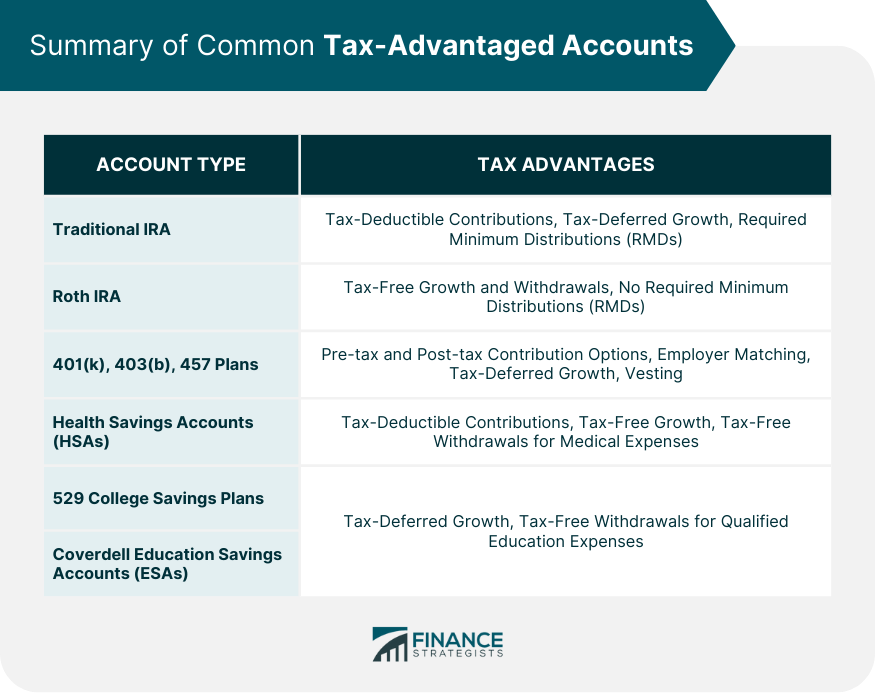

Tax-advantaged accounts are financial accounts designed to provide tax benefits to investors. These benefits can include tax deductions, deferrals, or exemptions, making them an attractive option for long-term financial planning. Tax-efficient investing aims to minimize tax liability while maximizing returns. Various tax-advantaged accounts cater to different financial goals and situations. Some common account types include Individual Retirement Accounts (IRAs), employer-sponsored retirement plans, Health Savings Accounts (HSAs), and education savings accounts. Traditional IRAs allow individuals to make tax-deductible contributions; reducing taxable income in the year the contribution is made. This can lead to significant tax savings, especially for those in higher tax brackets. Investments within a traditional IRA grow tax-deferred, meaning taxes on earnings are postponed until funds are withdrawn in retirement. This deferral allows investments to compound more rapidly, ultimately leading to a larger retirement nest egg. Traditional IRA holders must begin taking required minimum distributions (RMDs) at age 73. These mandatory withdrawals help ensure the account owner pays taxes on their retirement savings, but they can also limit the account's long-term growth potential. Roth IRAs are funded with post-tax dollars, meaning contributions are not tax-deductible. However, this arrangement offers several advantages, including tax-free growth and withdrawals in retirement. Investments in a Roth IRA grow tax-free, and qualified withdrawals during retirement are not subject to income tax. This can result in significant tax savings for those who anticipate being in a higher tax bracket during retirement. Unlike traditional IRAs, Roth IRAs do not have RMDs, allowing account owners to leave their assets untouched for as long as they wish. This can be beneficial for estate planning and maximizing wealth transfer to heirs. Both traditional and Roth IRAs have eligibility requirements and annual contribution limits. These limits may vary based on factors such as age, income, and filing status, making it essential for individuals to understand the rules governing their specific situation. Premature withdrawals from an IRA may be subject to taxes and penalties, depending on the account type and the circumstances surrounding the withdrawal. Understanding these rules can help investors avoid costly mistakes and preserve their retirement savings. A traditional 401(k) is a tax-deferred employer-sponsored retirement plan that allows employees to make pre-tax contributions. Like traditional IRAs, these contributions reduce taxable income and grow tax-deferred until retirement. A Roth 401(k) combines features of a Roth IRA and a traditional 401(k) plan, allowing employees to make post-tax contributions that grow tax-free. Qualified withdrawals during retirement are also tax-free, making Roth 401(k)s an attractive option for those expecting higher tax rates in retirement. 403(b) and 457 plans are tax-advantaged retirement plans for employees of specific organizations, such as non-profit organizations, public schools, and government agencies. These plans operate similarly to 401(k) plans, offering both pre-tax and post-tax contribution options and tax-deferred growth. Employer-sponsored retirement plans, including 401(k), 403(b), and 457 plans, have annual contribution limits. Employers may also offer matching contributions, providing additional retirement savings incentives for employees. Understanding the specific limits and matching policies can help employees maximize their retirement savings. Vesting schedules determine when an employee gains ownership of employer-contributed funds in their retirement account. Different employers may have varying vesting schedules, and understanding these can help employees make informed decisions about their employment and retirement planning. Employer-sponsored retirement plans have rules governing withdrawals, including potential taxes and penalties for early withdrawals. Familiarizing oneself with these rules can help employees avoid unnecessary financial losses and preserve their retirement savings. Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals save for medical expenses. Eligibility for HSAs is typically tied to enrollment in a high-deductible health plan (HDHP), offering tax benefits to offset the higher out-of-pocket costs associated with these plans. HSAs have annual contribution limits that may vary based on factors such as the individual's health plan and age. Understanding these limits can help individuals plan for medical expenses and maximize the tax benefits associated with HSAs. HSAs can be used to pay for qualified medical expenses, including deductibles, copayments, and other out-of-pocket healthcare costs. Utilizing an HSA for these expenses can provide significant tax savings and help individuals manage their healthcare spending. HSAs offer several tax advantages, including tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. These benefits make HSAs an attractive option for individuals seeking to save for healthcare costs while minimizing their tax liability. Withdrawing funds from an HSA for non-medical expenses may result in taxes and penalties. Understanding these rules can help individuals avoid costly mistakes and ensure their HSA funds are used effectively for healthcare expenses. 