Real estate refers to land and any permanent improvements attached to the land, whether natural or man-made—including water, trees, minerals, buildings, homes, fences, and bridges. Real estate is a significant facet of the global economy and plays a crucial role in the world of finance. The real estate sector is a cornerstone of economic development. It contributes to the GDP, provides employment, and is a significant source of revenue for local and central governments through taxation. Real estate development also spurs the growth of ancillary industries such as construction, infrastructure, cement, and steel. Understanding the intricacies of real estate not only helps you make informed investment decisions but it also provides you with a broader perspective of economic trends, potentially empowering your personal financial success and economic contribution. Residential real estate, which includes properties such as houses, apartments, townhouses, and vacation homes, caters to the living requirements of individuals and families. These properties can provide a home for personal use or serve as an investment to generate rental income or capital gains. Commercial real estate involves properties used for business activities, including shopping centers, office buildings, hotels, and multifamily housing complexes. Investors in commercial real estate seek to generate profit through rental income, often secured via long-term leases and appreciation of the property's value. Industrial real estate primarily includes properties used for manufacturing, storing, and distributing goods. Factories, warehouses, and industrial parks fall under this category. These properties often have specific features to meet industrial requirements, such as access to transportation, specialized facilities, or zoning permits. Raw land represents the most fundamental form of real estate. It includes undeveloped property without any buildings or other structures. Investors in raw land anticipate value appreciation due to future developments or rezoning. Raw land can also be used for various purposes, such as farming or ranching, or be developed into any property type mentioned above. Investing in real estate is a popular strategy to accumulate wealth, but it has complexities. Whether you are considering buying a rental property, joining a real estate investment group, or purchasing shares in a Real Estate Investment Trust (REIT), it's important to understand the different investment methods and the associated risks and rewards. Real estate investment comes in many forms, each offering a unique risk/reward profile. Here are some of the most common methods: This is the most straightforward method of investing in real estate. It involves buying a residential or commercial property and then selling it at a profit or renting it out to generate income. This could be anything from single-family homes to apartment buildings or commercial properties. REITs are companies that own, operate, or finance income-generating real estate. By purchasing shares of a REIT, investors can own a portion of real estate without having to buy, manage, or finance properties themselves. This makes it an accessible way to invest in real estate for many people. REITs are usually traded on major exchanges, just like stocks, offering a way to invest in real estate while enjoying liquidity. Another indirect real estate investment firm is mortgage-backed securities (MBS). These are investments in residential and commercial mortgages rather than the properties themselves. MBS are bonds that give the investor a claim on mortgage payments over time. As with any investment, there are risks associated with real estate. Here are a few to consider: Market Risk: This is the risk that the property's value will decrease due to changes in market conditions. Real estate markets can be volatile, influenced by local and national economic trends. Liquidity Risk: Real estate investments are more easily bought or sold than stocks or bonds. If you need to sell your property quickly, you may have to accept a lower price. Maintenance and Unexpected Costs: Properties require ongoing maintenance and can have unexpected costs, such as major repairs or increases in property taxes. Vacancy Risk: If you’re depending on rental income, any period without tenants—known as vacancy—can be financially stressful. Despite these risks, there are several potential rewards to investing in real estate: Cash Flow: Rental properties can provide a steady income stream, known as cash flow. This can particularly appeal to retirees or others seeking a stable income stream. Appreciation: Over the long term, the value of real estate properties tends to rise or appreciate. This price appreciation can result in significant profit when selling the property. Tax Benefits: Real estate investors can take advantage of numerous tax benefits, including deductions for mortgage interest, property taxes, operating expenses, depreciation, and more. Leverage: Real estate allows for leverage, meaning you can multiply your return on investment using borrowed money. Real estate development is the process of creating value by making tangible improvements to real property. It includes various activities such as purchasing land, developing building plans, securing financing, constructing and leasing buildings, and ultimately selling the developed property. Developers coordinate all of these activities, converting ideas from paper to real property. Development projects can vary significantly in size and complexity, from small-scale projects like refurbishing an existing building to large-scale endeavors such as developing a multi-story commercial complex from scratch. Regardless of the project's scale, the goal remains to add value to the property. Real estate development typically unfolds in the following stages: 1. Site Identification: This involves finding a suitable piece of land that aligns with the developer's vision and objectives. Factors considered at this stage include location, market conditions, zoning regulations, and potential return on investment. 