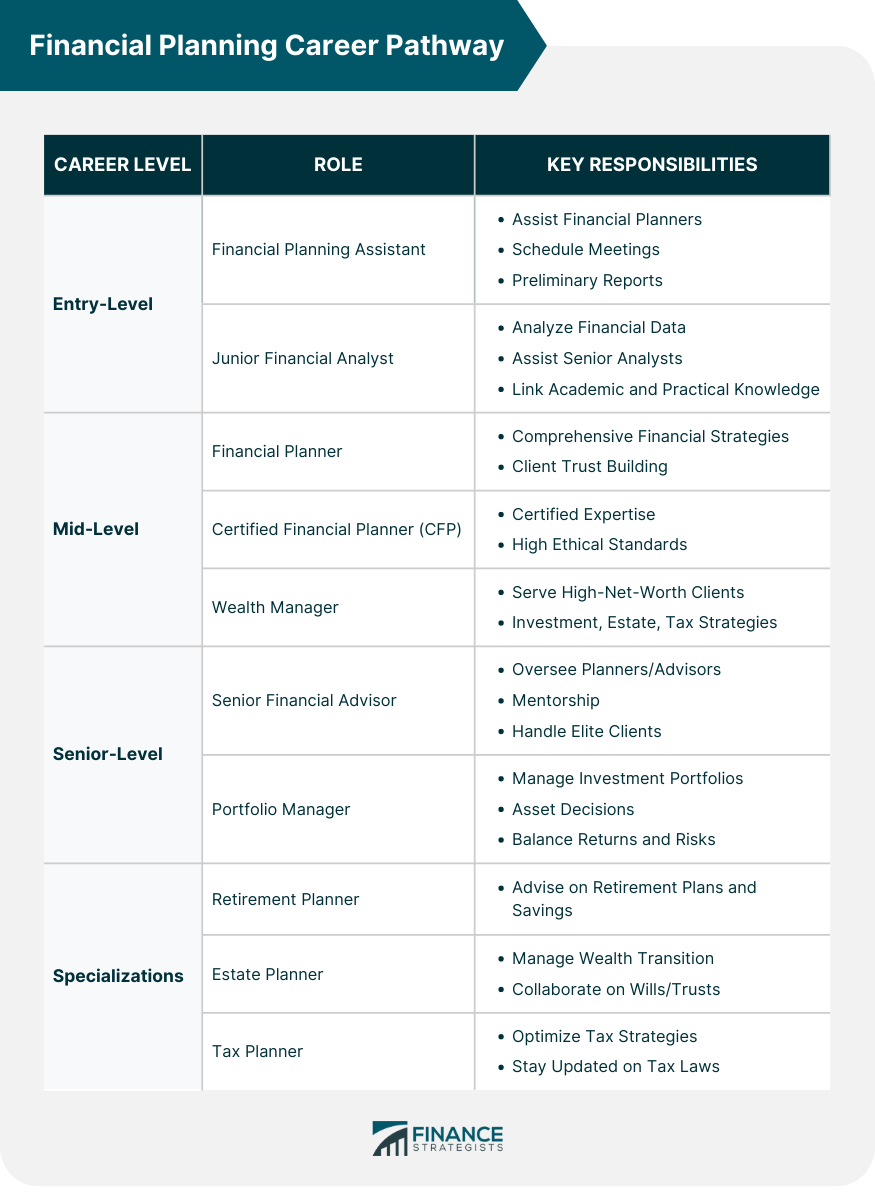

Financial planning is a dynamic field, melding the rigors of finance with the art of personal connection. As a profession, it involves crafting tailored strategies to help individuals and organizations reach their financial objectives. Whether it’s planning for retirement, saving for a child's education, or ensuring a business's financial stability, a financial planner's role is crucial. The vocation has transformed over the decades, evolving with financial trends, technology, and client needs. In an ever-changing economic landscape, the importance of financial planning can't be overstated. As market complexities rise and investment avenues proliferate, the need for expert guidance has become paramount. Financial planning not only ensures fiscal health but also helps individuals and entities build, protect, and eventually transfer their wealth. Today, as economies grapple with uncertainties, having a structured financial plan stands as a beacon of hope, offering direction and security. A Financial Planning Assistant often serves as the right hand to a Financial Planner or Advisor. They are responsible for tasks like scheduling client meetings, preparing preliminary financial reports, and handling administrative tasks such as data entry and document management. Their role offers a foundational understanding of financial planning, providing an excellent starting point for those new to the field. The Junior Financial Analyst dives deeper into the world of numbers. Their primary role is to analyze financial data, from market trends to company-specific financial statements. By providing insights based on this data, they assist senior analysts and financial planners in crafting strategies for clients or for the firm's own investments. This role provides a crugcial bridge between academic, financial knowledge and its practical application. Financial Planners play a pivotal role in assisting clients with comprehensive financial strategies. They consider every facet of a client's financial life—from savings and investments to insurance and retirement planning—to craft a holistic financial roadmap. Building trust with clients is crucial as planners often guide significant life decisions. A CFP is a Financial Planner with a recognized certification showcasing their expertise and ethical standards in the field. To attain this certification, professionals undergo rigorous exams and are expected to adhere to high ethical standards. They are equipped to offer advice on a broader range of topics, ensuring that clients receive comprehensive, expert-guided financial planning. Wealth Managers usually cater to high-net-worth individuals, providing them with a suite of services that extends beyond basic financial planning. Their services might encompass investment management, estate planning, tax strategies, and more. Given the complexity and breadth of their responsibilities, strong interpersonal skills, coupled with deep financial acumen, are crucial. A Senior Financial Advisor brings a wealth of experience to the table. Their role often involves overseeing other financial planners and advisors, providing mentorship, and handling a select group of high-profile clients. Their decisions carry significant weight and can influence the direction of an entire firm or the financial future of their clients. Portfolio Managers are the stewards of investment portfolios, be it for individuals, institutions, or mutual funds. Their primary responsibility is to decide which assets to buy or sell, ensuring optimal returns while managing risks. Deep analytical skills, an understanding of global markets, and a pulse on economic indicators are essential for success in this role. Retirement Planners focus on strategies to ensure