The Social Security system was established in 1935 as part of President Franklin D. Roosevelt's New Deal program during the Great Depression. Its aim was to provide income to retired workers who, due to the economic crisis, found themselves in financial straits. Over time, the program expanded to include not just retirees, but also survivors and the disabled. Originally, the Social Security system was a pay-as-you-go system, where the contributions of current workers financed the benefits of retirees. In the 1980s, however, the system was overhauled to accumulate surpluses in anticipation of the Baby Boomer retirement wave. Social Security was designed to provide financial assistance to retired workers, helping to replace a portion of their pre-retirement income. It serves as a crucial lifeline for many elderly citizens, often forming the bedrock of their retirement income. The amount you receive in Social Security benefits is based on a combination of factors: The age at which you choose to start collecting Social Security can have a significant impact on your monthly benefit amount. If you begin collecting at the earliest age possible, which is 62, you will receive a reduced benefit. However, if you delay taking Social Security until after your full retirement age (between 66 and 67 for those born after 1954), your benefit will increase until you reach age 70. Your Social Security retirement benefits are calculated based on your 35 highest-earning years of work. Therefore, individuals with higher lifetime earnings will typically receive higher benefits. You earn Social Security credits for each year you work and pay into the system. The number of credits you need to be eligible for retirement benefits depends on when you were born, but most people need at least 40 credits, equivalent to ten years of work. The Social Security Administration uses a complex formula to calculate your monthly benefit amount. This formula takes into account your indexed monthly earnings during the 35 years in which you earned the most. It then applies a formula to these earnings, which results in your primary insurance amount (PIA) — the benefit you would receive if you decided to start receiving benefits at your full retirement age. Creating a "my Social Security" account is the first step towards understanding your estimated retirement income. This can be done online via the Social Security Administration's website. Here, you can review your earnings record, estimate future benefits, and more. Once your account is set up, you can access your Social Security Statement. This statement gives an accurate record of your earnings and provides an estimate of potential future benefits. It's crucial to review this statement carefully and report any discrepancies to the SSA, as errors can affect your future benefit amount. Your Social Security Statement will display the estimated benefits you could receive at different ages. It will show your benefit amount if you start collecting at 62, at your full retirement age, and at 70. Remember that these estimates are based on the assumption that you will continue to earn your current salary until you start collecting benefits. Therefore, if your income changes, your estimated benefits may also change. The Social Security Administration provides an online Retirement Estimator. This tool provides a personalized estimate of your future retirement benefits. This estimate is based on your actual Social Security earnings record, which can provide a more accurate projection than other calculators that use averaged earnings or growth rates. In addition to the Retirement Estimator, the SSA offers several detailed calculators. These include the Early or Late Retirement Calculator, which can show you how taking your benefits early or late can affect your benefit amount, and the Life Expectancy Calculator, which can help you make an informed decision about when to start receiving benefits. Numerous financial companies and websites also offer retirement income calculators. These tools can provide a comprehensive view of your retirement income, incorporating not just your Social Security benefits but also your personal savings, investments, and potential retirement expenses. Choosing to retire early can have a significant impact on your Social Security benefits. If you start collecting benefits before your full retirement age, your benefits will be permanently reduced. This reduction can be as much as 30% if you start collecting at age 62. Conversely, if you choose to delay retirement past your full retirement age, your benefits will increase. This increase continues until you reach age 70, at which point the benefit amount does not increase further. This increase can be significant – for every year you delay retirement past your full retirement age, your benefits increase by approximately 8%. One of the most effective ways to increase your Social Security retirement income is to work longer. This allows you to earn more Social Security credits and potentially replace lower-earning years in your benefit calculation, leading to a higher monthly benefit amount. If you're married, you can maximize your benefits by coordinating with your spouse. For example, one strategy might be for the lower-earning spouse to collect benefits early while the higher-earning spouse delays benefits until age 70. If you continue to work while receiving Social Security benefits before your full retirement age, your benefits may be temporarily reduced if you earn more than certain limits. Therefore, limiting your income during this period can help to maximize your benefits. A financial advisor can be an invaluable resource when planning for retirement. They can help you understand the complex rules surrounding Social Security and devise a strategy that maximizes your retirement income. An advisor can also help you incorporate your Social Security benefits into a broader retirement income plan, taking into account your savings, investments, and lifestyle goals. Inflation can erode the purchasing power of your retirement income over time. To help mitigate this, Social Security provides annual Cost-Of-Living Adjustments (COLAs) that are designed to keep pace with inflation. The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) and can lead to increases in your monthly benefit amount. The Social Security system is subject to changes in legislation, which can impact your retirement income. Policymakers periodically discuss proposals to change the system, such as increasing the full retirement age or altering the benefit calculation formula. Staying informed about these potential changes is critical for planning your retirement strategy. Depending on your overall income level, a portion of your Social Security benefits may be taxable. If you have substantial income from other sources—such as wages, self-employment, interest, dividends, and other taxable income—you could owe federal income tax on a portion of your benefits. While Social Security can provide a significant portion of your retirement income, it's crucial to have other sources of income as well. These might include personal savings, investments, pensions, or annuities. Diversifying your retirement income can help ensure financial stability and protect against unexpected expenses. Social Security is a vital part of most people's retirement planning. Understanding how much you can expect to receive from Social Security can help you plan your savings and investment strategy, and determine the lifestyle you can afford in retirement. Your desired lifestyle and expected living costs in retirement should play a significant role in your retirement planning. These factors can significantly affect how much income you'll need in retirement, and should be factored into your decisions about when to start collecting Social Security benefits and how much you need to save and invest. Social Security Retirement Income acts as a financial safety net for retirees, the amount of which is influenced by factors such as age at retirement, lifetime earnings, and accumulated Social Security credits. Various tools and resources can help estimate potential income, including creating a "my Social Security" account, accessing your statement, and utilizing online calculators. Maximizing this income can involve strategies such as prolonging your working years, coordinating benefits with your spouse, and limiting post-retirement income. Consideration should also be given to potential system changes, tax impacts, and cost-of-living adjustments. Early and strategic retirement planning, which should incorporate Social Security, diverse income sources, and lifestyle and living cost considerations, can significantly enhance your financial stability post-retirement. Consulting with a financial advisor or a retirement planning service can offer personalized guidance to navigate retirement complexities and optimize potential income.Overview of Social Security Retirement Income

