Investment income refers to the earnings generated from various types of investments, including stocks, bonds, real estate, and other financial assets. It plays a crucial role in building wealth and achieving financial goals, such as funding retirement or meeting other long-term financial objectives. Investment income is essential for investors as it contributes to their overall financial well-being and helps in achieving long-term financial goals. It can also serve as a passive income source, providing a steady cash flow and supplementing other income streams. Investment income comes in various forms, including dividends, interest, capital gains, rental income, royalties, and annuities. Each type of investment income has its characteristics and tax implications. Dividends are payments made by companies to their shareholders as a distribution of profits. They can provide a steady stream of income for investors, particularly when investing in well-established companies with a history of consistent dividend payments. Interest income is generated from fixed-income investments, such as bonds, certificates of deposit (CDs), and savings accounts. Interest payments provide a predictable income stream and can be particularly attractive during periods of low market volatility or economic uncertainty. Capital gains are the profits realized from the sale of an investment that has appreciated in value. Capital gains can be a significant source of investment income, particularly for investors focused on growth-oriented investments like stocks or real estate. Rental income is generated from leasing real estate properties, such as residential or commercial units. This income stream can provide a consistent cash flow for property owners and contribute to overall investment income. Royalties are income generated from intellectual property, such as patents, copyrights, or trademarks. These payments are usually received when others use the intellectual property for commercial purposes, providing a passive income stream for the owner. Annuities are financial products designed to provide a guaranteed income stream, typically during retirement. They can be purchased through insurance companies, and payments can be structured as fixed or variable amounts, depending on the terms of the annuity contract. Market conditions, such as stock market performance and economic growth, can significantly impact investment income. Investors must remain aware of market trends and adjust their investment strategies accordingly. Interest rates influence the returns on fixed-income investments like bonds and CDs. Changes in interest rates can affect the value of these investments and the income generated from them. Economic growth is a critical factor in determining investment income, particularly for stocks and real estate investments. Strong economic growth can lead to increased corporate profits and higher property values, positively impacting investment income. Inflation can erode the purchasing power of investment income over time. Investors must consider the impact of inflation on their investment income and adjust their strategies to preserve the real value of their earnings. Investment risk, such as market volatility and credit risk, can impact investment income. A higher level of risk may result in higher potential returns, but it also carries a greater chance of losses. Diversification is essential in mitigating risks and ensuring a stable investment income stream. A well-diversified portfolio can help protect against market fluctuations and reduce the impact of specific risks on investment income. Dividend investing focuses on stocks with a history of consistent and growing dividend payments. This strategy aims to generate a steady income stream while potentially benefiting from capital appreciation. Fixed-income investing involves allocating a portion of the investment portfolio to bonds, CDs, and other interest-bearing instruments. This strategy aims to generate predictable income streams and reduce portfolio volatility. Real estate investing involves purchasing and managing properties to generate rental income and capital appreciation. This strategy can provide a consistent income stream while potentially benefiting from property value increases over time. Growth investing focuses on investments with high potential for capital appreciation, such as stocks of companies with strong growth prospects. This strategy can generate significant investment income through capital gains but may involve higher risks and lower income stability. Value investing involves identifying and purchasing undervalued investments with strong fundamentals. This strategy aims to generate investment income through capital appreciation as the market eventually recognizes the true value of these investments. Dividends are generally subject to taxation at the individual investor's ordinary income tax rate or the qualified dividend tax rate, depending on the holding period and other factors. Interest income is typically taxed at the investor's ordinary income tax rate. However, some types of interest income, such as that from municipal bonds, may be exempt from federal income tax and, in some cases, state and local taxes. Capital gains are subject to capital gains tax, which varies depending on the holding period and the investor's tax bracket. Long-term capital gains are generally taxed at a lower rate than short-term capital gains. Rental income is generally subject to taxation at the investor's ordinary income tax rate. However, various deductions and credits may be available to offset rental income, such as depreciation, property taxes, and maintenance expenses. Royalty income is generally taxed at the investor's ordinary income tax rate. Specific deductions and credits may apply, depending on the nature of the intellectual property and the investor's circumstances. The tax treatment of annuity income depends on the type of annuity and the investor's specific circumstances. Annuity payments may be fully or partially taxable, and some annuities may provide tax-deferred growth opportunities. Investment income plays a crucial role in portfolio allocation, as it contributes to the overall return on investment and helps investors achieve their financial goals. A balanced portfolio should include a mix of income-generating assets and growth-oriented investments to optimize returns and manage risk. Reinvesting investment income can help grow the portfolio and compound returns over time. Investors can reinvest dividends, interest, or capital gains in additional investments, enhancing their future income potential. Investors need to strike a balance between income generation and capital growth, depending on their financial goals and risk tolerance. A focus on income generation may provide stability and cash flow but may limit potential capital appreciation. Conversely, a focus on capital growth may offer higher returns but lower income stability. Investment income is vital during retirement, as it can supplement Social Security benefits, pensions, and other income sources to maintain a desired lifestyle. A well-planned investment strategy can help ensure a steady income stream during retirement years. Retirement income strategies may include a mix of dividends, interest, rental income, annuities, and systematic withdrawals from investment accounts. A diversified approach can help manage risk and provide a stable income stream during retirement. Social Security and pensions can provide a stable income base for retirees, but they may not be sufficient to meet all financial needs during retirement. Investment income can supplement these sources, helping retirees maintain their desired lifestyle and cover expenses such as healthcare, travel, and other leisure activities. Market volatility can impact the value of investments and the income generated from them. Investors must be prepared to manage fluctuations in their investment income and adjust their strategies accordingly. Interest rate risk refers to the potential impact of changing interest rates on investment income, particularly for fixed-income investments. When interest rates rise, the market value of existing fixed-income investments may decline, leading to lower investment income. Inflation risk is the possibility that the purchasing power of investment income will decrease over time due to rising prices. Investors should consider inflation-protected investments or strategies that can generate real returns to mitigate this risk. Currency risk arises from fluctuations in exchange rates when investing in foreign assets. Changes in exchange rates can impact investment values and income, particularly for investors with significant international exposure. Changes in tax policies can affect the after-tax returns on investment income. Investors should stay informed about potential tax policy changes and adjust their strategies to optimize their tax situation. Investment income plays a crucial role in wealth building, providing a source of passive income that can supplement other income streams, fund retirement, and help achieve long-term financial goals. Understanding the various sources of investment income and their associated risks is essential for investors to make informed decisions and optimize their investment strategies. By evaluating and managing these risks, investors can build a diversified portfolio that generates stable income while also offering potential for capital appreciation. Strategic planning and effective portfolio management are critical to generating investment income and achieving long-term financial objectives. By striking a balance between income generation and capital growth, investors can optimize their portfolios to meet their unique financial goals and risk tolerance.What Is Investment Income?

