Bond markets are financial markets where participants can issue, buy, and sell debt securities, commonly known as bonds. Bonds are fixed-income investments that represent loans made by investors to borrowers, typically governments, corporations, or other entities. In exchange for the loan, the borrower promises to pay periodic interest payments (called coupon payments) to the bondholder and to repay the principal amount (face value) when the bond reaches its maturity date. Bond markets are essential for facilitating the flow of capital between borrowers and lenders, and they play a critical role in the global economy. They allow governments, companies, and other organizations to raise funds for various purposes, such as infrastructure projects, business expansion, or public spending. At the same time, bond markets provide investors with opportunities to earn interest income and diversify their investment portfolios. Bond markets provide a platform for issuers to raise funds for various purposes, such as expanding businesses, financing infrastructure projects, or managing debt. They offer an efficient way to access a large pool of potential investors. For investors, bond markets present an array of fixed-income investment options with different risk and return profiles. They allow investors to diversify their portfolios and manage risk according to their investment objectives. Governments rely on bond markets to fund public expenditures and implement fiscal policies. By issuing bonds, governments can raise capital without increasing taxes, thus supporting economic growth and public welfare. National, regional, and local governments issue bonds to raise capital for public projects, manage debt, and support economic growth. Government bonds are generally considered low-risk investments due to the creditworthiness of the issuing entities. Corporations issue bonds to fund various business initiatives such as expansion, research and development, or mergers and acquisitions. Corporate bonds typically offer higher yields than government bonds to compensate investors for the increased risk. Local governments and their agencies issue municipal bonds to fund public projects like infrastructure development, education, and healthcare. These bonds often provide tax benefits to investors, making them appealing to high-income individuals. Institutional investors such as pension funds, insurance companies, and mutual funds invest in bonds to meet their long-term liabilities and diversify their portfolios. They typically have significant buying power, influencing bond market dynamics. Retail investors buy bonds as a way to preserve capital, generate income, and diversify their portfolios. They typically invest in bonds through brokerage accounts, mutual funds, or exchange-traded funds (ETFs). Investment banks play a critical role in the bond market by underwriting new bond issues, acting as intermediaries between issuers and investors. They help issuers structure the bond offering and distribute the securities to potential investors. Broker-dealers facilitate bond trading in the secondary market by connecting buyers and sellers. They play a crucial role in price discovery, ensuring market liquidity and efficient allocation of capital. Rating agencies assess the credit quality of bond issuers and assign credit ratings, which help investors gauge the risk associated with a particular bond. These agencies play a crucial role in the bond market, as their ratings influence investor decisions and borrowing costs for issuers. The primary market is where new bonds are issued and sold to investors for the first time. Issuers work with investment banks to structure the bond offering, set the terms, and market the securities to potential investors. During the underwriting process, investment banks help issuers determine the terms of the bond offering, such as the interest rate, maturity date, and offering size. The underwriters also assume the risk of selling the bonds to investors and may buy any unsold securities. Once bonds are issued in the primary market, they are traded among investors in the secondary market. This enables investors to buy and sell existing bonds, providing liquidity and price discovery for the bond market. Bond prices in the secondary market are determined by supply and demand dynamics, influenced by factors such as interest rates, credit quality, and market sentiment. Market participants continuously update their valuations, which affects the bond's market price. Liquidity refers to the ease with which bonds can be bought or sold in the market without significantly affecting their price. Higher liquidity enables investors to enter and exit positions more efficiently, while lower liquidity can lead to larger price fluctuations. The bond market is a significant component of the global financial system, with outstanding debt securities exceeding the size of global equity markets. As governments and corporations continue to issue bonds to meet their financing needs, the bond market is expected to grow further. The current yield is a measure of a bond's annual interest income relative to its current market price. It is calculated by dividing the bond's annual interest payment by its market price and is expressed as a percentage. Yield to maturity (YTM) is the total return an investor can expect if they hold a bond until it matures. YTM takes into account not only the bond's interest payments but also any capital gains or losses arising from changes in the bond's market price. Yield to call (YTC) is the total return an investor can expect if they hold a callable bond until its call date. Callable bonds give the issuer the right to redeem the bond before its maturity date, which may affect the bond's total return. Duration measures a bond's price sensitivity to changes in interest rates, while convexity accounts for the curvature of the bond's price-yield relationship. Both metrics help investors assess a bond's interest rate risk and manage their fixed-income portfolios more effectively. A bond's credit quality reflects the issuer's ability to meet its debt obligations. Credit ratings assigned by rating agencies help investors evaluate the credit risk associated with a bond and compare it with other investment options. Interest rates have a significant impact on bond prices. As interest rates rise, bond prices generally fall, and vice versa. This inverse relationship exists because higher interest rates make new bonds more attractive, reducing