Financial contingency planning refers to the process of preparing for unexpected events that can impact an organization's financial health. It involves identifying potential risks, assessing their potential impact, and developing strategies to mitigate or manage these risks. The goal is to ensure that a company can continue to operate and meet its financial obligations even in the face of unforeseen challenges. This might involve setting aside emergency funds, diversifying revenue streams, securing alternate lines of credit, or establishing specific protocols for cost-cutting measures. By having a contingency plan in place, businesses can react quickly and efficiently to financial shocks, reducing potential losses and maintaining stakeholder confidence. In essence, financial contingency planning is about expecting the unexpected and having a roadmap to navigate through economic uncertainties. An emergency fund acts as a financial buffer, ensuring that you have reserves during unexpected adversities. The primary purpose of this fund is to cover essential expenditures without having to liquidate investments prematurely or incur debt. Determining the right size for this fund often involves evaluating monthly expenses and then setting aside three to six months' worth. The strategies for building and maintaining this fund vary, but regularly setting aside a portion of income or windfalls can steadily grow this safety nest. The old adage, "Don't put all your eggs in one basket," rings particularly true in finance. Investment diversification is a cornerstone of risk management. It involves spreading investments across different asset classes or sectors to minimize potential losses from any single investment going south. By diversifying, one can aim to achieve more consistent returns over time and cushion the financial blow when particular sectors underperform. Insurance acts as a shield against potential financial setbacks. Different types of insurance cover various aspects of life and assets, from health and life to property and disability. It's vital to ensure adequate coverage to prevent exorbitant out-of-pocket expenses during emergencies. Regularly reviewing and updating insurance policies ensures they align with current needs, assets, and liabilities. High levels of debt can be crippling during financial emergencies. Without a proper strategy, debt can spiral, causing a cascading effect on one's financial health. Managing debt involves understanding what you owe, prioritizing repayments (typically focusing on high-interest debts first), and avoiding unnecessary future debts. Being proactive in debt management ensures that when financial setbacks occur, they don't become insurmountable due to existing liabilities. Emergencies aren't limited to financial upheavals; they can also involve personal tragedies or incapacitations. Having updated legal documents such as wills and trusts ensures that assets are distributed according to one's wishes. Additionally, powers of attorney and healthcare proxies can dictate decision-making in situations where one may be unable to make decisions independently, ensuring that personal wishes are honored even during crises. A financial contingency plan isn't a one-and-done effort. The financial landscape, personal situations, and goals evolve over time. As such, it's crucial to revisit and revise the plan periodically. By keeping it relevant, one can ensure that it remains a sturdy shield against ever-changing financial challenges. Merely having a contingency plan isn’t enough. It's equally essential to test its effectiveness. Simulating financial emergencies—like a sudden job loss or a market crash—can offer insights into how well-prepared one truly is. Based on these mock scenarios, adjustments can be made to strengthen the plan further. A contingency plan's effectiveness also hinges on those involved understanding it. For families, this means ensuring all adult members are aware of the plan's intricacies. In business scenarios, relevant stakeholders should be in the loop. This collective awareness ensures a coordinated response during crises, minimizing panic and hasty, ill-informed decisions. With a contingency plan in place, individuals and businesses are better equipped to handle unexpected expenses or drops in income, ensuring stability even in turbulent times. Knowing there's a plan in place to handle financial setbacks can significantly reduce the emotional strain often associated with monetary crises. In times of crisis, having a clear plan minimizes hasty or emotional financial decisions, promoting rational and strategic choices instead. With a well-laid-out contingency plan, there's often no need to liquidate assets prematurely, ensuring that investments can mature and provide maximum returns. Emergency funds and other contingency measures can prevent or reduce the need to take on high-interest debt during financial challenges. For businesses, a financial contingency plan ensures continuity of operations, even when facing economic downturns or other unforeseen challenges. Investors, partners, and other stakeholders are more likely to trust and support businesses that demonstrate foresight and preparedness through financial contingency planning. By nature, emergencies are unpredictable. Although general scenarios can be anticipated, specific events, their severity, and timing can often catch individuals off guard. Financial strategies must address both current needs and future uncertainties. Allocating too much for contingencies might impede present-day objectives. Conversely, a focus solely on present needs may leave one vulnerable in the face of emergencies. Financial situations, personal circumstances, and external economic factors evolve. A once-effective contingency plan can become obsolete if not reviewed and revised regularly. A contingency plan often involves multiple parties, especially in business settings. If all stakeholders are not on the same page, it can lead to confusion, mismanagement, and ineffective crisis response. While general guidelines suggest keeping three to six months' worth of expenses, these figures might not suit everyone. Overestimating might lock up valuable resources, whereas underestimating could result in inadequate funds during a crisis. Financial contingency planning is a pivotal process designed to safeguard an individual's or organization's financial stability against unpredictable adversities. At its core, it emphasizes risk identification, strategic mitigation, and proactive measures to counter potential threats. Key components include establishing an emergency fund as an immediate financial buffer and ensuring diversification in investments to spread and minimize risk. Additionally, routine reviews of insurance coverage guarantee protection against diverse setbacks, while efficient debt management prevents the amplification of crises. Updated legal documents, such as wills and trusts, further strengthen the plan by addressing potential personal crises. It's essential to revisit and adjust this plan, ensuring it remains robust against the evolving financial landscape. Engaging and educating relevant stakeholders fortifies a united response during crises. In essence, a well-structured financial contingency plan offers a balanced and comprehensive approach to navigating unforeseen financial challenges, ensuring resilience and sustainability.What Is Financial Contingency Planning?

