The Affordable Care Act, colloquially known as ACA, PPACA, or Obamacare, is a transformative healthcare legislation enacted in March 2010 in the United States. Its main objective is to extend health insurance coverage to millions of uninsured Americans. The Act has instituted sweeping changes in the health insurance landscape, including the introduction of health insurance marketplaces, the expansion of Medicaid, and the enforcement of insurance mandates. Obamacare provides subsidies, also referred to as premium tax credits, to individuals and families with incomes between 100% and 400% of the federal poverty level (FPL). These subsidies lower the cost of health insurance premiums, making coverage more affordable for eligible people. Income plays a crucial role in determining eligibility for Obamacare subsidies. Specifically, your Modified Adjusted Gross Income (MAGI) is the key determinant. In addition to wages, interest, and dividends, MAGI encompasses various other income sources, such as alimony, Social Security benefits, and certain types of retirement income. Consequently, understanding how different forms of income are assessed is critical when applying for or maintaining Obamacare benefits. The answer is yes, but with some qualifications. All or part of your retirement income can affect your eligibility for Obamacare subsidies, depending on its type. When it comes to Obamacare, the focus is on your MAGI. This figure includes certain kinds of retirement income. For instance, taxable Social Security benefits are counted, as are withdrawals from traditional IRAs and 401(k)s. However, tax-free income, such as certain portions of Social Security benefits and qualified withdrawals from Roth IRAs, does not contribute to MAGI. Therefore, depending on your sources of retirement income, you may find yourself eligible or ineligible for Obamacare subsidies. For example, let's assume you're single, retired, and your only income is from Social Security benefits, of which $10,000 is taxable. If the FPL is set at $13,000, you would be eligible for subsidies because your MAGI ($10,000) falls below 400% of the FPL ($52,000). Conversely, if you add a $20,000 taxable withdrawal from your traditional IRA, your MAGI becomes $30,000. While this still qualifies you for a subsidy, the subsidy amount would be lower because the subsidy decreases as income increases. Different types of retirement income can have different impacts on Obamacare eligibility. Here are a few key types: Only the taxable portion of Social Security benefits counts towards MAGI. If Social Security is your only income or you have other income but it's below a certain threshold, your benefits may not be taxable, hence not affecting your Obamacare eligibility. Withdrawals are typically fully taxable and thus add to your MAGI. These could potentially push you into a higher income bracket, reducing your Obamacare subsidy. Qualified withdrawals are not included in MAGI, therefore they don't impact Obamacare eligibility. These are generally fully taxable and contribute to MAGI. However, if you have an annuity that is part insurance payout and part investment return, only the investment portion is taxable and counts towards MAGI. The taxability of investment income depends on the type of investment. Long-term capital gains and qualified dividends have preferential tax rates and will contribute to MAGI. However, selling a personal residence could result in tax-free income that wouldn't add to MAGI. Remember, these are general rules. Everyone's financial situation is unique, and tax laws are complex. Therefore, it's essential to consult with a tax advisor or financial planner to understand how your retirement income could affect your Obamacare eligibility. Retirement income typically comes from various sources. These may include Social Security benefits, pensions, annuities, Individual Retirement Accounts (IRAs), 401(k) or other employer-sponsored retirement plans, and investments. Other possible sources are part-time employment during retirement and rental income. Each of these sources of income is taxed differently and can therefore impact the MAGI differently. In general, retirement money does count as income. However, it's not as straightforward as it seems. Some types of retirement income, like Social Security benefits, might be partially taxable or entirely tax-free, depending on other income. On the other hand, withdrawals from tax-deferred retirement accounts, such as traditional IRAs and 401(k)s, are fully taxable. Meanwhile, withdrawals from Roth IRAs, after the age of 59½ and once the account has been open for at least five years, are generally tax-free. This variation in taxability greatly influences the calculation of the MAGI for Obamacare purposes. Pensions and annuities, which are typically considered taxable income, are included in the MAGI calculation. However, it's important to note that non-taxable portions of these payments, such as return of principal or cost basis, do not contribute to MAGI. Distributions from traditional IRAs are fully taxable, and therefore count towards your MAGI. However, qualified distributions from Roth IRAs—which are tax-free—do not factor into MAGI calculations. The tax-free status of these Roth IRA distributions makes them a potentially useful tool for managing MAGI to qualify for Obamacare subsidies. Social Security income is a little trickier. Only the