A Certified Public Accountant (CPA) is a title granted to accounting professionals in the United States who have demonstrated proficiency in accounting and auditing through a rigorous examination and subsequent licensure process. Attaining the CPA designation signals a high level of competency, ethical standards, and knowledge in accounting practices. Given the trust placed upon CPAs by the public, businesses, and government entities, they must adhere to strict ethical guidelines and professional standards. While the CPA designation is recognized primarily in the U.S., the impact and importance of CPAs stretch globally. These individuals handle a wide range of financial services, including auditing, tax preparation, financial planning, and consultation. Their role in ensuring financial transparency and accuracy makes them essential in the modern business landscape, providing confidence to stakeholders that financial statements and operations are correct and reliable. A Certified Public Accountant or "CPA" is the designation for public accountants who are licensed to practice in the United States. A public accountant is an individual who performs accounting-related work on behalf of external clients, often for regulatory purposes. The interests and standards of the profession are centrally guided by the American Institute of Certified Public Accountants or "AICPA." Have a question for a Certified Public Accountant? Click here. Large public companies enlist the help of CPA firms annually in order to provide the SEC with audited financial statements and the IRS with their corporate tax return. CPA's play an important role in giving confidence to investors to trust the financial statements they are analyzing. Each state has their own CPA board which determines the requirements of obtaining licensure, but typically, CPAs must have the following: 120-150 school credit hours One-full year of experience with an established CPA firm Pass four standardized tests in the areas of Financial Accounting, Taxation, Auditing, and Business Concepts To become a CPA, a candidate must meet specific educational criteria, which usually includes earning a bachelor’s degree in accounting or a related field. Most states in the U.S. require prospective CPAs to complete 150 semester hours of college education, which is typically 30 hours more than a standard 4-year bachelor's degree. This extra requirement often leads candidates to pursue a master's degree in accounting or a related field to fulfill this condition. However, while the 150-hour rule is prevalent, requirements can vary by state. It's essential for prospective CPAs to familiarize themselves with the specific educational prerequisites of the state in which they intend to practice. Not meeting these criteria can hinder an individual's path to licensure. Beyond education, aspiring CPAs must meet other eligibility criteria to sit for the CPA Exam. Typically, this includes specific coursework in accounting and business. Some states also require candidates to have a certain amount of work experience under the supervision of a licensed CPA before they can take the exam. The combination of educational and practical experience ensures that CPA candidates have both theoretical knowledge and practical insights. This combination prepares them adequately for the rigorous challenges of the CPA Exam and their subsequent professional roles. While it's not mandatory, a strong academic background in accounting, finance, and business administration can provide CPA candidates with a significant advantage. Many universities and colleges offer specialized accounting programs geared toward preparing students for the CPA Exam and their future roles. Engaging in internships, participating in accounting organizations, and seeking mentorship from experienced CPAs can further enhance one's academic and practical preparation. The CPA Exam is divided into four sections, each designed to test a different area of accounting expertise: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Each section must be passed to earn the CPA designation. These sections are not arbitrary but reflect the comprehensive nature of a CPA's role. From understanding the intricate details of financial reporting to grasping broader business concepts and regulations, the exam ensures that CPAs are well-equipped to serve in various capacities. The CPA Exam's content areas reflect the diverse skill set required of modern accountants. The AUD section focuses on obtaining and documenting information, forming conclusions, and reporting. BEC encompasses corporate governance, economic concepts, and financial management. FAR delves into financial statement accounts and state and local governments. Lastly, REG examines ethics, federal tax procedures, and business law. The range of topics ensures that CPAs are not only proficient in numbers but are also well-versed in the broader business landscape, from understanding corporate structures to navigating complex tax scenarios. Each of the four sections of the CPA Exam is taken separately, and candidates can choose the order in which they take them. The exam is computer-based and uses a combination of multiple-choice questions, task-based simulations, and written communication tasks. The total testing time for each section ranges from three to four hours. It's imperative that candidates prepare extensively for each section, not only to pass but also to ensure they're ready for the multifaceted challenges they'll face as CPAs. The independence of CPA's in relation to the clients they serve is one of the most important foundations of the profession. In 2002, independence was compromised as a "Big Five" firm, Arthur Andersen, willfully destroyed documentation which proved Enron's accounting fraud and became one of the largest accounting frauds in history. In response, regulators passed the Sarbanes Oxley Act of 2002 which largely shapes the CPA-client relationships and auditing standards of today. Certified Public Accountants (CPAs) are at the forefront of financial reporting and assurance, ensuring the accuracy and reliability of financial statements presented to stakeholders. This duty is paramount as financial statements form the backbone of informed decision-making for investors, regulators, and other interested parties. By providing assurance services, CPAs audit these statements to confirm that they adhere to generally accepted accounting principles (GAAP) and other relevant regulations. Beyond the routine of financial statement auditing, CPAs are often tasked with reviewing internal financial controls, performing agreed-upon procedures, and delivering compilations of financial data. In each of these capacities, their role is pivotal in fostering trust among stakeholders, ensuring