Retirement income for federal employees varies significantly, influenced by factors such as length of service, pay grade, and specific retirement plans. For those who retired under Civil Service Retirement System (CSRS) in fiscal year 2022, the average monthly annuity was $5,447. For those who retired under Federal Employees Retirement System (FERS), the average monthly annuity was $2,126. However, it is important to note that these are just the annuity payouts. For FERS retirees, retirement income also includes Social Security benefits and potential earnings from the Thrift Savings Plan (TSP). These additional sources of income are not included in the annuity averages mentioned. The exact amounts for Social Security benefits and TSP earnings would vary greatly depending on factors such as the employee's earnings history, the length of their federal service, the age at which they retire, and their contributions to the TSP. Like any other sector, federal employment encapsulates a wide range of job roles, from administrative positions to high-level management and specialized professional roles. Those in higher pay grades and with longer tenure tend to have higher retirement income. The location of service also affects pay scales, and therefore, retirement income, as certain areas have locality pay adjustments to account for the higher cost of living. Years of service are a significant contributor to retirement income for federal employees. Both FERS and CSRS calculate retirement benefits partly based on service length. For instance, if you decide to retire at the Minimum Retirement Age (MRA) and you have at least 10 years of service but less than 30, your retirement benefits will be decreased by 5% for each year that you're below the age of 62. However, this reduction does not apply if you have accumulated 20 years of service and you start receiving your benefits at the age of 60 or later. When compared with the private sector, federal employees often have more substantial retirement benefits. Many private-sector employees rely primarily on Social Security benefits and personal savings or 401(k) plans, while federal employees typically receive pensions and have access to the Thrift Savings Plan (TSP). Comparatively, state and local government employees' retirement incomes tend to be quite varied, depending on the specific retirement systems in place in each state or locality. Some might be on par with federal employees, while others may be lower. Federal employees are primarily part of two retirement systems. CSRS applies to federal employees who began their service before 1987, while FERS applies to those who started after 1987. FERS consists of three components: a basic benefit plan, Social Security, and the Thrift Savings Plan. On the other hand, CSRS does not include Social Security but provides a pension that is generally higher than FERS. The length of service has a significant impact on the retirement benefits of federal employees. Under both FERS and CSRS, longer service times equate to higher retirement income. In FERS, for example, employees receive 1% of their high-3 average salary for each year of service when they retire at the minimum retirement age with at least 30 years of service, 60 with 20 years, or 62 with five years. This rate increases to 1.1% for those retiring at age 62 or later with at least 20 years of service. The 'high-3' average salary refers to the highest average basic pay earned during any three consecutive years of service. This figure plays a pivotal role in calculating a federal employee's retirement income, as both FERS and CSRS use the high-3 average salary as a factor in their benefit calculations. TSP is a crucial aspect of retirement savings for federal employees. It is a defined contribution plan, similar to a 401(k) plan offered in the private sector. Employees can contribute a portion of their salary to the TSP, with matching contributions from the federal government. The accumulated funds, which benefit from tax advantages, can be a significant source of retirement income, supplementing the pension and Social Security benefits received by FERS enrollees. Inflation is a critical challenge faced by federal retirees. Although federal pensions do come with cost-of-living adjustments (COLAs), these adjustments may not keep pace with inflation, potentially eroding purchasing power over time. The location can also significantly impact the cost of living, with areas such as New York and San Francisco being considerably more expensive than smaller towns and rural areas. Healthcare is often a major expense in retirement. Even with federal health benefits, retirees may face substantial out-of-pocket costs. Other post-retirement expenses, such as housing, food, and transportation, can also take up a significant portion of a retiree's income. While FERS retirees receive Social Security benefits in addition to their federal pension and TSP, these benefits are often not enough to maintain pre-retirement living standards. As such, many federal retirees must rely on personal savings and investments to supplement their retirement income. Effective retirement planning starts early. The more time you allow for your savings to grow, the larger your nest egg will be when you retire. Early in their careers, federal employees should consider maximizing their TSP contributions, particularly to take full advantage of matching contributions. Additionally, it can be advantageous to start considering other personal savings or investment strategies outside of the federal retirement system. Financial advisors can provide valuable guidance and resources for retirement planning. They can help assess an individual's financial health, identify realistic retirement income goals, and develop a comprehensive plan to achieve these goals. A financial advisor can also provide advice on managing and mitigating potential financial risks, diversifying investments, and optimizing tax strategies. TSP is an invaluable resource for federal employees. Employees should consider contributing the maximum amount to the TSP, especially considering the matching contributions. Investing in TSP's Lifecycle (L) Funds, which automatically adjust the investment mix over time based on your target retirement date, can be a simple way to maintain a diversified and appropriately risk-adjusted portfolio. Other investment opportunities, such as Individual Retirement Accounts (IRAs) or real estate, can also help supplement federal retirement income. Retirement income for federal employees, with an average monthly annuity of $5,447 for those under the CSRS and $2,126 under the FERS in fiscal year 2022, is multifaceted and influenced by a variety of factors. These include length of service, pay grade, and the specific retirement system an employee is part of. However, these average figures only account for annuity payments and do not include other income sources like Social Security benefits and Thrift Savings Plan (TSP) earnings, making the full retirement income picture for FERS retirees more comprehensive. In comparison to the private sector, federal employees often enjoy more robust retirement benefits. Despite this, they still face certain challenges such as inflation, healthcare costs, and potential dependency on Social Security benefits. To address these challenges and maximize retirement income, early planning, maximizing contributions to the TSP, and seeking advice from financial advisors can prove crucial.Average Retirement Income of Federal Employees

