Financial Planning and Analysis (FP&A) is the process businesses use to plan and monitor their financial activities. It merges data-driven analysis with strategic planning to ensure a company's fiscal well-being. By diving into financial data, businesses can make informed decisions about their strategies and operations. This in-depth understanding enables firms to predict future trends and ready themselves accordingly. Within any business setting, FP&A serves as the backbone for fiscal health and stability. Not only does it provide a clear snapshot of a company's present financial state, but it also helps predict future trajectories and potential challenges. By ensuring a robust FP&A process, organizations can stay ahead of the curve, driving growth and sidestepping pitfalls that could otherwise go unnoticed. Every successful business journey begins with a clear destination in mind. Financial goals and objectives provide direction and a yardstick against which progress can be measured. Whether it's achieving a specific revenue target or maintaining a desired profit margin, these aspirations push companies forward. In setting these objectives, companies often look toward both short-term milestones and long-term visions. This balanced perspective ensures immediate tasks align with broader company aspirations, guiding every financial move. Understanding potential revenue streams is a pillar of financial planning. Revenue forecasting allows businesses to anticipate incoming cash flow, ensuring they're well-prepared for both opportunities and challenges. By examining past performance, market trends, and current operations, companies can develop realistic and actionable revenue predictions. In tandem with revenue forecasting is the equally crucial task of expense budgeting. This involves allocating resources to various business operations, ensuring that expenditure doesn't surpass income. By keeping a close eye on outflows and setting limits, companies can maintain profitability and avoid the pitfalls of financial strain. Investing in long-term assets, such as machinery or real estate, requires meticulous capital expenditure planning. It's about weighing the benefits of these assets against their costs and the potential financial returns they might bring. Proper planning ensures that such investments bolster the company's bottom line over time and don't become financial burdens. The business world is rife with uncertainties. Risks, both internal and external, can strike at any moment. Effective risk management involves identifying these potential threats, evaluating their likelihood and impact, and formulating strategies to mitigate them. In conjunction, contingency planning is the creation of a structured approach detailing the steps to be taken if identified risks materialize. Having such a plan in place ensures that, in the face of adversity, a company can respond swiftly and decisively, minimizing potential damage. At its core, financial planning isn't just about crunching numbers—it's about aligning those numbers with a company's overarching strategy. Each financial decision should mirror the broader objectives of the business, ensuring coherence and strategic direction. When finance and strategy walk hand-in-hand, companies can navigate the complex business terrain with purpose and clarity. An income statement provides a snapshot of a company's profitability over a specific period. By dissecting revenues, costs, and expenses, businesses can gauge their operational efficiency and financial health. Analyzing this statement helps identify patterns, underscoring areas of strength and potential concern. The balance sheet, showcasing a company's assets, liabilities, and equity, is a testament to its financial stability. Delving into these elements offers insights into the company's liquidity, solvency, and overall net worth. Regularly reviewing and analyzing the balance sheet can highlight potential vulnerabilities or areas ripe for improvement. Cash flow is the lifeblood of any business. The cash flow statement breaks down the inflows and outflows from operations, investments, and financing. Understanding this statement is pivotal for ensuring that a business remains solvent and has sufficient liquidity for both immediate needs and future investments. Liquidity ratios, such as the current ratio or quick ratio, gauge a company's ability to cover its short-term obligations using its short-term assets. These metrics offer insights into financial health, indicating whether a firm can handle its immediate liabilities without resorting to external financing. While liquidity focuses on the short-term, solvency ratios like the debt-to-equity ratio zooms out, providing a broader view of a company's long-term financial viability. These ratios measure a company's capacity to meet its long-term debt obligations, ensuring sustainability in the grander scheme of business operations. Profitability metrics, including the return on assets or net profit margin, shed light on a company's ability to generate profits relative to its size or its assets. These ratios offer a clear picture of operational efficiency, revealing how well a company turns inputs into profits. Variance analysis is a technique used to assess the difference between expected and actual performance. By identifying these variances, companies can pinpoint areas that are outperforming or underperforming expectations. This analysis offers a roadmap, guiding businesses towards areas needing attention