Financial planning and budgeting, while distinct, are both essential facets of personal finance management. Financial planning is a comprehensive, long-term approach, focusing on setting and achieving future monetary goals. It encompasses retirement strategies, investment decisions, estate planning, and risk mitigation, providing a roadmap for individuals to secure their financial future. On the other hand, budgeting is more immediate, concentrating on the allocation of current income against expenses. It's a tool that ensures individuals live within their means, directing funds to essential and discretionary expenses while setting aside savings. Budgeting can be seen as the tactical execution of a broader financial plan, ensuring available resources are used effectively to realize set objectives. Together, they offer a holistic strategy, with budgeting laying the groundwork for the overarching goals set out in financial planning. Financial planning is a methodical process where individuals set both personal and financial goals, whether for the short-term or long-term. It involves a comprehensive look at an individual's current financial situation, combined with strategies to meet desired financial outcomes. From retirement plans to investment portfolios, this process ensures a financially secure future. Retirement Planning: This focuses on setting aside sufficient funds to sustain one's lifestyle post-retirement. It may involve contributions to retirement accounts, pension plans, and making projections about future expenses. Investment Strategy: A tailored plan that takes into account an individual's risk tolerance and financial goals. It guides where and how to invest funds to grow wealth and possibly generate passive income. Risk Management and Insurance: This involves safeguarding against unforeseen events. Insurance products, such as life, health, and disability insurance, can protect an individual and their family against significant financial hardships. Tax Planning: This ensures that one takes advantage of any available tax benefits or deductions. Proper tax planning can minimize liabilities, keeping more money in one's pocket. Estate Planning: Concerns about the distribution of an individual's assets upon their demise. This may involve wills, trusts, or designating beneficiaries to ensure that one's wishes are respected. Clear Financial Vision: It gives a bird's eye view of one's financial state, making it easier to set and achieve goals. Preparedness for Uncertainties: With an effective plan, unforeseen challenges such as medical emergencies or job losses won't necessarily spell financial disaster. Peace of Mind: Knowing that there's a strategy in place for future financial goals, be it buying a home, funding education, or retiring comfortably, brings mental peace. Wealth Growth: Proper financial planning means optimizing investments, potentially leading to wealth accumulation over time. Lack of Diversification: Putting all financial eggs in one basket can be risky. A downturn in one investment can heavily impact one's portfolio. Ignoring Inflation: Not factoring in the rising cost of living can result in a shortfall in the future. For example, what seems like a hefty retirement fund today may not suffice in a couple of decades. Setting Unrealistic Goals: Overly ambitious goals might lead to aggressive investment strategies, which come with their own set of risks. Emotional Investing: Making investment decisions based on market speculation, hearsay, or personal biases can lead to losses. It's vital to base decisions on research, understanding, and long-term strategies. Budgeting, in contrast, zeros in on the present, providing a detailed plan of how one's current resources will be allocated. It deals with the nitty-gritty of daily finances, ensuring that expenditures don't surpass income, helping individuals navigate their immediate monetary concerns and challenges. This type of budgeting starts from scratch every month. It demands a justification for every penny spent, ensuring that every dollar has a designated purpose. Ideal for those who need a fresh perspective monthly and enjoy a meticulous approach to their finances. A more tactile budgeting method, it involves allocating specific amounts of cash into different envelopes for various expenses. Once the cash in an envelope is used up, no more spending occurs in that category until the next refill. This system provides a visual and tangible way to monitor spending and can be especially useful for those trying to rein in discretionary spending. A simplified budgeting method where income is divided into three main categories: 50% for necessities, 30% for wants, and 20% for savings or paying off debt. This strategy is great for individuals who prefer a more straightforward approach without diving deep into detailed categorizations. Financial Discipline: Regular budgeting fosters a disciplined approach to spending, ensuring one doesn't live beyond their means. Effective Resource Allocation: A well-maintained budget ensures that funds are allocated effectively, prioritizing essential expenses and savings. Savings Boost: By keeping tabs on income and expenses, individuals can identify and cut down on unnecessary spending, promoting increased savings. Insightful Spending Patterns: Over time, regular budgeting reveals spending habits, indicating areas where one might be overspending or where there's room for added savings. Underestimating Expenses: Often, people budget for the best-case scenario, neglecting potential unexpected costs. This can lead to budget shortfalls. Overlooking Irregular Costs: Some expenses, like annual memberships or quarterly bills, don't occur monthly. Forgetting to factor these in can disrupt a budget. Rigidity: Failing to adjust the budget to changing financial circumstances, whether they be windfalls or unexpected expenses, can lead to