Breakdown of Statistics: Variances Based on Job Role, Location, Grade Level, and Years of Service

Comparisons With the Private Sector and State or Local Government Employees

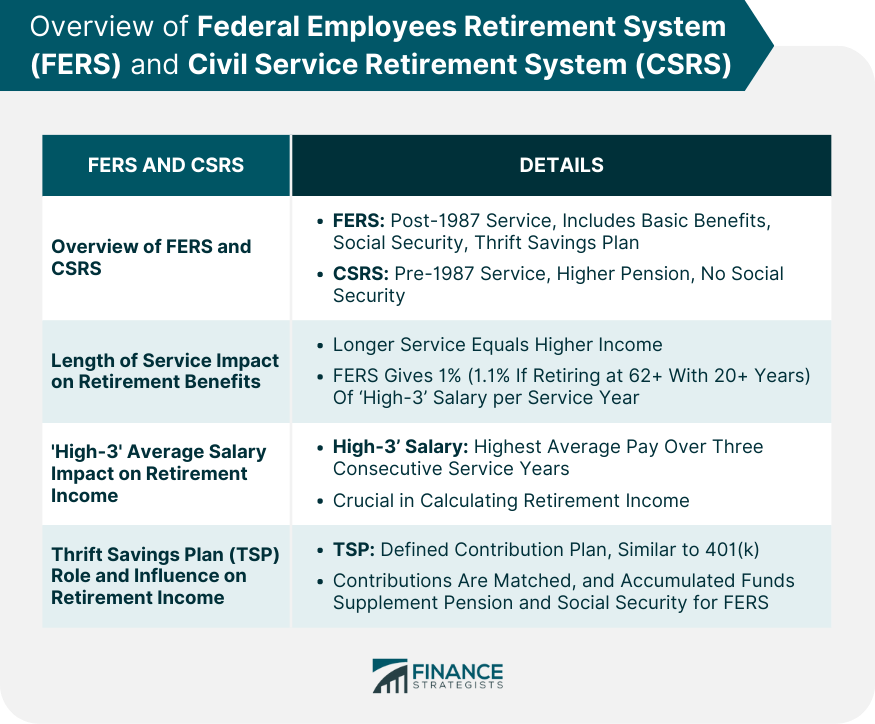

Overview of FERS and CSRS

Impact of the Length of Service on Retirement Benefits

Effect of 'High-3' Average Salary on the Retirement Income

Role of Thrift Savings Plan (TSP) Contributions and Its Influence on Retirement Income

Challenges Faced by Federal Retirees

Consideration of Inflation and Cost of Living

Healthcare Costs and Other Post-retirement Expenses

Dependence on Social Security Benefits

Strategies for Maximizing Federal Retirement Income

Importance of Early Planning and Savings

Role of Financial Advisors in Retirement Planning

Utilization of TSP and Other Investment Opportunities

The Bottom Line

What Is the Average Retirement Income of Federal Employees? FAQs

The average retirement income for federal employees under the CSRS was $4,973 per month as of fiscal year 2018.

Compared to CSRS, the average retirement income for federal employees under FERS was lower at $1,834 per month in fiscal year 2018. However, this does not account for additional income sources like Social Security benefits and potential earnings from the Thrift Savings Plan.

The average retirement income of federal employees is influenced by various factors, including the length of service, pay grade, and specific retirement plan (either FERS or CSRS). Additional income sources like Social Security benefits and Thrift Savings Plan (TSP) also contribute to the overall retirement income.

Generally, federal employees tend to have more substantial retirement benefits than those in the private sector. While many private-sector employees rely primarily on Social Security benefits and personal savings or 401(k) plans, federal employees typically receive pensions and have access to the Thrift Savings Plan (TSP).

Federal retirees face several challenges that may affect their income, such as inflation, the cost of living depending on location, healthcare expenses, and the possibility of over-reliance on Social Security benefits. These factors highlight the importance of effective financial planning to supplement retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.