Retirement planning is the process of preparing for financial independence during one's golden years. Retirement planning typically includes identifying how much money is needed to retire comfortably, estimating future expenses, and developing a plan to save and invest for retirement. Retirement planning is an essential aspect of financial planning. A retirement plan can help you achieve your goals and ensure a comfortable and secure retirement. Have questions about Retirement Planning? Click here.

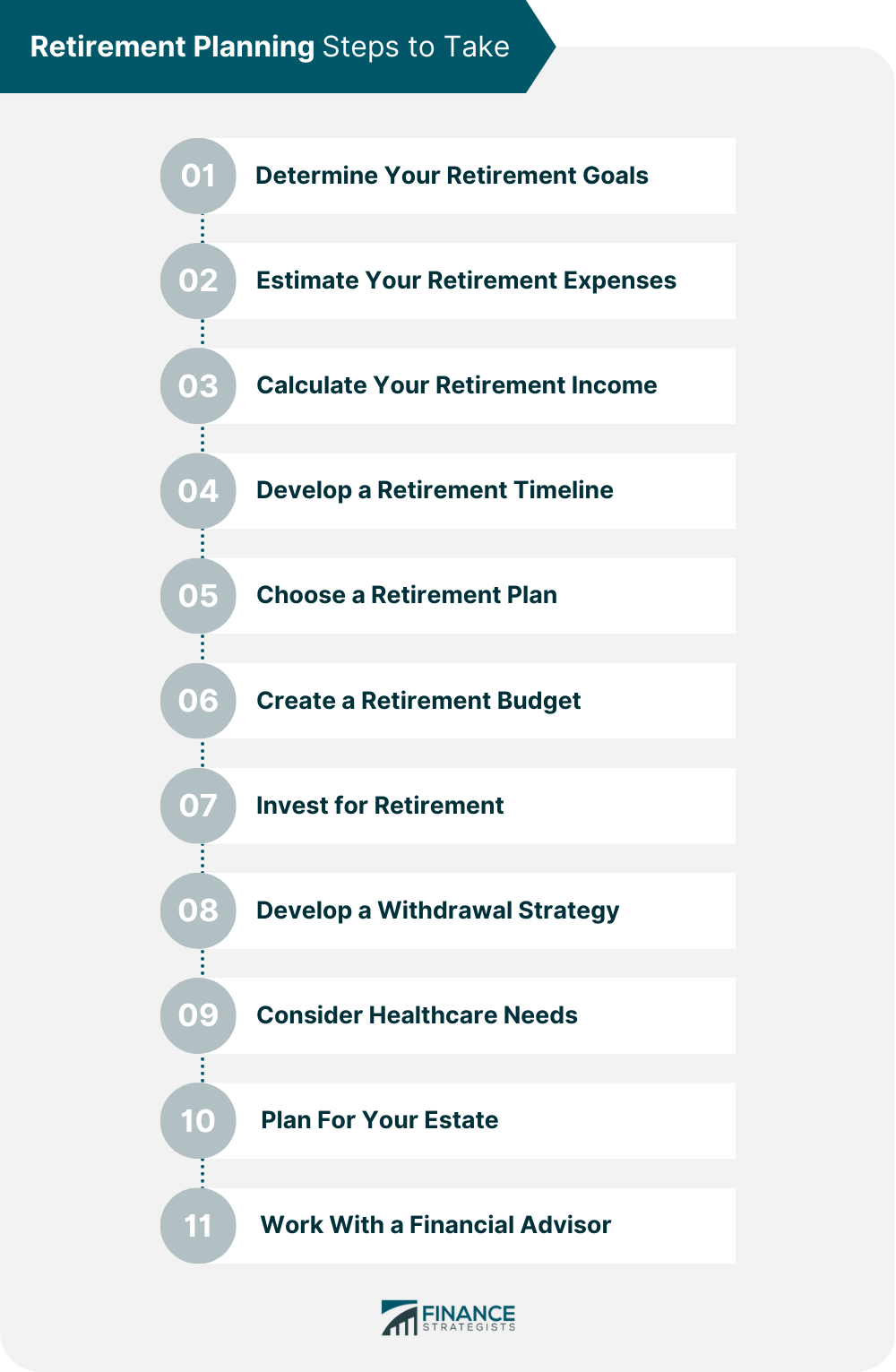

The following approach outlines the practical steps to retirement planning. The first step is to identify your retirement goals. Your goals may include traveling, starting a business, or enjoying a comfortable retirement. Consider your lifestyle, interests, and priorities to determine your retirement goals. In addition, consider your health, family, and other personal circumstances. Retirement expenses may include housing, food, healthcare, transportation, and other living expenses. You should also factor in any additional expenses that may arise, such as travel, hobbies, and entertainment. Retirement income may come from various sources, including Social Security, pension plans, retirement savings plans (401k, IRA, Roth IRA), and other investments. Consider any other sources of income that may be available to you, such as rental income or part-time work. Your retirement timeline should consider your retirement goals, estimated retirement expenses, and income. Similarly, consider all other factors that may impact your retirement, such as health or employment status changes. Choosing a retirement plan is a crucial step in retirement planning, and it's essential to select the one that suits your needs best. Your retirement budget should consider your estimated retirement expenses and income. It should also factor in any additional expenses, such as healthcare or travel expenses. Creating a retirement budget can help you stay on track and ensure you can meet your retirement goals. Investing in retirement is essential for building wealth and generating income in retirement. There are several types of investments that you can use to build your retirement portfolio, including stocks, bonds, mutual funds, and Exchange-Traded Funds (ETFs). Each investment option has its risks and rewards, and it is essential to understand these before investing your money. There are several withdrawal strategies that you can use to ensure that you have enough income in retirement, including systematic withdrawals, the 4% rule, and the bucket strategy. Each of these strategies has its own set of benefits and drawbacks, and it is important to understand these benefits and drawbacks before choosing a withdrawal strategy. Healthcare expenses can be significant in retirement, and planning for them is crucial. Medicare is the primary source of health insurance for retirees, but you may also want to consider other health insurance options, such as Medigap policies or Medicare Advantage plans. You should also consider the cost of long-term care, which can be expensive. Long-term care insurance can cover long-term care services, such as nursing home care or home healthcare. Estate planning involves creating a plan for how your assets will be distributed after your death. This includes creating a will and trusts to ensure your assets are distributed according to your wishes. It would help to consider naming beneficiaries for your retirement accounts and life insurance policies. When it comes to retirement planning, a financial advisor can provide a wealth of assistance, ranging from evaluating your retirement needs to devising a retirement plan and making investments. Look for someone qualified and experienced. Consider factors such as credentials, experience, and fees when choosing a financial advisor. A retirement plan can help you achieve your goals and ensure a comfortable and secure retirement. One of the primary benefits of making a retirement plan is achieving your retirement goals. Retirement goals include traveling, starting a business, or enjoying a comfortable retirement. Retirement planning can be greatly aided by the assistance of a financial advisor, who can offer valuable help with evaluating your retirement needs, creating a retirement plan, and investing. A retirement plan can help ensure that you have enough savings and investments to meet your living expenses and other financial obligations in retirement. With a well-designed retirement plan, you can avoid the stress and uncertainty of financial insecurity in retirement. Making a retirement plan early is also beneficial. The