Fannie Mae, formally known as the Federal National Mortgage Association, is a US Government-Sponsored Entity (GSE) tasked with providing liquidity, stability, and affordability to the secondary mortgage market. Established during the Great Depression, Fannie Mae purchases mortgages from lenders, converts them into mortgage-backed securities, and sells them to investors, ensuring a constant influx of capital into the mortgage market and thereby facilitating more loans at affordable rates. Fannie Mae also establishes lending guidelines, which are integral to the underwriting process. These guidelines dictate borrower eligibility, mortgage structure, property types, and income sources, setting a national standard for lending practices. Furthermore, Fannie Mae's guidelines aim to ensure borrowers' creditworthiness and ability to afford their mortgage payments. One significant component of these guidelines is income verification and analysis. Notably, Fannie Mae recognizes retirement income, providing an avenue for retired or near-retired individuals to secure, refinance, or modify a home mortgage. Retirement income encompasses a wide range of income sources that a borrower may receive upon retirement. These are funds received from an employer-sponsored pension plan. They are typically structured as either defined benefit or defined contribution plans. Social Security is a federal program that provides benefits to retirees, their survivors, and workers who become disabled. The monthly benefit amount is based on the individual's earnings history. 401(k) and Individual Retirement Accounts (IRA) are tax-advantaged retirement savings accounts. Distributions from these accounts qualify as retirement income. Other income sources can include annuities, distributions from retirement savings plans, and other government retirement benefits. Fannie Mae guidelines stipulate that the retirement income must continue for at least three years from the date of the mortgage application. For example, if a borrower is receiving pension payments, the lender must verify that these payments will continue for at least the next three years. Lenders must also be able to verify the retirement income. This requirement involves confirming the amount, frequency, and duration of the income. The specific method of verification may vary depending on the type of retirement income. To verify retirement income, lenders typically need to review certain documentation. For pensions and Social Security income, lenders typically need to see a benefits statement. This statement generally indicates the monthly benefit amount and the duration of the payments. For income from 401(k) or IRA distributions, lenders may need to review tax returns or account statements. These documents can show the amount and frequency of the distributions. Once the lender has verified the retirement income, they can then calculate the borrower's total retirement income. This calculation is typically based on the borrower's expected monthly income from all verified retirement income sources. For instance, if a borrower receives $1,000 per month from Social Security, $500 per month from a pension, and $500 per month from an IRA, the total expected monthly income would be $2,000. Certain factors can impact the income calculation, such as the volatility of the income (if the income fluctuates from month to month) and the potential for the income to decrease (if the borrower is withdrawing from a finite account like an IRA or 401(k)). Using retirement income for qualifying purposes carries some unique considerations. Lenders consider the stability of retirement income. Pensions and Social Security benefits are usually stable since they are generally the same amount each month. Income from 401(k)s or IRAs may be less stable if the borrower is withdrawing varying amounts. Retirement income may change over time. For instance, some pensions may provide a larger initial payout that decreases after a certain period. Lenders must consider these potential changes when qualifying the borrower. There are exceptions and special cases that Fannie Mae guidelines cover. Retirement accounts can be annuitized, meaning the account is converted into a stream of guaranteed payments. Fannie Mae guidelines have specific instructions for handling these cases. Some borrowers may have non-traditional retirement income, like income from investments or rental properties. Fannie Mae guidelines detail how to consider this type of income. For borrowers nearing retirement, lenders may need to consider the borrower's post-retirement income. If a borrower's income will decrease upon retirement, this could impact the borrower's ability to pay their mortgage. Fannie Mae guidelines provide insight into handling these situations. Expanding the Pool of Resources for Home Loans: Retirement income introduces a new avenue of financial resources for borrowers. This income, which can often be overlooked, can significantly boost borrowing capacity when securing a home loan. Unlocking Opportunities in the Housing Market: The inclusion of retirement income in mortgage calculations creates opportunities. The use of retirement income can enable a wider selection of housing choices during retirement years. Risk of Depleting Retirement Funds: Borrowers drawing income from finite resources like a 401(k) or IRA may face a decline in retirement funds potentially causing difficulties in meeting mortgage obligations and increasing default risk. Complexity of Verification and Calculation Process: Retirement income variability complicates the mortgage application process, making the verification and calculation of this income challenging and time-consuming for borrowers. From a lender's perspective, the inclusion of retirement income in Fannie Mae's guidelines broadens the pool of eligible borrowers. However, it also adds another layer of complexity to the mortgage approval process. Verifying and calculating retirement income can require additional time and resources compared to traditional income sources. Given the potential variability and decrease of retirement income over time, lenders must employ prudent risk management strategies. These might include requiring additional documentation, performing detailed analyses of retirement income stability, and considering potential changes in retirement income when qualifying borrowers. Freddie Mac, like Fannie Mae, recognizes retirement income in their underwriting guidelines. However, there may be slight differences in the type of documentation required and the methods used to calculate and analyze retirement income. FHA loans are insured by the federal government and have more lenient qualification criteria. The FHA also accepts retirement income, including Social Security, pensions, and distributions from retirement accounts. However, their guidelines may differ in specifics. The VA's loan program, geared towards service members and their families, also recognizes retirement income. This includes military retirement pay and other forms of retirement income. Fannie Mae's guidelines provide a comprehensive framework for using retirement income in mortgage lending. These guidelines cover various forms of retirement income, from pensions and Social Security to distributions from retirement accounts, and offer detailed directives on verifying, calculating, and analyzing this income. For borrowers, the key takeaway is that retirement income can be used to qualify for a mortgage, opening up home ownership possibilities during retirement. For lenders, these guidelines offer valuable insight into handling retirement income, a potentially complex and variable income source. Planning for retirement is a complex process, especially when considering large financial decisions like home mortgages. Therefore, it's essential to seek professional retirement planning services. These experts can help navigate the complexities of retirement income, ensuring that you maximize your financial resources for a secure and comfortable retirement.Overview of Fannie Mae Guidelines