inefficiencies. Inconsistent Tracking: A budget is only as effective as the effort put into tracking and updating it. Sporadic monitoring can result in spending missteps and missed saving opportunities. Regular reviews ensure the budget remains an accurate reflection of one's financial landscape. Financial planning primarily focuses on the alignment of financial decisions with personal and financial objectives. It's a blueprint for the future, mapping out strategies for long-term ambitions such as purchasing a home or planning for retirement. Its scope often extends years, if not decades, into the future, providing a holistic financial vision. On the other hand, budgeting has a narrower lens, addressing immediate financial needs and challenges. It revolves around managing daily or monthly finances, ensuring that income matches or exceeds expenditures. It's about financial discipline and ensuring that resources are allocated wisely in the present. In the realm of financial planning, professionals often use sophisticated tools to forecast future financial trends. From Monte Carlo simulations to financial modeling software, these tools provide detailed insights, allowing for informed decision-making regarding investments, asset allocations, and more. Conversely, budgeting often employs more straightforward tools. Numerous apps like Mint or YNAB have streamlined the budgeting process, enabling users to track every cent, categorize expenses, and even set financial reminders. These apps have made it more accessible for individuals to maintain a budget and adhere to it. Financial planning uses metrics centered on wealth accumulation, optimal asset allocation, and risk-adjusted returns. These metrics guide decision-making, ensuring that the financial plan remains aligned with an individual's overarching objectives. Budgeting, meanwhile, measures success in more immediate terms. This includes maintaining a positive cash flow, adhering to budgetary allocations, and steadily growing one's savings or emergency fund. Budgeting and financial planning are two sides of the same coin. Effective budgeting lays the groundwork for successful financial planning. By managing current finances efficiently through budgeting, individuals can allocate resources towards investments, savings, and other long-term financial goals. While budgeting addresses the present, its impact reverberates into the future. Savings accumulated through diligent budgeting can be channeled into investments, retirement funds, or other financial ventures, bridging the gap between present financial management and future financial aspirations. Financial planning, with its future-focused perspective, can offer direction to budgetary decisions. By setting clear financial goals, individuals can structure their budgets to achieve these objectives. For instance, if the financial plan emphasizes aggressive investments, the budget should be tailored to allocate more toward investment opportunities. In essence, while budgeting provides the resources, financial planning offers the roadmap. They complement each other, with financial planning providing the strategic direction and budgeting ensuring the means to achieve set objectives. Consistency is vital in both budgeting and financial planning. Regularly updating, reviewing, and adjusting ensures that both remain effective and relevant. Moreover, there should be cohesiveness between the two; budgetary allocations should support the objectives outlined in the financial plan. For example, if the financial plan emphasizes saving for a down payment on a house within five years, the budget should prioritize setting aside funds for this goal. Inconsistent actions or a lack of alignment between the two can hinder financial progress. Exploring these essential financial planning tips will provide valuable insights into effectively navigating the complexities of managing finances and securing a stable financial future. Successful financial planning starts with clear objectives. These should be specific, measurable, achievable, relevant, and time-bound (often referred to as SMART goals). Setting clear targets, whether it's building an emergency fund or achieving a certain investment return, provides direction. Achievability is crucial. While it's essential to be ambitious, goals should be rooted in reality. Unrealistic objectives can lead to disappointment and demotivation. Periodic reviews ensure these goals remain relevant and attainable. A financial plan isn't static; it's a living document that should evolve with changing circumstances. Regular reviews ensure it remains aligned with current financial situations and goals. Factors like market fluctuations, changes in income, or new financial objectives necessitate adjustments. Regular adjustments also account for unforeseen challenges. Economic downturns, personal emergencies, or unexpected expenses can impact a financial plan. Adapting to these changes ensures the plan remains robust and effective. Financial planning can be intricate. While many individuals are adept at crafting their plans, seeking professional advice can offer invaluable insights. Financial advisors bring expertise, experience, and an external perspective, often identifying opportunities or pitfalls that might be overlooked. It's also beneficial during complex financial situations, such as estate planning or tax optimization. Professional advice ensures that decisions are well-informed, optimizing financial outcomes. At the heart of financial planning lies the balance between risk and return. Every investment opportunity carries inherent risks, and it's essential to understand these before diving in. Risk tolerance varies among individuals. While some might be comfortable with aggressive investments, others might prefer more conservative avenues. Understanding risk and making informed decisions is crucial. It involves