or adjustment. Performance evaluation, meanwhile, goes beyond just identifying variances. It involves a holistic review of operations, strategies, and outcomes. Through this evaluation, companies can celebrate successes, learn from shortcomings, and recalibrate their strategies for future endeavors. Spotting trends can be a game-changer. Trend analysis involves examining financial data over a series of time periods to identify patterns or trajectories. By recognizing these trends, businesses can forecast future scenarios and position themselves advantageously. Comparative analysis, on the other hand, involves benchmarking a company's performance against others in the industry. Such comparisons provide context, showing where a company stands in the competitive landscape and highlighting areas for potential improvement. Financial models are mathematical constructs that represent a company's financial performance. These models, built using historical data, help in forecasting future financial scenarios. Through simulations, businesses can play out different scenarios, understanding potential outcomes and making informed decisions accordingly. Financial models and simulations are not static; they're dynamic tools that evolve with a company's needs. As businesses grow, face new challenges, or diversify, these models adapt, offering fresh perspectives and insights into changing financial landscapes. Scenario analysis delves into potential future events by considering various feasible outcomes or sequences of events. It's a 'what if' technique that enables businesses to strategize for a range of possible futures. By analyzing different scenarios, companies can develop strategies flexible enough to pivot based on shifting circumstances. Sensitivity analysis complements scenario analysis by determining how different values of an independent variable impact a particular dependent variable. It's about gauging the 'sensitivity' of one variable in the presence of changes to another, enabling businesses to pinpoint areas of vulnerability or potential opportunity within their operations. Benchmarking is the practice of comparing business processes and performance metrics to industry leaders or best practices from other industries. By understanding where a business stands relative to industry peers, companies can identify gaps in their processes and strive for excellence. KPIs, on the other hand, are a set of quantifiable measures that companies or industries use to gauge or compare performance in terms of meeting their strategic and operational goals. Utilizing KPIs effectively can provide a clear direction, maintain focus, and drive performance improvement across the organization. One of the most intricate dances in finance is that of balancing immediate needs with long-term visions. Short-term objectives often demand quick results and can sometimes divert resources from long-term goals. Companies must remain vigilant, ensuring that their desire for immediate gains doesn't jeopardize their future stability and growth. Similarly, an overemphasis on long-term aspirations can lead to missed short-term opportunities or immediate challenges being overlooked. The key lies in finding a balance where both short-term and long-term goals coexist harmoniously, driving the business forward. The digital age has ushered in a wave of technological innovations that have transformed the realm of FP&A. While these advancements offer unprecedented opportunities for data analysis and strategy formulation, they also present a challenge: the need for constant adaptation. Companies must be agile, ready to embrace new technologies while also ensuring that their teams are equipped with the necessary skills to leverage these tools effectively. Moreover, with the rapid pace of technological change, there's the ever-present risk of investing in technology that might soon become obsolete. It requires businesses to have both foresight and adaptability, ensuring they remain at the forefront of the tech curve. In FP&A, data is king. The insights drawn from this data drive decisions that can make or break a business. However, the influx of massive volumes of data in today's digital age brings about the challenge of maintaining accuracy and reliability. Erroneous data can lead to misguided strategies, potentially causing significant harm to a company. Hence, businesses need robust data management systems and practices. It's not just about gathering data but ensuring that this data is accurate, relevant, and timely. With reliable data in hand, FP&A professionals can craft strategies with confidence, knowing they're working from a solid foundation. The external business environment is in constant flux. Factors like economic shifts, geopolitical events, or even sudden pandemics can have profound impacts on a company's financial standing. For FP&A professionals, staying vigilant and adapting to these ever-changing external factors is paramount. Through continuous monitoring, businesses can detect shifts early, enabling them to adapt strategies before a potential threat becomes a reality. It's about proactive management, where businesses aren't just reacting to the world around them but are actively shaping their financial futures. A segmented view of a company can lead to fragmented strategies. For FP&A to truly drive growth, a holistic approach is essential. This involves understanding the interplay between different departments, processes, and strategies, ensuring that financial plans