clients have a comfortable retirement. This might involve advising on pension plans, retirement savings, and income strategies for the golden years. Estate Planners assist clients in managing their assets and ensuring a smooth transition of wealth to the next generation. They often collaborate with legal professionals to craft wills and trusts. Tax Planners provide guidance on optimizing tax strategies, ensuring clients benefit from available deductions and minimize their tax liabilities. They must be updated with ever-evolving tax laws and regulations. A foundational step in a financial planning career often starts with academia. Bachelor's degrees in finance, business, economics, or related fields lay the groundwork. These programs offer insights into financial principles, market dynamics, and economic theories, arming students with the knowledge required to step into the world of financial planning. As the industry evolves, so does the academic landscape. Today, universities and colleges worldwide offer specialized programs tailored for budding financial planners, bridging the gap between theory and real-world application, ensuring a smooth transition into the profession. The CFP designation is one of the most recognized certifications in the financial planning industry. Those who earn this title have demonstrated competence in various areas of financial planning, including retirement, tax planning, estate planning, insurance, and investment. Earning the CFP requires passing a comprehensive exam, meeting educational requirements, gaining relevant work experience, and adhering to a strict code of ethics. The Chartered Financial Analyst (CFA) designation is a globally recognized certification for investment professionals. Those with a CFA designation have mastered a range of topics related to investment management. The CFA program consists of three levels of exams that test knowledge in areas such as quantitative analysis, corporate finance, portfolio management, and ethics in investment. CFAs often work in asset management, investment research, and portfolio strategy. Apart from the CFP and CFA, there are several other certifications that financial professionals might pursue, depending on their specialization and interests. These might include: Certified Public Accountant (CPA): This designation is crucial for those focusing on tax planning and accounting. CPAs are experts in financial reporting and are often sought after for tax preparation and advice. Chartered Alternative Investment Analyst (CAIA): For professionals interested in alternative investments, the CAIA is a top credential. It emphasizes knowledge in areas like hedge funds, real estate, commodities, and private equity. Certified Investment Management Analyst (CIMA): This certification is designed for advisors and consultants working in investment management. It focuses on asset allocation, ethics, due diligence, risk measurement, and performance metrics. Each of these certifications requires a combination of education, examination, experience, and ongoing education, ensuring that professionals maintain high standards and are up-to-date with the latest industry developments. In the fast-paced world of finance, resting on one's laurels isn't an option. Continuous learning stands as a pillar, ensuring professionals stay abreast of market trends, regulatory changes, and evolving client needs. Workshops, seminars, and courses abound, offering insights into everything from emerging investment avenues to innovative financial tools. Furthermore, professional development goes beyond just academic pursuits. It involves networking, mentorship, and a relentless pursuit of excellence. As the financial landscape shifts, so must professionals, constantly adapting, learning, and growing. Investment