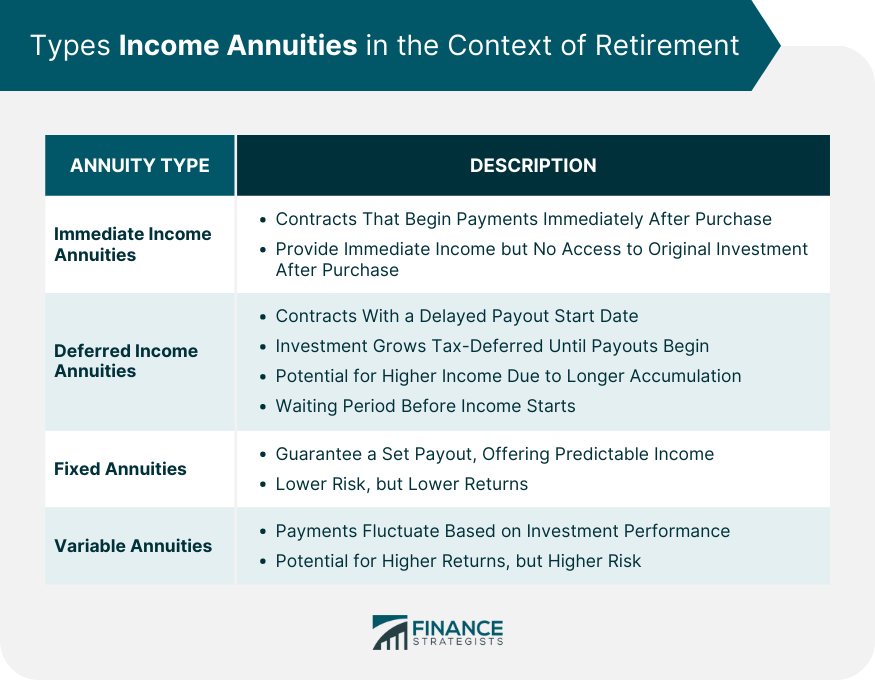

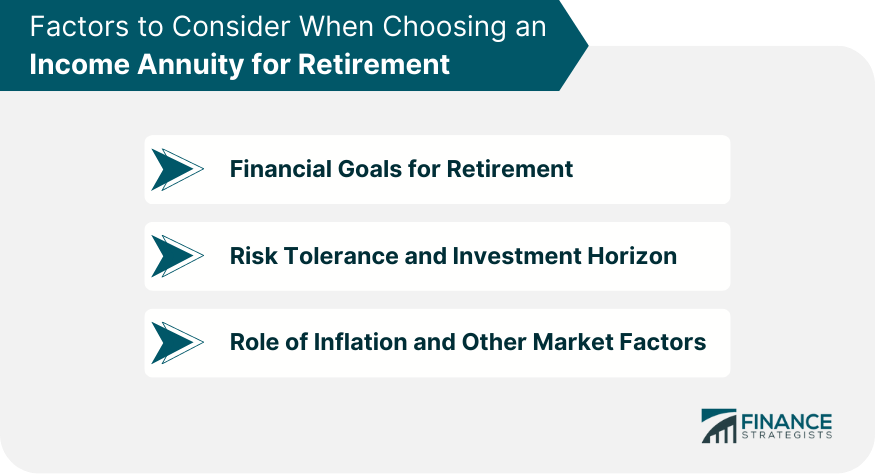

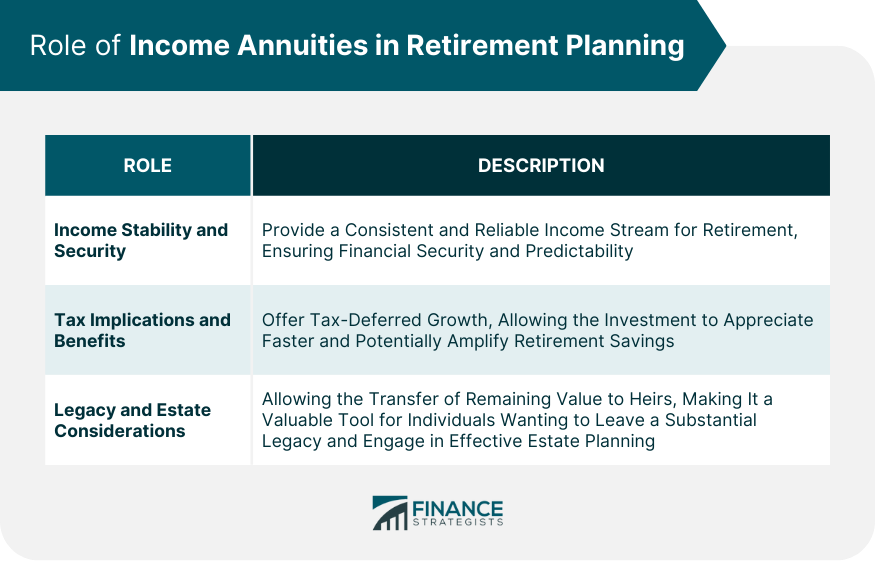

Income Annuities for Retirement refer to financial products that guarantee a steady income stream during one's retirement years. These annuities, purchased from an insurance company, can provide retirees with financial security, offering predictable payouts that can alleviate concerns about outliving their savings. They serve a vital role in retirement planning, either as a complement to other retirement income sources or as a primary income source. In the context of rising life expectancies and the potential for market volatility, income annuities offer retirees peace of mind and financial stability. Therefore, understanding the intricacies of income annuities, their benefits, and potential limitations is paramount for readers planning for retirement. By grasping these aspects, individuals can make informed decisions about their retirement strategies and potentially enhance their financial comfort in their later years. Immediate income annuities are contracts that begin disbursing payments right after purchase. The buyer invests a lump sum, and in return, the insurer guarantees a steady income stream for a predetermined period of life. These annuities provide immediate income, reducing worries about market fluctuations. However, once purchased, they generally don't allow access to the original investment, which might be a disadvantage if unexpected financial needs arise. Deferred income annuities are similar to immediate ones but with a delayed payout start date. The buyer invests money that grows tax-deferred until payouts begin. The key benefit is the potential for higher income due to longer accumulation. The primary drawback is the waiting period before income starts, during which the buyer may face other financial needs. Fixed annuities guarantee a set payout, providing predictable income. On the other hand, variable annuities' payments can fluctuate based on underlying investment performance. Variable annuities offer the potential for higher returns but come with more risk. Fixed annuities provide less risk, but they also offer lower returns. The choice between these depends on an individual's risk tolerance and financial goals. Financial Goals for Retirement: Consider whether the goal is maximum income, leaving a legacy, or something else. Different annuities suit different goals. Risk Tolerance and Investment Horizon: The annuity choice also depends on an individual's risk tolerance and investment horizon. For example, variable annuities might suit those with higher risk tolerance and longer investment horizons. Role of Inflation and Other Market Factors: Inflation can erode annuity income over time. Some annuities offer inflation protection, but this typically comes at a cost. It's essential to consider such market factors when choosing an annuity. Income annuities act as a financial safety net in retirement, delivering a consistent and reliable income stream that can be structured to last for your entire lifetime. This stable revenue foundation is fundamental to retirement planning as it provides an unrivaled level of financial security and predictability. Income annuities also serve as effective tax management tools, offering the advantage of tax-deferred growth. This implies that you owe no taxes on the annuity until you start receiving income, enabling your investment to appreciate more rapidly compared to a taxable account. This can significantly amplify your retirement savings. Moreover, certain types of annuities accommodate the transfer of the remaining value to your heirs upon your demise. This provision can be a pivotal factor for individuals keen on leaving a substantial legacy. This characteristic further enhances the value of income annuities in shaping a comprehensive and effective retirement plan. The best time to purchase an annuity depends on individual circumstances. However, it's generally beneficial to start early to take advantage of compounding and tax deferral. Annuities can be complex. It's