The Department of Veterans Affairs (VA) is a United States governmental agency dedicated to serving veterans. Established in 1930, it has evolved to provide comprehensive services such as healthcare, benefits programs, and memorial services. A significant part of the VA's mission is to provide veterans with disability benefits, including those who are unable to work due to service-connected disabilities. This leads us to the concept of "unemployability" within the VA framework. Unemployability, formally known as Total Disability Individual Unemployability (TDIU), is a unique VA disability compensation program. It allows veterans who cannot maintain substantially gainful employment due to their service-connected disabilities to be compensated at the 100% disability rate, even if their combined disability rating is less than 100%. This program is vital as it acknowledges the profound impact of service-connected disabilities on a veteran's earning capacity and provides a compensation structure that reflects this reality. The VA does not consider retirement income when assessing unemployability. Instead, the VA focuses on the effect of a veteran's service-connected disabilities on their ability to maintain substantially gainful employment. This system of determining eligibility for Individual Unemployability (IU) benefits provides veterans with service-connected disabilities a fair chance to receive adequate compensation, irrespective of any retirement income they might have. The eligibility for IU benefits is determined by a set of specific criteria, which focus solely on the service-connected disabilities of the veteran. These criteria include: A veteran must have at least one service-connected disability rated at 60% or more disabling. Alternatively, they might have two or more service-connected disabilities, with at least one rated at 40% or more disabling, and a combined rating of 70% or more. A veteran should be incapable of maintaining a steady job that provides a sufficient income, termed as substantially gainful employment. This inability should be primarily because of the veteran's service-connected disability or disabilities. However, the VA does not consider odd jobs, also known as marginal employment, in this context. If a veteran meets these criteria, the VA then determines their IU benefit amount based on their service-connected disability rating. The VA calculates the IU benefit amount on the basis of the veteran's service-connected disability rating. The maximum IU benefit amount aligns with the 100% disability compensation rate. This ensures that veterans, who are unable to work due to their service-connected disabilities, receive the full compensation they deserve. When assessing unemployability, the VA conducts a comprehensive evaluation that spans several aspects of the veteran's life. The VA primarily looks at the severity of the veteran's service-connected disabilities. The physical and mental impact of these disabilities, such as impaired mobility, chronic pain, or PTSD, significantly influences the veteran's capacity to maintain gainful employment. The VA considers the veteran's work history, including the jobs they held before and after their military service, and during the onset of their disabilities. This history gives insight into the veteran's skills and experiences and how their disabilities may impact their ability to continue in their line of work. The VA also takes into account the veteran's educational background and skill set. Veterans with higher education or specialized skills may be able to find work that accommodates their disabilities. Conversely, those with limited education or skills may find it challenging to secure gainful employment. The term "substantially gainful employment" is key in the VA's assessment. The VA seeks to determine if, considering the above factors, the veteran can secure or maintain employment that provides income above the poverty threshold. The VA's determination of unemployability hinges not only on a veteran's ability to work but also on their capacity to earn an income. In the VA's context, not all income is equal. The VA distinguishes between "earned income" and "unearned income." Earned income, which comes from employment or self-employment, is the primary concern in the VA's unemployability determination. If a veteran can earn a significant income despite their service-connected disabilities, they might not qualify for TDIU. This income indicates that they can maintain substantially gainful employment, which is contradictory to TDIU's premise. In contrast, unearned income, which includes sources like retirement benefits, is not factored into the TDIU assessment. This exclusion is because unearned income is not indicative of a veteran's ability to secure or maintain employment. Therefore, a veteran could receive unearned income, such as retirement benefits, and still qualify for TDIU if their service-connected disabilities prevent substantially gainful employment. Retirement income can come from various sources, such as Social Security, pensions, retirement savings accounts, and military retirement pay. While these incomes provide financial support during a veteran's retirement, they do not constitute earned income and thus, generally do not affect TDIU eligibility. Military retirement pay is a unique case. Veterans can receive military retirement pay based on their years of service and can also receive VA disability compensation. However, the law prevents "double-dipping," or receiving full benefits from both sources simultaneously. To navigate this, veterans often waive a portion of their military retirement pay equivalent to their VA disability compensation, which is tax-free. This arrangement usually does not affect TDIU eligibility. As previously highlighted, the VA focuses on the ability to earn an income when determining TDIU eligibility. Non-military retirement income, such as pensions, Social Security, or distributions from retirement accounts, is unearned income and does not influence TDIU eligibility. As such, a veteran can receive non-military retirement income while also receiving TDIU benefits. The VA's exclusion of retirement income from TDIU assessments has both benefits and drawbacks. On the positive side, it allows veterans whose service-connected disabilities prevent gainful employment to receive adequate compensation, irrespective of their retirement income. On the downside, it could lead to an overestimation of the financial hardship faced by veterans with substantial retirement incomes. The impact on individual veterans varies. Veterans with substantial retirement income and TDIU benefits can attain financial stability. However, veterans with less retirement income might feel disadvantaged, as their total income (including TDIU benefits) may still be insufficient to cover their living expenses. From a societal perspective, the policy ensures that veterans receive due recognition for their service and sacrifice. From a financial standpoint, it potentially raises the cost of VA disability benefits. However, these costs contribute to the social contract between the nation and its veterans, acknowledging their service and the personal cost of military duty. Different agencies and programs have varying approaches to retirement income and unemployability. For instance, Social Security Disability Insurance (SSDI) does not consider retirement income when determining disability benefits. Conversely, some state disability programs may offset benefits with retirement income. Compared to other government entities, the VA's policy of disregarding retirement income when determining unemployability stands out. It underscores the unique nature of veterans' service and sacrifice and the societal obligation to provide adequate compensation for service-connected disabilities. The Department of Veterans Affairs (VA) has a unique and specialized approach towards assessing unemployability for veterans with service-connected disabilities. Rather than considering retirement income, the VA's focus is primarily on the effect of a veteran's disabilities on their ability to maintain substantially gainful employment. The assessment for unemployability is comprehensive, taking into account factors such as the severity of the disability, the veteran's work history, educational background, and skills. The VA's policies, unlike some other government entities, underscore the societal obligation to provide adequate compensation for service-connected disabilities, acknowledging the distinct nature of veterans' service and the personal cost of military duty. While this policy may lead to financial stability for some veterans, it may also raise the costs of VA disability benefits. Nevertheless, it plays a crucial role in ensuring that veterans receive the recognition they deserve for their service and sacrifice.Overview of Unemployability in VA