taxable portion of Social Security benefits—generally from 0 to 85 percent, depending on your total income—counts towards your MAGI. Similar to traditional IRA distributions, withdrawals from tax-deferred accounts like 401(k) and 403(b) plans are fully taxable. Therefore, these distributions are part of the MAGI for Obamacare eligibility. Starting at age 72, owners of certain retirement accounts, including traditional IRAs and 401(k) plans, are required to take minimum distributions known as RMDs. These distributions are fully taxable and thus count towards the MAGI for Obamacare purposes. MAGI is your Adjusted Gross Income (AGI) with specific deductions added back in. These "add-backs" can include items like non-taxable Social Security benefits, tax-exempt interest, and foreign-earned income. For most people, MAGI is the same or slightly higher than AGI. As discussed, different types of retirement income have different tax treatments, and this taxability influences whether they are included in your MAGI. Fully taxable income—like traditional IRA, 401(k), and 403(b) distributions, pensions, annuities, and RMDs—will add to your MAGI. The taxable portion of Social Security income will also factor into your MAGI. However, tax-free income, such as qualified Roth IRA distributions, won't contribute to your MAGI. Your MAGI is the basis for determining your eligibility for Obamacare subsidies. If your MAGI falls between 100% and 400% of the federal poverty level, you may qualify for subsidies to help offset your health insurance premium costs. In the context of early retirement, managing your retirement income becomes particularly important for Obamacare eligibility. Early retirees often have more control over their income sources, which can be advantageous. By strategically choosing when and how much to withdraw from different accounts, they can potentially keep their MAGI within the subsidy-eligible range. At full retirement age, many people start receiving Social Security benefits and taking RMDs. Both of these income sources can push the MAGI up, potentially affecting Obamacare subsidies. Therefore, careful income planning remains important even in full retirement. If you delay retirement, you might continue to receive wages, which can increase your MAGI. However, delaying Social Security benefits and withdrawals from retirement accounts could help offset this and keep you within the range for Obamacare subsidies. In any scenario, understanding how your retirement income contributes to your MAGI is key to optimizing your eligibility for Obamacare. Under Obamacare, the amount of subsidy you receive is inversely proportional to your income level. The lower your income (up to a point), the higher your subsidy. As a result, increased retirement income could result in reduced subsidies. For example, if you make a large withdrawal from a traditional IRA, your MAGI may increase significantly for that year. This could not only reduce your subsidy for the following year but might even push you above the 400% FPL limit, making you ineligible for subsidies altogether. Excessive withdrawals from retirement accounts could negatively impact your Obamacare subsidies. These distributions, being taxable, will increase your MAGI. If this pushes your MAGI over the 400% FPL limit, you could lose your subsidy entirely. Carefully planning your retirement income can help maximize your Obamacare subsidies. Consider these strategies: 1. Manage Withdrawals: Keep withdrawals from taxable accounts to a minimum to avoid large spikes in your MAGI. 2. Use Roth Accounts: Withdrawals from Roth accounts, being tax-free, won't increase your MAGI. 3. Delay Social Security: By delaying Social Security benefits, you can avoid increasing your MAGI too soon. 4. Watch Your Investment Income: Interest, dividends, and capital gains can add to your MAGI, so monitor your investments carefully. Miscalculating your income and not understanding the tax implications of your retirement income can lead to reduced subsidies or unexpected tax liabilities. To avoid this: 1. Plan Ahead: Be aware of how each income source impacts your MAGI and tax situation. 2. Seek Professional Advice: Consult with a financial advisor or tax professional who understands both retirement income and Obamacare. 3. Stay Informed: Keep up to date with changes in tax laws and health care regulations, as these could affect your situation. Retirement money can significantly affect Obamacare eligibility and the amount of subsidy you receive. Your MAGI, which includes taxable retirement income, is the key determinant of your eligibility for subsidies. Therefore, understanding the types of retirement income and their tax implications is crucial when planning for retirement and health insurance costs. Managing retirement income for Obamacare purposes is a complex topic, involving an understanding of various income sources, tax rules, and health care regulations. Therefore, further research and professional advice are recommended to navigate this intersection of retirement and health care planning successfully. Take control of your financial future today. Whether you're in early, full, or delayed retirement, properly managing your retirement income can optimize your health care benefits. Reach out to a retirement planning service or financial advisor knowledgeable in both retirement income and Obamacare regulations.Overview of Obamacare

