Financial planning stands as the cornerstone of one's journey toward achieving monetary stability and success. This systematic approach encompasses a spectrum of activities, including setting financial objectives, mapping out strategies, and implementing action plans to ensure the attainment of these goals. Driven by a confluence of investments, savings, tax planning, and risk management, financial planning sets the foundation for a secure financial future. With constantly changing economic landscapes and evolving personal financial needs, staying ahead on financial planning requires both comprehensive knowledge and the ability to adapt swiftly to changes. Education is pivotal in the financial sector, endorsing both competency and marketplace respect. In a trust-driven industry, appropriate qualifications are crucial for client relations and professional credibility. The growing demand for skilled financial planners underscores the vital role of education in this domain. The Advanced Diploma in Financial Planning serves as an affirmation of a professional's deep-rooted expertise in the financial domain. This qualification isn't merely about mastering the basics. It is about traversing the expanse of financial planning, diving deep into its depths, and emerging with insights that are both profound and actionable. With the world of finance becoming increasingly multifaceted, the scope of this diploma extends far beyond conventional financial planning. It encapsulates advanced subjects, new-age financial instruments, and intricate planning techniques. As such, professionals with this diploma are recognized for their capability to offer bespoke financial solutions tailored to diverse needs. The curriculum of the Advanced Diploma in Financial Planning is a mosaic of comprehensive modules, each designed to foster specific competencies. From the nitty-gritty of tax planning to the nuances of investment strategies, the diploma covers it all, ensuring that its bearers are adept at addressing a plethora of financial scenarios. Furthermore, this diploma doesn't stop at theoretical knowledge. It delves into practical case studies, real-world scenarios, and hands-on training sessions, ensuring professionals are not only knowledgeable but also proficient in translating this knowledge into actionable financial strategies. A basic diploma in financial planning might offer an introduction to the world of finance, laying down foundational principles and elementary strategies. While it gives a glimpse of the financial cosmos, the Advanced Diploma goes several steps further, plunging into its very core and exploring areas that remain untouched by basic curricula. The distinction between the two isn't just in-depth but also breadth. An advanced diploma encapsulates a broader range of subjects, delves deeper into each topic, and equips professionals with the skills to address complex financial challenges. It's a difference akin to comparing a regional map with a detailed city blueprint. An advanced qualification invariably translates to enhanced career prospects. In the financial sector, where expertise and knowledge reign supreme, an Advanced Diploma in Financial Planning acts as a beacon, signaling a professional's prowess and dedication to the craft. In a competitive job market, this diploma serves as a differentiator. It positions individuals a cut above the rest, paving the way for opportunities in top-tier financial institutions, esteemed consultancy firms, and specialized financial service providers. The diploma not only opens doors but also positions its bearers on a trajectory of accelerated career growth. Specialized knowledge often carries a premium. Professionals with an Advanced Diploma in Financial Planning are in a unique position to leverage their expertise for higher remunerations. With businesses and individuals willing to pay a premium for top-notch financial advice, the earning potential for diploma holders sees a significant uptick. Moreover, this isn't just about immediate financial gains. Over time, as these professionals harness their expertise, build a robust clientele, and deliver consistent results, their value in the marketplace amplifies. This long-term potential, coupled with immediate financial benefits, underscores the diploma's worth in gold. Recognition is a byproduct of expertise. Within the close-knit financial planning community, an Advanced Diploma in Financial Planning stands out as a mark of excellence. Holders of this diploma are often held in high regard, viewed as thought leaders, and sought after for their insights. This elevated stature isn't just about professional pride. It facilitates networking opportunities, enables collaborations, and fosters partnerships. Being recognized as an expert also instills confidence in clients, creating a foundation of trust that is essential for long-term professional