of income. Others, such as North Carolina and Virginia, provide partial exemptions based on age and income limits. Even with taxation, there are ways military retirees can minimize their tax burden through available tax credits and deductions. Military retirees can potentially qualify for certain federal tax credits like the Credit for the Elderly or the Disabled, Child and Dependent Care Credit, and the Earned Income Tax Credit. Deductions that may be relevant include medical expenses and home mortgage interest. Tax laws are nuanced, so it's advisable to consult with a tax professional to understand which deductions and credits apply. Many states offer their own tax credits and deductions, some of which might be specific to military retirees. For instance, some states provide additional deductions for military pensions or credits for taxes paid to other states. Military retirees should check with their state's taxation department or a tax professional for more information. The Defense Finance and Accounting Service (DFAS) plays a vital role in military retirement taxation by providing the necessary tax forms to military retirees. Each year, the DFAS provides military retirees with a 1099-R form. This document is essential for filing both state and federal taxes, as it reports the retiree's income from the DFAS, including military retirement pay. Military retirees can access their 1099-R forms via the DFAS's myPay system. These forms provide the necessary information to report income accurately on tax returns. The Tax Cuts and Jobs Act (TCJA) of 2017 brought significant changes to the tax code, affecting various forms of income, including military retirement pay. Key changes brought by the TCJA include the doubling of the standard deduction, limiting of the State and Local Tax (SALT) deductions, and changes to tax brackets and rates. The increased standard deduction can significantly reduce taxable income for military retirees who do not itemize their deductions. Conversely, the SALT limitation can potentially increase the tax burden for retirees in states with high income or property taxes. Understanding tax liability is an important part of financial planning for military retirees. It can help identify opportunities to reduce tax burdens and optimize retirement income. Comprehending their tax liability empowers military retirees to strategize effectively for their fiscal future. This understanding aids in creating a realistic budget, fostering a sense of financial control and predictability. Additionally, it helps avoid any unexpected tax burdens during filing season, ensuring smoother financial operations. Thus, being knowledgeable about tax obligations is a crucial step toward comprehensive financial planning and peace of mind in retirement. Understand the Tax Laws in Different States: The taxability of military retirement income varies greatly from state to state. When planning for retirement, consider living in a state with lower or no taxes on military retirement income. Leverage Tax Credits and Deductions: There are numerous federal and state tax credits and deductions available to military retirees. These may include deductions for medical expenses, home mortgage interest, and credits for the elderly or disabled. Ensuring you're taking full advantage of these can reduce your overall tax burden. Consider Tax-Advantaged Investment Accounts: Contributions to tax-advantaged retirement accounts such as IRAs or 401(k)s can lower your taxable income. Earnings on these investments grow tax-free until withdrawal, providing long-term tax savings. Plan for the Tax Implications of the Survivor Benefit Plan (SBP): If you choose to participate in the SBP, be aware that these benefits are typically taxable to the recipient. However, they may be excluded from income in certain situations, such as if the recipient is a child or if the death was service-related. Consult With a Tax Advisor: Tax laws can be complex and change often. A tax advisor can provide guidance tailored to your specific situation, helping you understand your tax liabilities and find strategies to reduce them. They can keep you informed about new laws or provisions that might impact your tax situation. Some organizations offer free tax preparation services to military retirees. These include the Volunteer Income Tax Assistance (VITA) program, which provides free tax help to people who generally make $60,000 or less, persons with disabilities, and limited English-speaking taxpayers. Online resources like the IRS's "Tax Information for Members of the U.S. Armed Forces" guide, the DFAS's tax information webpage, and state taxation department websites can provide valuable information to military retirees. Understanding the taxation of military retirement income is pivotal in financial planning. Yes, military retirement pay is generally considered taxable at the federal level, but exceptions exist for disability-related benefits and retirees above the age of 62 with limited income. State taxation varies significantly, making it beneficial to understand the tax laws of individual states. Available tax credits, deductions, and tax-advantaged accounts can help mitigate the tax burden. The DFAS plays a crucial role by providing necessary tax forms, and the Tax Cuts and Jobs Act has had considerable impacts on tax obligations. Comprehensive knowledge of tax liabilities, proactive use of tax minimization strategies, and utilization of tax assistance resources can aid military retirees in navigating tax complexities, enabling them to maximize their retirement income and achieve financial stability.Is Military Retirement Income Taxable?

