Planning for retirement is crucial to ensure financial stability and maintain the desired lifestyle in your golden years. A well-prepared retirement plan helps you avoid financial stress, allowing you to enjoy your retirement without worrying about money. Retirement budgeting aims to help you achieve financial independence, cover your living expenses, and fulfill your retirement aspirations. By carefully managing your income and expenses, you can ensure a comfortable retirement and potentially leave a financial legacy for your loved ones. Calculating your net worth provides a snapshot of your current financial health. Your net worth is the difference between your assets and liabilities, giving you an idea of how much wealth you have accumulated thus far. Identifying your current income sources is essential to determine how much you'll need in retirement. Consider your salary, rental income, dividends, and other sources that contribute to your earnings. Understanding your debts and liabilities is crucial for effective retirement planning. Paying off high-interest debts before retirement can reduce financial stress and increase your disposable income during retirement. Your basic living expenses include housing, food, utilities, and transportation. These expenses may change in retirement, depending on factors such as downsizing, moving to a more affordable location, or having a paid-off mortgage. Healthcare costs often rise as you age. It's essential to plan for potential medical expenses, including insurance premiums, out-of-pocket costs, and long-term care to ensure you have adequate coverage in retirement. Your retirement budget should account for your travel and leisure expenses. These costs can vary significantly depending on your desired lifestyle and interests, so it's essential to estimate them accurately. Unforeseen expenses, such as home repairs or medical emergencies, can strain your retirement budget. Establishing an emergency fund can help you manage these unexpected costs without jeopardizing your financial stability. Your retirement goals should reflect your desired lifestyle, including your preferred living arrangements, travel plans, and hobbies. These aspirations will influence your retirement budget and help determine your required savings. Financial independence in retirement means having sufficient income and savings to cover your expenses without relying on full-time employment. Establishing a clear goal for financial independence can help you plan and prioritize your retirement budgeting efforts. Legacy planning involves deciding how you want to distribute your wealth after your passing. This can include leaving an inheritance for your loved ones or donating to charitable organizations, which should be factored into your retirement budget. Social Security benefits are a critical income source for many retirees. Understanding how much you can expect to receive and when you can start collecting benefits will help you plan your retirement budget more effectively. Pensions can provide a reliable income stream during retirement. If you have a pension plan, it's essential to know the terms, payout options, and any potential tax implications to maximize your benefits. Investing in rental properties can provide a steady stream of income during retirement, along with potential appreciation in property value over time. Part-Time Work or Business Income Some retirees choose to work part-time or run a business to supplement their retirement income. If you plan to continue working, factor this additional income into your retirement budget. Housing is a major expense in retirement. Your budget should account for mortgage payments or rent, property taxes, maintenance, and homeowners or renters insurance to ensure you can afford your desired living arrangements. Utilities, such as electricity, water, and gas, are ongoing expenses in retirement. Budgeting for these costs can help you maintain a comfortable lifestyle while keeping your expenses in check. Insurance coverage, including life, health, and property insurance, protects your assets and provides financial security. Make sure to include these costs in your retirement budget to maintain adequate protection. Even in retirement, you may be subject to taxes on income, property, and investments. Proper tax planning can help you minimize your tax burden and optimize your retirement budget. Travel can be a significant part of your retirement lifestyle. Allocating funds for vacations, visiting family, or exploring new destinations will