relationships. The journey through the Advanced Diploma in Financial Planning is transformative. As learners traverse through its modules, they are continually exposed to a depth of knowledge that reshapes their financial perspectives. This isn't just a learning experience; it's a metamorphosis. Beyond knowledge, the diploma also hones one's expertise. Through a mix of theoretical insights and practical exercises, it sharpens the skills needed to craft tailored financial strategies. By the end of the course, professionals are not just better informed but also better equipped to navigate the intricate world of finance. Taxation, a pivotal element in financial planning, requires both precision and foresight. The curriculum offers a deep dive into the labyrinth of tax laws, providing insights into compliant wealth maximization strategies. Estate planning, another integral module, focuses on the seamless transition of assets to heirs, ensuring their value is preserved across generations. Estate planning isn't just about asset transition. It encompasses will drafting, trust formation, and ensuring that one's legacy is passed on in alignment with their wishes. The curriculum, through a blend of theory and practical exercises, ensures professionals are well-versed in these domains. Investment planning is both an art and a science. The curriculum introduces learners to the dynamics of global markets, varied investment instruments, and the principles of risk and reward. It molds them into astute investors capable of crafting portfolios that align with specific financial objectives. Asset allocation goes hand in hand with investment planning. The course delves into the strategies for diversifying investments across asset classes, ensuring optimized returns while mitigating risks. Through hands-on exercises and real-world simulations, professionals are trained to navigate the investment landscape with agility. Retirement signifies a life phase where financial stability becomes paramount. The curriculum journeys through the nuances of retirement planning, equipping learners with strategies to construct robust retirement portfolios. From understanding diverse pension schemes to forecasting post-retirement expenses, the modules cover every facet. Retirement isn't just about financial accumulation; it's about ensuring sustained financial comfort. The course touches upon long-term care considerations, medical expenses, and lifestyle adjustments, ensuring professionals can craft retirement blueprints that cater to holistic needs. The volatile nature of financial markets makes risk management crucial. The curriculum arms professionals with tools to assess potential pitfalls, strategize for risk minimization, and ensure sustained financial growth. Every financial decision carries inherent risks, and through this module, learners are trained to make informed choices. Insurance, a cornerstone of risk mitigation, is explored in detail. From understanding diverse insurance products to claim management and policy optimization, the curriculum ensures that professionals can advise clients with clarity. In a world riddled with uncertainties, this module underscores the importance of safeguarding one's financial future. Ethics form the bedrock of any profession, especially in the world of finance, where trust is paramount. Financial professionals must not only focus on achieving clients' financial goals but also ensure that they act with integrity and uphold the highest standards of moral conduct. The curriculum of the Advanced Diploma delves into the ethical considerations pertinent to financial planning, ensuring that every financial decision is underpinned by a strong ethical compass. Moreover, in an ever-evolving financial landscape, staying updated with regulatory guidelines and ethical codes becomes indispensable. The course equips professionals with the knowledge to navigate these complexities, fostering a culture of ethical decision-making and transparent client interactions. Effective communication is the linchpin of successful financial planning. Clients often come with varied backgrounds, and it's imperative for financial planners to articulate complex financial concepts in a manner that's both accessible and actionable. The Advanced Diploma program delves into the art of client communication, ensuring that professionals are adept at translating their expertise into actionable advice. Relationship management goes hand in hand with communication. In the world of finance, client relationships aren't transient; they're lifelong partnerships. The curriculum focuses on cultivating these relationships, emphasizing the importance of understanding client needs, setting clear expectations, and fostering trust through consistent performance and transparent interactions. Theory, while important, is only one facet of financial planning. Real-world application is where