Passive income through real estate refers to the income generated from real estate investments without requiring active, day-to-day involvement. It's a strategy that allows investors to earn a steady flow of income from properties they own or have invested in. The importance of passive income through real estate lies in its ability to provide a supplementary and, often, a significant source of income. It's a vital strategy for those looking to diversify their income streams, build wealth, and achieve financial freedom. Real estate investments can offer a hedge against inflation and a stable income in fluctuating economies, making them an essential component of a well-rounded investment portfolio. Real estate investments come in various forms, each with its own set of characteristics and income potentials. The most common types include residential properties (like single-family homes and apartments), commercial properties (such as office buildings and shopping centers), industrial properties, and raw land. Earning passive income in real estate typically involves purchasing a property, making it rent-ready, and then leasing it out to tenants. The income generated from rent serves as the passive income. The success of this process depends on several factors, including property location, market conditions, and the ability to attract and retain tenants. Property management plays a crucial role in passive real estate income. A property manager handles the day-to-day operations of a rental property, including tenant screening, lease management, maintenance, and rent collection. Financing is a key aspect of real estate investing. Most investors rely on mortgages to purchase properties. Various financing options are available, including traditional bank loans, government-backed loans, and private lenders. Rental properties are one of the most common and straightforward ways to generate passive income in real estate. Investors purchase residential or commercial properties and rent them out to tenants. The rent collected, minus expenses like mortgage, taxes, and maintenance, constitutes the investor’s passive income. REITs offer a way to invest in real estate without owning physical properties. These are companies that own, operate, or finance income-producing real estate and are required to distribute at least 90% of their taxable income to shareholders. Real estate crowdfunding and partnerships have emerged as innovative ways to invest in real estate with less capital. Crowdfunding platforms allow multiple investors to pool their money to finance a real estate project, while partnerships involve collaborating with other investors or firms. Short-term vacation rentals, popularized by platforms like Airbnb, offer another avenue for passive income. Owners rent out their properties for short periods, often at higher rates than traditional rentals. One of the primary advantages of real estate investing is the potential for steady cash flow. Rental properties, in particular, can provide a consistent and predictable income stream, which can be a significant supplement to other income sources. Real estate typically appreciates over time, meaning the value of the property increases. This appreciation can result in substantial capital gains when the property is sold. Investing in real estate offers various tax advantages. These include deductions for mortgage interest, property taxes, operating expenses, depreciation, and repairs. Real estate is a tangible asset class that often behaves differently from stocks and bonds, providing portfolio diversification. This diversification can reduce overall investment risk and improve returns, especially during times of stock market volatility. Real estate investments typically require a significant upfront capital investment, which can be a barrier for some investors. The costs associated with purchasing and maintaining properties are higher compared to other investment vehicles, making them less accessible to those with limited funds. Like any investment, real estate is subject to market risks and economic volatility. Property values and rental rates can fluctuate based on economic conditions, interest rates, and local market dynamics. Even with property management, real estate requires oversight and decision-making. Maintenance issues, tenant disputes, and property upgrades are part of owning rental properties. Real estate investors must navigate a complex web of legal and regulatory requirements. These include landlord-tenant laws, zoning regulations, property taxes, and fair housing mandates. Successful real estate investing starts with thorough market research and location analysis. Understanding local market trends, property values, and demographic shifts is crucial in selecting the right property. Real estate markets move in cycles, influenced by factors like interest rates, economic growth, and government policies. Recognizing the phase of the cycle a particular market is in can guide investment decisions, helping investors to buy low and sell high or to find the best rental markets. Effective financial planning and budgeting are vital for profitable real estate investing. This includes assessing cash flow, calculating return on investment, and preparing for unexpected expenses. Proper budgeting ensures that the property remains a viable investment even in challenging economic times. Risk management is an integral part of real estate investing. This involves diversifying investments, securing appropriate insurance, and being prepared for market fluctuations. By managing risks effectively, investors can protect their assets and ensure steady income flow. Keeping abreast of current real estate market trends is essential for investors. This includes monitoring changes in housing demand, rental market trends, and shifts in consumer preferences. Understanding these trends helps investors make informed decisions about where and when to invest. Predicting the future of real estate markets involves analyzing economic indicators, demographic trends, and historical data. While it’s impossible to predict market movements with certainty, staying informed about potential future trends can help investors position themselves for long-term success. Economic and regulatory changes can have a significant impact on real estate markets. Changes in interest rates, tax laws, and housing regulations can alter the landscape for investors. Real estate investments should align with an individual's broader financial goals. Whether it's generating retirement income, funding education, or building wealth, real estate can be tailored to meet various financial objectives. Balancing real estate with other investments is key to a well-rounded portfolio. This might involve diversifying across different types of real estate, mixing real estate with stocks and bonds, or varying investment timelines. A balanced approach reduces risk and maximizes return potential. Real estate can play a significant role in retirement planning. The steady cash flow from rental properties can provide a reliable income stream in retirement, while the potential for property appreciation can contribute to a retirement nest egg. Passive income through real estate presents a multifaceted opportunity for investors seeking financial growth and stability. From rental properties to REITs and innovative options like crowdfunding, real estate offers various paths to generate income and diversify investment portfolios. The benefits, including steady cash flow, property appreciation, and tax advantages, make it an appealing strategy. However, investors must be mindful of the challenges, such as the substantial initial capital required, market volatility, and management responsibilities. Success in real estate investing hinges on thorough market research, understanding real estate cycles, astute financial planning, and effective risk management. Additionally, integrating real estate investments into one's broader financial goals and retirement planning can enhance overall financial security. What Is Passive Income Through Real Estate?

