Longevity risk refers to the potential financial risk that arises from individuals living longer than expected. Specifically, it is the risk that an individual or entity will outlive their expected lifespan, resulting in a longer period of retirement or payout obligations than originally planned or accounted for. This risk is particularly relevant in retirement planning, pension funds, and insurance industries, where projections of life expectancy are crucial to calculating future payments and liabilities. Longevity risk can have significant implications for financial stability and sustainability, and managing this risk requires careful consideration of demographic trends, mortality rates, and other factors that may impact life expectancy. For individuals, longevity risk can lead to running out of retirement savings, having to rely on social welfare, or having to reduce their standard of living later in life. If an individual lives longer than expected, they may need to make their retirement savings last longer, which can be difficult if they did not plan for a longer lifespan. For pension funds and insurance companies, longevity risk can lead to higher payout obligations than anticipated, which can strain their financial resources and solvency. This can also result in higher premiums for policyholders, which can make insurance products less affordable and accessible. From a societal perspective, longevity risk can also have broader economic implications. As people live longer, the demand for healthcare and social services increases, which can strain public resources and budgets. Additionally, a larger elderly population can also impact labor markets, as fewer people retire and vacate job positions, which can limit opportunities for younger generations. Longevity risk is influenced by a variety of factors, including demographic, healthcare, and socioeconomic factors. Demographic factors are important determinants of longevity risk because they reflect variations in population characteristics that can influence lifespan. For instance, age is a crucial factor as older individuals tend to have a higher risk of mortality than younger individuals. Gender is another demographic factor as women tend to live longer than men due to differences in genetics and lifestyle factors. Additionally, geography can also impact longevity risk, with people in certain regions or countries having higher life expectancies than others due to factors such as diet, healthcare infrastructure, and environmental factors. Healthcare advancements have contributed significantly to longer lifespans by improving medical treatments and reducing mortality rates. Medical breakthroughs, such as vaccines, antibiotics, and surgical procedures, have helped people recover from illnesses and live longer. Improved treatments for chronic diseases, such as diabetes and heart disease, have also played a significant role in reducing mortality rates. Socioeconomic factors, such as income, education, and lifestyle, are also important determinants of longevity risk. People with higher income and education levels tend to live longer than those with lower income and education levels. This is partly because they have better access to healthcare, can afford healthier diets, and are less likely to engage in risky behaviors such as smoking. Lifestyle choices, such as diet and exercise, also play a crucial role in determining longevity risk. Longevity risk has significant financial, economic, and societal implications for individuals, financial institutions, and society as a whole. Longevity risk can have significant financial implications for individuals and institutions. Individuals may outlive their retirement savings, resulting in a potential shortfall of income in retirement. Financial institutions, such as insurance companies and pension funds, may face increased liabilities as people live longer. Longevity risk also has broader economic and societal implications. For example, an aging population can strain government resources and social welfare systems. The increasing demand for healthcare and social services can also impact the economy and labor market. Various strategies can be used to manage longevity risk, including longevity insurance, pension plans, retirement planning, and financial products. Longevity insurance is a financial product that provides a regular income stream to individuals in exchange for a lump sum payment. This product can help mitigate the risk of outliving one's savings in retirement. Pension plans are retirement savings vehicles that provide a guaranteed income stream in retirement. These plans can be defined benefit plans, which provide a specific benefit amount upon retirement, or defined contribution plans, which allow individuals to contribute to a retirement savings account. Retirement planning and financial products, such as annuities and life insurance, can also help individuals manage longevity risk. These products provide income or death benefits that can help mitigate the risk of outliving one's savings or leaving loved ones with a financial burden. While there are various strategies to manage longevity risk, there are also challenges and limitations to consider. Uncertainty and unpredictability are some of the main challenges in managing longevity risk. It is difficult to accurately predict how long an individual will live, and the uncertainty around longevity can make it challenging to plan and manage the financial implications of longevity risk. The uncertainty can lead to underestimating the length of retirement and underestimating the resources needed to fund retirement. Regulatory challenges can also limit the effectiveness of strategies to manage longevity risk. For example, regulations may restrict the types of investments that financial institutions can make, limiting their ability to manage longevity risk effectively. This can create difficulties for insurance companies, pension funds, and other institutions that need to manage the risk of paying out more than expected. Behavioral biases can also be a limitation in managing longevity risk. Behavioral biases, such as overconfidence or the tendency to underestimate longevity risk, can impact individuals' financial planning and decision-making. This can lead to a lack of preparation for the financial implications of living longer than expected. For instance, people may assume that they will not live as long as predicted, and they may not save enough to cover the additional years of retirement. Longevity risk is a significant financial risk that is becoming increasingly relevant in today's world. Individuals, financial institutions, and policymakers must understand the sources and impacts of longevity risk and develop effective strategies to manage it. Strategies such as longevity insurance, pension plans, retirement planning, and financial products can help mitigate the financial implications of living longer than expected. However, challenges such as uncertainty, regulatory restrictions, and behavioral biases must also be considered. By understanding and managing longevity risk effectively, individuals and institutions can plan for a more secure financial future.Definition of Longevity Risk