Sources of Investment Income

Dividends

Interest

Capital Gains

Rental Income

Royalties

Annuities

Factors Affecting Investment Income

Market Conditions

Interest Rates

Economic Growth

Inflation

Investment Risk

Diversification

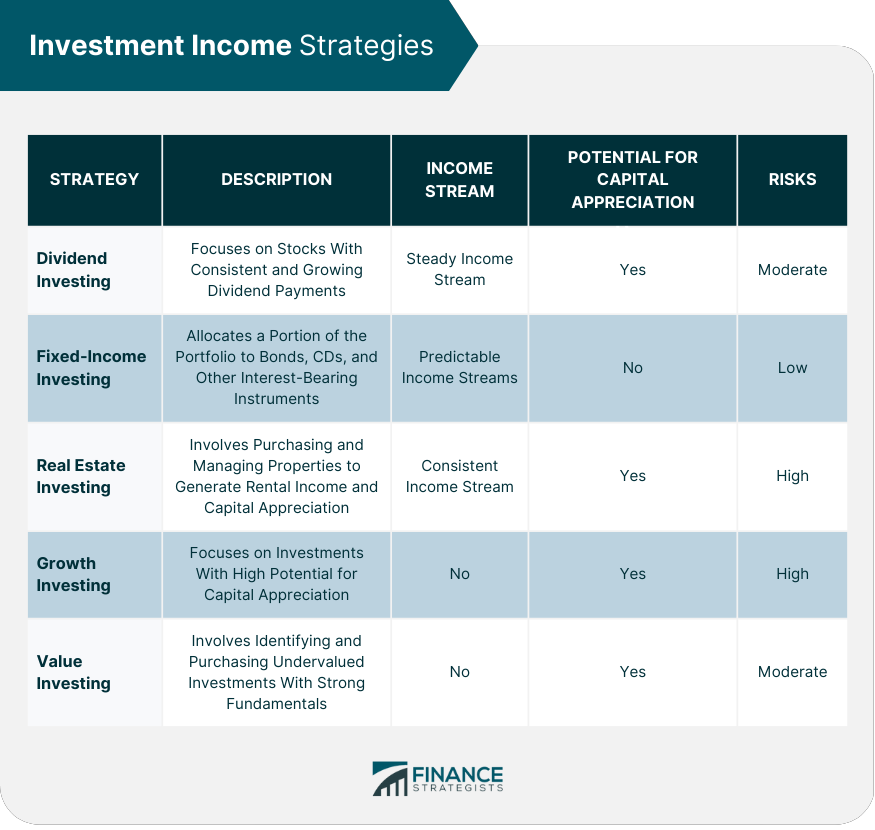

Investment Income Strategies

Dividend Investing

Fixed-Income Investing

Real Estate Investing

Growth Investing

Value Investing

Tax Implications of Investment Income

Taxation of Dividends

Taxation of Interest

Taxation of Capital Gains

Taxation of Rental Income

Taxation of Royalties

Taxation of Annuities

Investment Income and Portfolio Management

Role of Investment Income in Portfolio Allocation

Reinvestment Strategies

Balancing Income Generation and Capital Growth

Retirement and Investment Income

Importance of Investment Income During Retirement

Retirement Income Strategies

Role of Social Security and Pensions

Risks and Challenges of Investment Income

Market Volatility

Interest Rate Risk

Inflation Risk

Currency Risk

Tax Policy Changes

Conclusion

Role of Investment Income in Wealth Building

Importance of Understanding Investment Income Sources and Risks

Importance of Strategic Planning and Portfolio Management

Investment Income FAQs

Investment income refers to the income earned from investments, such as interest, dividends, and capital gains.

Investments that generate investment income include stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and certificates of deposit (CDs).

The tax treatment of investment income depends on the type of income and the investor's tax bracket. Interest income and short-term capital gains are generally taxed at the investor's ordinary income tax rate, while qualified dividends and long-term capital gains are taxed at a lower rate.

Realized investment income is income that has been earned and received, such as interest or dividends that have been paid out. Unrealized investment income is income that has been earned but not yet received, such as capital gains on investments that have not been sold.

Investors can increase their investment income by investing in higher-yielding investments, such as stocks with high dividend yields or bonds with higher interest rates. They can also reinvest their investment income to compound their returns over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.