analysis involves evaluating securities, such as stocks and bonds, to provide investment recommendations based on expected returns and risks associated. Analysts use various quantitative and qualitative methods, including financial statement analysis, price-to-earnings ratios, and macroeconomic trends, to predict how investments will perform and guide allocation decisions. Tax planning is the strategic approach to financial affairs with the aim of maximizing tax efficiency. Professionals with this skill help clients navigate complex tax codes to minimize liabilities. This includes leveraging tax-advantaged accounts, understanding deductions, credits, and structuring financial transactions in ways that are tax-efficient. Estate planning involves helping individuals manage the allocation and distribution of their assets during their life and upon their death. This can include drafting wills, creating trusts, and planning for tax implications to ensure that heirs receive assets in the most efficient and intended manner. Effective communication is paramount in the financial industry. Financial professionals must articulate complex financial concepts in ways clients can easily understand. Whether it's through written reports or face-to-face interactions, clear and concise communication builds trust and ensures clients feel confident in their financial decisions. Given the sensitive nature of financial planning and the impact of decisions on clients' lives, maintaining high ethical standards is non-negotiable. Ethical professionals prioritize clients' interests over their own, avoid conflicts of interest, and adhere to industry regulations and standards. Ethical behavior fosters trust and upholds the reputation of the financial profession. Building and maintaining strong relationships is at the core of financial planning. Professionals need to understand clients' life situations, goals, and risk tolerance and be responsive to their concerns. Beyond providing financial guidance, this skill involves empathizing with clients during major life events, celebrating successes, and offering support during challenges. Effective relationship management ensures long-term client loyalty and fosters referrals. The digital revolution hasn't spared the financial planning realm. Today, technology stands as an ally, offering tools that simplify analysis, enhance client communication, and streamline processes. From sophisticated software that forecasts market trends to client portals that foster transparency, technology's imprint is undeniable. But it's not just about tools and platforms. It's about the paradigm shift technology heralds. A shift towards data-driven insights, real-time communication, and above all, enhanced client satisfaction. Building a successful career in financial planning isn't just about individual prowess; it's about the community. Networking plays a pivotal role, in connecting professionals with peers, mentors, and potential clients. Industry conferences, seminars, and associations offer platforms to forge these connections, fostering collaborations and opening doors to new opportunities. While the benefits of networking are manifold, its essence lies in shared knowledge. In the collective wisdom of peers, in the insights of mentors, and in the aspirations of the community. The journey of financial planning, like any profession, is fraught with challenges. Here, a mentorship emerges as a guiding light, offering direction, advice, and often, a listening ear. Veteran professionals, with their wealth of experience, guide budding planners, helping them navigate the industry's intricacies. This symbiotic relationship not only aids professional growth but also ensures the industry's future remains bright. Parallel to mentorship is the