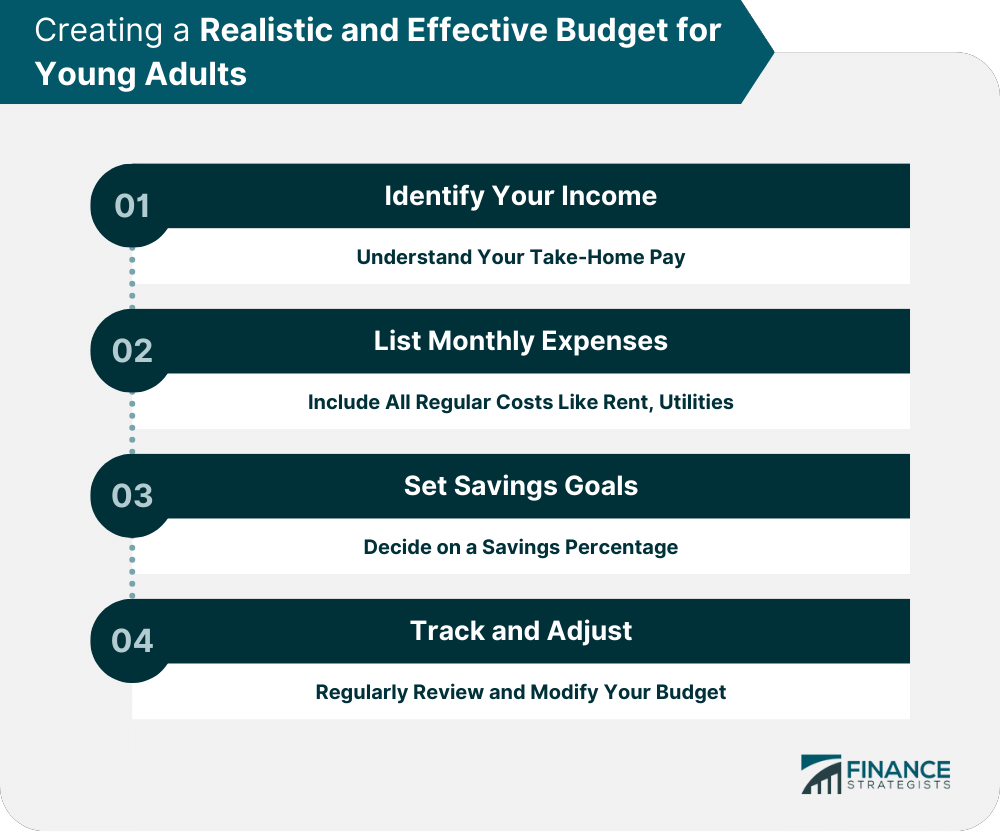

Financial stability is crucial for young adults, setting the tone for lifelong financial habits. Firstly, establish an emergency fund, ensuring you have 3-6 months of living expenses saved; this safeguards against unexpected financial setbacks. Next, tackle any existing debt, especially high-interest ones like credit cards. Prioritize paying these off to avoid accumulating interest. As early as possible, explore the world of investments. Understand the power of compound interest—small, regular investments now can lead to significant returns over time. Don't shy away from retirement accounts, such as a 401(k) or IRA; starting young can lead to a comfortable retirement. It's also vital to set a realistic budget. Adopt the 50/30/20 rule—50% of income towards necessities, 30% on wants, and 20% into savings. Lastly, continuously educate yourself about financial trends and tools, including investment strategies like diversifying your stock portfolio. This knowledge empowers you to make informed decisions that can outpace inflation and lead to lasting financial wellness. "Financial stability for young adults means making smart money choices, like saving for emergencies and investing early to benefit from compound interest," emphasized Tedd Shimp, ChFC®. Identify Your Income: Understand your take-home pay. List Monthly Expenses: Include rent, utilities, groceries, entertainment, and miscellaneous expenses. Set Savings Goals: Determine a percentage of your income you wish to save. Track and Adjust: Review and modify your budget regularly. There are several digital tools and mobile apps that can make budget management simpler. Popular options include Mint, YNAB (You Need A Budget), and PocketGuard. These tools often integrate with bank accounts, categorizing and tracking expenses automatically. Life is unpredictable. An emergency fund acts as a financial safety net, protecting against unforeseen events like medical emergencies, job loss, or urgent car repairs. Start small, aiming for $1,000 initially. Over time, work towards saving three to six months' worth of living expenses. It's advisable to keep these funds in a high-yield savings account for easy access. Student loans can be daunting. It's essential to understand your loan terms, interest rates, and payment options. If possible, prioritize paying off higher-interest loans first. Loan refinancing or consolidation might be options worth exploring. Use credit cards responsibly: always pay the full balance, be wary of high-interest rates, and understand the benefits and fees associated with your card. Adopt the snowball method (focusing on smaller debts first) or the avalanche method (targeting high-interest debts first). Regardless of the approach, consistency is key. A good credit score opens doors to better interest rates on loans, favorable terms on rental agreements, and even potential job opportunities. Pay bills on time, avoid maxing out credit cards, and be patient. Building credit is a marathon, not a sprint. Regularly check your credit reports for errors. Consider services like Credit Karma or AnnualCreditReport.com. Be cautious of identity theft; consider setting up fraud alerts if necessary. Investing isn't just for the wealthy. Even with modest amounts, young adults can tap into the power of compound interest. Understand the basics of stocks, bonds, and mutual funds. Consider opening an