Life insurance is a contractual agreement between an individual (the policyholder) and an insurance company. Under the contract, the insurer promises to pay a designated beneficiary a sum of money (the death benefit) upon the death of the insured person. Depending on the contract, other events such as terminal illness may also trigger payment. In return, the policyholder agrees to pay a stipulated amount (the premium) at regular intervals or in lump sums. For many people, life insurance is seen solely as a way to protect their family's financial future in the event of their death. While this is certainly a major aspect of what life insurance can do, it can also play a pivotal role in retirement income planning. It can provide a supplemental source of income, offer tax advantages, and even serve as an estate planning tool. As people transition into retirement, their financial needs and goals shift. The primary purpose of life insurance in retirement isn't necessarily about providing a death benefit to beneficiaries but more about creating an additional stream of income, while still offering financial protection for loved ones. Permanent life insurance policies, like whole and universal life, build cash value over time that a policyholder can access during retirement. This cash value can be borrowed against tax-free, providing supplemental retirement income. In addition, life insurance can serve as a risk management tool, helping protect retirees against outliving their income. Retirees who've lost a spouse may experience a significant reduction in income. A life insurance policy can replace that lost income, helping the surviving spouse maintain their standard of living in retirement. Life insurance can offer numerous tax advantages. The death benefit is generally tax-free to beneficiaries. The cash value growth within a permanent life insurance policy is tax-deferred, and loans taken against the cash value are typically tax-free. Life insurance can protect a retiree's heirs from potential estate taxes. It can also ensure the policyholder's spouse is financially secure, providing peace of mind for retirees. Permanent life insurance policies have a death benefit and a cash value component. The cash value accumulates over time and can be accessed during retirement, offering an additional income source. Meanwhile, the death benefit provides financial protection to beneficiaries. Whole life insurance provides lifelong coverage and a guaranteed death benefit, along with a cash value component that grows over time at a guaranteed rate. Policyholders can borrow against the cash value, providing a potential income stream in retirement. Whole life insurance tends to be more expensive than other forms of life insurance. If a policyholder borrows from the cash value, the death benefit is reduced until the loan is repaid. Furthermore, if a policy is surrendered before death, there could be hefty surrender charges. Universal life insurance offers more flexibility than whole life. Policyholders can adjust their premium payments and death benefit (within certain limits), and the cash value component can grow based on the performance of the insurer's portfolio. Like whole life, policyholders can borrow against the cash value. Universal life insurance can be more complex and riskier than whole life. The cash value's growth isn't guaranteed, and if the insurer's portfolio performs poorly, the policyholder may need to increase premium payments to keep the policy in force. Variable life insurance allows policyholders to invest the cash value in a variety of sub-accounts (similar to mutual funds). This offers potential for greater cash value growth, providing more income for retirement. Variable life is the riskiest type of permanent life insurance. If the investments perform poorly, the cash value and death benefit can decrease. Furthermore, variable life insurance policies tend to have higher fees and may be less suited for risk-averse individuals. Each type of life insurance has its strengths and weaknesses. It's essential to consult with a financial advisor or insurance professional before purchasing a policy for retirement income planning. With the right planning, life insurance can be a valuable part of a comprehensive retirement income strategy. One strategy to generate retirement income is to take loans or withdrawals from the cash value of a permanent life insurance policy. Loans are typically tax-free and can be paid back at the policyholder's discretion. However, any outstanding loan amount will reduce the death benefit. Withdrawals, on the other hand, are tax-free up to the amount of the policyholder's basis in the policy. A life settlement involves selling your life insurance policy to a third party for a cash payment. The buyer takes over premium payments and receives the death benefit when you pass away. Life settlements can be an effective way to get a lump sum of cash for a policy you no longer want or need. Many life insurance policies include an accelerated death benefit provision, which allows policyholders to receive a portion of the death benefit while they are still alive if they have a terminal or chronic illness. This can provide an additional source of income during retirement if health costs become burdensome. Some retirees choose to use a portion of their life insurance policy's cash value to purchase an annuity, which can provide a steady stream of income for a specific period or for the rest of their life. Before considering life insurance as a retirement income strategy, it's important to assess your overall financial health. For those with substantial debt or limited savings, investing in life insurance may not be the best option. It's recommended to consult with a financial advisor to determine if this strategy fits within your overall retirement plan. Life insurance policies come with various costs and fees, such as premium payments, surrender charges, and loan interest. It's crucial to fully understand these costs before buying a policy. There's a certain level of risk involved in using life insurance for retirement income. For instance, the cash value of a policy could be less than anticipated due to low investment returns or high loan balances. It's essential to assess your risk tolerance before employing this strategy. One significant risk that retirees face is outliving their savings, also known as longevity risk. While life insurance can provide additional income during retirement, it may not be enough to sustain a long retirement period. Other sources of guaranteed income, like Social Security or pensions, are crucial to mitigate this risk. Pensions provide a steady income stream during retirement, which is usually based on your salary and years of service. However, not everyone has access to a pension, and those that do may not receive enough to cover all retirement expenses. Social Security is a key component of most people's retirement income. While it provides a consistent income stream, it often isn't enough to sustain a comfortable retirement lifestyle on its own. 401(k)s and IRAs allow individuals to save and invest for retirement on a tax-advantaged basis. While these accounts can accumulate substantial savings, they are subject to market risk and required minimum distributions (RMDs). Compared to these traditional sources of retirement income, life insurance offers unique benefits like tax-free loans and a death benefit, but it also comes with its own set of risks and costs. Choosing a trusted financial advisor is crucial in making informed decisions about using life insurance for retirement income. Look for an advisor with expertise in retirement income planning and a solid understanding of life insurance products. While insurance agents and financial advisors can both provide valuable advice, they serve different roles. Insurance agents specialize in selling insurance products, while financial advisors provide comprehensive financial planning services, including retirement planning, investment management, and estate planning. Life insurance can be a valuable tool for retirement income, but it's not suitable for everyone. By understanding the strategies, considerations, and alternatives, you can make an informed decision that supports your retirement goals. Using life insurance for retirement income involves leveraging the cash value in permanent life insurance policies like whole, universal, and variable life insurance. While this approach offers unique benefits such as tax advantages and an additional income stream, it's important to understand the associated costs, risks, and other considerations. It's also vital to consider this strategy in the context of other retirement income sources such as pensions, Social Security, and retirement savings accounts. Using life insurance for retirement income isn't a one-size-fits-all solution. It's a strategy that can work well for some individuals, particularly those who have maximized other retirement savings options, have a long-term need for life insurance, and have the financial ability to pay the premiums over time. As with any financial decision, it's crucial to seek advice from a financial professional to ensure that this strategy aligns with your overall retirement goals and financial situation.Overview of Life Insurance

