Fixed income investments refer to investment vehicles that provide a steady stream of income to investors over a predetermined period. These investments typically involve lending money to an entity, such as a government or a corporation, in exchange for regular interest payments and the return of the principal amount at maturity. The name "fixed income" comes from the predictable nature of the income generated by these investments, as the interest rates and payment schedules are usually fixed or predetermined. Fixed income investments are considered relatively low-risk compared to other investment options, such as stocks, as they offer a more stable income stream and focus on the return of principal rather than capital appreciation. These investments are particularly attractive to investors who prioritize income generation and capital preservation, making them popular choices for retirement planning. Fixed income investments play a crucial role in retirement planning and offer several key advantages that make them essential components of a well-rounded retirement portfolio. One of the primary benefits of fixed income investments is the reliable and regular income they provide. During retirement, when individuals are no longer earning a steady paycheck, having a predictable income stream becomes vital for meeting living expenses and maintaining a comfortable lifestyle. Fixed income investments, such as bonds or annuities, offer consistent interest payments or periodic income, which can supplement other sources of retirement income like Social Security or pensions. Fixed income investments are designed to preserve the capital invested while generating income. Unlike stocks, which can be subject to significant price fluctuations, fixed income investments prioritize the return of the principal amount at maturity. This focus on capital preservation ensures that retirees have a stable base of funds to rely on and can help mitigate the risk of market volatility. A well-diversified investment portfolio is crucial for managing risk and optimizing returns, especially during retirement when protecting wealth becomes a priority. Fixed income investments offer an excellent opportunity to diversify a retirement portfolio by balancing the higher volatility of stocks with the stability of fixed income securities. By including a mix of asset classes, including fixed income, investors can reduce the overall risk exposure and potentially achieve more consistent long-term returns. Stock market volatility can be a source of anxiety for retirees who rely on their investments to sustain their retirement lifestyle. Fixed income investments tend to be less volatile than stocks, providing a sense of stability and peace of mind. The income generated from fixed income investments can help offset potential losses from more volatile investments, thereby reducing the overall risk in a retirement portfolio. Fixed income investments are influenced by interest rates, and retirees can benefit from favorable interest rate environments. When interest rates rise, new fixed income investments offer higher yields, increasing the income potential for retirees. Moreover, fixed income investments with longer maturities may benefit from locking in higher interest rates, providing a reliable income stream for an extended period. As individuals approach retirement, their risk tolerance tends to decrease as they seek to preserve their accumulated wealth. Fixed income investments, with their lower risk profile compared to equities, can help retirees manage risk and maintain a more conservative investment approach. By diversifying across various fixed income securities with different risk profiles, retirees can achieve an appropriate balance between income generation and risk management. Fixed income investments encompass a wide range of financial instruments that offer regular income payments to investors. These investments are generally considered more conservative and stable compared to equity investments. Bonds are debt securities issued by governments, municipalities, and corporations to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for regular interest payments over a specified period. At maturity, the principal amount is returned to the investor. Bonds are considered relatively low-risk investments, with varying levels of risk depending on the issuer and credit rating. They are available in different forms, including government bonds, corporate bonds, municipal bonds, and agency bonds. Certificates of Deposit, commonly known as CDs, are time deposits offered by banks and credit unions. Investors deposit a specific amount of money for a fixed term, which can range from a few months to several years. In return, the financial institution pays a fixed interest rate on the deposit until maturity. CDs are known for their low risk and predictable returns, making them popular among conservative investors. However, early withdrawal before maturity may result in penalties. Treasury securities are debt instruments issued by the U.S. Department of the Treasury to finance the government's operations and pay for public spending. They are considered one of the safest fixed income investments available. Treasury securities include Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds), each with different maturities ranging from a few days to several decades. These investments are backed by the full faith and credit of the U.S. government, making them virtually risk-free. Municipal bonds, or "munis," are debt securities issued by state and local governments, as well as government agencies, to finance public projects such as schools, highways, and water systems. Investors who purchase municipal bonds lend money to the issuing entity in exchange for regular interest payments and the return of the principal at maturity. One attractive feature of municipal bonds is their potential tax advantages, as the interest income may be exempt from federal income tax and, in some cases, state and local taxes. Municipal bonds vary in credit