Financial planning, at its core, is the strategic process of determining how individuals or businesses can meet their life goals through the proper management of their finances. Historically, financial planning was primarily a privilege of the wealthy, often limited to preserving family fortunes or ensuring the continuity of business empires. However, as economies grew more, personal financial needs evolved, and the realm of financial planning began to expand. Over the years, it transitioned from a luxury to a necessity, serving diverse populations with varied financial goals. Innovations in technology, changing societal norms, and the democratization of financial information have all played a part in reshaping the discipline. Today, financial planning integrates a vast array of tools, methodologies, and philosophies, reflecting the unique financial goals and challenges faced by individuals in different stages of life. Robo-advisors and automated financial planning tools have emerged as game-changers, democratizing access to high-quality financial advice while minimizing human errors. These platforms harness algorithms to offer tailored advice, reallocating investments based on market conditions and client preferences. The use of AI and machine learning in predicting financial markets offers unprecedented insights, allowing for proactive rather than reactive strategies. Moreover, blockchain technology has started revolutionizing financial transactions, promoting transparency, and drastically reducing the potential for fraud while also creating avenues for new financial products. The rising importance of ESG investing indicates a broader shift towards valuing not just financial returns but the societal impact of investments. Investors today are vigilant and demand transparency and ethical practices. Companies are now evaluated not just on profitability but their adherence to environmental standards, societal contributions, and governance structures. Today, financial strategies are as unique as individual fingerprints. Tailored financial strategies based on individual goals ensure that every investment, every saving, aligns with personal life goals. Fueling this hyper-personalization is the use of big data analytics which delves deep into clients' behaviors, preferences, and aspirations, enabling financial planners to craft plans that resonate on a personal level. The growth of financial education platforms online has enabled individuals worldwide to grasp the basics of finance, empowering them to make informed decisions. These platforms, ranging from webinars to interactive courses, are breaking down complex financial jargons into digestible insights. Furthermore, the push towards integrating financial literacy into early education is a significant stride, equipping younger generations with the tools to navigate the financial landscape confidently and wisely. In the interconnected world of 2024, global influences and external factors play pivotal roles in steering financial strategies and decisions. Prudent investors, while keeping a keen eye on growth sectors, are diversifying their portfolios and maintaining liquidity to weather potential economic downturns. Inflationary concerns are another dominant narrative in 2024, prompting a strategic shift. As traditional cash and fixed-income instruments struggle with eroding real returns, there's a noticeable trend toward real assets, commodities, and inflation-protected securities as means to safeguard and grow wealth. International tax reforms are redrawing the lines of global wealth management. These reforms, aimed at addressing loopholes and ensuring a fair share of corporate taxes, are prompting multinational corporations and global investors to restructure and rethink their investment locales and strategies. Simultaneously, evolving regulations in dynamic sectors like digital currencies, peer-to-peer lending, and online securities trading are shaping the contours of global investments. Geopolitical events pose tangible threats to global investments. Investors are increasingly hedging, diversifying across regions, and sometimes retreating to safe havens during pronounced tensions. Yet, amidst these challenges, emerging markets present a silver lining. Often viewed as the frontiers of growth, these markets, albeit volatile, offer return potentials. The key for investors is to balance high growth with unpredictabilities, leveraging local insights and staying agile in their investment approach. The financial industry has witnessed significant transformations in its product and service offerings over the years, evolving in response to technological advancements, changing regulatory landscapes, and shifting consumer preferences. Fintech Revolution: Fintech startups began offering specialized financial products and services, from peer-to-peer lending platforms to crowdfunding solutions. These innovations filled gaps left by traditional banking institutions. Cryptocurrencies and Blockchain: The 2010s introduced the world to Bitcoin and other digital currencies, leading to the development of new financial products like cryptocurrency exchanges and blockchain-based contracts. Robo-Advisors: Harnessing artificial intelligence, robo-advisors provided automated, algorithm-driven financial planning services with little to no human intervention, making wealth management accessible to the masses. ESG Investing Platforms: Recognizing the growing consumer interest in sustainable investing, platforms that prioritize environmental, social, and governance factors became popular. Decentralized Finance (DeFi): Building on blockchain technology, DeFi platforms offer financial services without traditional intermediaries, ranging from lending and borrowing to insurance and trading. Personalized Financial Products: With advancements in data analytics, financial institutions now offer products tailored to individual preferences and financial behaviors, from insurance packages to customized investment portfolios. Rapid Tech Changes: Staying updated with fast-evolving financial technologies, from robo-advisors to blockchain applications. Data Security: Ensuring client data remains confidential and protected amidst rising cyber threats. Diverse Client Needs: Catering to varied financial expectations of different age groups, from tech-savvy Gen Z to retiring Boomers. Regulatory Compliance: Keeping pace with frequently changing global financial regulations and ensuring all strategies are compliant. Ethical Investing Demand: Meeting growing client interest in ESG (Environmental, Social, and Governance) investments without compromising returns. Financial planning has evolved from an exclusive privilege to a universal necessity, adapting to changing technological, societal, and economic landscapes. The trends reveal a dynamic industry propelled by digital solutions, ensuring personalized financial strategies aligned with individual aspirations. The rise of ESG investments underscores the shift towards socially responsible choices, while financial literacy empowers individuals to make informed decisions. Global influences, economic shifts, regulatory reforms, and geopolitical risks emphasize the need for adaptable strategies that balance growth and stability. The financial sector's evolution is marked by fintech revolutions, cryptocurrencies, and decentralized finance, offering diverse options for investors. Amid these advancements, financial planners confront the challenges of keeping pace with tech, safeguarding data, addressing diverse client needs, ensuring compliance, and ethical investment demands. Embracing these trends and navigating challenges will define the success of financial planners in this dynamic landscape.What Is Financial Planning?