Importance of Understanding Longevity Risk

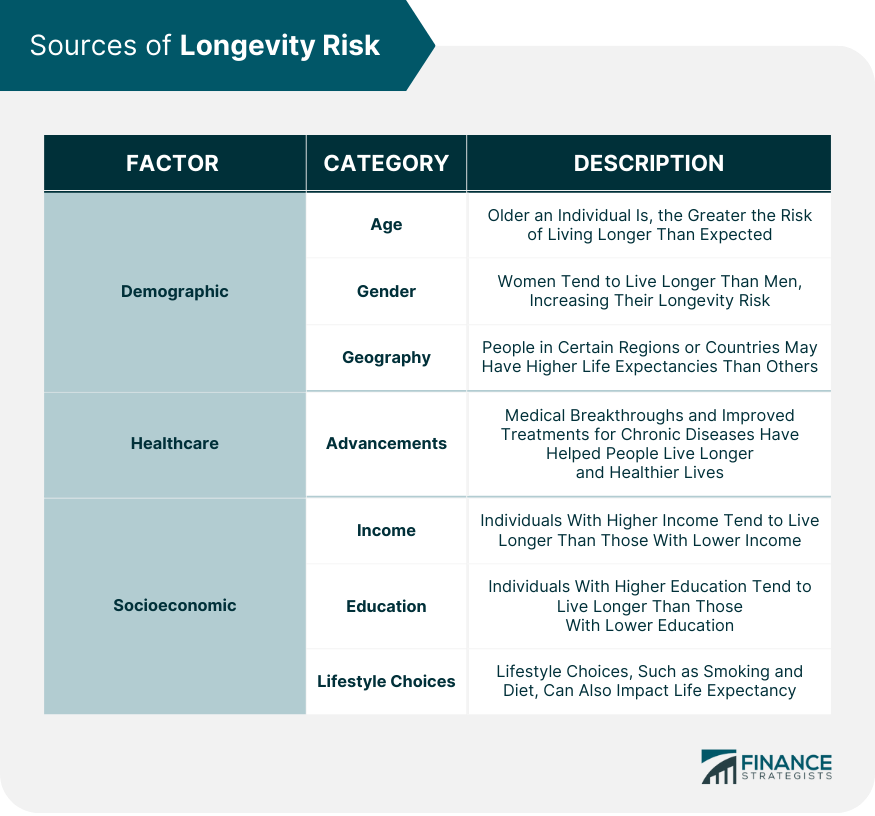

Sources of Longevity Risk

Demographic Factors

Healthcare Advancements

Socioeconomic Factors

Impacts of Longevity Risk

Financial Implications for Individuals and Institutions

Economic and Societal Implications

Managing Longevity Risk

Longevity Insurance

Pension Plans

Retirement Planning and Financial Products

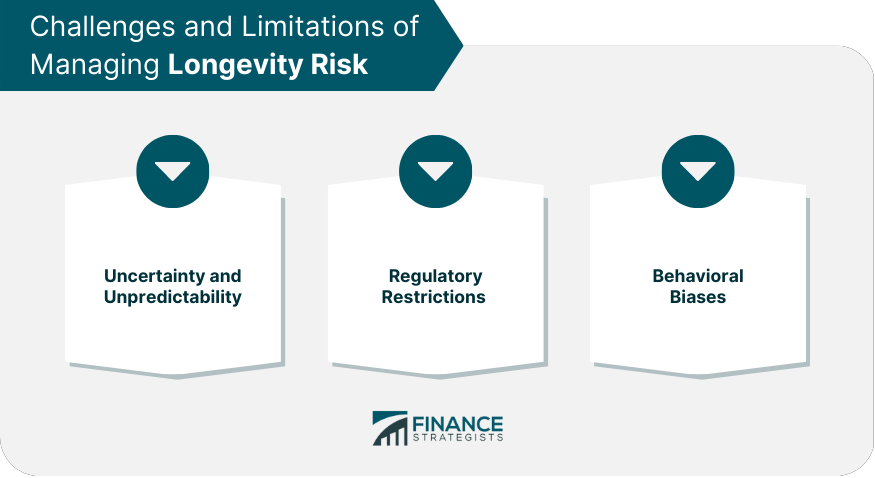

Challenges and Limitations of Managing Longevity Risk

Uncertainty and Unpredictability

Regulatory Challenges

Behavioral Biases

The Bottom Line

Longevity Risk FAQs

Longevity risk is the financial risk of outliving one's expected lifespan, which can result in a shortfall of income or savings in retirement. It is important to understand longevity risk because people are living longer, and the risk of running out of money in retirement due to unexpected longevity is increasing.

Longevity risk is influenced by demographic factors, such as age and gender, healthcare advancements, and socioeconomic factors, such as income and lifestyle choices.

Strategies to manage longevity risk include longevity insurance, pension plans, and retirement planning and financial products such as annuities and life insurance.

Longevity risk can strain government resources and social welfare systems, increase the demand for healthcare and social services, and impact the economy and labor market.

Challenges to managing longevity risk include uncertainty and unpredictability, regulatory restrictions, and behavioral biases such as underestimating longevity risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.