quality, with general obligation bonds backed by the issuer's taxing power and revenue bonds supported by specific revenue streams. Corporate bonds are debt securities issued by companies to raise capital for various purposes, such as expansion, acquisitions, or refinancing existing debt. Investors who buy corporate bonds become creditors of the issuing company and receive periodic interest payments and the return of the principal at maturity. Corporate bonds offer higher yields compared to government or municipal bonds, reflecting the additional credit risk associated with corporate issuers. Credit rating agencies assess the creditworthiness of corporate bonds, providing investors with insights into the issuer's ability to meet its financial obligations. Assessing your risk tolerance is crucial in determining the appropriate fixed income investments for your retirement portfolio. Some investments, such as high-yield corporate bonds, carry higher levels of risk compared to government bonds. Evaluate how comfortable you are with potential fluctuations in the value of your investments and the possibility of default by the issuer. Clarify your investment objectives, such as income generation, capital preservation, or long-term growth. Your investment goals will influence the types of fixed income investments that best suit your needs. For instance, if you prioritize stable income, you may focus on bonds with consistent coupon payments. Consider your time horizon—the duration until you plan to use the funds in your retirement portfolio. A longer time horizon may allow for a greater allocation to bonds with longer maturities, potentially offering higher yields. Alternatively, if you have a shorter time horizon, you may prefer shorter-term bonds or certificates of deposit (CDs) to ensure the availability of funds when needed. When interest rates rise, bond prices tend to decline, affecting the value of existing bonds in the market. Conversely, falling interest rates can lead to price appreciation for bonds. Evaluate the current interest rate environment and consider how potential changes may impact your fixed income investments. Additionally, consider the potential effects of inflation on the purchasing power of your fixed income returns over time. Credit ratings provided by rating agencies offer insights into the issuer's ability to meet their financial obligations. Higher-rated bonds generally carry lower default risk but may offer lower yields. Lower-rated bonds, such as high-yield or junk bonds, offer higher yields but come with increased credit risk. Assess the credit quality of the issuers and diversify your fixed income investments to manage issuer-specific risk. Understand the tax implications of different fixed income investments, as they can impact your after-tax returns. Some bonds, such as municipal bonds, may offer tax advantages, such as exemption from federal income tax or certain state and local taxes. Taxable bonds, on the other hand, may be subject to ordinary income tax. Evaluate your tax bracket and consult with a tax advisor to optimize your fixed income investments from a tax perspective. The appropriate allocation to fixed income within a retirement portfolio depends on factors such as risk tolerance, investment goals, and time horizon. Generally, fixed income investments provide stability and income, making them suitable for conservative investors or those nearing retirement. Considerations such as desired income level, capital preservation, and growth objectives will guide the allocation decision. Balancing fixed income with other asset classes, such as equities or alternative investments, can help diversify the portfolio and potentially enhance returns. The specific allocation will depend on individual circumstances and preferences. Younger investors with longer time horizons may have a higher allocation to equities, while retirees may allocate a larger portion to fixed income for income generation and capital preservation. Diversification within the fixed income portion of the portfolio is essential for managing risk. Spread investments across different issuers, such as governments, municipalities, and corporations, to mitigate the impact of potential defaults or credit events. Explore various types of fixed income securities to enhance diversification and optimize returns. Examples include government bonds, corporate bonds, municipal bonds, Treasury Inflation-Protected Securities (TIPS), mortgage-backed securities, and international bonds. Each type of security carries its own risk and return profile, so selecting a mix that aligns with your risk tolerance and investment objectives is crucial. Regularly review and rebalance the fixed income portfolio to maintain the desired asset allocation and manage risk. Rebalancing involves selling or buying assets to restore the original target allocation. Factors such as changes in market conditions, investment performance, and individual circumstances can lead to deviations from the initial allocation. Rebalancing ensures that the portfolio stays aligned with long-term goals and avoids becoming overly concentrated or exposed to excessive risk. Fixed income investments are vital for retirement, offering a steady income, capital preservation, and risk mitigation. They offer diversification benefits in a balanced portfolio, reducing volatility and promoting consistent returns. The array includes government, corporate, municipal bonds, and Certificates of Deposit (CDs), each varying in yield, risk, and return predictability. Choosing the right instrument depends on risk tolerance, investment objectives, and time horizon. Other crucial factors include interest rates and inflation, credit quality, issuer risk, and tax implications. An appropriate asset allocation, based on individual needs and risk tolerance, is crucial to creating a balanced retirement portfolio. Consulting a financial advisor can help tailor a portfolio that aligns with personal investment objectives and risk tolerance.What Are Fixed Income Investments?

