A financial plan functions as a strategic roadmap, guiding individuals on how to allocate their resources efficiently to achieve specific life goals. While these goals vary for everyone, they often encompass facets like purchasing a home, ensuring a comfortable retirement, or creating generational wealth. Like a map in uncharted territory, a financial plan highlights potential challenges and offers alternate routes to reach the desired destination. Moreover, financial plans aren’t static documents. They breathe, change, and evolve with life's vicissitudes. As life's events unfold—be it marriage, the birth of a child, or a career switch—a well-structured financial plan adapts, ensuring that long-term objectives remain within reach. A solid financial plan offers immediate clarity, direction, and confidence in financial choices, reducing stress. It's more than just numbers; it's melding aspirations, values, and resources into a unified strategy, reflecting one's genuine life goals. The thrill of ticking off a short-term goal is unparalleled. These are objectives set for a period of one year or less. It might be saving for a vacation, buying a new gadget, or setting aside funds for unexpected expenses. While they seem immediate and sometimes frivolous, achieving short-term goals can be a confidence booster. They provide immediate gratification and serve as small reminders that larger goals, though distant, are achievable. Moreover, short-term goals help in cultivating financial discipline. By consistently achieving them, one hones the habit of saving and budgeting, foundational pillars for navigating larger financial challenges that lie ahead. Spanning a period of one to five years, medium-term goals strike a balance between immediate gratification and prolonged patience. They might involve purchasing a car, going on a dream vacation, or even furthering one’s education. Given their extended timeframe, these goals often demand a mix of savings and investments. The beauty of medium-term goals lies in their transformative nature. They're often milestones that can reshape lifestyles or offer new experiences. Meeting them requires a blend of patience, strategy, and foresight. It's about the dance between saving enough and ensuring those savings grow at a pace that outpaces inflation. Ah, the long haul! These are goals set for over five years and often include retirement planning, buying a home, or funding a child's education. They demand vision, persistence, and a hefty dose of optimism. Given their distant nature, they also provide the luxury (and challenge) of navigating the volatile world of investments. Long-term goals are a testament to one’s resilience. They're rarely linear, often interspersed with market downturns, personal upheavals, and unexpected challenges. Yet, they're the lighthouse, guiding all other financial decisions, ensuring every monetary move aligns with the endgame. A personal balance sheet provides a snapshot of one’s financial health at a specific point in time. It outlines assets (what you own) and liabilities (what you owe). The difference between the two reveals net worth. This statement is a financial mirror, reflecting the cumulative result of past financial choices. While it's a simple tool, its revelations can be profound. For some, it's a moment of pride, witnessing assets overshadow liabilities. For others, it's a wake-up call, realizing the weight of debts. Regardless, it's an essential starting point, grounding future financial decisions in present realities. While the balance sheet captures a moment, the income statement is a narrative. It details income and expenses over a period, illustrating the flow of money. By examining this statement, one can discern patterns, identify leaks in spending, and understand savings rates. Such insights are invaluable. They paint a clear picture of one’s financial habits, allowing for targeted interventions. Maybe it’s about cutting back on dining out or realizing the potential of a side hustle. The income statement doesn’t judge; it merely presents the facts, empowering informed financial choices. Cash is king. Cash flow analysis drills deeper, examining the inflow and outflow of cash. It's not just about earnings but about liquidity. How much cash is on hand? Is there enough to meet short-term obligations? Are there opportunities to invest excess cash? These are pivotal questions in the realm of financial planning. Regularly analyzing cash flows ensures liquidity. It prevents the paradoxical situation of being asset-rich but cash-poor. More crucially, it enables timely investment decisions, ensuring money isn't idly sitting but actively growing. Money, left unchecked, has a whimsical nature—it tends to slip away unnoticed. Here’s where a budget swoops in, bringing order to chaos. It's a financial framework allocating money towards various needs and wants. But creating a budget isn't just about restraint; it's about intentionality. It ensures every dollar has a purpose, be it for essentials, indulgences, or investments. While the process may seem tedious, the outcomes are liberating. A well-structured budget grants the freedom to spend without guilt. It eliminates the nagging uncertainty of affordability, replacing it with the confidence of financial prudence. While crafting a budget is commendable, its power truly unfolds when