A hardship withdrawal is a special provision that allows individuals to withdraw funds from their retirement accounts due to immediate and substantial financial needs. It is essential to recognize the implications and alternatives before pursuing this option. Understanding hardship withdrawals is crucial because they can significantly impact one's long-term financial planning and retirement goals. It is essential to be aware of eligibility, potential consequences, and alternatives to make an informed decision. A 401(k) hardship withdrawal pertains to the withdrawal of funds from an employer-sponsored 401(k) retirement plan due to financial hardship. The IRS regulates these withdrawals, and there are specific eligibility requirements and potential tax consequences. An IRA hardship withdrawal refers to the withdrawal of funds from an individual retirement account (IRA) due to financial hardship. While similar to 401(k) withdrawals, there are differences in eligibility requirements, penalties, and tax implications. Other types of retirement accounts, such as 403(b) or 457 plans, may also offer hardship withdrawal options. Each plan has its eligibility criteria, documentation requirements, and potential consequences, making it essential to understand the specific plan's guidelines. To qualify for a hardship withdrawal, an individual must demonstrate an immediate and heavy financial need. This need must be substantiated, and the withdrawal amount should not exceed the financial need or the available balance in the retirement account. There are several expenses that may qualify for a hardship withdrawal: Expenses for medical care, including diagnosis, treatment, and prevention, for the individual, their spouse, or dependents may qualify for a hardship withdrawal. A hardship withdrawal can be used to cover costs associated with buying a primary residence, such as a down payment, closing costs, and other related fees. Educational expenses for the next 12 months, such as tuition, fees, and room and board, for the individual, spouse, or dependents may qualify for a hardship withdrawal. A hardship withdrawal can be used to prevent eviction from or foreclosure on a primary residence, covering rent or mortgage payments and associated fees. Funeral and burial expenses for a deceased parent, spouse, child, or dependent may qualify for a hardship withdrawal. Expenses for repairing damage to a primary residence caused by a natural disaster or other unforeseen events may qualify for a hardship withdrawal. To apply for a hardship withdrawal, individuals must provide documentation to verify their financial needs. This documentation may include medical bills, eviction notices, tuition statements, or other evidence supporting the claim of financial hardship. The first step in requesting a hardship withdrawal is to contact the plan administrator or financial institution responsible for managing the retirement account. They will provide information on eligibility, required forms, and documentation needed for the application. Applicants must complete the necessary forms provided by the plan administrator or financial institution. These forms typically require personal information, details about the financial hardship, and the requested withdrawal amount. Applicants must submit supporting documentation that verifies their financial hardship along with the required forms. This documentation may include medical bills, tuition statements, eviction notices, or any other evidence that demonstrates the financial need. The plan administrator or financial institution will review the application and supporting documentation to determine if the applicant meets the eligibility criteria for a hardship withdrawal. If approved, the withdrawal amount will be disbursed; if denied, the applicant will be informed of the reason for the denial. The timeline for receiving hardship withdrawal funds vary depending on the plan administrator or financial institution's processes. Generally, it can take several weeks from the submission of the application to the disbursement of funds. Taking a hardship withdrawal can have a significant impact on retirement savings. Funds withdrawn are no longer invested and cannot grow, potentially resulting in a reduced retirement nest egg and affecting long-term financial goals. Hardship withdrawals may be subject to various taxes and penalties: Withdrawn funds from a hardship withdrawal are generally considered taxable income and subject to federal income tax, potentially increasing the individual's overall tax liability. In addition to federal income tax, hardship withdrawals may also be subject to state income tax, depending on the state's tax laws. If the individual is under 59½ years old, a 10% early withdrawal penalty may apply to the hardship withdrawal amount, in addition to federal and state income taxes. Hardship withdrawals cannot be repaid to the retirement account, unlike loans from retirement accounts. Additionally, some plans may restrict contributions to the retirement account for a period after the hardship withdrawal, further impacting long-term savings. Instead of a hardship withdrawal, individuals may consider taking a loan from their retirement account, which allows them to borrow funds without incurring taxes or penalties and repay the loan over time, including interest. Depending on the nature of the financial hardship, individuals may be eligible for assistance from government programs, such as unemployment benefits, food assistance, or housing assistance, which can help alleviate financial burdens without impacting retirement savings. Another alternative to hardship withdrawals is obtaining a personal loan or line of credit from a financial institution. This option may provide the necessary funds while keeping retirement savings intact, although interest rates and repayment terms should be carefully considered. For those struggling with debt, a debt management plan or credit counseling may help address financial hardships without resorting to a hardship withdrawal. These services can assist in negotiating lower interest rates, creating a repayment plan, and offering financial guidance. Creating an emergency fund can help individuals prepare for unexpected expenses, reducing the likelihood of needing a hardship withdrawal. Aim to save three to six months' worth of living expenses in an easily accessible account. Regularly reviewing and adjusting one's financial plan can help identify potential issues and make necessary changes to avoid financial hardship. This process includes assessing income, expenses, savings, and investments to ensure they align with financial goals. Having appropriate insurance coverage, such as health, disability, and property insurance, can help protect against financial hardships resulting from unexpected events. Regularly review insurance policies to ensure they provide sufficient coverage. Consulting with a financial professional can help individuals create a comprehensive financial plan that includes strategies for preventing financial concerns. A hardship withdrawal is a provision that permits individuals to take money from their retirement accounts in cases of urgent and significant financial needs. Before deciding to pursue a hardship withdrawal, it is crucial to carefully consider the potential consequences, such as the impact on retirement savings, taxes, and penalties. Exploring alternative options may help alleviate financial hardship without affecting long-term financial goals. When facing financial hardship, it is essential to balance immediate needs with long-term financial goals. By assessing the situation thoroughly and seeking guidance, individuals can make informed decisions that prioritize both short-term relief and future financial stability. To better understand the implications of hardship withdrawals and explore alternatives, consider seeking the assistance of a professional retirement planning service. These experts can provide valuable guidance on managing financial hardships while preserving long-term financial health.What Is Hardship Withdrawal?

