Social Security Disability Insurance (SSDI), a federal program in the United States, provides financial assistance to individuals incapacitated by disability. Funded by payroll taxes, SSDI is part of the larger Social Security system, offering vital financial support to those with long-term disabilities. The SSDI program operates under income restrictions known as the Substantial Gainful Activity (SGA), established to ensure that only those genuinely unable to work receive benefits. In 2024, the monthly SGA amount is $2,590 for statutorily blind individuals. For non-blind individuals, the SGA amount for 2024 is set at $1,550 per month. This indicates the maximum income one can earn from employment while still qualifying for benefits. SSDI considers two types of income: earned and unearned. Earned income includes wages or business profits, whereas unearned income encompasses non-work related funds such as other Social Security benefits, pensions, state disability benefits, unemployment benefits, interest income, as well as gifts and inheritances. The answer is yes, but with some critical nuances to consider. In general, the SSA considers all income when determining your eligibility for SSDI benefits and the amount you can receive. This assessment includes personal retirement benefits. However, not all forms of retirement benefits may affect your SSDI benefits. This decision is based on various factors, including the nature of the retirement benefits, your age, your work history, and your financial need. The Social Security Administration (SSA) follows a structured process to ascertain whether your personal retirement benefits should be counted as income for SSDI purposes. Here are the critical factors that the SSA will consider: Amount of Your Personal Retirement Benefits: The total value of your retirement benefits could influence the calculation of your SSDI benefits. Your Age: The age at which you retire and begin drawing on your personal retirement benefits can impact the amount of SSDI benefits you can receive. Your Work History: Your work history, particularly whether you paid Social Security taxes on your earnings, can significantly influence whether your retirement benefits affect your SSDI. Your Financial Need: The SSA will consider your financial situation to assess whether you need SSDI benefits on top of your personal retirement benefits. If your personal retirement benefits are considered income for SSDI purposes, they can affect the amount of your SSDI benefits in one of two primary ways: Your SSDI benefits may be reduced by a certain percentage. This reduction generally applies if your retirement benefits are from a job where you did not pay Social Security taxes, such as certain federal civil service, state or local government jobs, and many jobs outside of the United States. In some situations, the SSA might determine that your retirement benefits meet or exceed the substantial gainful activity (SGA) limit, leading to ineligibility for SSDI benefits. If you are concerned about how your personal retirement benefits may affect your SSDI benefits, it is advisable to contact the SSA directly to discuss your individual situation. Remember that each case is different, and general rules may not apply directly to your specific circumstances. Consulting with a legal professional or an SSDI benefits expert can also help you navigate this complex terrain and make informed decisions that best serve your interests. Consider Jane, a former federal civil service employee, who begins receiving SSDI benefits due to a disability. Jane also receives a civil service pension from a job where she did not pay Social Security taxes. As per the SSA guidelines, her SSDI benefits might be reduced because of her civil service pension. On the other hand, consider John, a retired private sector employee, who also starts receiving SSDI benefits. Unlike Jane, John's private pension does not reduce his SSDI benefits because Social Security taxes were deducted from his earnings when he was working. These examples underscore the importance of the nature of the retirement benefits and whether Social Security taxes were paid on the job's earnings that provide those benefits. Here are few scenarios that elucidate the interplay between SSDI and retirement benefits. Mark is eligible for both Social Security retirement benefits and SSDI. If he starts receiving retirement benefits before he is eligible for SSDI, his SSDI application could be denied. However, if he becomes disabled and starts receiving SSDI before reaching full retirement age, his SSDI benefits will automatically convert to retirement benefits when he reaches his full retirement age. The key point here is that the amount will remain the same, underscoring that in this scenario, SSDI and Social Security retirement benefits do not cumulate but rather transition from one to another. Now imagine Lisa, who is receiving SSDI benefits and is contemplating taking early retirement. If Lisa does decide to retire early, her future retirement benefits could be significantly reduced. This scenario emphasizes the potential long-term financial implications of decisions surrounding SSDI and retirement benefits. The complexity and potential long-term financial impact of these decisions make it advisable for individuals in similar situations to consult with a legal professional or an SSDI benefits expert. They can provide tailored advice based on a comprehensive understanding of the Social Security system and the individual's specific circumstances. SSDI and Social Security retirement benefits are two different programs, but they intersect in a unique way. If a person becomes disabled and starts receiving SSDI before reaching their full retirement age, their SSDI benefits automatically convert into retirement benefits when they reach full retirement age. However, the amount remains the same, as the benefits are not cumulative but transition from one to the other. Spousal and survivor benefits are also part of the Social Security program and can intersect with SSDI benefits. For instance, a disabled widow or widower could potentially be eligible for both survivor benefits and SSDI. However, there are specific rules about the concurrent receipt of these benefits, so it's essential to seek professional advice. Receiving both SSDI and personal retirement benefits could potentially affect your SSDI benefits, depending on the type of retirement benefit and whether Social Security taxes were paid on the income that provides those benefits. If the retirement benefits are from a job where you did not pay Social Security taxes, your SSDI benefits might be reduced. The tax implications of receiving both SSDI and personal retirement benefits can be complex. Generally, SSDI benefits are not taxable unless you have substantial income in addition to your benefits. However, personal retirement benefits may be taxable and could push your total income to a level where a portion of your SSDI benefits become taxable. Navigating the complexities of SSDI and personal retirement benefits requires understanding key points, like the nature of your retirement benefits and whether Social Security taxes were paid on the earnings that provide those benefits. Realizing that specific retirement benefits might reduce your SSDI, and being aware of the tax implications, are also essential in making informed decisions. The critical takeaway here is the value of professional advice. Whether it's consulting with the SSA directly, seeking legal advice, or working with an SSDI benefits expert, getting tailored guidance can help you optimize your benefits and plan more effectively for your financial future. If you're in a situation where you're receiving or are eligible for both SSDI and personal retirement benefits, consider seeking retirement planning services. This important step can provide clarity and help ensure that you make decisions that align with your long-term financial security and well-being.SSDI and Income: How They Relate