the rubber meets the road. Integrated case studies form an integral part of the Advanced Diploma curriculum, offering students a glimpse into real-world financial scenarios. These case studies, curated from diverse sectors, challenge students to apply their knowledge, craft bespoke financial solutions, and evaluate the outcomes. Through these case studies, students confront a myriad of financial challenges, from intricate tax scenarios to complex retirement planning. This immersive approach ensures that once they step into the professional realm, they're not just knowledgeable but also prepared to tackle real-world financial challenges head-on. The journey toward acquiring an Advanced Diploma in Financial Planning starts with meeting specific academic criteria. Prospective students must typically possess a foundational qualification in finance or a related field. This prerequisite ensures that learners come with a base knowledge, facilitating a smoother transition into advanced topics. Over the years, these academic prerequisites have evolved, reflecting the changing dynamics of the financial sector. While some institutions may require a bachelor's degree, others might accept candidates with relevant diplomas or certifications, underscoring the diverse pathways leading to this advanced qualification. Experience, they say, is the best teacher. Some institutions offering the Advanced Diploma value practical experience, making it a criterion for admission. Candidates with a stint in the financial sector might find themselves at an advantage, benefiting from their hands-on exposure to financial dynamics. However, it's worth noting that the emphasis on work experience varies across institutions. While some might consider it indispensable, others may focus more on academic achievements, reflecting the diverse entry pathways into this esteemed qualification. Embarking on the journey toward an Advanced Diploma requires navigating the application process. Institutions typically have a structured application procedure, encompassing submission of academic transcripts, letters of recommendation, and, in some cases, a personal statement detailing the candidate's passion for financial planning. Deadlines play a crucial role. Given the prestige associated with the Advanced Diploma, seats are often limited, making timely application imperative. Prospective students are advised to stay updated with application timelines, ensuring they put their best foot forward within stipulated timeframes. The debate between a Bachelor’s Degree and an Advanced Diploma often centers on depth versus breadth. While a Bachelor's Degree offers a comprehensive overview of financial planning, spanning over a more extended period, the Advanced Diploma hones in on specific advanced areas, delving deep into each topic. Moreover, the decision between the two often hinges on career aspirations. Those seeking a broader understanding of finance might gravitate towards a Bachelor's Degree, while those aiming for specialized roles often find the Advanced Diploma more aligned with their goals. Both qualifications, while distinct, pave the way for a fruitful career in financial planning. The CFP designation, a globally recognized certification, stands as a testament to a professional's prowess in financial planning. On the other hand, the Advanced Diploma, with its deep dive into specialized areas, offers a more academic and in-depth approach. While the CFP emphasizes practical skills and ethical standards, the Advanced Diploma focuses on theoretical knowledge and its application. Choosing between the two often boils down to individual career aspirations. For those seeking global recognition and a practitioner-focused approach, the CFP might hold appeal. However, for individuals seeking deep academic insights coupled with practical training, the Advanced Diploma emerges as the preferred choice. In the ever-evolving financial milieu, staying relevant becomes paramount. Both the Advanced Diploma and other financial qualifications offer a pathway to stay updated with current financial dynamics. However, the Advanced Diploma, with its focus on specialized areas, ensures that professionals are not just knowledgeable but also prepared to tackle emerging financial challenges. With the financial sector undergoing rapid transformations, driven by technological advancements and regulatory changes, the Advanced Diploma positions professionals at the forefront. It equips them with the tools to navigate these changes, ensuring they remain relevant and in demand. With the Advanced Diploma in Financial Planning in tow, a plethora of career opportunities unfurls. From financial analysts and wealth managers to estate planners and tax consultants, the horizon is vast. Holders of this esteemed qualification are equipped to tackle specialized roles, leveraging their deep insights to offer bespoke