IRA or taking advantage of employer-sponsored 401(k) plans. Even small contributions can grow significantly over decades. Spread investments across asset classes to mitigate risk. Understand your risk tolerance – are you comfortable with aggressive investments, or do you prefer a conservative approach? Whether it's a dream vacation, a home, or further education, identify your goals and prioritize them. Break down each goal into actionable steps. Automatic transfers to savings accounts or investments ensure consistent savings. It's a "set it and forget it" approach that builds wealth over time. Buying might be an investment, but it also comes with long-term commitments. Renting offers flexibility. Consider your personal and financial circumstances. Weigh the ROI of further studies. Scholarships, part-time jobs, and community colleges can reduce financial strain. Discuss finances with your partner, set joint goals, and be transparent about debts and financial expectations. Just because you earn more doesn't mean you should spend more. Prioritize savings and investments over lavish lifestyles. Travel and social events are valuable experiences, but plan and budget for them. Look for deals, travel in the off-season, and value experiences over material possessions. Maintain a strict budget, save during peak months, and avoid unnecessary expenses during lean periods. Understand tax deductions available for businesses. Consider hiring a tax professional or using software like QuickBooks. Remember, you're not alone. Consider financial counseling, stick to your budget, and celebrate small financial wins. Mistakes happen. Analyze what went wrong, adjust your strategies, and always continue learning. Major life events, complex financial situations, or planning for retirement might necessitate expert advice. Look for certified professionals, ask for referrals, and ensure their fee structure aligns with your expectations. Books like "Rich Dad Poor Dad" by Robert Kiyosaki or "The Total Money Makeover" by Dave Ramsey provide foundational knowledge. Stay updated with resources like the "BiggerPockets" podcast or the "Mr. Money Mustache" blog. Navigating the financial landscape as a young adult is crucial for laying a stable foundation for the future. At the heart of this journey is the emphasis on creating a realistic budget, understanding the transformative power of compound interest, and taking early steps toward investments, notably in retirement accounts. Debt management, especially concerning student loans and credit cards, is vital to ensure financial freedom. Equally essential is the practice of building a robust emergency fund as a safety net against life's unpredictabilities. As earnings increase, young adults must resist lifestyle inflation, ensuring that their expenses don't rise proportionally with income. In an era of technological advancement, leveraging digital tools, such as Mint and YNAB, can simplify budgeting. Lastly, ongoing financial education, whether through books, podcasts, or professional advice, is indispensable for informed decision-making and long-term financial wellness.Financial Tips for Young Adults Overview

Steve Goffner, an advisor from 11Financial suggests, "Start investing in a diversified stock portfolio now, and watch your money grow faster than inflation, building the foundation for a secure financial future."What Financial Tips Are Essential for Young Adults?