ensure you can enjoy your retirement adventures without financial strain. Pursuing hobbies and interests can enrich your retirement experience. Set aside funds for activities you enjoy, such as golf, photography, or art classes, to maintain a fulfilling lifestyle. Dining out can be a pleasurable aspect of retirement. Budgeting for restaurant visits and social outings allows you to indulge in culinary experiences without compromising your financial stability. If you're passionate about philanthropy, include charitable donations in your retirement budget. This allows you to contribute to causes that matter to you while maintaining a balanced financial plan. Health insurance premiums can be a significant expense in retirement. Ensure you have sufficient coverage by budgeting for Medicare, supplemental insurance, or private health insurance costs. Out-of-pocket healthcare costs, such as copayments, deductibles, and prescription medications, can add up quickly. Incorporate these expenses into your retirement budget to avoid unexpected financial strain. Long-term care expenses, such as assisted living or nursing home care, can be costly. Planning for these costs in your retirement budget can help protect your assets and provide peace of mind. Inflation can erode your purchasing power over time, making it essential to account for its impact on your retirement budget. By adjusting your expenses and income for inflation, you can maintain your desired lifestyle throughout retirement. Incorporating inflation-adjusted investments, such as Treasury Inflation-Protected Securities (TIPS), can help protect your retirement savings from inflation. Additionally, periodically reviewing and adjusting your budget can ensure you stay on track with your financial goals. Conducting annual or semi-annual reviews of your retirement budget helps ensure your financial plan remains on track. Regular assessments can identify areas that require adjustment, allowing you to maintain your desired lifestyle and financial security. Significant life events, such as marriage, divorce, or the loss of a spouse, can affect your retirement budget. Reassessing your financial plan during these times can help you adapt to new circumstances and preserve your financial stability. An emergency fund provides a financial safety net for unexpected expenses, such as medical emergencies or urgent home repairs. Building and maintaining an emergency fund can help you manage unforeseen costs without jeopardizing your retirement budget. Long-term care insurance can help cover the costs of assisted living or nursing home care, protecting your assets and providing peace of mind. Evaluating your need for long-term care insurance and incorporating it into your retirement budget can help ensure adequate coverage. Market downturns can impact your retirement savings and investment income. Developing strategies, such as maintaining a diversified portfolio and adjusting your withdrawal rate, can help you navigate market fluctuations and protect your retirement budget. Financial advisors and planners can provide valuable guidance in developing and managing your retirement budget. They can help you navigate complex financial matters, optimize your investments, and ensure you're on track to meet your retirement goals. Effective tax planning can minimize your tax burden and maximize your retirement income. Consulting with a tax professional can help you identify tax-saving strategies and ensure compliance with applicable tax laws. Estate planning involves preparing for the distribution of your assets after your passing. Working with an estate planning professional can help you create a plan that meets your legacy goals while minimizing potential tax liabilities and legal complications. Ongoing budget management is crucial for maintaining financial stability and peace of mind in retirement. Regularly reviewing and adjusting your retirement budget can help you adapt to changing circumstances and ensure you can enjoy your golden years worry-free. By diligently planning, monitoring, and adjusting your retirement budget, you can achieve financial security and peace of mind. This allows you to focus on enjoying your retirement, pursuing your passions, and spending quality time with loved ones. Don't wait to start planning for your retirement. Reach out to a professional retirement planning service today to begin creating a comprehensive retirement budget that will ensure your financial security and peace of mind throughout your golden years.What Is Retirement Budgeting?