2. Securing Financing: Real estate development is capital-intensive. Developers need to secure financing to cover the costs of land acquisition, construction, and operation until the project starts generating revenue. Financing can come from various sources, including banks, private investors, or equity partners. 3. Design and Planning: This stage involves creating detailed plans for the development, including architectural, structural, and site designs. These plans lay out the property's intended use, the buildings' design, and how they'll fit within the surrounding environment. 4. Obtaining Approvals: Before construction can begin, developers must obtain necessary permits and approvals from local government agencies. This often requires compliance with zoning laws, environmental regulations, and building codes. 5. Construction: Construction begins once all plans are approved, and financing is in place. Depending on the project's complexity and scale, this stage can take months or years. 6. Leasing and Management: The property is marketed and leased to tenants after construction. Property management involves maintaining the building, ensuring tenant satisfaction, and overseeing operational functions. 7. Sales: Once the property is leased and generating revenue, the developer may choose to sell it. The sale provides a return on investment for the developer and any equity partners. Successful real estate development requires a team of skilled professionals. Key players typically include: Developers: They lead the project, coordinating the activities of all other participants. They make critical decisions and assume financial risk. Architects: They design the buildings and oversee the creation of detailed plans and blueprints. Engineers: Various types of engineers may be involved, including civil, structural, and mechanical engineers. They ensure the technical aspects of the building design are sound and feasible. City Planners: They review the plans to ensure they comply with local zoning laws and are consistent with the community’s long-term planning goals. Contractors: They execute the construction work, transforming the project plans into a physical building. Leasing Agents: They market the property and secure tenants. Property Managers: They manage the property's daily operations, addressing tenant needs and overseeing maintenance and repairs. Financing is a critical aspect of the real estate industry. From home buyers obtaining a mortgage to investors seeking capital for large-scale projects, understanding real estate financing is crucial. This sector is built around various types of loans and mortgages, interest rates, and the impact of credit scores. Several types of loans and mortgages are available, each serving different needs and circumstances. Here are a few common types: Conventional Loans: These loans are not insured by the federal government. Lenders typically require a down payment, and borrowers must meet certain income and credit score requirements. Government-Insured Loans: These are loans insured by the federal government, designed to help certain groups of people become homeowners. Fixed-Rate Loans: These loans have the same interest rate for the life of the loan, which means the monthly payment remains consistent. This can be advantageous for budgeting purposes. Adjustable-Rate Loans (ARMs): These loans have an interest rate that adjusts over time, typically with an index. While ARMs often start with lower interest rates, they can cost more if rates rise significantly over time. Interest rates are a crucial factor in real estate financing. They determine how much a borrower will pay to the lender over the life of the loan beyond repaying the principal. Interest rates fluctuate based on various factors, including the economy's health, inflation rates, and monetary policy. When rates are low, borrowing money is cheaper, potentially stimulating more real estate activity. Borrowing becomes more expensive when rates are high, potentially cooling the real estate market. Changes in interest rates can significantly affect a consumer's ability to purchase real estate. A rise in rates means higher monthly mortgage payments, reducing what a consumer can afford to borrow. Falling interest rates can make homeownership more affordable, spurring demand for homes. Credit scores play a critical role in real estate financing. A credit score is a statistical number that evaluates a consumer's creditworthiness based on their credit history. Lenders use credit scores to predict how likely you are to repay your loan timely. Higher credit scores usually lead to better loan terms and lower interest rates because lenders perceive less risk associated with lending to people who have demonstrated they can manage credit responsibly. Lower credit scores may lead to higher interest rates or even loan denial. Understanding real estate economics is crucial for anyone interested in investing in property or working in the industry. Real estate economics encompasses how real estate markets function and how different economic variables affect those markets. Real estate is a significant contributor to the economy, both locally and globally. Its impact is multifaceted, influencing several key areas: Employment: Real estate stimulates job creation in various sectors, including construction, architecture, engineering, and property management. Commerce: Commercial real estate provides spaces for businesses to operate. The presence of commercial properties can boost local economies by attracting businesses that provide jobs and services. Financial Stability: Homeownership is often associated with financial stability. Real estate wealth can also contribute to local and national economic resilience. Interest Rates: Interest rates impact the cost of borrowing, thereby influencing the demand for property. Lower rates typically stimulate demand, while higher rates dampen it. Economic Health: The overall health of the economy affects real estate markets. In periods of economic growth, increased employment and incomes can boost demand for real estate. Demographics: Trends in population size, age distribution, family structure, and