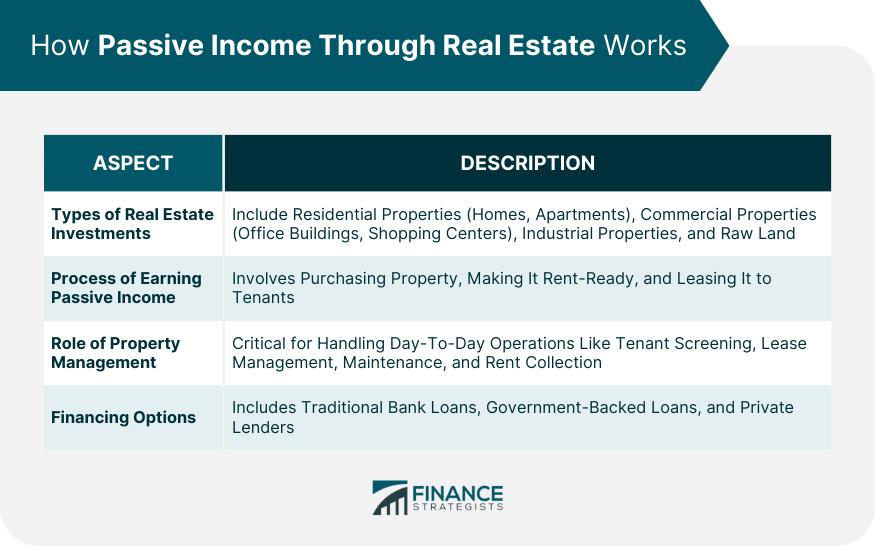

How Passive Income Through Real Estate Works

Types of Real Estate Investments

Process of Earning Passive Income in Real Estate

Role of Property Management

Finance Options for Real Estate Investments

Strategies for Generating Passive Income Through Real Estate

Rental Properties

Real Estate Investment Trusts (REITs)