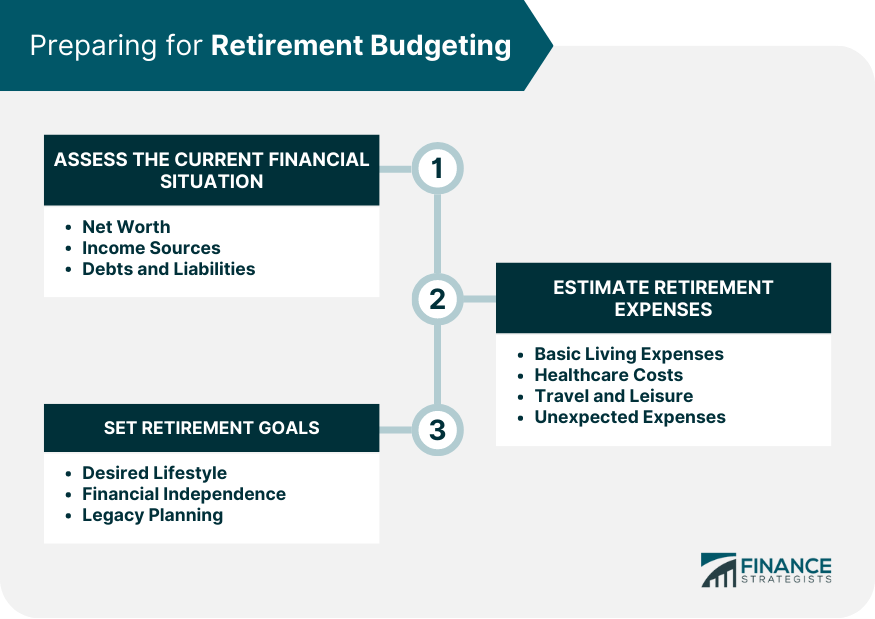

Preparing for Retirement Budgeting

Assess the Current Financial Situation

Net Worth

Income Sources

Debts and Liabilities

Estimate Retirement Expenses

Basic Living Expenses

Healthcare Costs

Travel and Leisure

Unexpected Expenses

Set Retirement Goals

Desired Lifestyle

Financial Independence

Legacy Planning

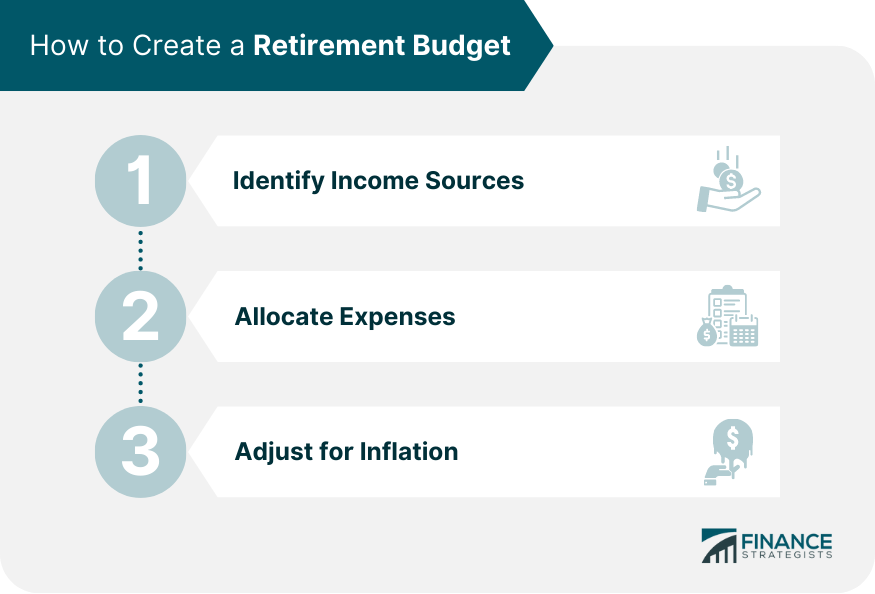

How to Create a Retirement Budget

Identify Income Sources

Social Security Benefits

Pensions

Investments and Savings

Allocate Expenses

Fixed Expenses

Housing

Utilities

Insurance

Taxes

Discretionary Expenses

Travel

Hobbies

Dining Out

Charitable Giving

Healthcare Expenses

Insurance Premiums

Out-of-Pocket Costs

Long-Term Care

Adjust for Inflation

Importance of Inflation Considerations

Strategies to Account for Inflation

Monitoring and Adjusting the Retirement Budget

Regular Reviews and Updates

Annual or Semi-Annual Reviews

Life Changes and Their Impact on the Budget

Contingency Planning

Emergency Fund

Long-Term Care Insurance

Strategies for Market Downturns

Seeking Professional Advice

Financial Advisors and Planners

Tax Planning

Estate Planning

Final Thoughts

Retirement Budgeting FAQs

One should begin by assessing their current financial situation, estimating their retirement expenses, and setting retirement goals. Creating a retirement budget that includes income sources, fixed and discretionary expenses, and healthcare costs is essential. Adjusting the budget for inflation and conducting regular reviews helps to stay on track.

A comprehensive retirement budgeting plan includes assessing one's current financial situation, estimating retirement expenses, setting retirement goals, identifying income sources, allocating expenses, adjusting for inflation, and monitoring and adjusting the budget over time.

To account for inflation, one should consider incorporating inflation-adjusted investments like Treasury Inflation-Protected Securities (TIPS) and periodically review and adjust the budget. For market fluctuations, maintaining a diversified portfolio and developing strategies to adjust the withdrawal rate during market downturns is recommended.

Seeking professional advice for retirement budgeting can be beneficial at any stage of the planning process. Financial planners, tax professionals, and estate planning experts can help individuals navigate complex financial matters, optimize investments, and ensure they are on track to meet their retirement goals.

Regular reviews and updates, such as annual or semi-annual assessments, are crucial for maintaining financial security in retirement. These reviews help individuals identify areas that require adjustment and adapt their budget to life changes and market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.