demand for existing bonds with lower yields. Inflation erodes the purchasing power of future cash flows from a bond, which may lower the bond's value. Fixed-income securities with longer maturities are generally more sensitive to inflation expectations than shorter-term bonds. Economic conditions, such as GDP growth, employment levels, and consumer spending, can influence bond prices. Strong economic growth may lead to higher interest rates and lower bond prices, while weaker economic conditions may result in lower interest rates and higher bond prices. Investor sentiment and market expectations can affect bond prices. During times of uncertainty or market stress, investors may seek the relative safety of bonds, driving up their prices. Conversely, improving market conditions may lead to investors reallocating funds to riskier assets, resulting in lower bond prices. Interest rate risk is the potential for bond prices to decline due to rising interest rates. Bonds with longer maturities and lower coupon rates are generally more sensitive to interest rate changes. Credit risk refers to the possibility that a bond issuer may default on its interest and principal payments. Investors can mitigate credit risk by diversifying their bond holdings and focusing on higher-rated securities. Reinvestment risk is the possibility that an investor may not be able to reinvest the bond's interest payments at the same yield as the bond's current yield. This risk is more prevalent during periods of declining interest rates. Inflation risk is the potential for rising inflation to erode the purchasing power of a bond's future cash flows. Investors can manage inflation risk by investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS). Liquidity risk arises when an investor may not be able to buy or sell a bond at a desirable price due to limited trading activity. Illiquid bonds may be subject to wider bid-ask spreads and greater price fluctuations. Currency risk is the potential for losses due to fluctuations in exchange rates when investing in foreign bonds. Investors can hedge currency risk by using currency derivatives or investing in currency-hedged bond funds. Political risk refers to the potential for changes in government policies or geopolitical events to negatively affect bond prices. Investors can mitigate political risk by diversifying their bond holdings across different countries and regions. A buy-and-hold strategy involves purchasing bonds and holding them until maturity, regardless of market fluctuations. This strategy is suitable for investors seeking predictable income and capital preservation. Bond indexing involves investing in a diversified portfolio of bonds that replicates the performance of a bond market index. This passive strategy allows investors to gain broad exposure to the bond market while minimizing management fees and transaction costs. Interest rate anticipation strategies involve adjusting a bond portfolio's duration based on expectations of future interest rate movements. Investors may increase the duration when interest rates are expected to fall and decrease the duration when rates are expected to rise. Credit analysis involves evaluating the credit quality of bond issuers to identify potential investment opportunities or risks. Active investors may use credit analysis to select bonds with attractive risk-return profiles and avoid bonds with deteriorating credit quality. Yield curve strategies involve positioning a bond portfolio to benefit from expected changes in the shape of the yield curve. Investors may use various tactics, such as riding the yield curve, bullet strategies, or barbell strategies, to capitalize on anticipated yield curve movements. Sector rotation involves shifting a bond portfolio's allocation among different bond market sectors based on expected relative performance. Active investors may use macroeconomic, credit, or interest rate analysis to identify sectors poised to outperform or underperform. Central banks play a key role in regulating bond markets by setting monetary policy, supervising financial institutions, and acting as lenders of last resort. Their actions can influence interest rates, credit conditions, and overall bond market dynamics. In the United States, the Securities and Exchange Commission (SEC) oversees the bond market by regulating the issuance, trading, and reporting of debt securities. The SEC enforces securities laws to promote transparency, protect investors, and maintain market integrity. FINRA is a self-regulatory organization in the United States that oversees broker-dealers and other market participants in the bond market. It develops and enforces rules, supervises member firms, and provides investor education and resources. Bond market regulations require issuers to provide detailed information about their financial condition, the terms of the bond offering, and the associated risks. These disclosure requirements help investors make informed decisions and promote transparency in the bond market. Trading rules in the bond market govern the execution, reporting, and settlement of bond transactions. These rules ensure fair and efficient trading practices, protect investors from market abuses, and promote market integrity. Regulators impose risk management requirements on bond market participants, such as capital adequacy standards, margin requirements, and stress testing. These measures help mitigate systemic risks and promote financial stability. The bond market is a crucial component of the global financial system, where participants issue, buy, and sell debt securities. It serves multiple purposes, including raising capital for governments and corporations, providing investment opportunities for investors, and facilitating government spending. The market involves various participants such as issuers (governments, corporations, and municipalities), investors (institutional and individual), and intermediaries (investment banks, broker-dealers, and rating agencies). Bond valuation and pricing are important considerations, with metrics like current yield, yield to maturity, yield to call, duration, and convexity helping investors assess risk and make informed decisions. Additionally, credit quality and ratings provide insights into the issuer's ability to meet obligations. Understanding the factors influencing bond prices, market risks, strategies, and regulations is essential for effective participation in the bond market.What Is The Bond Market?