Fannie Mae Guidelines on Using Retirement Income

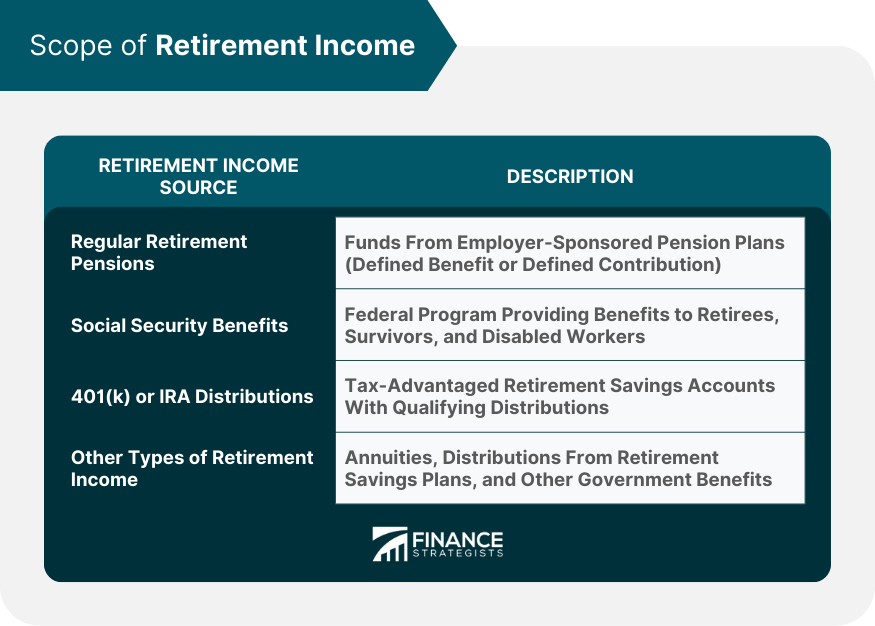

Scope of Retirement Income

Regular Retirement Pensions

Social Security Benefits

401(k) or IRA Distributions

Other Types of Retirement Income

Eligibility Criteria for Using Retirement Income

Requirement of Continuity

Verifiability of Retirement Income

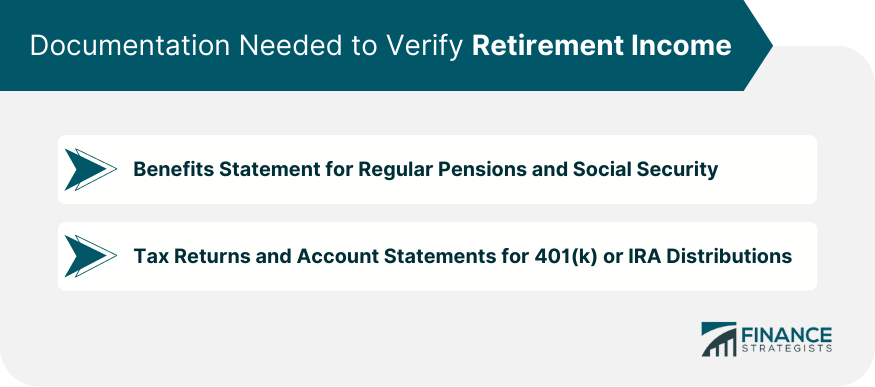

Documentation Needed to Verify Retirement Income

Benefits Statement for Regular Pensions and Social Security

Tax Returns and Account Statements for 401(k) or IRA Distributions

Calculating the Borrower's Retirement Income

Expected Monthly Income Calculation

Factors That May Impact Income Calculation

Considerations When Using Retirement Income for Qualifying Purposes

Stability of Retirement Income

Changes in Retirement Income Over Time

Exceptions and Special Cases

Annuitized Retirement Accounts

Non-traditional Retirement Income

Borrowers Nearing Retirement

Implication of These Guidelines on Borrowers and Lenders

Borrowers' Perspectives

Advantages of Using Retirement Income for Mortgage Qualification

Challenges and Risks

Lenders' Perspectives

Impact on Mortgage Approval Process

Risk Management Strategies

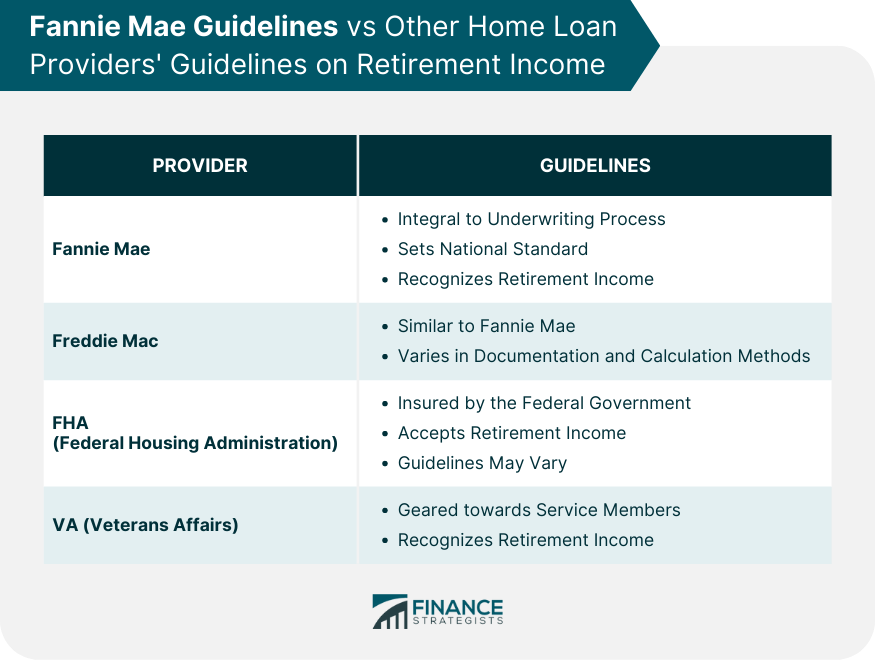

Comparison With Other Home Loan Providers' Guidelines on Retirement Income

Freddie Mac's Guidelines

Federal Housing Administration (FHA)'s Guidelines

Veterans Affairs (VA)'s Guidelines

The Bottom Line

Fannie Mae Guidelines on Using Retirement Income FAQs

The Fannie Mae guidelines allow borrowers to use retirement income, such as pensions, Social Security benefits, and distributions from retirement accounts like 401(k)s or IRAs, for mortgage qualification. Lenders must verify this income and ensure it will continue for at least three years from the date of the mortgage application.

Fannie Mae's guidelines define retirement income as any regular income a borrower receives upon retirement. This could include regular pensions, Social Security benefits, distributions from 401(k) or IRA accounts, and other government retirement benefits.

To verify retirement income as per Fannie Mae guidelines, lenders typically need to review a benefits statement for regular pensions and Social Security. For income from 401(k) or IRA distributions, lenders may need to review tax returns or account statements showing the amount and frequency of the distributions.

According to the Fannie Mae guidelines, a borrower's retirement income is calculated based on the expected monthly income from all verified retirement income sources. Factors like volatility of income and potential for the income to decrease are also considered.

The Fannie Mae guidelines require lenders to consider the post-retirement income of borrowers nearing retirement. If a borrower's income will decrease upon retirement, this could impact their ability to pay their mortgage, and this must be factored into the underwriting decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.