Understanding Estimated Social Security Retirement Income

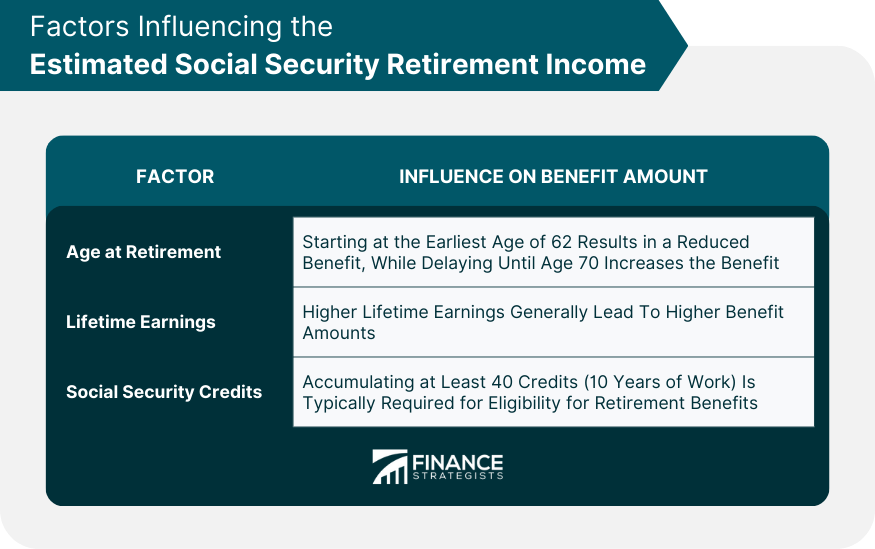

Factors Influencing the Estimated Social Security Retirement Income

Age at Retirement

Lifetime Earnings

Social Security Credits Earned

Explanation of Social Security Benefit Formulas

Process of Estimating Your Social Security Retirement Income

How to Create a "My Social Security" Account

Accessing the Social Security Statement

Reading the Estimated Benefits

Tools for Estimating Social Security Retirement Income

Online Social Security Retirement Estimator

Detailed Calculators Provided by the Social Security Administration (SSA)

Private Retirement Income Calculators

Impact of Early or Late Retirement on Estimated Income

Consequences of Early Retirement on Social Security Benefits

Effects of Delaying Retirement on Social Security Benefits

Maximizing Your Social Security Retirement Income

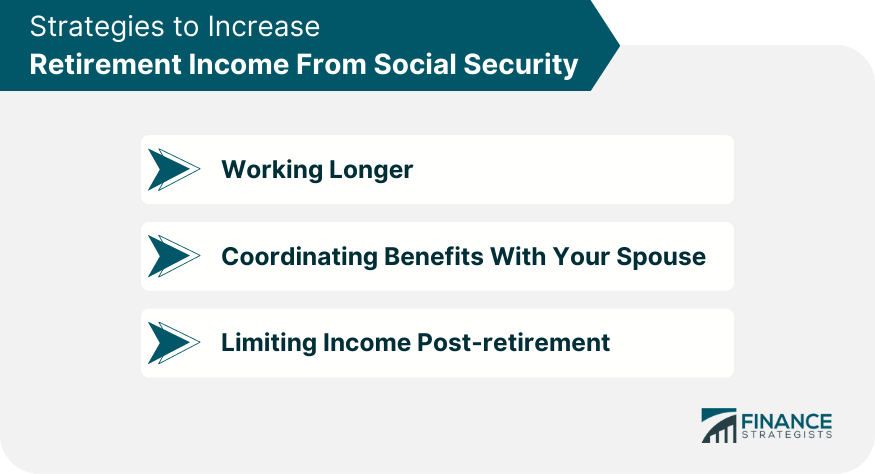

Strategies to Increase Retirement Income From Social Security

Working Longer

Coordinating Benefits With Your Spouse

Limiting Income Post-retirement

Role of Financial Advisors in Optimizing Retirement Income

Other Factors That Can Affect Social Security Retirement Income

Role of Inflation and Cost-Of-Living Adjustments (COLAs)

Potential Future Changes to the Social Security System

Impact of Taxes on Social Security Benefits

Planning for Retirement With Social Security Income

Importance of Diversifying Retirement Income Sources

Role of Social Security Income in Retirement Planning

Consideration of Lifestyle and Living Costs in Retirement Planning

Final Thoughts

Estimated Social Security Retirement Income FAQs

Your Social Security retirement income is based on your 35 highest-earning years, the age at which you begin to take benefits, and the number of Social Security credits you've earned.

You can estimate your Social Security retirement income using tools such as the online Social Security retirement estimator and calculators provided by the Social Security Administration.

Yes, you can increase your Social Security retirement income by working longer, coordinating benefits with your spouse, and limiting your post-retirement income. A financial advisor can provide more personalized strategies.

If you start collecting benefits before your full retirement age, your Social Security retirement income will be reduced. On the other hand, if you delay taking benefits past your full retirement age, your income will increase up until age 70.

Inflation, cost-of-living adjustments, potential changes to the Social Security system, and taxes can all influence your Social Security retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.