Investment research is a crucial aspect of making informed decisions in the world of finance. It involves the systematic study of financial assets, markets, and economic trends to help investors identify and evaluate investment opportunities. Qualitative analysis involves assessing a company's non-financial aspects, such as management quality, corporate governance, brand recognition, industry positioning, and competitive advantage. This analysis helps investors determine the company's potential to generate future revenue and growth. Quantitative analysis focuses on financial data and ratios derived from a company's financial statements. It helps investors assess the company's profitability, liquidity, solvency, and efficiency. Technical analysis is a method of evaluating financial assets based on historical price and volume data. It involves the use of various chart patterns, indicators, and statistical tools to predict future price movements. Macro-economic analysis focuses on the broader economic environment and its impact on financial assets. It involves studying economic indicators, such as GDP growth, inflation, interest rates, and unemployment, to evaluate investment opportunities across various asset classes. Sentiment analysis involves examining investor sentiment, market psychology, and behavioral biases to gauge market trends and potential turning points. This analysis relies on news, social media, and other sources of information to assess market sentiment. Alternative data analysis involves using non-traditional sources of information, such as satellite images, web traffic data, and social media metrics, to gain insights into a company's performance or market trends. The first step in the investment research process is identifying the investor's objectives, such as capital appreciation, income generation, or risk management. These objectives guide the research and help determine suitable investment strategies. Asset allocation involves determining the optimal mix of various asset classes, such as stocks, bonds, and real estate, based on the investor's objectives, risk tolerance, and time horizon. This process helps to diversify the portfolio and reduce overall risk. Security selection involves identifying individual financial assets that align with the investor's objectives and chosen asset allocation. This process typically involves conducting fundamental, technical, or macro-economic analysis to evaluate the investment potential of various securities. Portfolio construction is the process of assembling a diversified mix of selected securities that align with the investor's objectives and risk tolerance. This process requires the careful balancing of potential returns, risks, and correlations among the chosen assets. Performance evaluation involves assessing the portfolio's returns and risks relative to a benchmark or the investor's objectives. This process helps investors determine if their chosen investment strategies are effective and if any adjustments are needed. Portfolio rebalancing is the periodic adjustment of the portfolio's asset allocation and security holdings to maintain the desired level of risk and return. This process helps to mitigate portfolio drift and realign the portfolio with the investor's objectives. Company financial statements, such as balance sheets, income statements, and cash flow statements, provide essential data on a company's financial performance and health. They serve as the foundation for quantitative analysis. Economic indicators, such as GDP growth, inflation, interest rates, and unemployment, provide insights into the overall economic environment and its potential impact on financial assets. Government reports, such as central bank publications and regulatory filings, offer valuable information on monetary policy, fiscal policy, and industry-specific regulations that can affect investment opportunities. Industry reports, published by research firms or industry associations, provide insights into market trends, competitive landscapes, and growth prospects within a specific sector. Research providers, such as investment banks, brokerage firms, and independent research firms, offer in-depth analysis and recommendations on financial assets, industries, and economic trends. News and media outlets, including newspapers, magazines, TV, and online platforms, provide timely information on market developments, corporate news, and global events that can influence financial markets. Academic research conducted by universities and research institutions offers theoretical and empirical insights into various aspects of finance, economics, and investment management. Financial modeling software allows investors to create, analyze, and visualize complex financial models, such as discounted cash flow (DCF) models and valuation models, to evaluate investment opportunities. Technical analysis tools, such as charting software and technical indicators, help investors analyze historical price and volume data to identify patterns and trends that can inform their investment decisions. Portfolio management software helps investors track, analyze, and optimize their investment portfolios by providing tools for asset allocation, performance evaluation, and risk management. Data visualization tools enable investors to create interactive charts, graphs, and dashboards that visually represent complex financial data, making it easier to analyze and interpret. Screening and filtering tools help investors identify potential investment opportunities based on specific criteria, such as financial ratios, market capitalization, and dividend yield. Sentiment analysis tools use natural language processing (NLP) and machine learning algorithms to analyze news articles, social media posts, and other sources of information to gauge market sentiment and predict potential market trends. Information asymmetry refers to the unequal distribution of information among market participants, which can lead to inefficient markets and suboptimal investment decisions. Market efficiency is the idea that financial markets quickly and accurately incorporate all available information into asset prices. In efficient markets, it becomes difficult for investors to outperform the market through active investment research consistently. Behavioral biases, such as overconfidence, loss aversion, and confirmation bias, can influence investors' decision-making processes and lead to irrational investment decisions. The accuracy and reliability of investment research are highly dependent on the quality of data used in the analysis. Inaccurate or outdated data can lead to erroneous conclusions and poor investment decisions. Regulatory constraints, such as insider trading laws and disclosure requirements, can limit the availability and use of certain types of information in investment research. Insider trading involves the use of non-public information to make investment decisions. It is illegal and unethical, undermining market integrity and creating an uneven playing field for market participants. Market manipulation refers to the deliberate distortion of market prices or trading activity to create false signals or induce other investors to buy or sell securities. This practice is illegal and unethical. Conflicts of interest can arise when investment researchers have personal or financial relationships that may compromise the objectivity of their research. Transparency and disclosure are essential to maintaining trust and credibility in investment research. Corporate social responsibility (CSR) is the commitment of businesses to contribute to sustainable economic development by working with stakeholders to improve their social, environmental, and economic impact. Investors should consider a company's CSR practices when conducting investment research. ESG criteria refer to the environmental, social, and governance factors that investors consider when evaluating an investment's sustainability and ethical impact. ESG investing seeks to promote responsible business practices and long-term value creation while minimizing potential risks. Blockchain and distributed ledger technology have the potential to revolutionize investment research by enhancing data integrity, transparency, and accessibility. These technologies can also enable new investment opportunities, such as tokenized assets and decentralized finance (DeFi) platforms. and digital assets represent a new asset class that offers unique investment opportunities and challenges. As these assets become more mainstream, investment research will need to adapt to the specific characteristics and risks associated with this emerging market. Investment research is critical to successful investing, enabling investors to make informed decisions based on a thorough understanding of financial assets, markets, and economic trends. As the world of finance continues to evolve, investment research must adapt to new technologies, data sources, and market dynamics. By continuously learning and developing their research skills, investors can enhance their ability to identify and capitalize on investment opportunities in a rapidly changing financial landscape.What Is Investment Research?