adhered to. Sticking to a budget is akin to following a fitness regimen. There might be temptations, missteps, and moments of weakness. Yet, consistency is key. Over time, the benefits compound, leading to robust financial health. Moreover, adhering to a budget isn’t about rigid austerity. It's about awareness and course correction. It's recognizing when one deviates and realigning with financial priorities. Like a trusted compass, it continually points towards the true financial north. Life is dynamic, and so are financial realities. A budget, once set, isn't set in stone. It requires periodic revisions, reflecting changing incomes, goals, and responsibilities. Perhaps it’s a new job, an addition to the family, or a sudden medical expense. These shifts necessitate budget adjustments. Revisiting the budget ensures its continued relevance. It's not about restraints but about alignment. By adjusting to evolving financial landscapes, the budget remains a true reflection of one's aspirations and priorities, ensuring harmony between desires and resources. The magic of compound interest is best witnessed early. Saving early isn’t merely about setting aside a portion of the income. It’s about letting those savings grow, benefiting from the exponential growth that compound interest offers. Every year saved enhances the growth potential of savings, transforming modest amounts into substantial sums. Starting early also cushions against life’s unpredictabilities. It provides a safety net, ensuring there's a financial buffer to lean on during unforeseen challenges. Moreover, it nurtures a savings habit, instilling financial discipline that pays dividends throughout life. The world of investments is vast and varied. From the stability of bonds to the dynamism of stocks, from the tangibility of real estate to the novelty of cryptocurrencies, myriad options exist. Each vehicle offers a unique blend of risk and reward, catering to diverse financial profiles and goals. Navigating this landscape requires discernment. It’s about understanding one’s risk tolerance, financial objectives, and investment horizon. Some might be drawn to the rhythmic dividends of blue-chip stocks, while others might seek the thrill of startup investments. Regardless of the choice, the goal remains universal: capital growth. In the investment realm, risk and return are intertwined dance partners. Higher potential returns often come with heightened risks. Assessing this delicate balance is pivotal. It's not just about chasing returns but understanding the potential pitfalls and one's comfort with them. This assessment is deeply personal. For some, the volatility of equities might be sleep-depriving, while others might revel in it, seeing market downturns as buying opportunities. Being attuned to one's risk tolerance ensures investment decisions that are both rational and comfortable, leading to sustainable investment journeys. In the unpredictability of life, health insurance emerges as a beacon of stability. It's not just a financial product; it’s peace of mind. By mitigating the monetary impact of medical emergencies, it ensures that health concerns aren’t compounded by financial anxieties. The benefits of health insurance are manifold. Beyond handling hospital bills, many policies offer preventive care benefits, promoting overall well-being. They become not just a safety net but a tool for holistic health management. Life insurance is a promise—a commitment to loved ones that their financial well-being will be safeguarded, come what may. It's a shield against life’s most harrowing uncertainties, ensuring that financial obligations are met even in one’s absence. Beyond its protective nature, life insurance also offers avenues for savings and investment. With products like whole life and universal life, it combines risk coverage with wealth creation, making it a multifaceted tool in financial planning. Assets, be it a home or a vehicle, are often the result of years of hard work. Property and casualty insurance protect these prized possessions against unforeseen damages, be it due to natural calamities, theft, or accidents. It’s about safeguarding tangible reminders of one’s financial journey. This insurance isn't merely about monetary compensation. It’s about continuity. In the face of adversities, it ensures life’s pace isn’t halted, offering both financial and emotional stability. The uncertainties of life aren’t confined to health emergencies or accidents. There might be prolonged periods demanding specialized care, be it due to aging, illnesses, or disabilities. Long-term care and disability insurance emerge as saviors in these scenarios, covering costs associated with extended care. Such insurance ensures dignity and quality of life. It ensures that specialized care isn’t a financial burden but a well-deserved right, offering comfort in life’s challenging chapters. Taxes, though inevitable, offer a realm of strategic planning. Central to this is understanding tax brackets. One’s income doesn’t get uniformly taxed. Instead, it's subjected to increasing rates as it surpasses specific thresholds. By grasping these brackets, one can optimize financial decisions to minimize tax liabilities. Knowledge of tax brackets is empowering. It informs decisions, be it about realizing investment gains, timing large purchases, or structuring bonuses. It’s