Federal Taxation of Military Retirement Income

State Taxation of Military Retirement Income

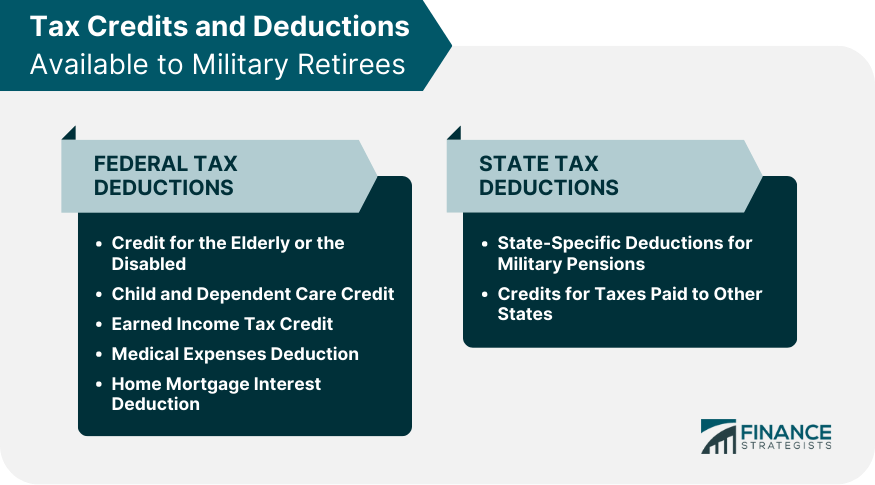

Tax Credits and Deductions Available to Military Retirees

Federal Tax Credits and Deductions

State Tax Credits and Deductions

Role of the DFAS in Military Retirement Taxation

How DFAS Issues Tax Forms for Military Retirees

How Military Retirees Can Access and Use These Forms

Implications of the TCJA on Military Retirement Income

Provisions of the TCJA Relevant to Military Retirement Income

Impacts and Potential Benefits for Military Retirees

Considerations for Military Retirees in Tax Planning

Importance of Understanding Tax Liability

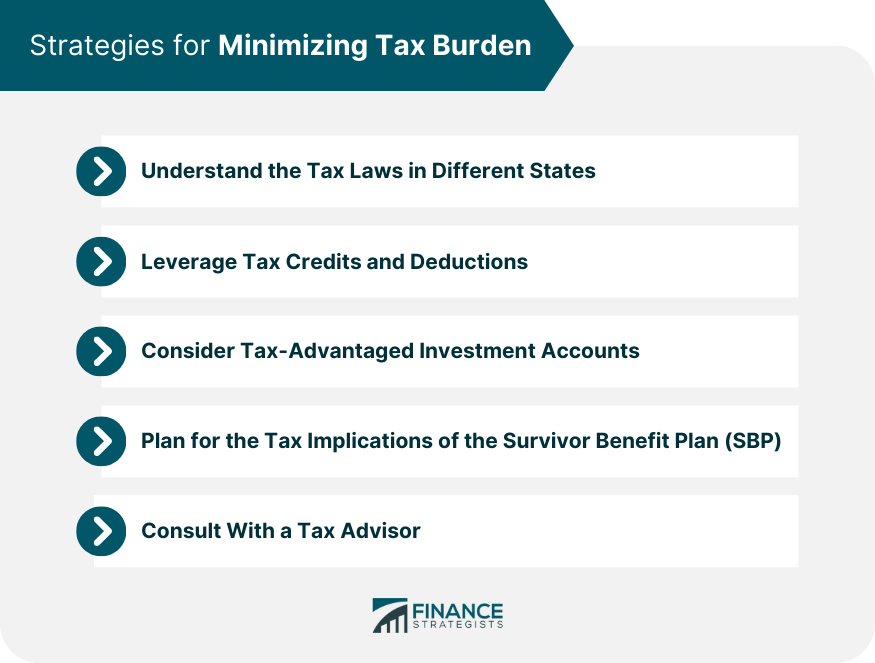

Strategies for Minimizing Tax Burden

Tax Assistance Resources for Military Retirees

Free Tax Preparation Services for Military Retirees

Helpful Online Resources and Guides

Conclusion

Is Military Retirement Income Taxable? FAQs

Yes, military retirement income is generally considered taxable income at the federal level. There are exceptions, however, for certain benefits like disability pensions and Survivor Benefit Plan payments tied to death from service-related injury or disease.

The taxability of military retirement income varies by state. Some states, like Florida and Texas, do not have a state income tax, so military retirement income is not taxed. Others, like Alabama and Hawaii, fully exempt military retirement pay. However, states like California and Vermont fully tax military retirement income, while some offer partial exemptions.

Yes, there are several federal and state tax credits and deductions available to military retirees. These can significantly minimize the tax burden. Federal credits may include the Credit for the Elderly or the Disabled, Child and Dependent Care Credit, and the Earned Income Tax Credit. Many states also offer their own tax credits and deductions.

The DFAS provides military retirees with the necessary tax forms (1099-R) to file their federal and state taxes. This form reports the retiree's income from the DFAS, including military retirement pay.

The Tax Cuts and Jobs Act introduced several changes that impact military retirement income. It increased the standard deduction, which can reduce taxable income for retirees who do not itemize their deductions. It also placed a limit on the State and Local Tax (SALT) deductions, which could increase the tax burden for retirees in states with high income or property taxes.