relentless pursuit of knowledge. Continuous learning, be it through courses, workshops, or self-study, ensures professionals stay ahead of the curve, ever-ready to serve their clients. As professionals mature in their careers, many yearn for specialization or even entrepreneurial pursuits. Specialized roles in areas like tax planning, retirement strategies, or estate planning beckon, offering avenues to dive deep and become industry stalwarts. For the more adventurous, launching their own financial advisory firm or fintech venture stands as an enticing prospect. Such transitions, while challenging, offer unparalleled rewards. They signify not just career progression but also personal growth, marking milestones in a fulfilling professional journey. The financial world is in constant flux, shaped by regulatory changes that dictate the industry's direction. For professionals, staying abreast of these shifts is paramount. From changes in tax laws to evolving investment regulations, every alteration impacts client strategies and professional practices. Navigating this ever-changing landscape demands vigilance and adaptability. It calls for professionals to be on their toes, ensuring their advice remains compliant and, above all, beneficial for their clients. The realm of financial planning is, at times, a tightrope walk. On one side lie client expectations, brimming with aspirations and dreams. On the other, the stark realities of financial markets, economic cycles, and investment risks. Striking a balance, crafting strategies that align with client aspirations while remaining rooted in financial realities, is a challenge every planner faces. This balancing act, while delicate, underscores the essence of financial planning. It's about managing hopes, tempering expectations, and forging paths that lead to fiscal success. Every profession has its dilemmas, and financial planning is no exception. Ethical challenges lurk, be it in the form of conflicted interests, transparency concerns, or the simple act of prioritizing client welfare over personal gains. Navigating these challenges demands integrity, a moral compass that guides professionals through murky waters. Ethical considerations, while challenging, define the soul of the profession. They ensure that trust remains unbroken, that professionalism stands untarnished, and that the sanctity of client-advisor relationships is preserved. The journey through the world of financial planning is multifaceted, filled with opportunities, challenges, growth, and learning. As the industry evolves, so do its professionals, ever-ready to guide their clients towards a brighter financial future. Financial planning is a robust profession that synergizes the intricacies of finance with the personal touch of relationship management. Rooted in both academic knowledge and real-world application, this profession focuses on devising strategies to achieve individual and organizational financial goals, from retirement plans to wealth transition. With evolving economic challenges, a structured financial strategy becomes a beacon of hope, providing a roadmap to financial security. The career in financial planning progresses from foundational roles such as a Financial Planning Assistant to specialized roles like Estate Planners. Achieving proficiency requires continuous education, with certifications like CFP and CFA holding significant value. As digital transformation accelerates, technology further augments the profession, enhancing analysis and client relations. Continuous networking, mentorship, and adaptability are paramount for success. The essence of financial planning lies in balancing client aspirations with financial realities, ensuring a brighter fiscal future.Overview of Financial Planning as a Profession