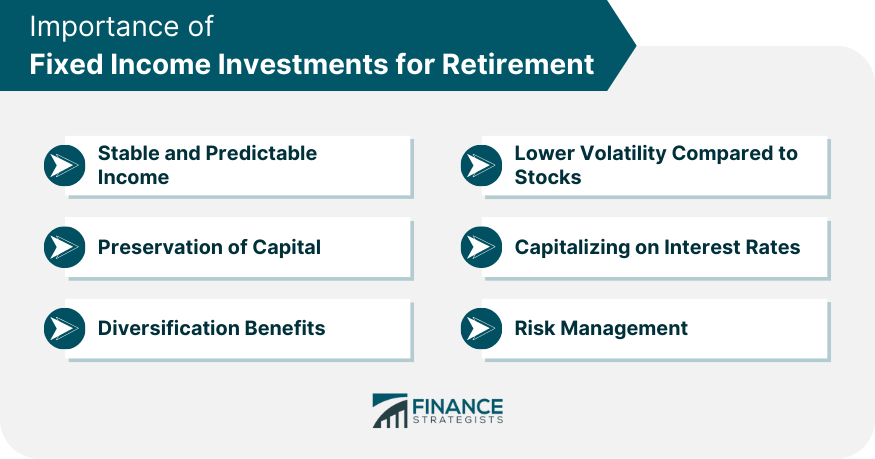

Importance of Fixed Income Investments for Retirement

Stable and Predictable Income

Preservation of Capital

Diversification Benefits

Lower Volatility Compared to Stocks

Capitalizing on Interest Rates

Risk Management

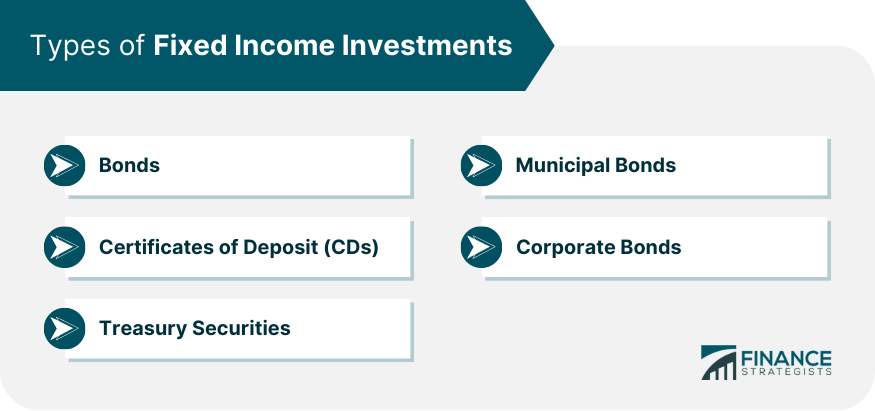

Types of Fixed Income Investments

Bonds

Certificates of Deposit (CDs)