Does SSDI Count Personal Retirement Benefits as Income?

Factors Considered by the SSA

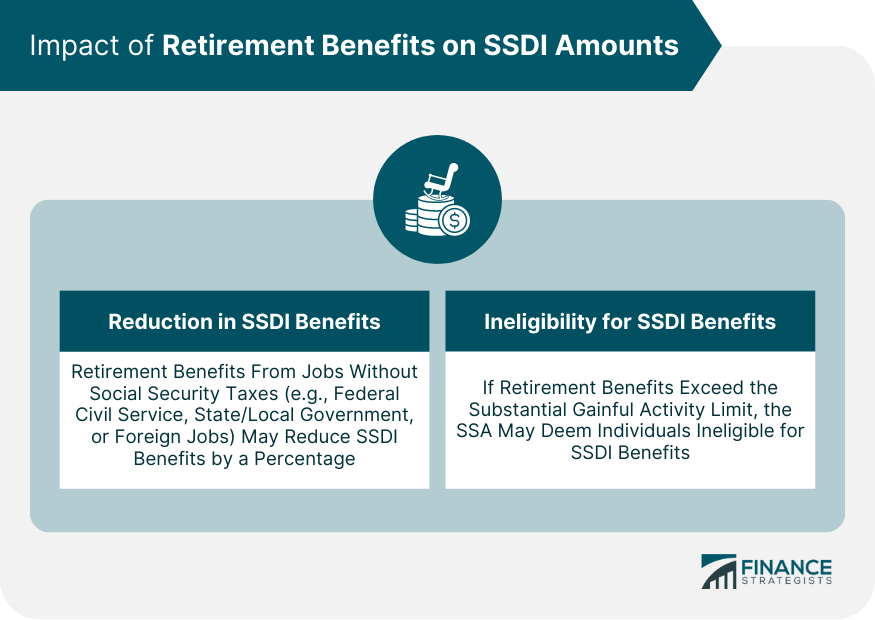

Impact of Retirement Benefits on SSDI Amounts

Reduction in SSDI Benefits

Ineligibility for SSDI Benefits

Case Studies and Scenarios

Examples Illustrating How Personal Retirement Benefits Can Impact SSDI

Various Scenarios Exploring the Interplay Between Retirement Benefits and SSDI

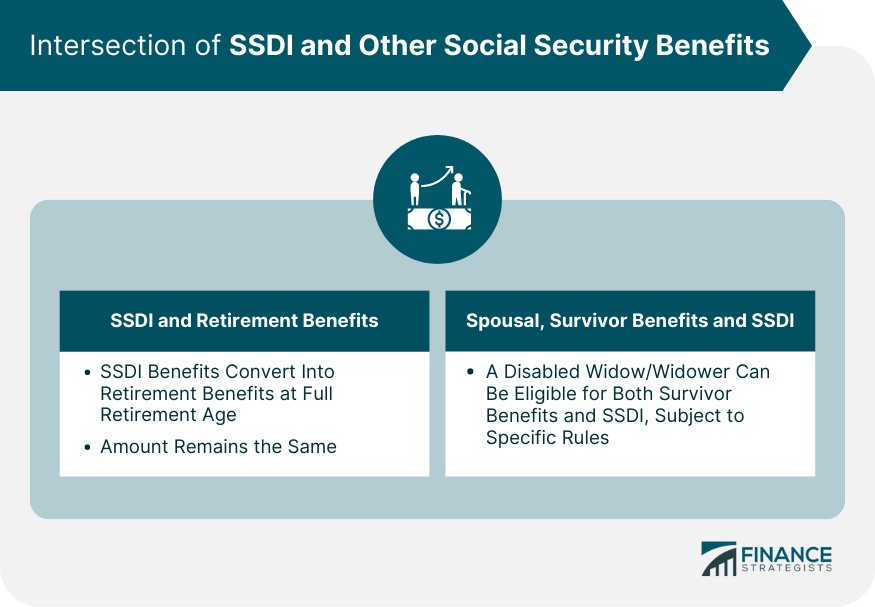

Intersection of SSDI and Other Social Security Benefits

Social Security Retirement Benefits and SSDI

Spousal Benefits, Survivor Benefits, and SSDI

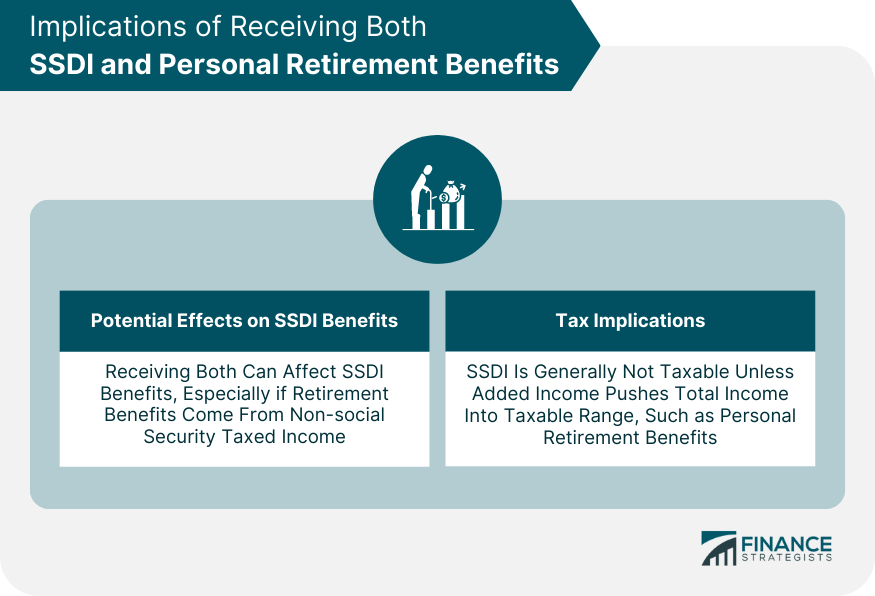

Implications of Receiving Both SSDI and Personal Retirement Benefits

Potential Effects on SSDI Benefits

Tax Implications

Conclusion

Does SSDI Count Personal Retirement Benefits as Income? FAQs

Yes, SSDI can count certain types of personal retirement benefits as income, particularly those from jobs where you did not pay Social Security taxes. However, private pensions or 401(k) plans typically do not affect SSDI benefits.

SSDI might consider personal retirement benefits from federal civil service jobs, certain state or local government jobs, and many jobs outside of the United States as income, especially if Social Security taxes were not paid on those jobs' earnings.

No, SSDI does not count Social Security retirement benefits as income in the traditional sense. However, once you start receiving Social Security retirement benefits, your SSDI benefits will cease and continue as retirement benefits at the same rate.

Yes, if your personal retirement benefits come from a job where you did not pay Social Security taxes, your SSDI benefits could be reduced.

The SSA considers several factors, such as the amount of your personal retirement benefits, your age, your work history, and your financial need when determining whether to count your personal retirement benefits as income for SSDI.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.