529 College Savings Plans are tax-advantaged accounts designed to help individuals save for education expenses. These plans offer tax-deferred growth and tax-free withdrawals for qualified education expenses, making them an attractive option for families planning for future education costs. Most 529 plans are state-sponsored, with each state offering its own plan options. Some states also offer tax benefits to residents who invest in their state's plan, making it important for individuals to research and compare available options. While 529 plans generally have high contribution limits, some states may impose their own limits or rules. Understanding these limits can help individuals maximize their education savings while adhering to the specific guidelines of their chosen plan. 529 plan funds can be used for a variety of qualified education expenses, including tuition, fees, books, and certain room and board costs. Using 529 plan funds for these expenses can provide tax-free withdrawals and significant savings for families. Investments in a 529 plan grow tax-deferred, and withdrawals for qualified education expenses are tax-free. These tax benefits can result in substantial savings, helping families better manage the costs of education. Coverdell Education Savings Accounts (ESAs) are tax-advantaged accounts designed to help individuals save for both K-12 and higher education expenses. ESAs offer tax-deferred growth and tax-free withdrawals for qualified education expenses, providing families with flexible savings options. Coverdell ESAs have lower annual contribution limits compared to 529 plans. Understanding these limits, as well as other rules governing ESAs, can help individuals maximize their education savings while adhering to specific account guidelines. ESAs can be used for a wide range of qualified education expenses, including tuition, fees, books, supplies, and certain room and board costs. Utilizing ESA funds for these expenses can lead to tax-free withdrawals and significant savings. Investments in a Coverdell ESA grow tax-deferred, and withdrawals for qualified education expenses are tax-free. These tax advantages can result in considerable savings and help families better manage education costs. Asset location is a tax-efficient investment strategy that involves placing investments with differing tax characteristics in the most suitable accounts. This can help maximize after-tax returns by strategically allocating assets to take advantage of various tax treatments. Tax-loss harvesting is a strategy that involves selling underperforming investments to realize capital losses, which can offset capital gains and potentially reduce tax liability. This strategy can be particularly beneficial in years with substantial realized capital gains. Investing in tax-exempt bonds, such as municipal bonds, can provide income that is exempt from federal and potentially state income taxes. This strategy can be particularly beneficial for investors in higher tax brackets seeking tax-efficient income sources. Holding investments for more than one year can result in more favorable tax treatment, as long-term capital gains are generally taxed at lower rates than short-term capital gains. This strategy can help investors minimize their tax liability and maximize after-tax returns. Tax-advantaged accounts can offer significant benefits to investors, including tax deductions, deferrals, and exemptions. Different types of tax-advantaged accounts cater to varying financial goals and situations, such as retirement savings, healthcare expenses, and education costs. Traditional and Roth IRAs, employer-sponsored retirement plans, HSAs, 529 plans, and Coverdell ESAs are some common account types with their unique features and eligibility criteria. To maximize the benefits of tax-advantaged accounts, investors can also use tax-efficient investment strategies such as asset location, tax-loss harvesting, investing in tax-exempt bonds, and holding investments for the long term. Understanding the rules and guidelines governing these accounts and investment strategies can help individuals make informed decisions and maximize their after-tax returns.What Are Tax-Advantaged Accounts?