Crowdfund and Real Estate Partnerships

Short-Term Vacation Rentals

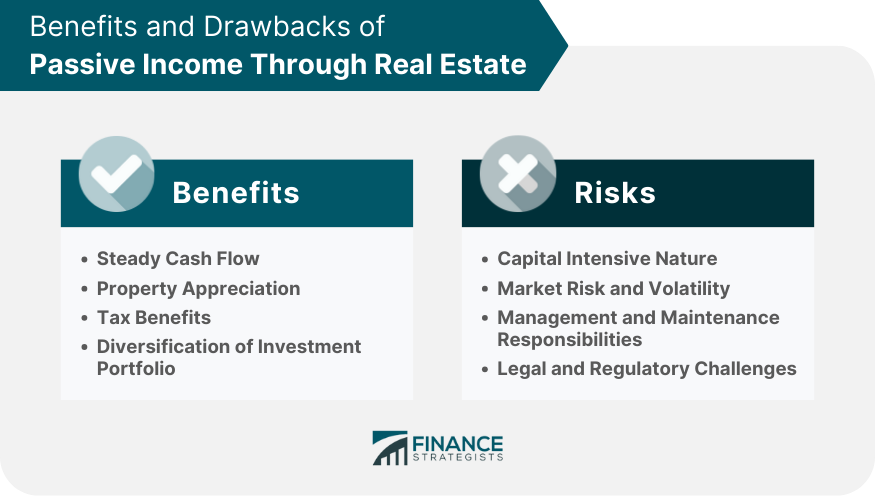

Benefits of Passive Income Through Real Estate

Steady Cash Flow

Property Appreciation

Tax Benefits

Diversification of Investment Portfolio

Drawbacks of Passive Income Through Real Estate

Capital Intensive Nature

Market Risk and Volatility

Management and Maintenance Responsibilities

Legal and Regulatory Challenges

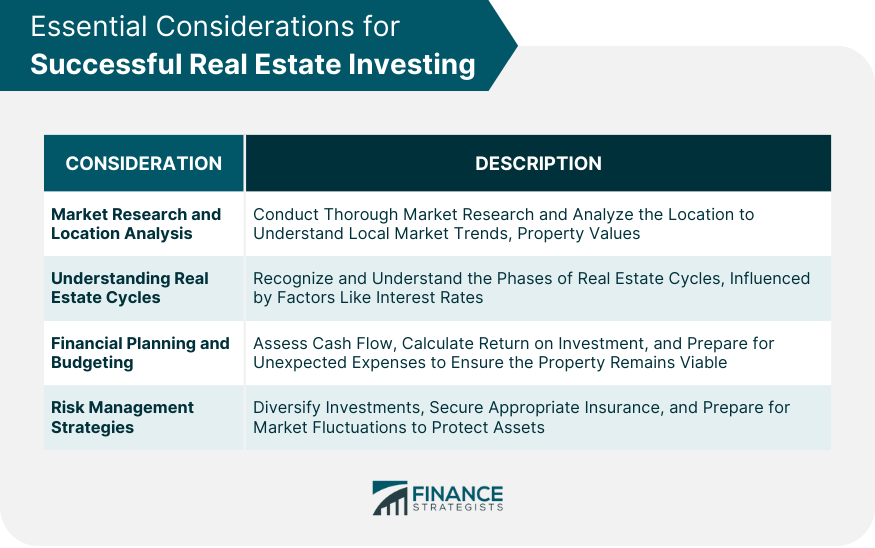

Essential Considerations for Successful Real Estate Investing

Market Research and Location Analysis

Understanding Real Estate Cycles

Financial Planning and Budgeting

Risk Management Strategies

Real Estate Investment Trends and Market Analysis

Current Market Trends in Real Estate

Future Outlook for Real Estate Investing

Impact of Economic and Regulatory Changes on Real Estate

Personal Finance Integration With Real Estate Investing

Aligning Real Estate Investments With Personal Financial Goals

Strategies for Balancing Real Estate with Other Investments

Role of Real Estate in Retirement Planning

Conclusion

While navigating the complexities of real estate investing requires diligence and adaptability, the potential rewards make it a compelling avenue for achieving long-term financial independence and wealth accumulation.

Passive Income Through Real Estate FAQs

The primary ways to achieve passive income through real estate include investing in rental properties, participating in Real Estate Investment Trusts (REITs), engaging in real estate crowdfunding or partnerships, and operating short-term vacation rentals.

Yes, passive income through real estate can be truly passive, especially when investors utilize property management services to handle daily operations, though some level of oversight and decision-making will still be required.

Financial benefits of generating passive income through real estate include the potential for a steady cash flow, property value appreciation, various tax deductions, and the diversification of an investment portfolio.

Challenges in generating passive income through real estate include the need for significant upfront capital, exposure to market risks and economic volatility, ongoing management and maintenance responsibilities, and navigating legal and regulatory requirements.

Location is crucial when considering passive income through real estate as it impacts rental demand, property appreciation potential, and overall investment success. Thorough market research and location analysis are essential before making a real estate investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.