income levels can influence the demand for different types of real estate. Like many economic sectors, real estate experiences growth and decline cycles, often called boom and bust cycles. Various factors, including changes in interest rates, economic conditions, and demographic trends, can influence these cycles. Understanding these cycles can help investors decide when to buy or sell real estate. Real estate market analysis is essential for investors, realtors, and developers. It assesses the viability of a real estate investment and helps identify opportunities and risks. Several types of market analysis provide unique perspectives on a potential real estate investment: Economic Analysis: This examines the broad economic conditions impacting real estate markets, such as GDP growth, employment rates, and inflation. Demographic Analysis: This focuses on population-based factors like age distribution, income levels, and migration trends. Geographic Analysis: This considers location-specific factors, such as proximity to amenities, schools, and transportation links. Psychographic Analysis: This explores the population's lifestyle attributes, attitudes, and behaviors that could influence housing preferences. Demographics plays a critical role in market analysis. It includes examining characteristics such as population size and growth, age distribution, household income, and family size. Understanding these demographic factors helps predict the demand for different real estate types. In real estate, understanding the balance between supply and demand is crucial. High demand and limited supply can increase property prices and rental rates. Conversely, low demand and surplus supply can result in declining property values. Monitoring these dynamics can help inform investment strategies and timing. Real estate law and ethics form the backbone of the real estate industry. They guide how property rights are defined and protected and how transactions are conducted. Real estate law is a branch of civil law that covers the rights to possess, use, and enjoy land and the permanent man-made additions attached to it. This covers the ability to hold and transfer interests in property, permissible property rights, relationships between owners, community, landlords, and tenants, and property financing, including deeds and mortgages. Real estate transactions, such as purchases, sales, and leases, must be in writing to be legally enforceable. The law provides a formal system for recording land conveyance and establishing who owns a piece of property. It also governs the duties of agents and brokers, the licensing of those professionals, and the legal effects of representations, erroneous statements, or fraudulent acts in real estate transactions. Ethics in real estate refers to the moral principles and professional standards guiding the practices of those working in the property industry. These principles govern how real estate professionals deal with their clients, peers, and the general public. For instance, the National Association of REALTORS® (NAR) has established a Code of Ethics for its members, promoting honest and equitable practices in the real estate industry. Key principles of real estate ethics as per NAR include: In both real estate law and ethics, the ultimate aim is to promote fair, ethical, and professional behavior in the industry, protecting the interests of all parties involved in real estate transactions. Understanding these principles is essential for anyone participating in real estate, whether professional or consumer. Real estate is a vast field offering a variety of career options. Here are a few key roles: These professionals assist clients in buying, selling, and renting properties. They need to have a good understanding of the real estate market, negotiation skills, and knowledge of property laws. Real estate agents work under brokers, while brokers are licensed to manage their own real estate businesses. An appraiser estimates the value of a property, typically for purposes like sales, investment analysis, property insurance, or taxation. They need to have strong analytical skills and a detailed understanding of the factors that influence property value. These professionals manage a property's day-to-day operations, whether residential, commercial, or industrial. Their responsibilities include collecting rent, managing building maintenance, and dealing with tenants. Developers buy land, finance real estate deals, build, or have builders build projects, create, control, and orchestrate the development process from beginning to end. Developers work with many different counterparts, including architects, city planners, engineers, surveyors, inspectors, contractors, leasing agents, and more. These professionals evaluate commercial properties for investment purposes. They typically work for investment firms, banks, or real estate investment trusts (REITs). Their responsibilities include conducting financial analysis, market research, and risk assessment. Real estate attorneys specialize in property-related legal matters, from transactions to handling disputes between parties. They might also provide services in negotiating deals, reviewing contracts, or managing estate planning. Each of these careers requires a unique set of skills, qualifications, and interests. It's crucial to thoroughly understand the requirements and demands of a career in real estate before deciding to pursue it. Real estate refers to land and any permanent improvements on it. It's a multifaceted industry that significantly impacts local, national, and global economies. From understanding different real estate types and how to finance them to grasping market trends and legal issues, we've seen that real estate is a diverse and complex field. But with its potential for significant returns, it's an attractive option for many investors. Given the complexities involved in real estate, working with professionals who can provide advice and guidance is often beneficial. Contact a trusted wealth management advisor to explore how real estate could fit into your financial plan.What Is Real Estate?