assessing potential returns against the likelihood of losses. Diversification, or spreading investments across varied assets, is a common strategy to manage this balance, ensuring a mix of high and low-risk investments. Debt can be a significant impediment to financial progress. High-interest debts, in particular, can erode savings and hinder financial growth. Prioritizing debt reduction, especially costly debts like credit card balances, is crucial for financial well-being. A strategic approach often involves targeting high-interest debts first, while also ensuring timely payment of all obligations to avoid penalties. As debts are cleared, it's also essential to adopt habits to prevent future debt accumulation. The foundation of a robust budget is accurate tracking. Every income source should be documented, and every expenditure, no matter how trivial, should be recorded. This provides a clear picture of financial health, highlighting areas of surplus or deficit. Over time, consistent tracking can offer insights into spending habits. It can reveal patterns, indicating areas of unnecessary expenditure or potential savings. It's the first step towards optimizing financial management. Not all expenses are created equal. Some are essential, like rent or mortgage payments, utility bills, and groceries. Others, like dining out or entertainment, are more discretionary. A successful budget prioritizes the essentials, ensuring that fundamental needs are always met. Once essential expenses are covered, the remaining funds can be allocated toward discretionary spending or savings. This approach ensures financial stability, preventing potential shortfalls or deficits. A golden rule of budgeting is to "pay yourself first." Before diving into monthly expenses, a portion of income should be earmarked for savings or investments. This instills discipline, ensuring financial growth and preparedness for future needs or emergencies. By consistently setting aside savings, individuals can steadily grow their wealth. Whether it's for an emergency fund, a significant purchase, or investments, this approach ensures that savings aren't an afterthought but a priority. Budgets, much like financial plans, should be dynamic. As financial situations change, budgets should be adjusted accordingly. Regulr reviews can account for changes in income, unforeseen expenses, or new financial goals. Moreover, periodic reviews can offer insights into budgetary adherence. If certain areas consistently exceed budgetary allocations, it might be time to re-evaluate and adjust. Regular monitoring ensures that budgets remain effective and aligned with financial objectives. Impulse purchases can quickly derail a budget. While the occasional splurge might seem harmless, they can accumulate over time, straining finances. One effective strategy is to implement a waiting period for significant or unplanned purchases. By delaying the purchase, individuals can assess its necessity and affordability. Often, after reflection, the urge to buy diminishes. This approach curbs unnecessary spending, ensuring budgetary compliance. Technology has significantly impacted the world of finance. Modern apps and platforms have democratized financial planning and budgeting, offering tools previously reserved for professionals. These tools, from basic expense trackers to intricate financial modeling software, have made managing finances more accessible and often more efficient. Beyond mere accessibility, these apps have introduced gamification, insights, and automation to personal finance. They've transformed mundane tasks like tracking expenses into interactive and engaging activities, promoting financial literacy and discipline. Automation is the future of budgeting. Modern apps offer features like automatic transfers to savings accounts or round-up investments. These features, often running in the background, ensure consistent savings without active intervention. By automating certain financial tasks, individuals can achieve their financial goals with minimal effort. These small, automated contributions, though seemingly insignificant, can accumulate over time, paving the way for significant financial growth. With digital progress comes new challenges, primarily in the form of cybersecurity. Personal financial data is a lucrative target for malicious actors. Protecting this information is paramount in the digital age. Ensuring robust security measures is essential. This includes employing strong, unique passwords, leveraging two-factor authentication, and regularly updating software. It's also crucial to be wary of phishing attempts and to only use trusted platforms. By taking these precautions, individuals can reap the benefits of digital finance tools while safeguarding their information. Financial planning and budgeting are two pivotal components of personal finance, each serving distinct roles yet intertwining seamlessly. Financial planning offers a long-term perspective, providing a roadmap for future financial goals, including investments, estate planning, and retirement. It requires foresight, strategic planning, and often, professional advice to navigate the complexities. In contrast, budgeting is an immediate tool, focusing on the allocation of present income against expenses, ensuring a disciplined approach to current financial obligations and saving opportunities. While financial planning crafts the broader vision, budgeting acts as its tactical executor, making certain that today's financial decisions support tomorrow's objectives. Together, they create a holistic approach to finance, ensuring individuals are prepared for both present challenges and future aspirations. To optimize these processes, one must remain adaptable, continuously reviewing and adjusting plans as life evolves, always keeping financial well-being at the forefront.Financial Planning vs Budgeting: Overview