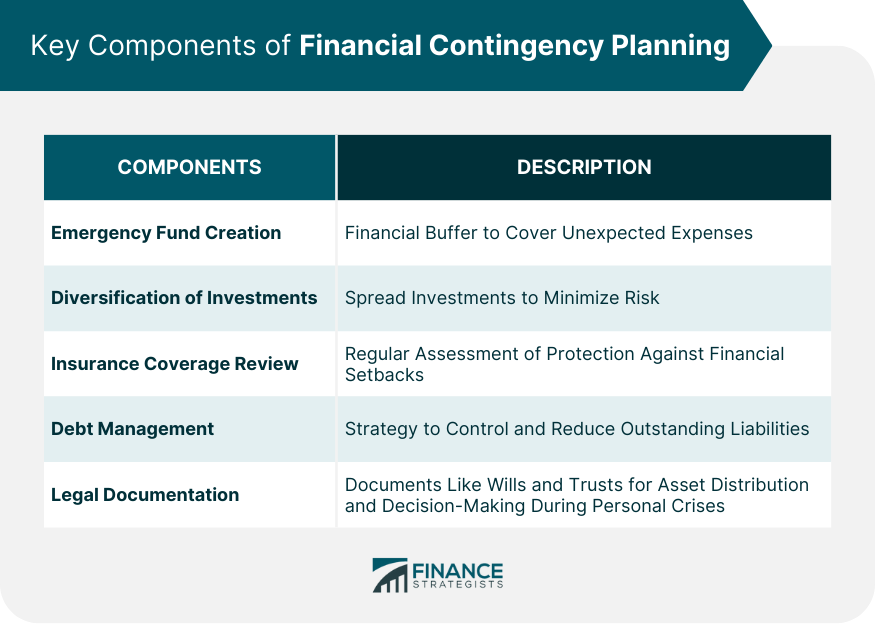

Key Components of Financial Contingency Planning

Emergency Fund Creation

Diversification of Investments

Insurance Coverage Review

Debt Management

Legal Documentation

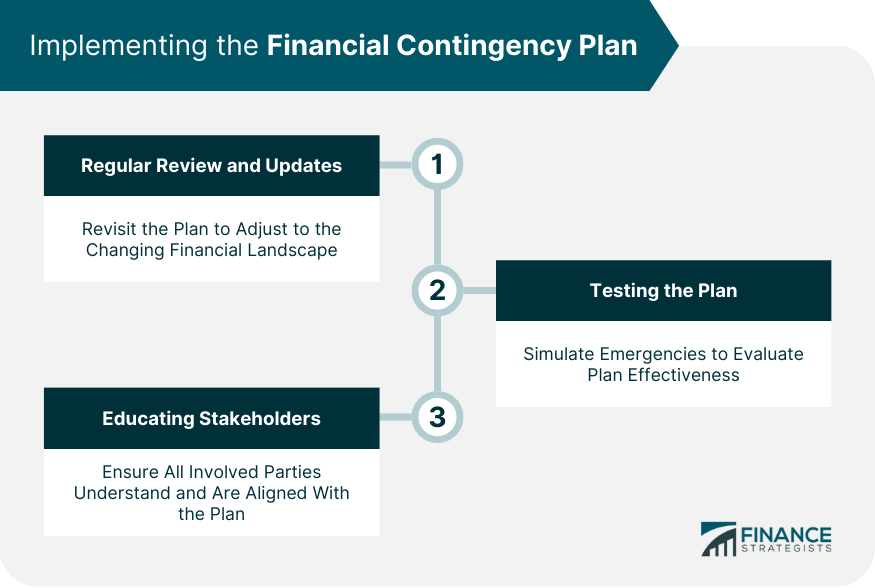

Implementing the Financial Contingency Plan

Regular Review and Updates

Testing the Plan

Educating Stakeholders

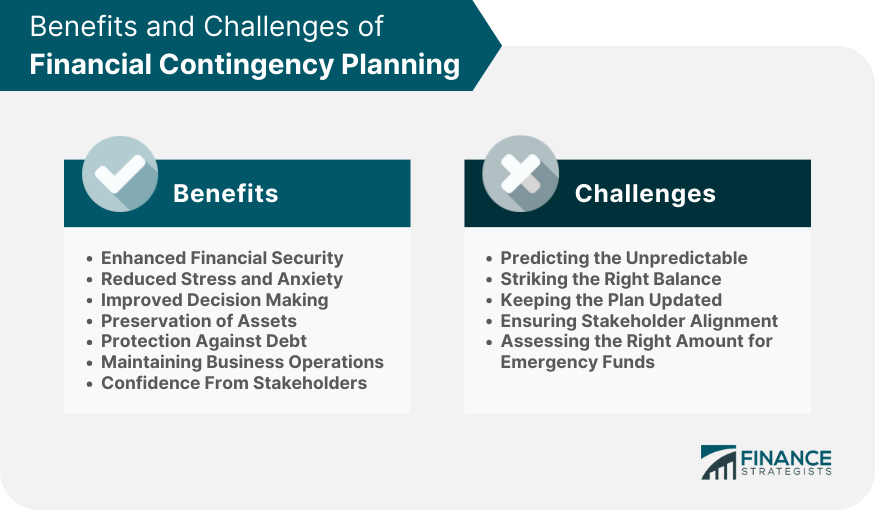

Benefits of Financial Contingency Planning

Enhanced Financial Security

Reduced Stress and Anxiety

Improved Decision-Making

Preservation of Assets

Protection Against Debt

Maintaining Business Operations

Confidence From Stakeholders

Challenges in Financial Contingency Planning

Predicting the Unpredictable

Striking the Right Balance

Keeping the Plan Updated

Ensuring Stakeholder Alignment

Assessing the Right Amount for Emergency Funds

Conclusion

Financial Contingency Planning FAQs

The primary goal of financial contingency planning is to prepare individuals or businesses for unforeseen financial challenges, ensuring stability and risk mitigation during emergencies.

It's advisable to review and update your financial contingency planning annually or whenever there's a significant change in your financial or personal circumstances.

Typically, financial contingency planning recommends setting aside three to six months' worth of expenses in an emergency fund, though individual needs may vary based on risk tolerance and financial obligations.

Yes, diversifying investments is a foundational aspect of financial contingency planning as it spreads risk, aiming to provide more consistent returns and protection against significant losses in any single sector or asset class.

Insurance is a protective component in financial contingency planning. It offers a financial shield against potential setbacks, covering aspects like health, life, property, and disability, thus preventing high out-of-pocket expenses during emergencies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.