Types of Real Estate

Residential Properties

Commercial Properties

Industrial Properties

Raw Land

Real Estate Investment

Direct Purchase

Real Estate Investment Trusts (REITs)

Mortgage-Backed Securities

Risks and Rewards of Investing in Real Estate

Risks

Rewards

Real Estate Development

Stages in Development

Key Players in Development

Real Estate Financing

Types of Loans and Mortgages

For example, FHA loans (insured by the Federal Housing Administration) and VA loans (guaranteed by the Department of Veterans Affairs) typically require smaller down payments. They are more forgiving of lower credit scores.Understanding Interest Rates

Impact of Credit Scores

Real Estate Economics

Impact on the Local and Global Economy

Factors Influencing Market Conditions

Understanding Real Estate Cycles

Real Estate Market Analysis

Types of Market Analysis

Importance of Demographics

Understanding Supply and Demand

Real Estate Law and Ethics

Real Estate Law

Real Estate Ethics

1. Putting clients' interests first.

2. Avoiding exaggeration, misrepresentation, or concealment of pertinent facts related to property or transactions.

3. Cooperating with other real estate professionals to advance clients' best interests.

4. Competing fairly with all other real estate professionals.

5. Providing equal professional services to all, regardless of race, color, religion, sex, handicap, familial status, national origin, sexual orientation, or gender identity.

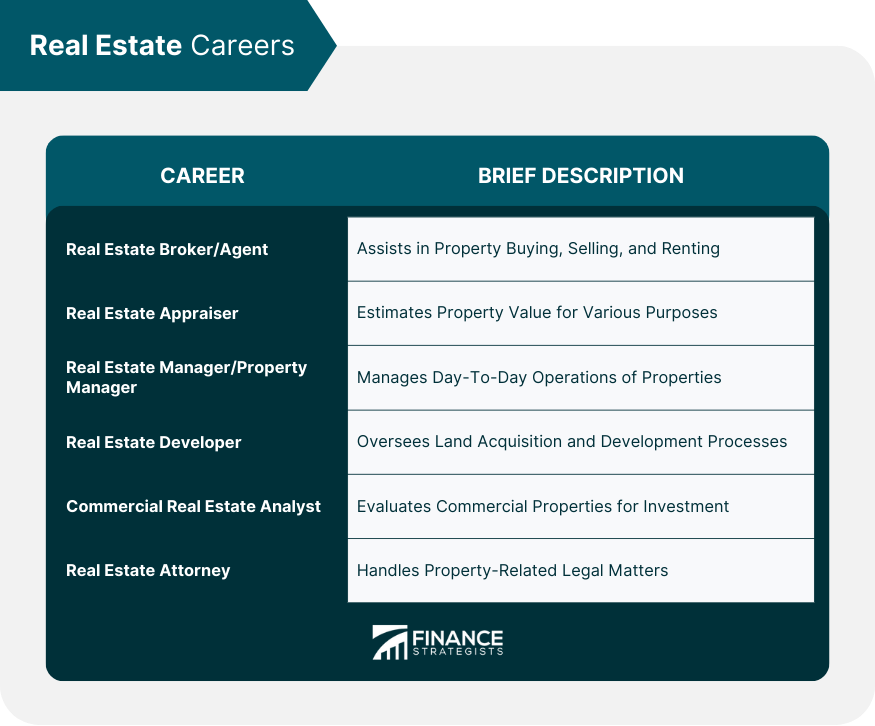

Real Estate Careers

Real Estate Broker/Agent

Real Estate Appraiser

Real Estate Manager/Property Manager

Real Estate Developer

Commercial Real Estate Analyst

Real Estate Attorney

Final Thoughts

Real Estate FAQs

Real estate refers to land and its permanent fixtures, such as buildings. Real property includes real estate and also extends to a bundle of rights related to the real estate, including the right to sell, lease, or enjoy the property.

Investing in real estate involves purchasing physical land or property while investing in stocks or bonds involves buying a piece of a company or lending money to an entity. Real estate can provide a steady income stream and potential tax benefits but also requires active management.

Risks in real estate investment include property market fluctuations, the potential for vacancies, difficulty in selling the property (liquidity risk), and unexpected costs such as major repairs or increases in property taxes.

A REIT is a company that owns, operates, or finances income-generating real estate. It allows individual investors to buy shares in commercial real estate portfolios, distributing income as dividends.

Technology is reshaping real estate in many ways, from online listings and virtual tours to AI-powered property management systems. It's also enabling new forms of property investment through digital platforms and blockchain-based "tokenization."

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.