Digging Deeper Into Financial Planning

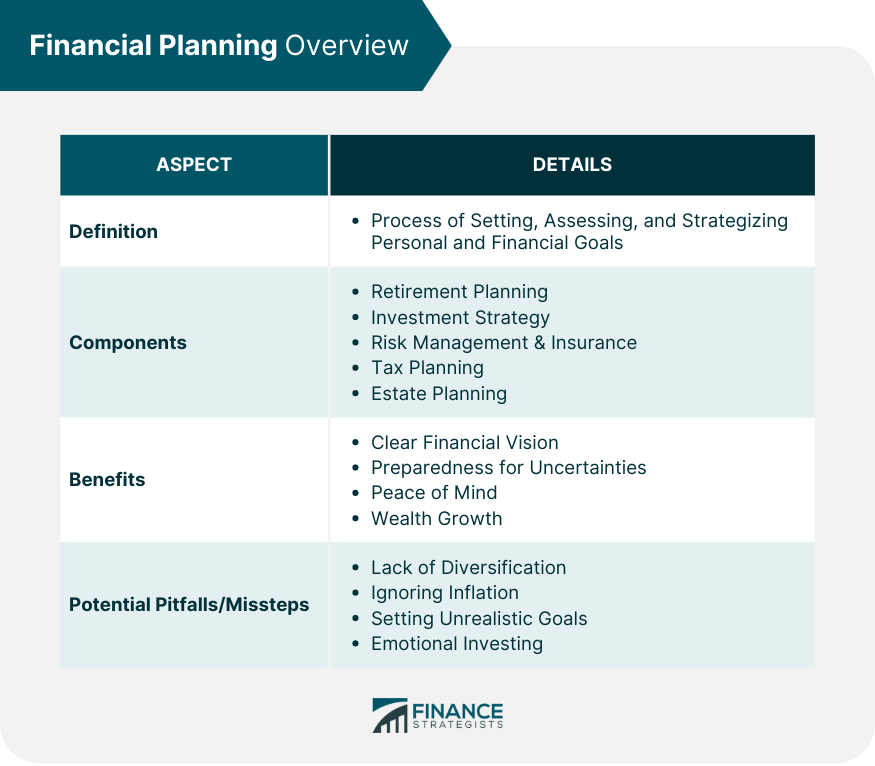

Definition of Financial Planning

Components of a Comprehensive Financial Plan

Benefits of Proper Financial Planning

Potential Pitfalls or Missteps

Exploring the Intricacies of Budgeting

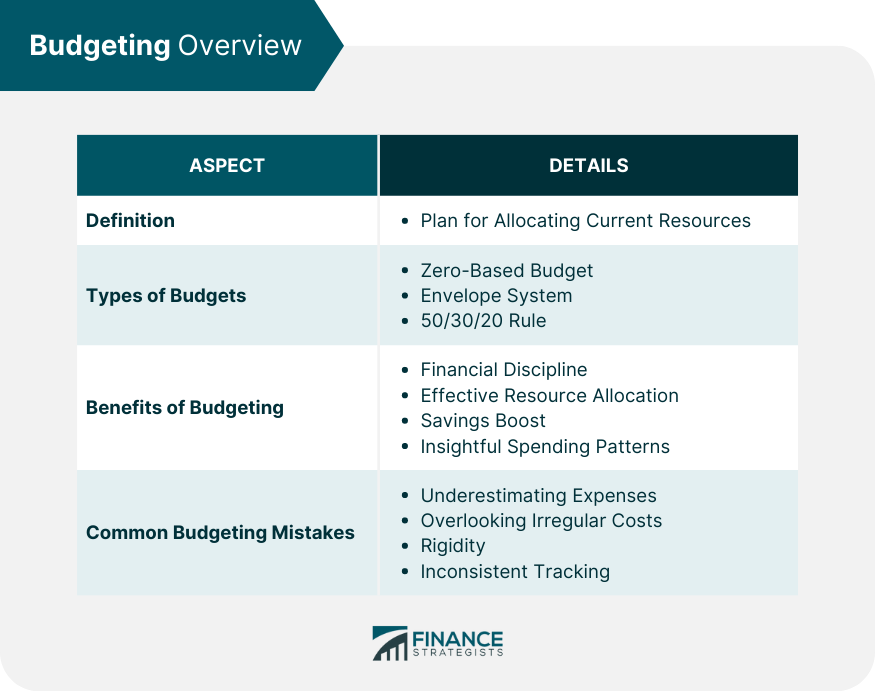

Definition of Budgeting

Types of Budgets

Zero-Based Budget

Envelope System

50/30/20 Rule

Benefits of Regular Budgeting

Common Mistakes in Budgeting

Comparing Financial Planning and Budgeting

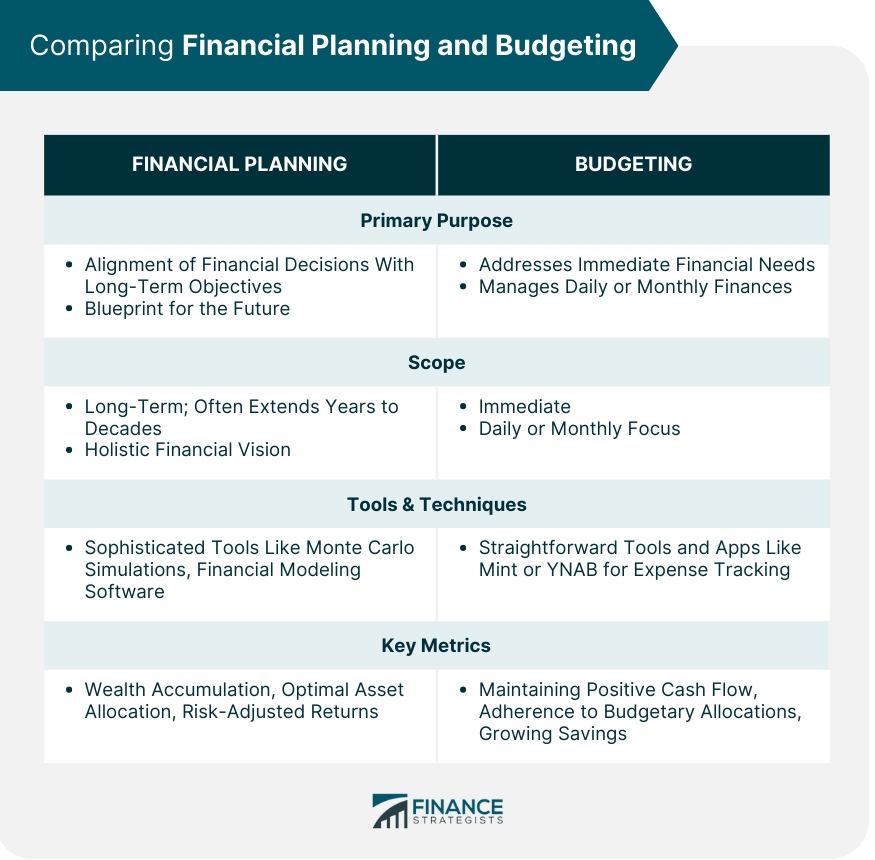

Primary Purpose of Each

Tools and Techniques Employed

Key Metrics for Success

Relationship Between Financial Planning and Budgeting

How Budgeting Serves as the Foundation for Effective Financial Planning