about mastering the rules of the game, ensuring every financial move is tax-efficient. Amidst the intricate tax landscape, certain accounts emerge as oases, offering tax advantages. Think of retirement accounts like 401(k)s or IRAs, which either offer tax deductions on contributions or tax-free withdrawals. Then there are Health Savings Accounts, cushioning medical expenses with tax benefits. Harnessing these accounts is strategic. It’s about amplifying savings by reducing tax liabilities. By channeling funds through these vehicles, one supercharges their growth potential, enjoying the dual benefits of savings and tax efficiency. While building wealth is commendable, passing it on efficiently is equally crucial. Estate taxes, often dubbed as 'death taxes,' can erode substantial portions of wealth meant for heirs. Planning for these is imperative, ensuring that generational transfers aren’t heavily taxed. Strategies might involve gifting assets, setting up trusts, or structuring wills optimally. It’s a dance between current financial realities and future aspirations, ensuring that the legacy left behind is robust and minimally taxed. Visions of retirement are varied. For some, it’s a tranquil beachside home, while for others, it’s about globe-trotting adventures. Regardless of the dream, it’s crucial to quantify it, determining the financial corpus required for a comfortable retirement. Estimating retirement needs encompasses various facets. It's about anticipating living costs, accounting for medical expenses, and factoring in inflation. By crystallizing these needs, retirement planning becomes targeted, ensuring life’s golden years are truly golden. Fueling retirement dreams are specialized accounts, each designed to optimize savings for the post-working years. Whether it’s the employer-sponsored 401(k) with its matching contributions or the flexibility of an IRA, these accounts are instrumental in building a retirement corpus. Each account type comes with its nuances—varying tax benefits, withdrawal rules, and contribution limits. Grasping these intricacies is essential. It ensures one leverages these vehicles effectively, maximizing savings and minimizing tax implications. As retirement approaches, the focus shifts. It's no longer just about building the corpus but strategically drawing from it. Distribution strategies become pivotal, determining how one accesses their savings to ensure longevity and tax efficiency. The art of distribution is nuanced. It might involve drawing from tax-advantaged accounts first or considering Roth conversions. It’s about ensuring that retirement savings, painstakingly built over decades, serve optimally, sustaining the retirement dream. Life’s impermanence makes will and testament planning indispensable. It’s about ensuring that one’s assets are distributed as per their wishes, without legal wrangles or family disputes. A will is more than a legal document; it’s a reflection of one’s values and desires. Crafting a will demands contemplation. It's about taking stock of assets, considering beneficiaries, and perhaps even detailing specific bequests. With a well-structured will, one ensures that their legacy is passed on seamlessly, honoring their life’s work and aspirations. Trusts, in the realm of estate planning, are powerful tools. They offer more than just asset distribution; they offer control. With trusts, one can stipulate terms of asset distribution, ensuring they are used for specific purposes, like education or philanthropy. The benefits of trusts are multifaceted. From tax advantages to protecting assets from creditors, they offer an elevated level of estate management. For many, trusts are not just about wealth distribution but about leaving a lasting, purposeful legacy. Leaving a mark on the world isn't confined to family and heirs. Many envision a legacy that impacts broader society, and philanthropy becomes their tool. Through strategic gifting, one can support causes close to their heart, ensuring their wealth makes a tangible difference. Philanthropic strategies are varied. It might involve establishing foundations, donating stocks, or setting up scholarship funds. Each strategy carries its benefits, from tax deductions to sustained societal impact. Philanthropy, thus, becomes a confluence of personal values and strategic financial planning. Debt, often viewed with apprehension, is multifaceted. There’s debt that propels growth, like mortgages or student loans, dubbed as 'good' debt. Then there’s debt stemming from impulse, like credit card dues, often termed 'bad' debt. Understanding this distinction is paramount in sound financial management. Good debt, when managed well, can amplify wealth. It can enable asset acquisitions that appreciate over time or fuel education that leads to elevated earning potential. Conversely, bad debt, with its high interest, can erode financial health. Navigating this spectrum requires discernment and discipline. Being in debt isn’t a cul-de-sac; it's a challenge, one that can be overcome with strategy. Whether it’s the snowball method, focusing on small debts first, or the avalanche method, targeting high-interest debts, various strategies exist to regain financial freedom. Each strategy has its merits, resonating differently with individuals based on their debt portfolio and temperament. What's universal is