Individual Retirement Accounts (IRAs)

Traditional IRA

Tax-Deductible Contributions

Tax-Deferred Growth

Required Minimum Distributions (RMDs)

Roth IRA

Post-Tax Contributions

Tax-Free Growth and Withdrawals

No Required Minimum Distributions (RMDs)

Eligibility and Contribution Limits

IRA Withdrawal Rules and Penalties

Employer-Sponsored Retirement Accounts

401(k) Plans

Traditional 401(k)

Roth 401(k)

403(b) and 457 Plans

Contribution Limits and Employer Matching

Vesting Schedules

Withdrawal Rules and Penalties

Health Savings Accounts (HSAs)

Purpose and Eligibility

Contribution Limits

Qualified Medical Expenses

Tax Benefits and Growth

Withdrawal Rules and Penalties

529 College Savings Plans

Purpose and Benefits

State-Sponsored Plans

Contribution Limits and Rules

Qualified Education Expenses

Tax Benefits and Growth

Coverdell Education Savings Accounts (ESAs)

Purpose and Benefits

Contribution Limits and Rules

Qualified Education Expenses

Tax Benefits and Growth

Tax-Advantaged Accounts Investment Strategies

Asset Location

Tax-Loss Harvesting

Tax-Exempt Bonds

Long-Term Capital Gains

Final Thoughts

Tax-Advantaged Accounts FAQs

Tax-advantaged accounts are financial accounts designed to provide tax benefits to investors. These benefits can include tax deductions, deferrals, or exemptions, making them an attractive option for long-term financial planning.

Some common types of tax-advantaged accounts include Individual Retirement Accounts (IRAs), employer-sponsored retirement plans, Health Savings Accounts (HSAs), and education savings accounts.

Investing in tax-advantaged accounts can significantly impact an investor's overall financial health, leading to more substantial retirement savings and reduced tax burdens. These accounts offer tax benefits such as tax deductions, deferrals, or exemptions, making them a tax-efficient investment option.

Yes, premature withdrawals from tax-advantaged accounts may be subject to taxes and penalties, depending on the account type and the circumstances surrounding the withdrawal. Understanding these rules can help investors avoid costly mistakes and preserve their retirement savings.

Determining the right tax-advantaged accounts for you will depend on factors such as your income, tax bracket, and anticipated future expenses. Consulting with a professional financial advisor or retirement planning specialist can be beneficial in understanding and navigating the complex world of tax-advantaged accounts and identifying the best accounts for your unique financial goals and circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.