crucial to understand the contract terms, including fees, surrender charges, and other features. Insurance companies sell annuities, and financial advisors can provide guidance. It's essential to choose reliable professionals who prioritize clients' interests. It's essential to note that several safeguards are in place to protect investors. Most notably, state guarantee associations offer a robust layer of protection, stepping in to provide coverage up to a certain limit in the event of insurer insolvency. This protective measure significantly mitigates the risk associated with insurance companies' financial uncertainty, thereby enhancing the security of your retirement income from annuities. Income annuities for retirement serve as powerful financial tools, providing a stable income stream and offering invaluable financial security during retirement years. They come in several types, including immediate and deferred, as well as fixed and variable annuities, each carrying its unique benefits and limitations. Considerations in choosing an income annuity should encompass one's financial goals, risk tolerance, and awareness of market factors such as inflation. Furthermore, annuities can aid in tax optimization and estate planning, adding another layer to their appeal. Despite potential risks tied to the insurer's financial stability, safeguards such as state guarantee associations act as safety nets, offering a level of protection to investors. Understanding and strategically incorporating income annuities in retirement planning can significantly enhance financial preparedness, ensuring a comfortable and secure retirement.Overview of Income Annuities for Retirement

Income Annuities in the Context of Retirement

Immediate Income Annuities

Deferred Income Annuities

Fixed vs Variable Annuities

Factors to Consider When Choosing an Income Annuity

Role of Income Annuities in Retirement Planning

Ensuring Income Stability and Promoting Financial Security

Optimizing Tax Implications and Harnessing Financial Benefits

Considering Legacy and Estate Planning

Buying Income Annuities for Retirement

When to Purchase an Annuity

How to Shop for an Annuity

Understanding the Contract

Role of Insurance Companies and Financial Advisors

Navigating Risks and Implementing Safeguards

The Bottom Line

Income Annuities for Retirement FAQs

Income annuities for retirement are financial products that provide a steady income stream during retirement. They are important because they offer financial stability and help mitigate the risk of outliving your savings, ensuring a predictable and regular income throughout your retirement years.

Immediate income annuities for retirement start providing payouts shortly after purchase, offering immediate income. On the other hand, deferred income annuities start disbursing income at a later, predetermined date, allowing for a potentially higher income due to longer accumulation.

The choice between fixed and variable income annuities for retirement depends on your risk tolerance and financial goals. Fixed annuities provide a guaranteed payout, offering a lower risk but also potentially lower returns. Variable annuities, however, can yield higher returns but with a higher risk, as the payouts can fluctuate based on the performance of the underlying investments.

When buying income annuities for retirement, it's crucial to consider your financial goals for retirement, your risk tolerance and investment horizon, and the role of inflation and other market factors. Also, understanding the annuity contract, considering the insurer's reliability, and getting advice from financial professionals are key steps in the purchasing process.

Yes, there are risks involved in purchasing income annuities for retirement. These risks include the financial stability of the insurance company providing the annuity and the potential impacts of market fluctuations and inflation on your annuity income. However, safeguards such as state guarantee associations can provide some protection against these risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.