Types of Hardship Withdrawals

401(k) Hardship Withdrawal

IRA Hardship Withdrawal

Other Retirement Account Hardship Withdrawals

Criteria for Hardship Withdrawal

Immediate and Heavy Financial Need

Specific Expenses Eligible for Hardship Withdrawal

Medical Expenses

Purchase of a Primary Residence

College Tuition and Related Expenses

Preventing Eviction or Foreclosure

Funeral Expenses

Home Repair Expenses Due to Damage or Natural Disaster

Verification and Documentation Requirements

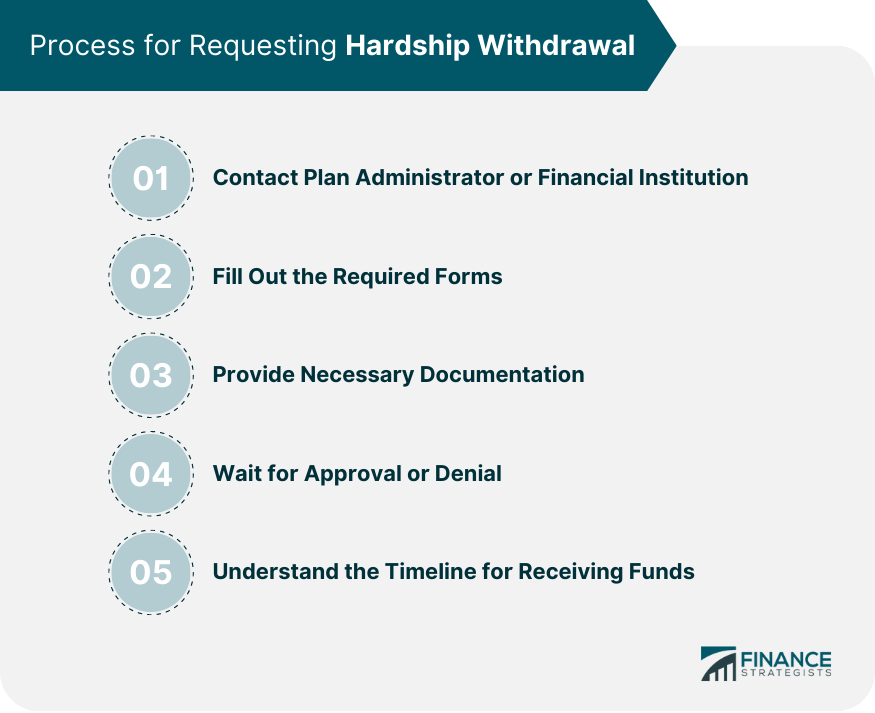

Process for Requesting Hardship Withdrawal

Contact Plan Administrator or Financial Institution

Fill Out the Required Forms

Provide Necessary Documentation

Wait for Approval or Denial

Understand the Timeline for Receiving Funds

Consequences of Hardship Withdrawal

Impact on Retirement Savings

Taxes and Penalties

Federal Income Tax

State Income Tax

Early Withdrawal Penalty

Repayment Restrictions and Limitations

Alternatives to Hardship Withdrawal

Loans from Retirement Accounts

Assistance from Government Programs

Personal Loans or Lines of Credit

Debt Management Plans or Credit Counseling

Strategies for Preventing the Need for Hardship Withdrawals

Building an Emergency Fund

Regularly Reviewing and Adjusting Financial Plans

Adequate Insurance Coverage

Seeking Professional Financial Advice

Final Thoughts

Hardship Withdrawal FAQs

A hardship withdrawal is a provision that allows individuals to withdraw funds from their retirement accounts, such as a 401(k) or IRA, due to immediate and substantial financial needs. It should be considered as an option only after exhausting other alternatives, as it can significantly impact long-term retirement savings and financial goals.

To be eligible for a hardship withdrawal, individuals must demonstrate an immediate and heavy financial need. Eligible expenses may include medical expenses, purchasing a primary residence, college tuition, preventing eviction or foreclosure, funeral expenses, or home repair expenses due to damage or natural disaster.

A hardship withdrawal can have a significant impact on retirement savings, as withdrawn funds are no longer invested and cannot grow. Additionally, the withdrawal is generally subject to federal and state income taxes and may incur a 10% early withdrawal penalty if the individual is under 59½ years old.

Alternatives to hardship withdrawals include loans from retirement accounts, assistance from government programs, personal loans or lines of credit, and debt management plans or credit counseling services. These options may help alleviate financial hardships without impacting retirement savings or incurring tax penalties.

To prevent the need for a hardship withdrawal, individuals can build an emergency fund, regularly review and adjust their financial plans, maintain adequate insurance coverage, and seek professional financial advice. These strategies can help mitigate financial hardships while preserving long-term financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.