financial solutions. Furthermore, the Advanced Diploma isn't just a gateway to employment opportunities. For many, it's the foundation of entrepreneurial ventures. With the knowledge acquired, many professionals set up their financial consultancy firms, guiding businesses and individuals toward financial success. The financial sector's tentacles spread across diverse industries. From healthcare and real estate to technology and manufacturing, every industry requires financial expertise. Advanced Diploma holders often find themselves in demand across these sectors, their specialized knowledge positioning them as assets. Moreover, with the global economy becoming increasingly interconnected, opportunities aren't just limited to one's home country. Many professionals, armed with their Advanced Diplomas, embark on international careers, capitalizing on the global demand for specialized financial expertise. The world of finance, ever-evolving, demands continuous learning. The Advanced Diploma, while comprehensive, is just one milestone in a professional's journey. Many diploma holders often embark on further certifications, workshops, and courses, ensuring they stay abreast of emerging financial trends. Continuing professional development isn't just about acquiring new knowledge. It's about networking, The prestige of the Advanced Diploma in Financial Planning is upheld by the premier institutions offering this program worldwide. These educational behemoths, often renowned for their pedagogy and industry linkages, have crafted the curriculum to meet the dynamic demands of the financial sector. From established universities in financial hubs like New York and London to emerging centers of academic excellence in Asia and the Middle East, the Advanced Diploma can be pursued from a mosaic of institutions, each bringing its unique flavor to the course. Furthermore, these institutions aren't just about academics. They offer a holistic experience, fostering networking opportunities, industry internships, and global exposure. For many aspirants, the choice of the institution becomes a crucial decision, influenced by factors like faculty credentials, research opportunities, and the alumni network. Given the diverse audience the Advanced Diploma caters to, institutions have adopted varied delivery modes to enhance accessibility. Traditionally a full-time program spanning a year or more, the Advanced Diploma is now available in flexible formats to accommodate working professionals and international students. Online learning has emerged as a boon, with many institutions offering the Advanced Diploma through digital platforms. These online courses, often equipped with interactive sessions, virtual case studies, and peer networking, ensure that distance is no longer a barrier to acquiring top-notch education. On the other hand, part-time courses cater to those juggling work and studies, offering weekend or evening classes to minimize disruption. An investment in education, they say, pays the best dividends. However, financial planning for one's education becomes a crucial aspect of the decision-making process. The cost of the Advanced Diploma can vary significantly based on factors like the institution's reputation, geographical location, and mode of study. While premier institutions in global financial hubs might command a premium, many emerging institutions offer competitive rates without compromising on educational quality. Additionally, aspirants need to factor in ancillary costs like accommodation, study materials, and examination fees. On the brighter side, many institutions offer scholarships, financial aid, and payment plans to ensure that financial constraints don't impede academic aspirations. In the end, the Advanced Diploma is an investment, one that promises rich returns in terms of knowledge, opportunities, and career growth. The realm of financial planning is multifaceted and ever-evolving, demanding expertise and credibility. An Advanced Diploma in Financial Planning, while not the only educational pathway, serves as a distinct mark of advanced proficiency in the industry. Unlike foundational qualifications, this diploma delves deeply into nuanced areas of finance, ensuring its bearers are adeptly equipped to navigate complex scenarios. It also sets them apart in a competitive marketplace, enhancing career prospects and amplifying earning potential. This diploma's hands-on and theoretical approach provides professionals with a transformative experience, enriching their skills and perspectives. Moreover, when compared to other qualifications, its depth and breadth solidify its standing in today's dynamic financial landscape. In essence, pursuing an Advanced Diploma in Financial Planning is an investment in one's future, ensuring relevancy, credibility, and excellence in the financial planning sector.Brief Overview of Financial Planning