transparency, and upholding the integrity of the financial ecosystem. Taxation, with its intricate regulations and frequent updates, is a domain where CPAs play an essential role. They help individuals and businesses navigate the complex web of federal, state, and local tax laws. By providing strategic tax planning and compliance services, CPAs ensure that clients not only meet all legal obligations but also optimize their financial positions. This involves staying updated with the ever-evolving tax codes, understanding nuances of international taxation for multinational corporations, and identifying potential tax credits or deductions. Furthermore, CPAs represent clients before taxation authorities during audits or disputes. Their deep knowledge of tax law, combined with their rigorous professional training, positions them as indispensable allies in ensuring that all tax-related matters are handled with the utmost precision and expertise. Beyond traditional accounting tasks, CPAs also serve as trusted advisors to their clients, offering insights on a wide array of business matters. This advisory role can span from mergers and acquisitions consulting, where they analyze potential financial implications and synergies, to personal financial planning, assisting individuals in achieving their financial goals. Many businesses, especially those without a robust internal financial team, lean heavily on their CPAs for advice on budgeting, financial forecasting, and risk management. These services not only underscore the versatility of the CPA profession but also highlight the profound trust that individuals and businesses place in these professionals' expertise. Forensic accounting is a specialized area where CPAs use their financial acumen to investigate potential fraud, embezzlement, or other financial discrepancies. This investigative role can be crucial in legal cases, where a CPA's findings can provide the evidence needed to support or refute claims made in court. By analyzing financial records, tracing funds, and evaluating financial practices, they unearth any irregularities that might indicate fraudulent activities. In addition to fraud detection, forensic accountants often participate in litigation support, valuing businesses during disputes, or assessing potential financial damages in legal cases. Whether working for law enforcement agencies, legal teams, or corporations, CPAs specializing in forensic accounting bring a meticulous approach to uncovering the truth behind the numbers. Because of their knowledge of financial accounting and critical thinking skills, common career paths for CPAs include CPA Firm Partner, Controller, Chief Financial Officer, Consultant, Financial Analyst, and Forensic Accountant. A CPA Firm Partner holds a senior leadership role within an accounting firm, where they are responsible for managing client relationships, overseeing audit and assurance engagements, and driving the strategic direction of the firm. They play a crucial role in business development, attracting new clients, and ensuring high-quality service delivery. As experts in accounting, tax, and financial consulting, CPA Firm Partners provide valuable insights and guidance to clients, helping them navigate complex financial matters and achieve their business objectives. Controllers are integral to organizations, overseeing their financial operations and ensuring accurate and timely reporting of financial information. As a controller, a CPA takes charge of managing budgets, financial analysis, internal controls, and financial statement preparation. They collaborate with various departments to provide financial guidance and support decision-making. Controllers play a vital role in maintaining regulatory compliance and safeguarding the organization's financial integrity. The Chief Financial Officer (CFO) is a high-ranking executive responsible for a company's overall financial strategy and management. A CPA in this role brings financial expertise to drive financial planning, risk management, and investment strategies. They analyze financial data to provide insights for strategic decision-making, monitor financial performance, and communicate financial results to stakeholders. A CPA as CFO contributes significantly to the company's financial success and sustainability. CPAs as consultants offer specialized financial advice and guidance to businesses and individuals. They provide insights into tax optimization, financial planning, and strategic financial management. Consultants assist clients in navigating complex financial regulations, making informed investment choices, and achieving their financial goals. With their extensive knowledge of financial systems and regulations, CPA consultants provide tailored solutions to address specific financial challenges. Financial analysts, often CPAs, conduct thorough analyses of financial data to inform investment decisions and assess the financial health of companies. They evaluate market trends, economic indicators, and financial statements to provide recommendations for investment strategies. Financial analysts play a critical role in mergers and acquisitions, risk assessment, and portfolio management. Their insights aid investors and businesses in making well-informed financial decisions. Forensic accountants utilize their CPA expertise to investigate financial irregularities and potential fraud. They work with legal teams, examining financial records and transactions to uncover discrepancies or fraudulent activities. These professionals analyze complex financial data, prepare reports, and often serve as expert witnesses in legal proceedings. With their unique skill set, forensic accountants contribute to upholding financial transparency and integrity within organizations and legal contexts. A Certified Public Accountant (CPA) is a professional title bestowed upon accounting experts in the U.S. who have proven their proficiency through rigorous examination and licensure. The CPA designation signifies competence, ethical standards, and comprehensive knowledge in accounting practices. Despite its primary recognition in the U.S., the impact of CPAs extends globally. These professionals handle diverse financial services such as auditing, tax preparation, financial planning, and consultation. Their pivotal role in ensuring financial accuracy and transparency is indispensable in the modern business landscape. By upholding strict ethical guidelines and professional standards, CPAs inspire trust among the public, businesses, and government entities. Their multifaceted responsibilities contribute significantly to the financial ecosystem, instilling confidence in stakeholders that financial operations and statements are reliable and accurate.What Is a Certified Public Accountant (CPA)?