the goal: achieving a debt-free existence, ensuring finances serve dreams, not liabilities. In today's financial ecosystem, credit scores are pivotal. They influence loan approvals, interest rates, and even employment opportunities. Ensuring a robust credit score isn’t just about financial prudence; it’s about safeguarding one's life opportunities. Managing credit isn’t just about timely debt repayments. It's about understanding credit utilization, the duration of credit history, and the types of credit availed. By mastering these nuances, one ensures they are creditworthy, opening doors to numerous financial and life opportunities. The world of finance is in perpetual flux, influenced by global events, market dynamics, and personal life changes. This demands continuous monitoring and evaluation of one's financial plan, ensuring it remains relevant and robust. Reviewing investment portfolios, reassessing goals, and recalibrating strategies become periodic essentials. It’s about agility, adapting to the ever-evolving financial landscape, and ensuring one’s financial journey remains on track. Life isn’t static. There are career shifts, family additions, health challenges, or even windfalls. Each of these events reshapes financial realities and aspirations. Adapting one’s financial plan to these changes isn't just necessary; it's imperative. Adaptation might involve altering investment allocations, revising insurance covers, or changing retirement goals. It ensures the financial plan remains a true reflection of one's current life and future aspirations, making it a dynamic, living document. While self-reliance in financial planning is commendable, there are junctures demanding expert insight. Complex financial decisions, tax implications, or market anomalies often necessitate professional guidance. Engaging with financial experts ensures informed decisions. These professionals, with their experience and expertise, offer perspectives that might elude the untrained eye. They become partners in one's financial journey, steering through complexities toward financial goals. Debt, especially high-interest ones, can be stifling, eroding one’s financial health. Prioritizing its reduction is not just a financial best practice; it’s a pathway to financial freedom. Targeting high-interest debts, like credit card dues, ensures savings in interest payouts. It improves credit scores and creates room in budgets for other financial goals. Debt reduction, in essence, is about reclaiming control over one's finances. The adage, "Don’t put all your eggs in one basket," finds profound resonance in investment. Diversifying investments across asset classes, geographies, and sectors ensures that risks are spread, shielding portfolios from market volatility. Diversification isn’t just about minimizing risk; it’s about optimizing returns. By investing across the spectrum, one captures various growth pockets, ensuring a balanced and robust investment portfolio. Financial decisions marinated in emotions can be perilous. Whether it's the euphoria driving an impulsive stock buy or fear triggering a premature sell, emotions can derail sound financial strategies. Objective decision-making is pivotal. It's about basing choices on research, analysis, and long-term objectives, not fleeting emotions. By maintaining this objectivity, one ensures a financial journey that's rational and rewarding. Estate and legacy plans, once crafted, aren’t set in stone. Life changes, be it in asset accumulation, family structures, or personal wishes, necessitate regular reviews and updates of these plans. Regular reviews ensure that these plans mirror one's current desires and realities. Whether it's including a new heir, altering asset distribution, or changing philanthropic goals, periodic updates ensure that one's legacy is accurately and comprehensively represented. Life's unpredictability necessitates a safety net, and that’s where emergency funds come into play. These funds cushion against unforeseen financial shocks, be it job losses, medical emergencies, or sudden repairs. The size of the emergency fund varies based on individual circumstances, but having 3-6 months of living expenses is a recommended benchmark. Regularly reviewing and replenishing this fund ensures it remains relevant to current living costs and financial obligations. A financial plan is a strategic compass, directing individuals on how to judiciously allocate resources to meet life’s milestones, be it acquiring a home, ensuring a retirement of ease, or cultivating generational affluence. This map, while pinpointing potential pitfalls, offers alternate pathways to desired endpoints. But what truly distinguishes a competent financial plan is its adaptability—its innate ability to morph in response to life's myriad twists and turns. Best practices further emphasize the significance of continuous oversight, flexibility in the face of evolving situations, and the occasional guidance from financial experts. These practices not only act as guiding lights in the financial journey but are instrumental in dodging impulsive decisions and in ensuring diversification to buffer against uncertainties. In summation, a financial plan, enriched by these practices, becomes a living testament to one’s ambitions, reflecting both present realities and future aspirations.Financial Plan Overview