encompass the entirety of the business. When FP&A professionals adopt a comprehensive view, they're better equipped to identify synergies, spot potential pitfalls, and ensure that financial strategies support overall business objectives. It transforms FP&A from a mere support function to a central driver of business success. The realm of FP&A is evolving, and with it, the skillsets required. For professionals in this field, continuous learning is not a luxury; it's a necessity. Whether it's staying updated with the latest technological tools, understanding emerging financial theories, or honing analytical skills, ongoing skill development is crucial. Encouraging a culture of learning within the FP&A department can lead to more innovative solutions, sharper insights, and a team that's ready to tackle the challenges of tomorrow. Continuous skill development ensures that the FP&A function remains agile, adaptable, and at the forefront of financial innovation. Modern FP&A is intertwined with technology. Tools like artificial intelligence, machine learning, and advanced analytics software can unearth insights that were previously unimaginable. However, merely having access to these tools isn't enough. It's about leveraging them to their fullest potential, ensuring that they drive tangible results. By integrating technology into their workflows, FP&A professionals can enhance accuracy, speed up processes, and delve deeper into data. It transforms the role of FP&A, allowing professionals to move beyond mere number crunching to become strategic advisors, guiding businesses toward a prosperous future. FP&A doesn't operate in isolation. Its insights and strategies impact every facet of a business. As such, collaborative decision-making becomes crucial. By working closely with other departments, gathering input, and ensuring that everyone is on the same page, FP&A can craft strategies that are both comprehensive and effective. Fostering a culture of collaboration also ensures buy-in from all stakeholders. When everyone feels involved in the financial planning and analysis process, there's a greater sense of ownership, driving collective efforts toward achieving the company's financial objectives. At the core of any business strategy lies financial planning. FP&A plays a pivotal role in shaping and supporting strategic initiatives, ensuring they're both ambitious and feasible. Whether it's entering a new market, launching a product, or restructuring operations, FP&A provides the financial backbone, ensuring these initiatives have the resources and planning they need to succeed. Strategic initiatives, with their long-term focus, require meticulous financial analysis. FP&A professionals ensure that every strategic move is backed by solid financial reasoning, ensuring a higher likelihood of success. Where to invest and how much to allocate are questions that every business grapples with. These decisions can dictate the future trajectory of a company. FP&A, with its data-driven insights, plays a crucial role in guiding these investment choices. By analyzing potential returns, weighing risks, and evaluating the broader financial landscape, FP&A professionals can offer invaluable insights. Their analyses ensure that investment decisions aren't just based on gut feelings but are rooted in solid financial logic. Mergers and acquisitions (M&A) are complex endeavors, with significant financial implications. FP&A professionals are often at the heart of these processes, evaluating potential targets, conducting due diligence, and modeling post-merger scenarios. Their analyses can uncover synergies, highlight potential challenges, and ensure that the financial aspects of the merger or acquisition align with the company's broader objectives. In the intricate world of M&A, FP&A acts as both a compass and a safeguard, guiding companies towards successful integrations. How a company allocates its capital can be the difference between growth and stagnation. FP&A professionals play a crucial role in these decisions, ensuring that resources are directed toward the most promising and strategic avenues. Through in-depth analyses, they can determine which departments, projects, or initiatives are most likely to offer substantial returns. Their insights guide top management, ensuring that capital allocation decisions bolster the company's financial health and drive long-term growth. Financial Planning and Analysis (FP&A) stands as a cornerstone of any business's fiscal strategy and stability. It offers a perfect amalgamation of data-driven insights and strategic planning, enabling organizations to anticipate future trends and make informed decisions. With components ranging from setting financial objectives to detailed risk management, FP&A provides a roadmap for businesses to monitor their financial health. The analysis of financial statements, combined with essential financial ratios, ensures an understanding of a company's profitability and stability. Meanwhile, tools such as financial modeling and scenario analysis facilitate decision-making in diverse scenarios. FP&A's importance extends to key business decisions, including mergers and acquisitions and capital allocation, with a focus on continuous learning and leveraging technology. In essence, FP&A is not just about numbers; it’s about aligning those figures with overarching business goals, ensuring coherence, growth, and prosperity in an ever-evolving business landscape.Overview of Financial Planning and Analysis (FP&A)