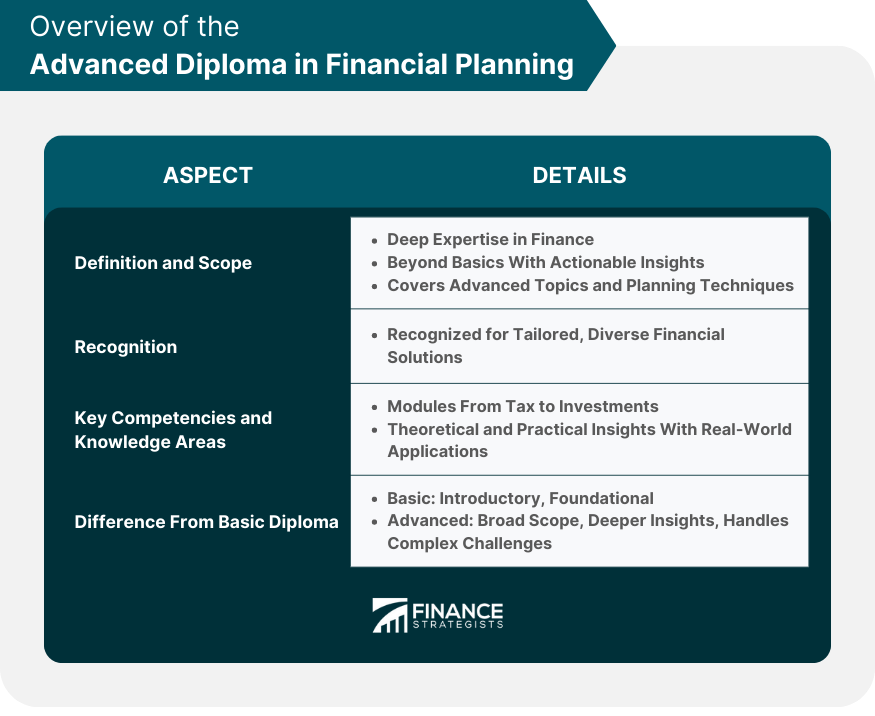

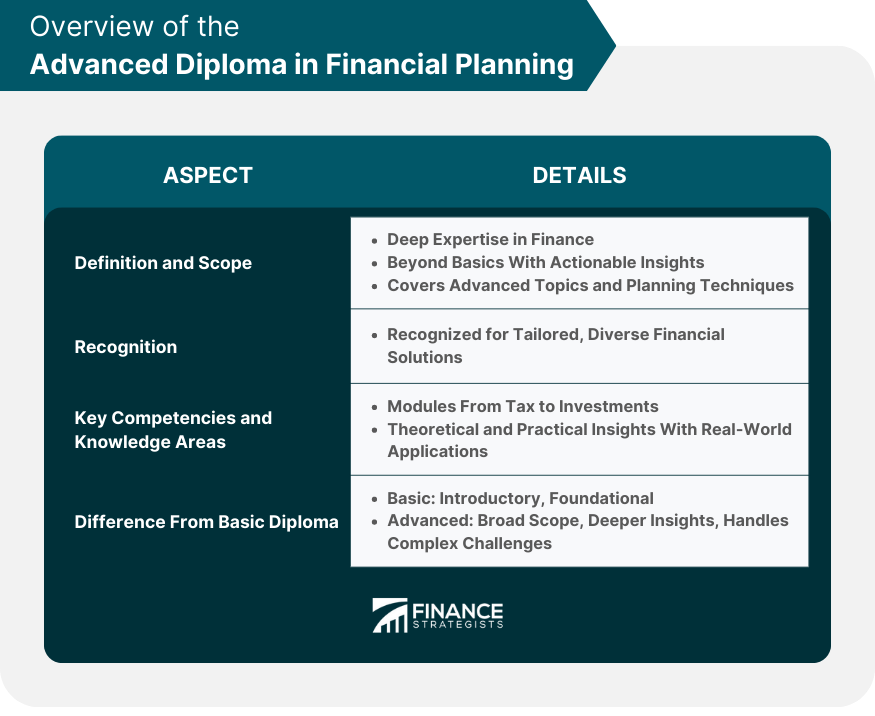

What Is the Advanced Diploma in Financial Planning?