Key Components of a Good Financial Plan

Financial Goals and Objectives

Short-Term Goals

Medium-Term Goals

Long-Term Goals

Financial Statements and Analysis

Personal Balance Sheet

Income Statement

Cash Flow Analysis

Budgeting and Expense Tracking

Creating a Budget

Importance of Sticking to a Budget

Adjusting Budget Over Time

Savings and Investments

Importance of Saving Early

Types of Investment Vehicles

Risk and Return Assessment

Insurance and Risk Management

Health Insurance

Life Insurance

Property and Casualty Insurance

Long-Term Care and Disability Insurance

Tax Planning and Strategies

Understanding Tax Brackets

Tax-Advantaged Accounts

Estate Tax Considerations

Retirement Planning

Determining Retirement Needs

Types of Retirement Accounts

Distribution Strategies

Estate and Legacy Planning

Will and Testament Planning

Trusts and Their Benefits

Philanthropy and Gifting Strategies

Debt Management

Good Debt vs Bad Debt

Strategies for Paying Down Debt

Importance of Credit Score and Management

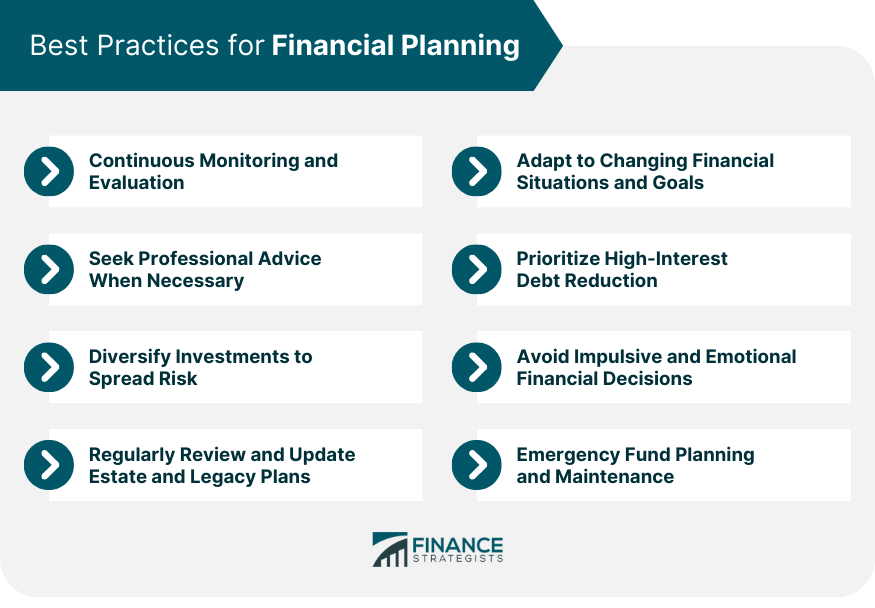

Best Practices for Financial Planning

Continuous Monitoring and Evaluation

Adapting to Changing Financial Situations and Goals

Seeking Professional Advice When Necessary

Prioritizing High-Interest Debt Reduction

Diversifying Investments to Spread Risk

Avoiding Impulsive and Emotional Financial Decisions

Regularly Reviewing and Updating Estate and Legacy Plans

Emergency Fund Planning and Maintenance

Bottom Line

Components of a Good Financial Plan FAQs

The core components include setting financial goals, analyzing financial statements, budgeting, savings, insurance, tax strategies, retirement, estate planning, debt management, and engaging with financial advisors.

Estate and legacy planning ensures that one's assets are distributed according to their wishes, reflecting their values and desires, and can include philanthropic efforts.

Diversification spreads investment risk across asset classes, geographies, and sectors, shielding your portfolio from market volatility and optimizing returns.

Debt management involves understanding good versus bad debt, strategizing repayments, and emphasizing the importance of credit scores, ensuring financial health and control.

Professional advice offers expert perspectives, guiding through complex financial decisions, tax implications, and market anomalies, ensuring informed, goal-oriented decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.