Importance of Income Determination for Obamacare

Does Retirement Money Count as Income for Obamacare?

Influence of Retirement Income on Obamacare Eligibility

Differentiating Between Types of Retirement Money and Their Impact on Obamacare

Social Security

Traditional IRAs and 401(k)s

Roth IRAs

Pensions and Annuities

Investments

Understanding Retirement Money

Different Sources of Retirement Income

Does Retirement Money Count as Income?

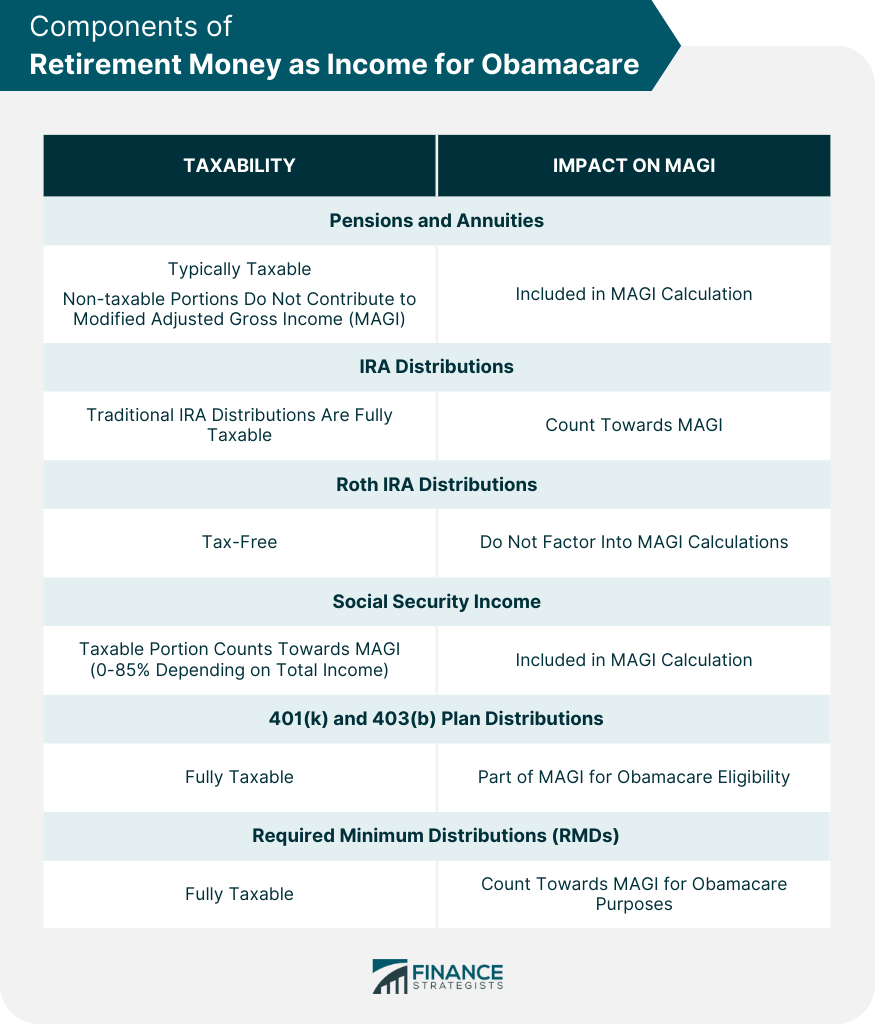

Components of Retirement Money as Income for Obamacare

Pensions and Annuities

IRA Distributions

Social Security Income

401(k) and 403(b) Plan Distributions

Required Minimum Distributions (RMDs)