earlier you start planning for retirement, the more time you have to save and invest. You can use compounding interest and other investment strategies to maximize your retirement savings. There are several tax benefits associated with retirement planning. Contributions to retirement plans, such as 401k plans and IRAs, are typically tax-deductible. This means you can reduce your taxable income and lower your tax bill by contributing to these retirement plans. By considering your healthcare needs in retirement, you can determine how much you need to save to cover these expenses. You can also explore health insurance options, such as Medicare and long-term care insurance, to ensure adequate retirement coverage. By creating a retirement plan, you can also make an estate plan to ensure that your assets are distributed according to your wishes after your death. This includes creating a will and trusts to ensure that your assets are distributed according to your wishes. You should also consider naming beneficiaries for your retirement accounts and life insurance policies. Finally, retirement planning can provide peace of mind. With a well-designed retirement plan, you can have confidence in achieving your retirement goals and meeting your financial obligations. You can avoid the stress and uncertainty of financial insecurity and enjoy a comfortable and secure retirement. Planning for retirement is an essential aspect of financial planning. By creating a comprehensive retirement plan, you can secure a comfortable and financially stable retirement. A well-designed retirement plan includes determining your retirement goals, estimating your expenses, calculating your retirement income, choosing a retirement plan, creating a retirement budget, investing for retirement, and developing a withdrawal strategy, among others. Regularly reviewing and updating your retirement plan is also important to ensure that it remains on track and aligns with your changing circumstances. Starting to plan for retirement early is crucial to achieving a comfortable retirement. The earlier you start, the more time you have to save and invest for your retirement. What Is Retirement Planning?

It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops working.

This plan may involve contributing to an employer-sponsored retirement account, such as a 401(k) or pension plan, as well as personal savings accounts and investments.Steps to Retirement Planning

Step 1: Determine Your Retirement Goals

Step 2: Estimate Your Retirement Expenses

Step 3: Calculate Your Retirement Income

Step 4: Develop a Retirement Timeline

Step 5: Choose a Retirement Plan

There are various retirement plans available, including traditional pension plans, 401(k) plans, individual retirement accounts (IRAs), and Roth IRAs.

Each type of plan has its unique features and advantages, and it's important to understand them before making a decision.

Traditional pension plans provide a fixed amount of retirement income, while 401(k) plans and IRAs are defined contribution plans that offer tax advantages.

Roth IRAs offer tax-free withdrawals, making them ideal for those who expect to be in a higher tax bracket in retirement.Step 6: Create a Retirement Budget

Step 7: Invest for Retirement

Step 8: Develop a Withdrawal Strategy

Step 9: Consider Healthcare Needs

Step 10: Plan For Your Estate

Step 11: Work With a Financial Advisor

Benefits of Making a Retirement Plan

Achieving Retirement Goals

Financial Security

Early Planning

Tax Benefits

Healthcare Needs

Estate Planning

Peace of Mind

Final Thoughts

Retirement Planning Guide FAQs

Retirement planning is the process of determining your retirement goals, estimating your expenses, calculating your income, investing, and considering healthcare needs and estate planning.

It is crucial to begin thinking about retirement as soon as possible. More time to save and invest for retirement is available the earlier you start.

While having a financial advisor for retirement planning is unnecessary, working with one can be helpful. A financial advisor can help you assess your retirement needs, create a retirement plan, and invest for retirement.

Several types of retirement plans are available, including traditional pension plans, 401k plans, IRAs, and Roth IRAs. Each of these plans has its own set of benefits and drawbacks.

Regularly reviewing and updating your retirement plan is important to ensure it remains on track. You should check your retirement plan at least once a year or whenever significant changes, such as a new job or a major life event.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.