Does VA Use Retirement as Income for Unemployability?

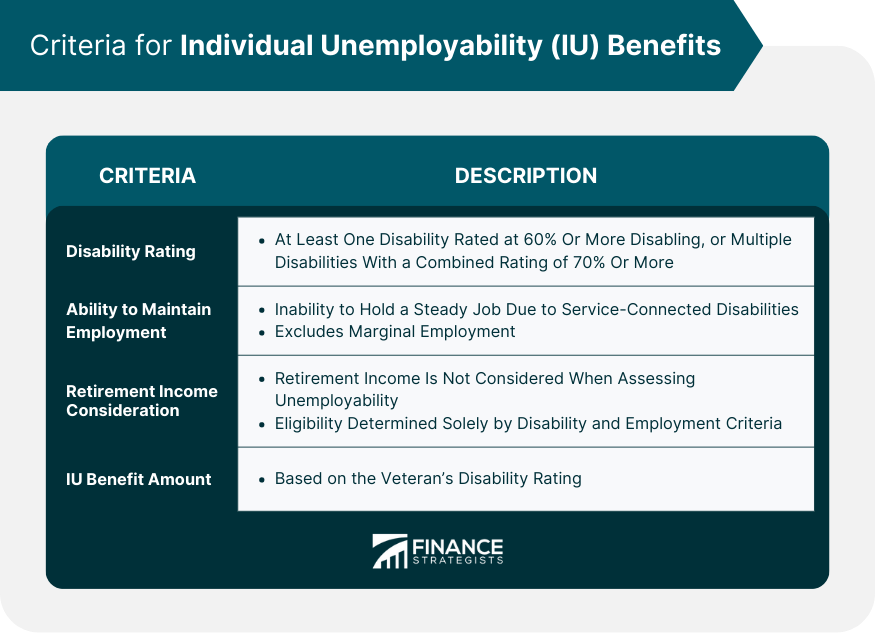

Criteria for Individual Unemployability (IU) Benefits

Service-Connected Disability Rating

Ability to Maintain Substantially Gainful Employment

Maximum IU Benefit Amount

Assessment of Income in VA Unemployability

Factors Considered by the VA in Assessing Unemployability

Severity and Nature of the Veteran's Disabilities

Veteran's Work History

Education and Skills

Substantially Gainful Employment

Role of Income in VA's Unemployability Determination

Focus on Earned Income

Exclusion of Unearned Income

Understanding Retirement Income in the Context of the VA

Different Types of Retirement Incomes and Their Implications

Effect of Military Retirement Pay on VA Unemployability

Effect of Non-military Retirement Income on VA Unemployability

Impacts of Retirement Income on Unemployability Benefits

Pros and Cons of Including Retirement Income in Unemployability Assessments

Impact on Individual Veterans and Their Families

Societal and Financial Implications

Comparisons to Other Government Agencies and Programs

How Other Agencies and Programs Handle Retirement Income in Relation to Unemployability

Comparison Between VA's Policies and Those of Other Government Entities

The Bottom Line

Does VA Use Retirement as Income for Unemployability? FAQs

No, the VA does not consider retirement income in determining unemployability. The primary focus is on the veteran's service-connected disabilities and their ability to maintain substantially gainful employment.

Retirement income is generally not considered in the context of individual unemployability by the VA. The primary criterion is the effect of the veteran's service-connected disabilities on their ability to work.

No, a veteran's retirement income does not affect their eligibility for VA unemployability benefits. The VA focuses on the veteran's ability to maintain substantially gainful employment due to their service-connected disabilities.

No, receiving retirement income does not disqualify a veteran from receiving unemployability benefits from the VA. The main factor considered is the veteran's capacity to work due to service-connected disabilities.

Unlike some other disability programs, the VA does not count retirement income when determining unemployability. The primary focus is whether a veteran's service-connected disabilities prevent them from maintaining substantially gainful employment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.