Understanding Life Insurance as a Tool for Retirement Income

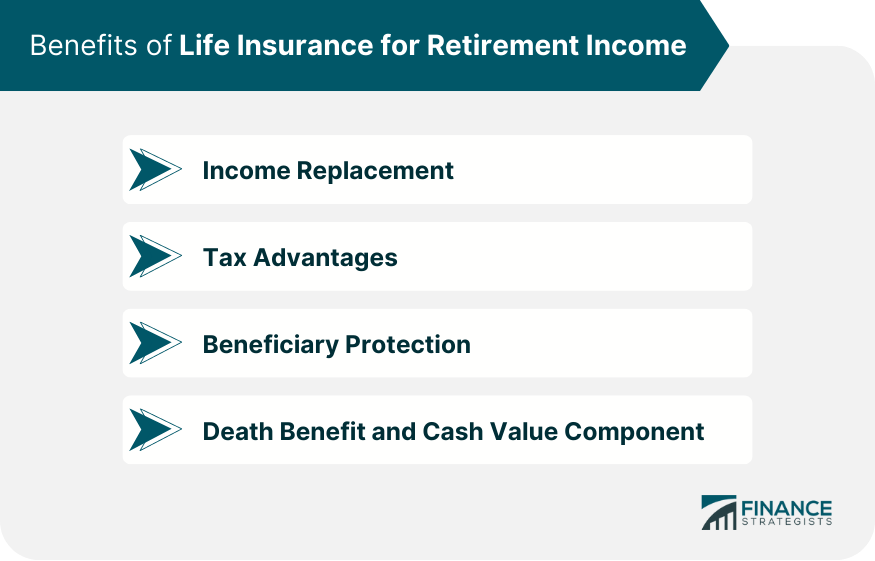

Benefits of Life Insurance for Retirement Income

Income Replacement

Tax Advantages

Beneficiary Protection

Death Benefit and Cash Value Component

Types of Life Insurance Policies for Retirement Income

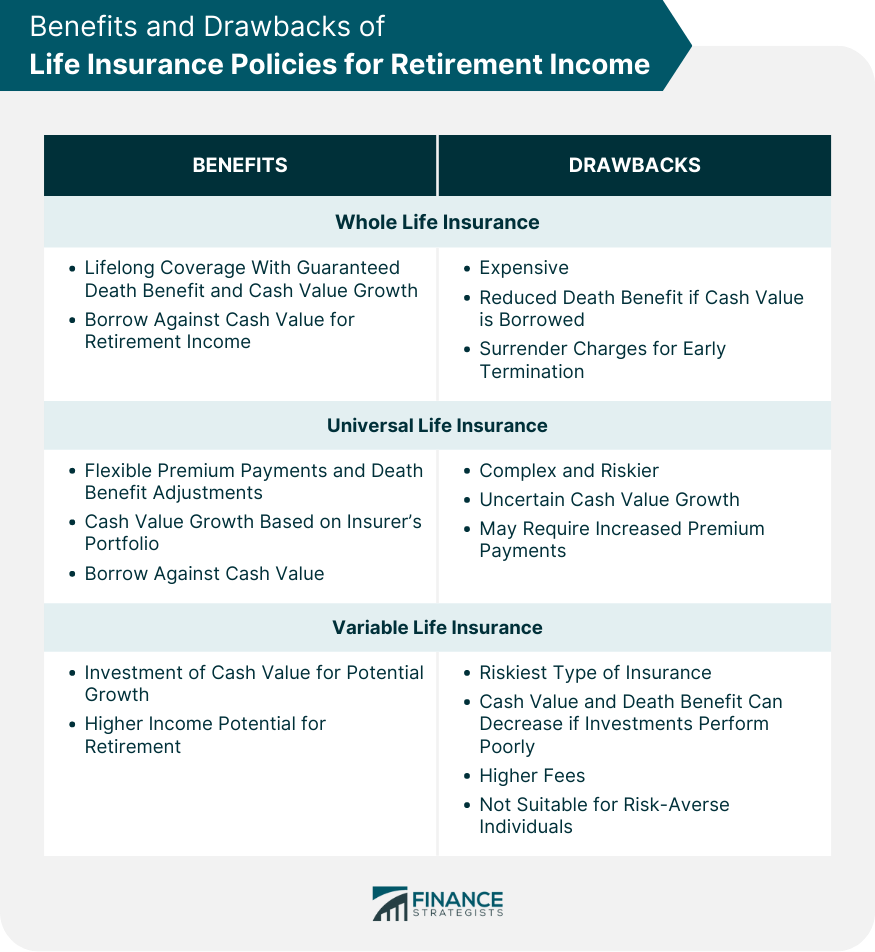

Whole Life Insurance

Benefits

Drawbacks

Universal Life Insurance

Benefits

Drawbacks

Variable Life Insurance

Benefits

Drawbacks

Strategies for Utilizing Life Insurance for Retirement Income

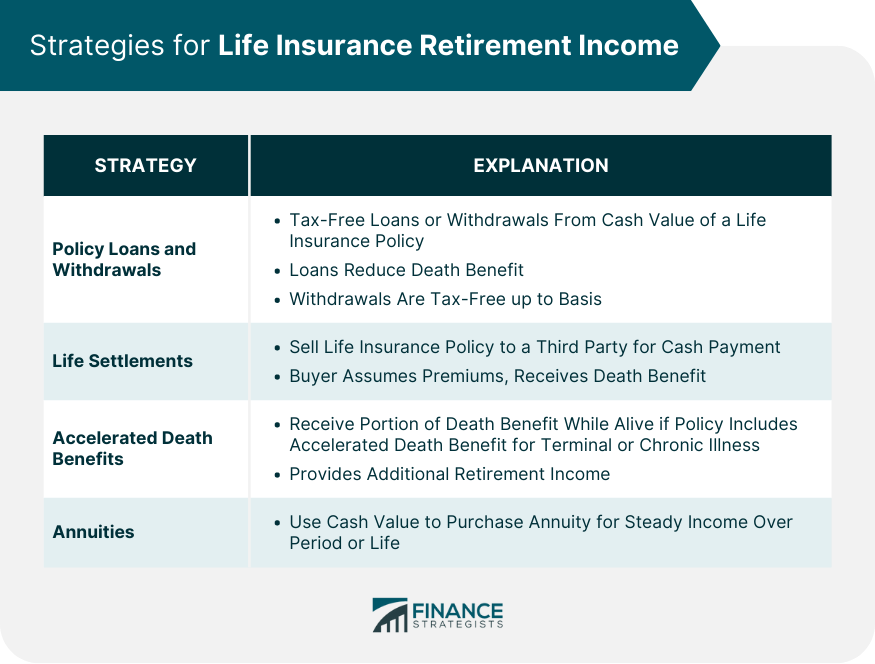

Policy Loans and Withdrawals

Life Settlements

Accelerated Death Benefits

Annuities

Considerations Before Using Life Insurance for Retirement Income

Financial Health and Life Insurance

Understanding the Costs and Fees

Risk Assessment

Longevity Risk

Life Insurance Comparison With Other Retirement Income Sources

Pensions

Social Security

Retirement Savings Accounts (401(k), IRA)

Role of Financial Advisors in Life Insurance Planning

Selecting the Right Advisor

Understanding the Role of Insurance Agents vs Financial Advisors

The Bottom Line

Life Insurance as a Retirement Income FAQs

Life insurance for retirement income offers multiple benefits, including the ability to draw upon the policy's cash value for supplemental income, potential tax advantages, and providing a financial safety net for beneficiaries.

There are several ways to use life insurance for retirement income, including taking policy loans or withdrawals, engaging in life settlements, accessing accelerated death benefits, or purchasing annuities.

While life insurance can be a beneficial tool for retirement income, it's not the right fit for everyone. Your financial health, risk tolerance, and retirement goals should all factor into the decision.

Whole life, universal life, and variable life insurance policies are often utilized for retirement income due to their cash value component.

While life insurance can provide a supplemental source of retirement income, it's generally not recommended to rely solely on it. A balanced retirement plan often includes other income sources like pensions, Social Security, and retirement savings accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.