Purpose of Bond Markets

Raising Capital

Providing Investment Opportunities

Facilitating Government Spending

Bond Market Participants

Issuers

Governments

Corporations

Municipalities

Investors

Institutional Investors

Individual Investors

Intermediaries

Investment Banks

Broker-Dealers

Rating Agencies

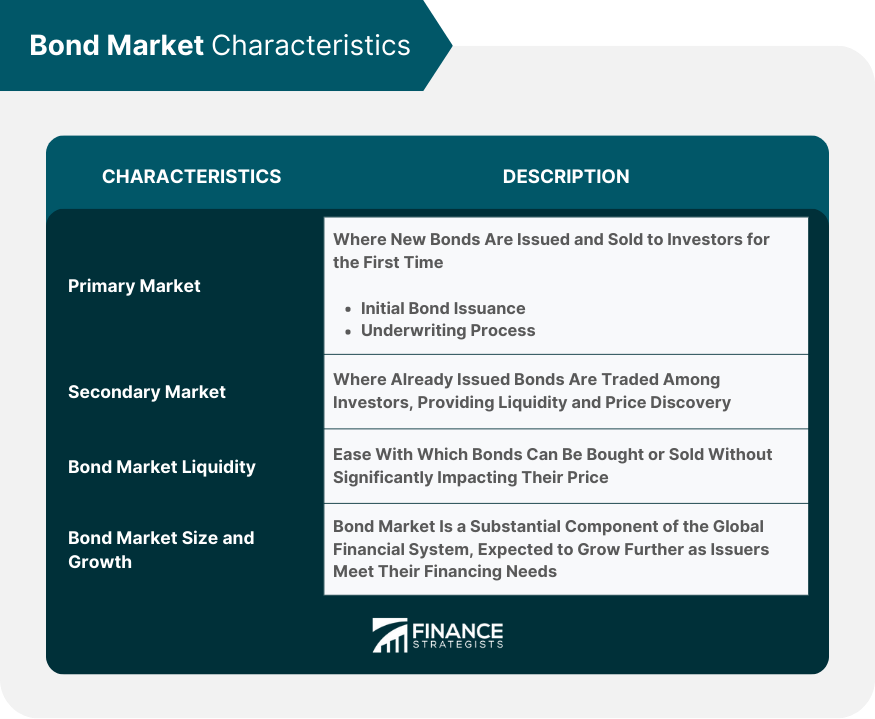

Bond Market Characteristics

Primary Market

Initial Bond Issuance

Underwriting Process

Secondary Market

Trading Between Investors

Price Determination

Bond Market Liquidity

Bond Market Size and Growth

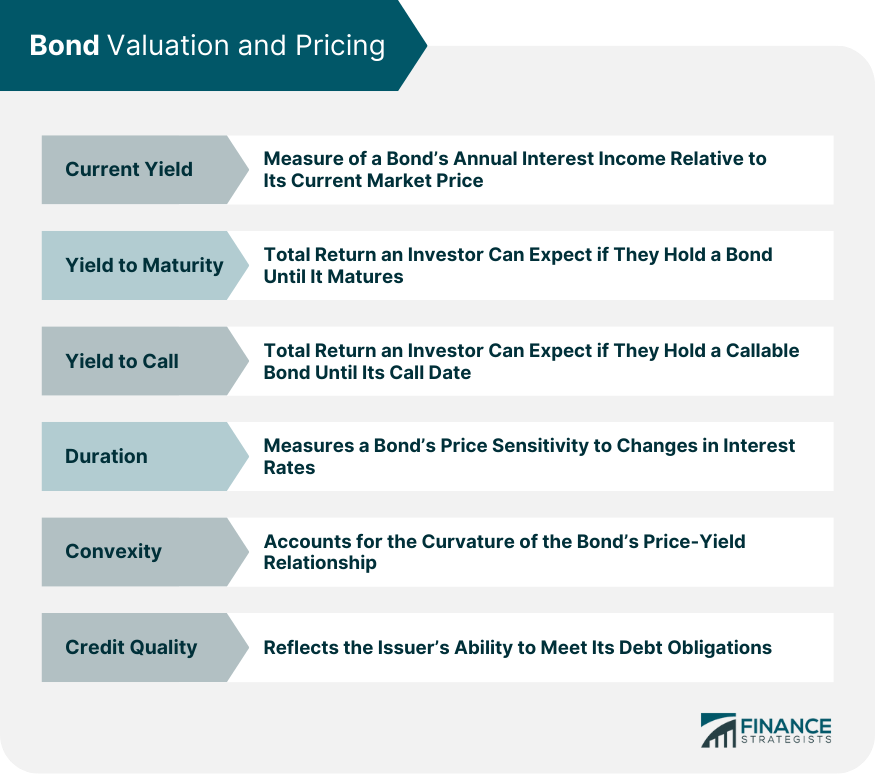

Bond Valuation and Pricing

Yield

Current Yield

Yield to Maturity

Yield to Call

Duration and Convexity

Credit Quality and Ratings

Factors Influencing Bond Prices

Interest Rates

Inflation

Economic Conditions

Market Sentiment

Bond Market Risks

Interest Rate Risk

Credit Risk

Reinvestment Risk

Inflation Risk

Liquidity Risk

Currency Risk

Political Risk

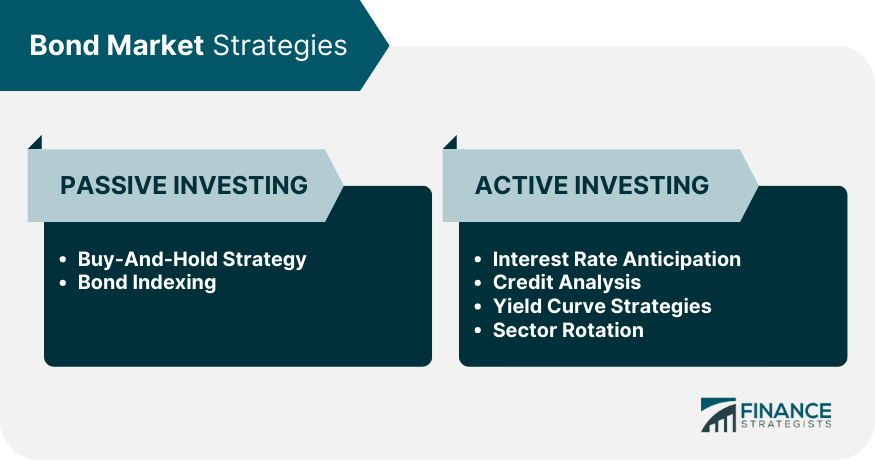

Bond Market Strategies

Passive Investing

Buy-and-Hold Strategy

Bond Indexing

Active Investing

Interest Rate Anticipation

Credit Analysis

Yield Curve Strategies

Sector Rotation

Bond Market Regulation

Regulatory Bodies

Central Banks

Securities and Exchange Commission (SEC)

Financial Industry Regulatory Authority (FINRA)

Key Regulations

Disclosure Requirements

Trading Rules

Risk Management

Final Thoughts

Bond Market FAQs

The bond market is a financial marketplace where investors buy and sell debt securities, such as government bonds, corporate bonds, and municipal bonds. It plays a crucial role in providing governments and corporations with capital to fund their operations while offering investors opportunities for income generation, capital preservation, and portfolio diversification.

Investors in the bond market face several risks, including interest rate risk, credit risk, reinvestment risk, inflation risk, liquidity risk, currency risk, and political risk. By understanding these risks and implementing appropriate risk management strategies, investors can optimize their bond portfolios to achieve their financial goals.

Bond valuation and pricing involve assessing a bond's credit quality, duration, convexity, and yield. Yield measures include current yield, yield to maturity, and yield to call. Factors such as interest rates, inflation, economic conditions, and market sentiment influence bond prices and yields.

Investors can employ various bond market strategies, such as passive investing (buy-and-hold and bond indexing) and active investing (interest rate anticipation, credit analysis, yield curve strategies, and sector rotation). These strategies help investors navigate changing market conditions and capitalize on opportunities in the bond market.

The bond market is regulated by various organizations, including central banks, the Securities and Exchange Commission (SEC), and the Financial Industry Regulatory Authority (FINRA). Key regulations involve disclosure requirements, trading rules, and risk management measures, which promote transparency, protect investors, and maintain market integrity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.