Types of Investment Research

Fundamental Analysis

Qualitative Analysis

Quantitative Analysis

Technical Analysis

Macro-Economic Analysis

Sentiment Analysis

Alternative Data Analysis

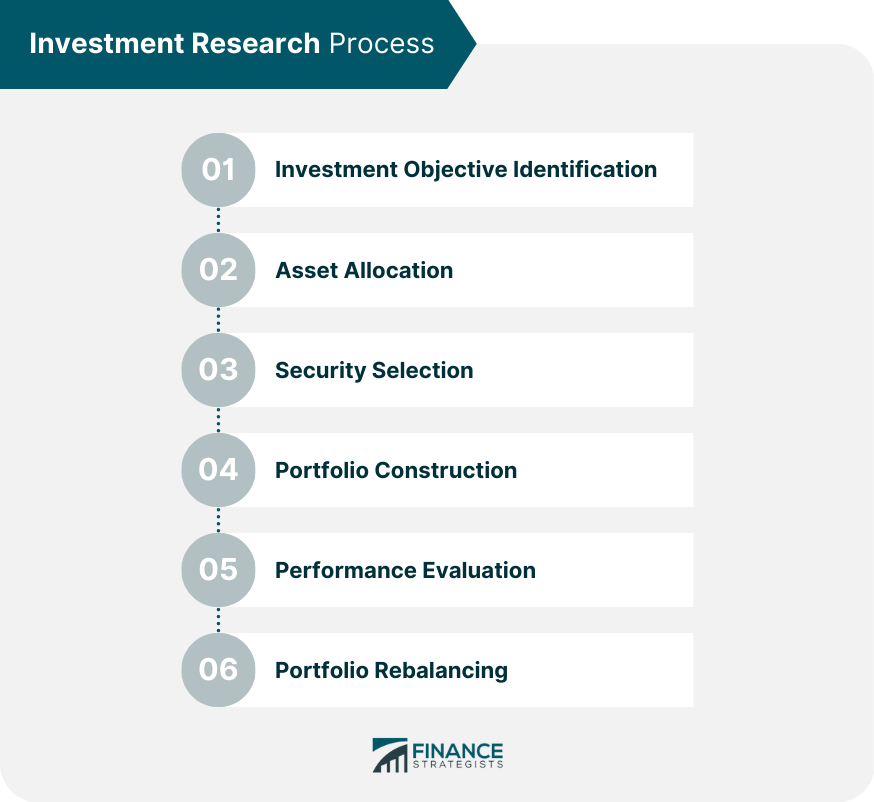

Investment Research Process

Investment Objective Identification

Asset Allocation

Security Selection

Portfolio Construction

Performance Evaluation

Portfolio Rebalancing

Sources of Investment Research

Company Financial Statements

Economic Indicators

Government Reports

Industry Reports

Research Providers

News and Media

Academic Research

Investment Research Tools and Software

Financial Modeling Software

Technical Analysis Tools

Portfolio Management Software

Data Visualization Tools

Screening and Filtering Tools

Sentiment Analysis Tools

Challenges and Limitations of Investment Research

Information Asymmetry

Market Efficiency

Behavioral Biases

Data Quality and Reliability

Regulatory Constraints

Ethical Considerations in Investment Research

Insider Trading

Market Manipulation

Conflicts of Interest

Corporate Social Responsibility

Environmental, Social, and Governance (ESG) Criteria

Future Trends in Investment Research

Blockchain and Distributed Ledger Technology

Cryptocurrency and Digital Assets

CryptocurrenciesConclusion

Investment Research FAQs

Investment research is the process of gathering and analyzing information about companies, industries, and markets to make informed investment decisions.

Investment research is important because it helps investors make informed decisions based on data and analysis rather than just speculation or intuition. It can help reduce risk and increase the chances of a profitable investment.

Common methods of investment research include analyzing financial statements, examining market trends, researching industry reports, attending conferences and events, and speaking with industry experts.

Financial analysts, investment managers, and research firms often conduct investment research. However, individual investors can also conduct their own research using publicly available information.

Investment research is not always accurate, and investors should be aware of potential biases or conflicts of interest when evaluating research. It is important to consider multiple sources and viewpoints before making any investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.