Treasury Securities

Municipal Bonds

Corporate Bonds

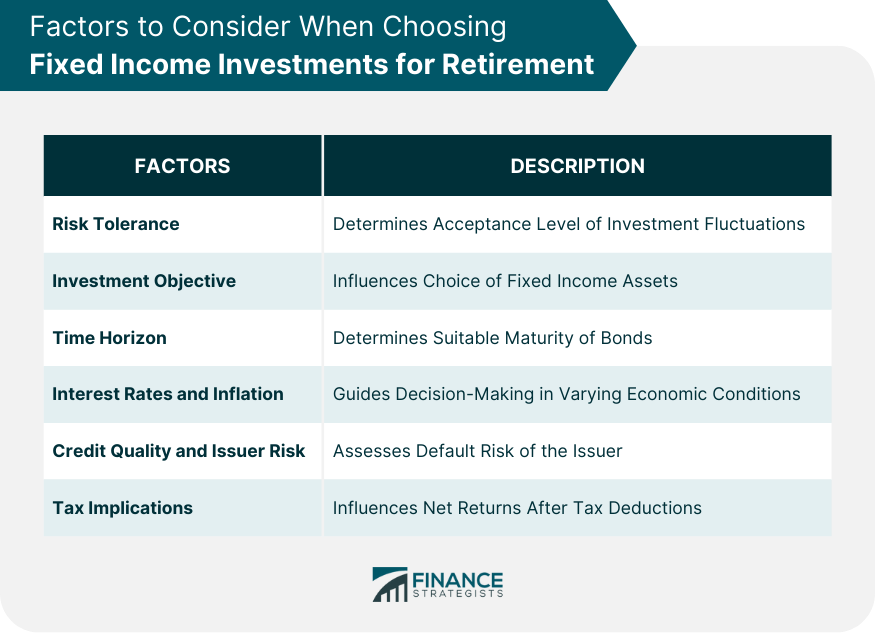

Factors to Consider When Choosing Fixed Income Investments for Retirement

Risk Tolerance

Investment Objective

Time Horizon

Interest Rates and Inflation

Credit Quality and Issuer Risk

Tax Implications

Building a Balanced Fixed Income Portfolio for Retirement

Asset Allocation Strategies

Determining the Appropriate Allocation to Fixed Income

Balancing Fixed Income With Other Asset Classes

Diversifying Fixed Income Investments

Spreading Investments Across Different Issuers and Sectors

Considering Different Types of Fixed Income Securities

Rebalancing the Portfolio Over Time

Conclusion

Fixed Income Investments for Retirement FAQs

Fixed income investments for retirement refer to financial instruments that provide a stable and predictable income stream, typically in the form of interest payments, to investors during their retirement years. These investments are designed to preserve capital and offer lower volatility compared to stocks.

Various types of fixed income investments are suitable for retirement, including bonds, certificates of deposit (CDs), treasury securities, municipal bonds, and corporate bonds. These investments offer different risk and return profiles, allowing retirees to diversify their portfolios based on their specific investment objectives and risk tolerance.

Fixed income investments play a crucial role in retirement planning due to their ability to generate a stable income stream. This income can help cover living expenses and provide financial security during retirement. Additionally, fixed income investments offer capital preservation and lower volatility, making them reliable assets for long-term financial stability.

When choosing fixed income investments for retirement, several factors should be considered. These include your risk tolerance and investment objectives, time horizon, interest rates and inflation, credit quality and issuer risk, and tax implications. Evaluating these factors will help you select investments that align with your financial goals and provide adequate income and capital preservation.

To incorporate fixed income investments into your retirement plan, it's advisable to work with a financial advisor who can provide personalized guidance. They can help determine the appropriate asset allocation, balance fixed income with other asset classes, diversify investments across issuers and sectors, and create an income distribution strategy. Regular monitoring and adjustments to the portfolio over time will ensure your retirement plan remains aligned with your financial needs and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.