Financial Planning Trends 2024

Shift Towards Digital and Technology-Driven Solutions

Environmental, Social, and Governance (ESG) Investments

Personalized Financial Planning

Focus on Financial Literacy and Education

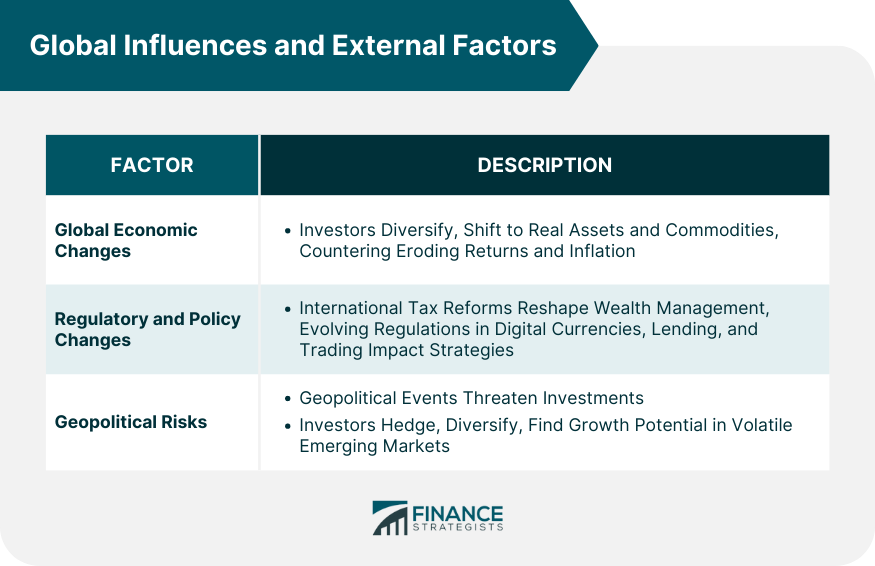

Global Influences and External Factors

Global Economic Changes

Regulatory and Policy Changes

Geopolitical Risks

Evolution of Financial Products

Challenges Facing Financial Planners in 2024

Conclusion

Financial Planning Trends FAQs

Key trends include a shift towards digital solutions like robo-advisors, a growing emphasis on ESG investments, personalized financial strategies, a focus on financial literacy, and adaptation to global economic changes.

Technology is playing a significant role, with robo-advisors offering automated advice, AI-driven insights for proactive strategies, and blockchain-enhancing transparency in financial transactions.

ESG investments reflect a broader shift towards valuing societal impact alongside financial returns. Investors prioritize companies adhering to environmental standards, societal contributions, and strong governance.

Financial planners are leveraging big data analytics to craft personalized strategies based on individual goals, behaviors, and preferences, ensuring that each financial decision aligns with personal aspirations.

Global influences, such as economic changes, regulatory reforms, and geopolitical risks, are prompting financial planners to diversify portfolios, focus on inflation protection, and navigate changing regulations to ensure effective strategies in a dynamic environment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.