Understanding the Modified Adjusted Gross Income (MAGI)

How Retirement Money Factors into MAGI

How MAGI Determines Eligibility for Obamacare

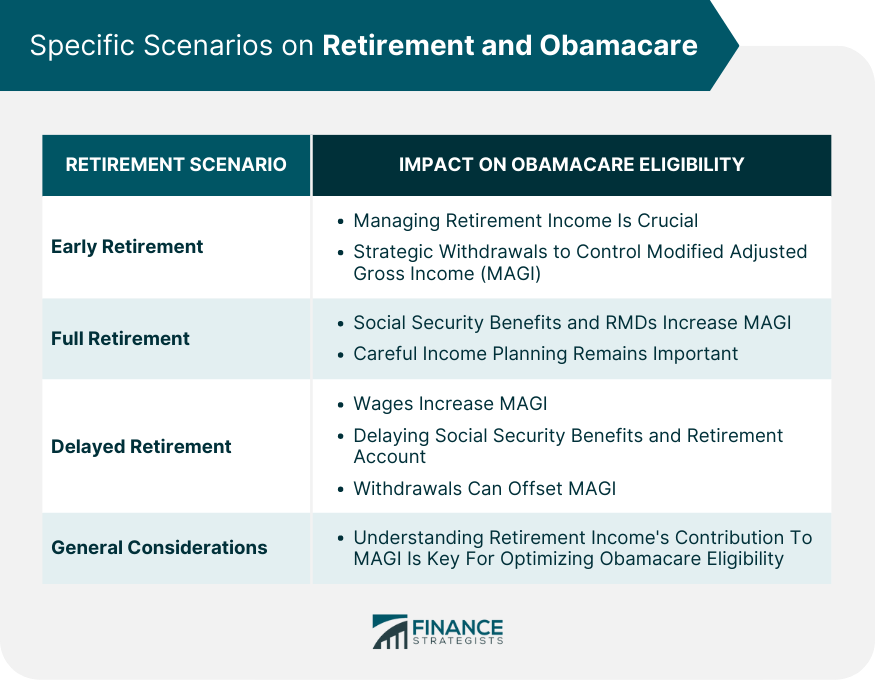

Specific Scenarios on Retirement and Obamacare

Early Retirement and Obamacare

Full Retirement and Obamacare

Delayed Retirement and Obamacare

Impact of Retirement Money on Obamacare Subsidies

How Income Level Affects the Amount of Subsidy Received

Effect of Excess Retirement Withdrawals on Obamacare Subsidies

Tips on Managing Retirement Money for Obamacare Benefits

Strategies for Income Management

Potential Pitfalls and How to Avoid Them

The Bottom Line

Does Your Retirement Money Count as Income for Obamacare? FAQs

Yes, certain types of retirement money, like distributions from traditional IRAs, 401(k)s, and taxable parts of Social Security benefits, count as income for Obamacare.

Taxable retirement money such as withdrawals from traditional IRAs, 401(k)s, pensions, annuities, and the taxable part of Social Security benefits are considered income for Obamacare.

Your retirement money, if taxable, increases your Modified Adjusted Gross Income (MAGI). If your MAGI falls within a specific range (100% to 400% of the federal poverty level), you may qualify for Obamacare subsidies.

No, tax-free retirement money, like qualified distributions from a Roth IRA, doesn't count as income for Obamacare, so it doesn't affect your eligibility.

Yes, RMDs from retirement accounts like traditional IRAs and 401(k)s are taxable and therefore count as income for Obamacare.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.