Role of Financial Planning in Guiding Budgetary Decisions

Emphasizing Consistency and Cohesiveness in Both Areas

Tips for Creating a Successful Financial Plan

Set Clear and Achievable Goals

Regularly Review and Adjust

Seek Professional Advice When Necessary

Understanding Risk and Return

Prioritize Debt Reduction

Tips for Creating a Successful Budget

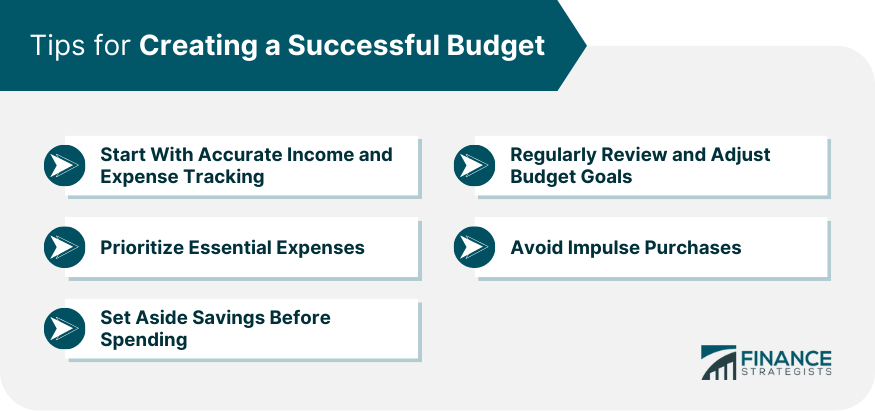

Start With Accurate Income and Expense Tracking

Prioritize Essential Expenses

Set Aside Savings Before Spending

Regularly Review and Adjust Budget Goals

Avoid Impulse Purchases

Role of Technology in Modern Financial Planning and Budgeting

Evolution of Finance Apps and Platforms

How Automation Is Changing the Face of Budgeting

Cybersecurity and Protecting Personal Financial Information

Bottom Line

Financial Planning vs Budgeting FAQs

Financial planning is long-term, focusing on future goals and growth, while budgeting addresses short-term income and expenditure management.

Budgeting serves as the foundation, ensuring resources are available to meet the objectives of the financial plan.

Components include retirement planning, investment strategy, risk management, tax planning, and estate planning.

Modern apps offer automation, gamification, and advanced tracking, transforming how we approach and manage budgets.

Begin with accurate income and expense tracking, prioritize essential expenses, set aside savings first, review regularly, and avoid impulse purchases.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.