Understanding the Financial Planning Career Pathway

Entry-Level Roles and Responsibilities

Financial Planning Assistant

Junior Financial Analyst

Mid-Level Financial Planning Careers

Financial Planner

Certified Financial Planner (CFP)

Wealth Manager

Senior-Level and Specialized Roles

Senior Financial Advisor

Portfolio Manager

Specializations

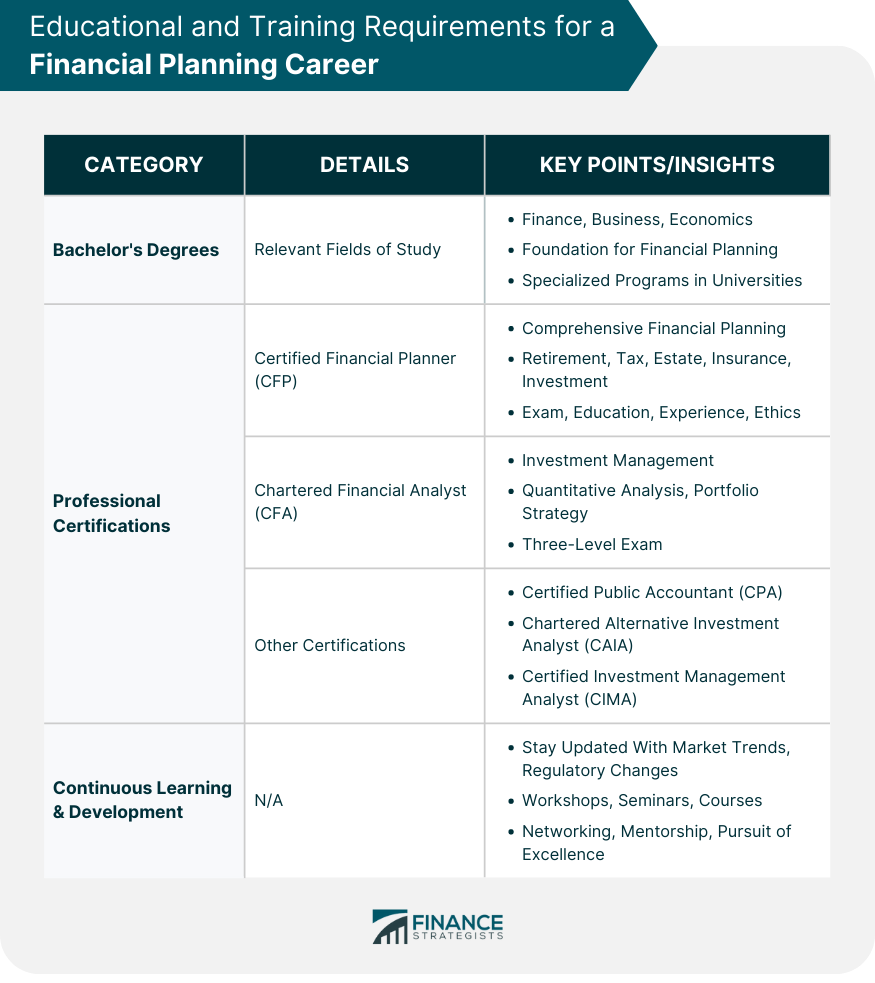

Educational and Training Requirements for a Financial Planning Career

Bachelor's Degrees and Relevant Fields of Study

Professional Certifications

Certified Financial Planner

Chartered Financial Analyst (CFA)

Other Relevant Certifications

Continuous Learning and Professional Development

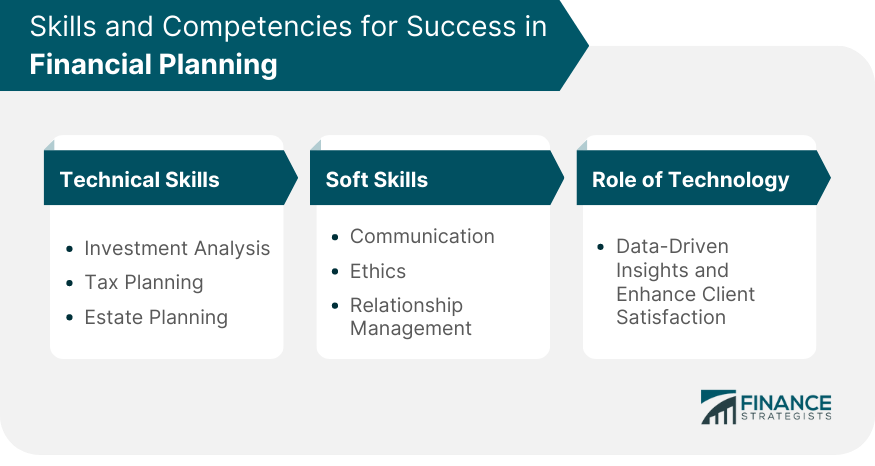

Skills and Competencies for Success in Financial Planning

Technical Skills

Investment Analysis

Tax Planning

Estate Planning

Soft Skills

Communication

Ethics

Relationship Management

Role of Technology in Modern Financial Planning

Opportunities for Growth and Advancement in a Financial Planning Career

Networking in the Financial Planning Industry

Role of Mentorship and Continuous Learning

Transitioning to Specialized Roles or Entrepreneurial Ventures

Challenges and Considerations in the Financial Planning Career

Keeping Up With Regulatory Changes

Balancing Client Expectations With Financial Realities

Addressing the Ethical Challenges in Financial Planning

Bottom Line

Financial Planning Career Pathway FAQs

It's a progression in the financial planning profession, starting from entry-level roles like assistants to senior positions like portfolio managers.

A bachelor's degree in finance or related fields is foundational. Professional certifications like CFP or CFA further enhance credentials.

Technology offers tools for investment analysis, streamlines processes, and fosters real-time client communication, enhancing overall client satisfaction.

Professionals must navigate regulatory changes, balance client expectations with financial realities, and address ethical challenges.

To stay updated with market trends, regulatory changes, and evolving client needs, continuous learning and professional development are paramount.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.