Define CPA in Simple Terms

How Do CPAs Work?

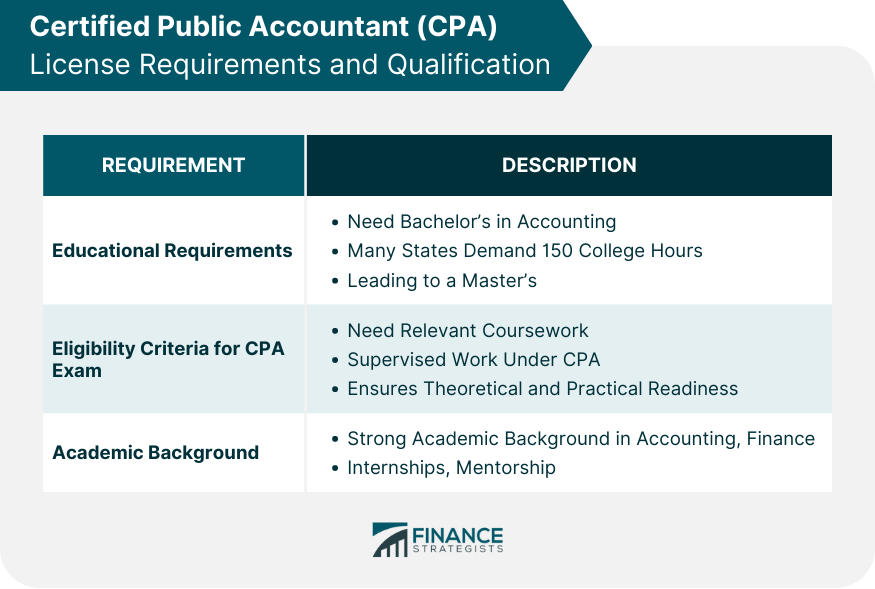

CPA License Requirements and Qualification

Educational Requirements

Eligibility Criteria for CPA Exam

Academic Background

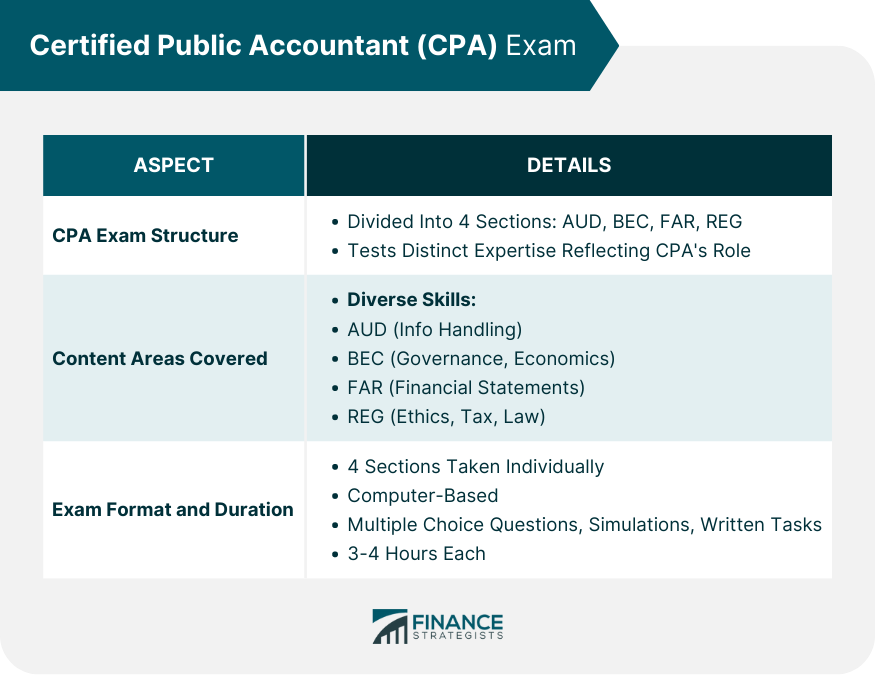

CPA Exam

Structure

Content Areas Covered in the Exam

Exam Format and Duration

Sarbanes Oxley Act of 2002

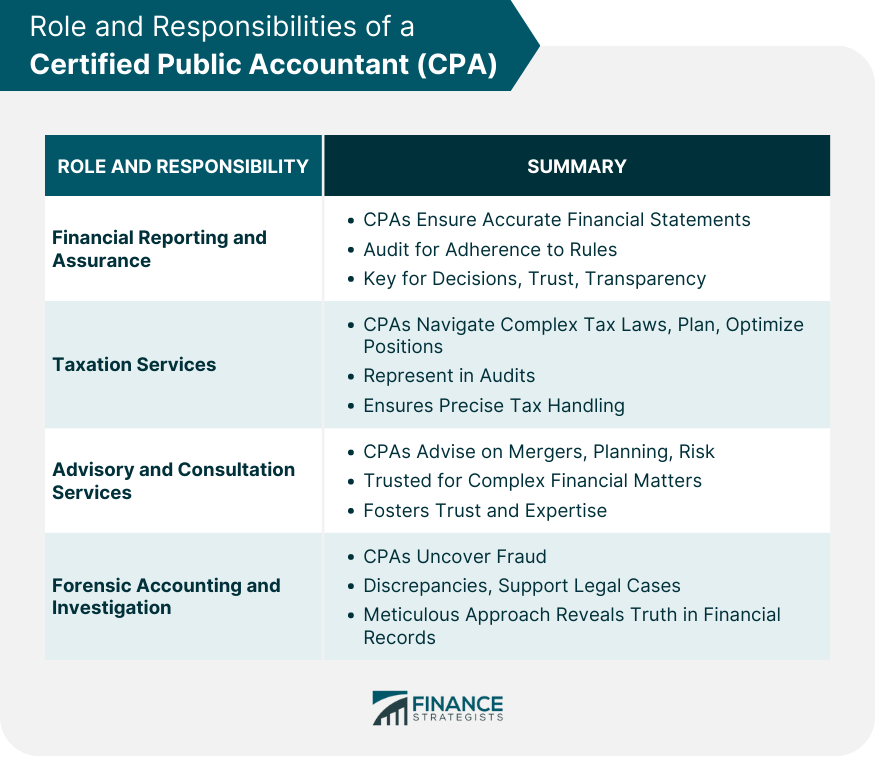

Roles and Responsibilities of CPAs

Financial Reporting and Assurance

Taxation Services

Advisory and Consultation Services

Forensic Accounting and Investigation

Careers for CPAs

CPA Firm Partner

Controller

Chief Financial Officer

Consultant

Financial Analyst

Forensic Accountant

Conclusion

Certified Public Accountant (CPA) FAQs

CPA stands for Certified Public Accountant.

A Certified Public Accountant or CPA is the designation for public accountants who are licensed to practice in the United States.

Large public companies enlist the help of CPA firms annually in order to provide the SEC with audited financial statements and the IRS with their corporate tax return.

In 2002, independence was compromised as a Big Five Firm, Arthur Andersen, willfully destroyed documentation which proved Enron’s accounting fraud and became one of the largest accounting frauds in history.

Exact requirements differ by state but typically, CPAs must have the following: 120-150 school credit hours, one-full year of experience with an established CPA firm, and pass four standardized tests in the areas of financial accounting, taxation, auditing, and business concepts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.