Create a Realistic and Effective Budget

Steps to Building a Budget for Young Adults

Tools and Resources for Budget Management

Build and Maintain an Emergency Fund

Why Young Adults Need an Emergency Fund

Best Practices for Establishing an Emergency Fund

Manage and Eliminate Debt

Navigating Student Loans as a Young Adult

Credit Card Management Tips for Young Adults

Strategies for Paying Down Debt

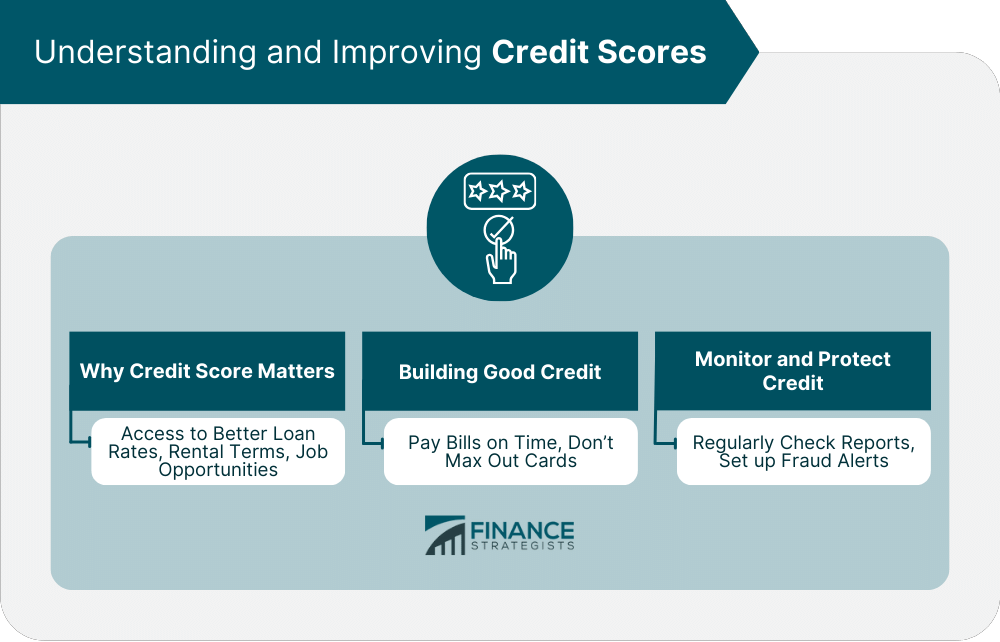

Understand and Improve Credit Score

Why Credit Score Matters for Young Adults

How Young Adults Can Build Good Credit

Monitoring and Protecting Credit

Investment Basics for Young Adults

Introduction to Investing for Young Adults

Retirement Accounts: Starting Early as a Young Adult

Diversification and Risk Tolerance

Smart Savings Strategies for Young Adults

Set and Prioritize Savings Goals

Automating Savings: Why and How

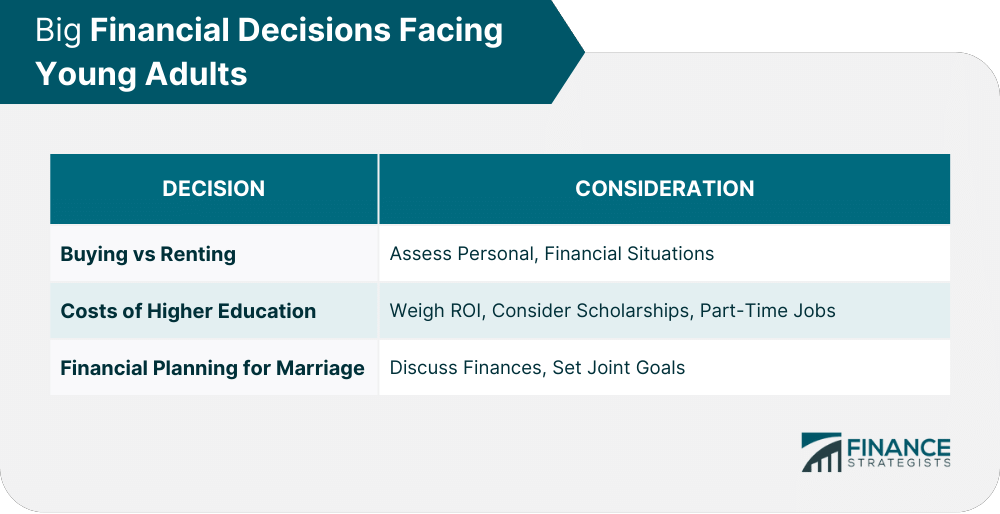

Big Financial Decisions Facing Young Adults

Buying vs Renting in Early Adulthood

Navigate the Costs of Higher Education

Financial Planning for Marriage and Family

Lifestyle and Financial Balance

Avoid Lifestyle Inflation as Earnings Increase

Balance Social Life, Travel, and Financial Goals

Financial Tips for Self-Employed Young Adults

Manage Irregular Income

Tax Considerations for Freelance or Self-Employed Young Adults

Navigate Financial Challenges Unique to Young Adults

Deal With Financial Anxiety and Stress

Recover From Financial Mistakes

Seek Professional Financial Advice

When and Why to Consult With a Financial Advisor

How to Choose a Financial Advisor as a Young Adult

Stay Informed and Continuing Education

Recommended Financial Books for Young Adults

Podcasts and Blogs for Ongoing Financial Learning

Conclusion

Financial Tips for Young Adults FAQs

For young adults, it's crucial to build a savings habit, understand basic investment principles, create a realistic budget, manage and eliminate debt, and monitor their credit score regularly.

Young adults can avoid lifestyle inflation by sticking to a budget, prioritizing savings and investments, and differentiating between needs and wants.

Yes, tools like Mint, YNAB (You Need A Budget), and PocketGuard are popular for budgeting, while resources like Credit Karma can help monitor credit scores.

Financial literacy equips young adults to make informed decisions, helping them achieve personal goals, avoid debt, and build a stable future.

Yes, consulting with a financial advisor can be beneficial, especially during major life events, complex financial situations, or when planning for long-term goals like retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.