Definition and Scope of the Diploma

Key Competencies and Knowledge Areas Covered

Differences Between Basic and Advanced Diplomas in Financial Planning

Benefits of Pursuing the Advanced Diploma in Financial Planning

Enhanced Career Opportunities

Potential for Increased Earning Power

Recognition in the Financial Planning Community

Depth of Knowledge and Expertise Acquired

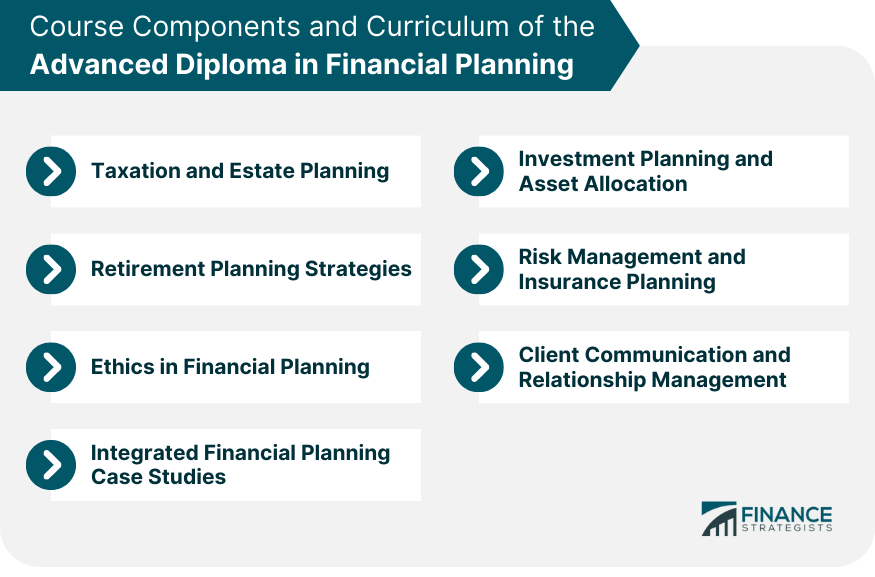

Course Components and Curriculum of the Advanced Diploma in Financial Planning

Taxation and Estate Planning

Investment Planning and Asset Allocation

Retirement Planning Strategies

Risk Management and Insurance Planning

Ethics in Financial Planning

Client Communication and Relationship Management

Integrated Financial Planning Case Studies

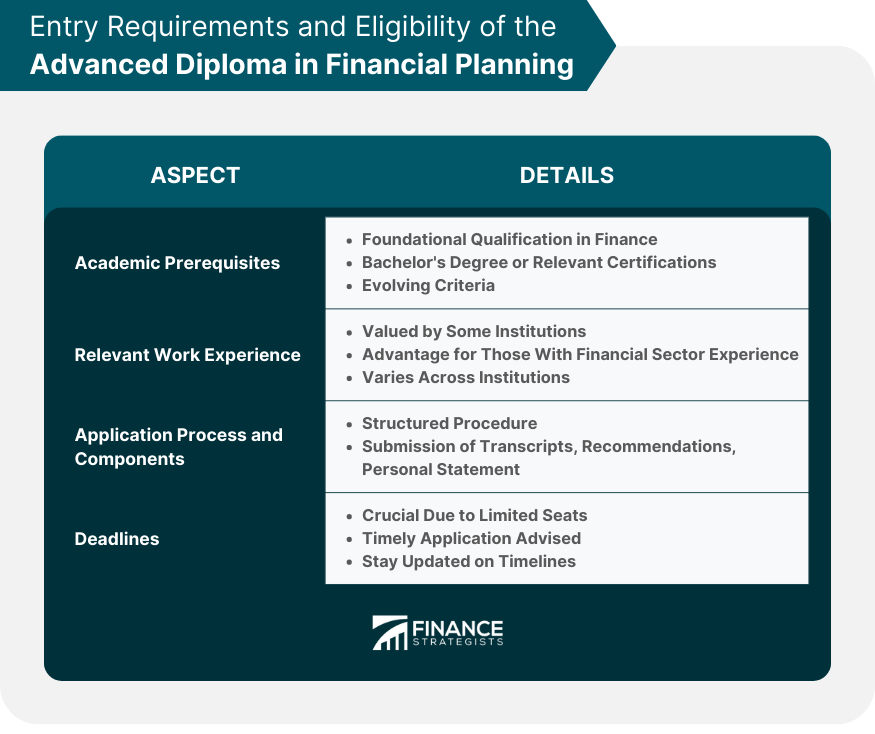

Entry Requirements and Eligibility of the Advanced Diploma in Financial Planning

Academic Prerequisites

Relevant Work Experience

Application Process and Deadlines

Advanced Diploma in Financial Planning vs Other Financial Planning Qualifications

Advanced Diploma vs Bachelor’s Degree in Financial Planning

Advanced Diploma vs Certified Financial Planner (CFP) Designation

Relevance in the Current Financial Landscape

Career Pathways After Completing the Advanced Diploma in Financial Planning

Potential Job Roles and Positions

Industries and Sectors in Demand

Continuing Professional Development

Institutions Offering the Advanced Diploma in Financial Planning

Leading Educational Institutions Globally

Duration and Mode of Study

Cost Considerations

Bottom Line

Advanced Diploma in Financial Planning FAQs

It's a specialized qualification focusing on deep areas of financial planning, ensuring professionals are adept in both theory and real-world application.

While a Bachelor's offers a broad overview, the Advanced Diploma delves into specific advanced topics, providing in-depth knowledge.

Holders can pursue roles as financial analysts, wealth managers, tax consultants, or even establish their financial consultancy firms.

Numerous premier institutions worldwide, from financial hubs like New York to emerging centers in Asia, offer this esteemed program.

Yes, many institutions offer online courses with interactive sessions, ensuring accessibility for global students and working professionals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.