Key Components of Financial Planning

Financial Goals and Objectives

Financial Projections and Budgets

Revenue Forecasting

Expense Budgeting

Capital Expenditure Planning

Risk Management and Contingency Planning

Integration With Business Strategy

Essential Elements of Financial Analysis

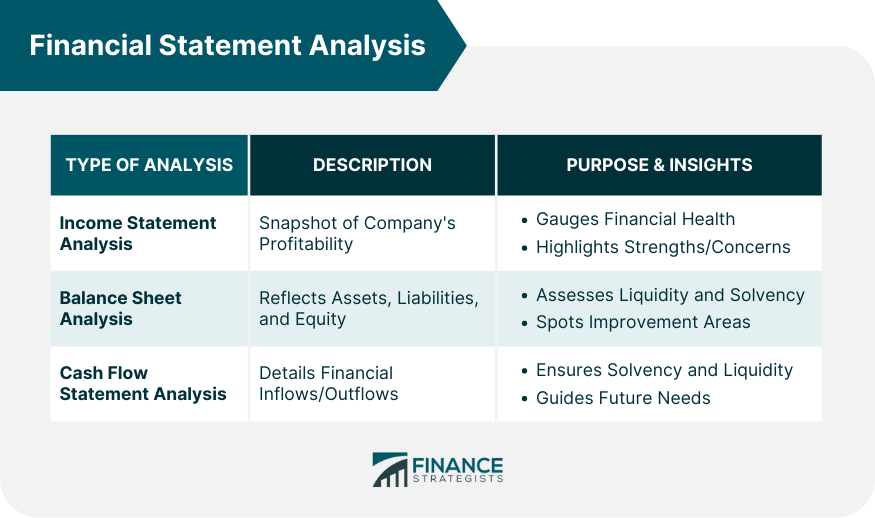

Financial Statement Analysis

Income Statement Analysis

Balance Sheet Analysis

Cash Flow Statement Analysis

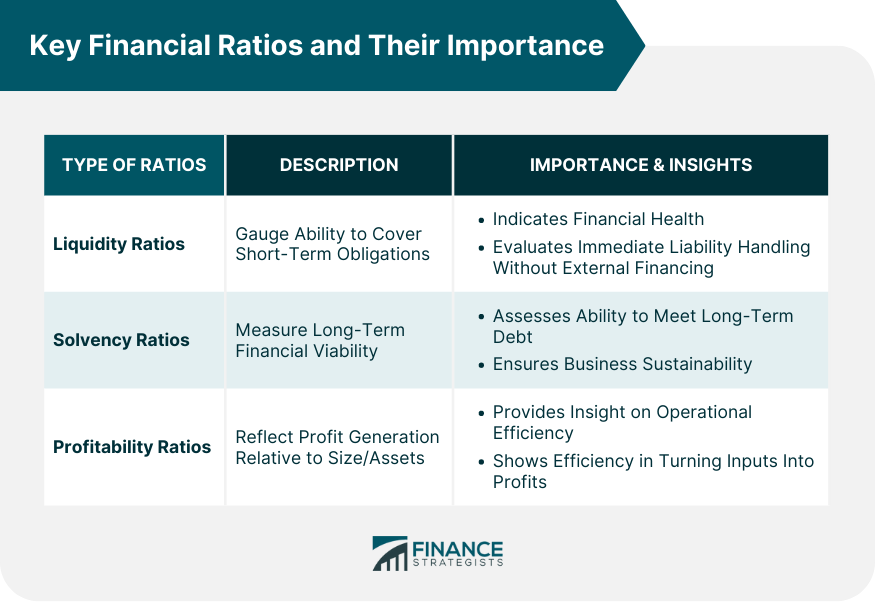

Key Financial Ratios and Their Importance

Liquidity Ratios

Solvency Ratios

Profitability Ratios

Variance Analysis and Performance Evaluation

Trend Analysis and Comparative Analysis

Tools and Techniques Used in Financial Planning and Analysis

Financial Modelling and Simulation

Scenario and Sensitivity Analysis

Benchmarking and Key Performance Indicators (KPIs)

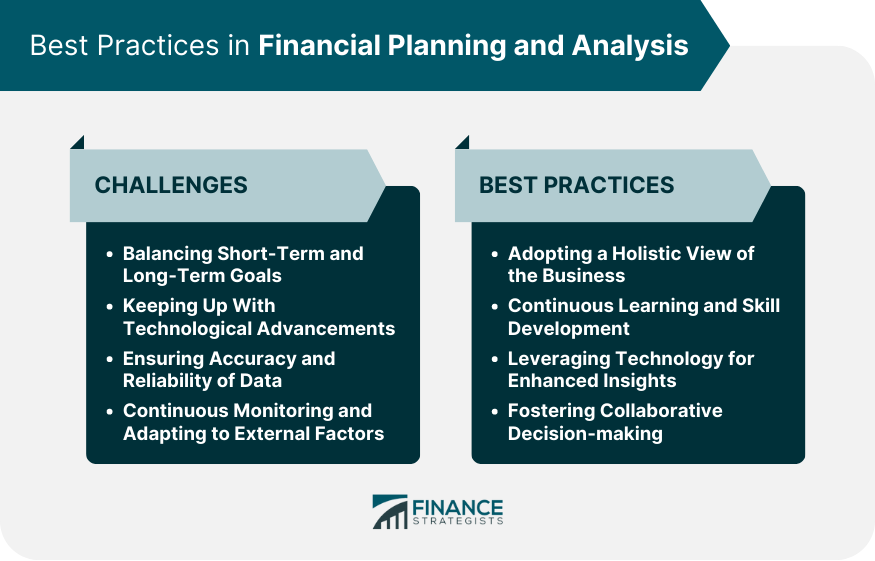

Challenges in Financial Planning and Analysis

Balancing Short-term and Long-term Goals

Keeping Up With Technological Advancements

Ensuring Accuracy and Reliability of Data

Continuous Monitoring and Adapting to External Factors

Best Practices in Financial Planning and Analysis

Adopting a Holistic View of the Business

Continuous Learning and Skill Development

Leveraging Technology for Enhanced Insights

Fostering Collaborative Decision-Making

Role of Financial Planning and Analysis in Decision Making

Support Strategic Initiatives

Provide Insights for Investment Decisions

Assist in Mergers and Acquisitions

Inform Capital Allocation Decisions

Bottom Line

Financial Planning and Analysis FAQs

FP&A involves forecasting financial outcomes, analyzing financial data, and assisting in strategic decision-making for organizations.

FP&A provides insights into financial health, guides investment decisions, supports strategic initiatives, and ensures sustainable growth.

Key tools include financial modeling, scenario analysis, benchmarking, and leveraging key performance indicators (KPIs).

FP&A professionals grapple with balancing short-term and long-term goals, keeping up with technology, and ensuring data accuracy.

FP&A assists in evaluating potential targets, conducting due diligence, and modeling financial scenarios post-merger.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.