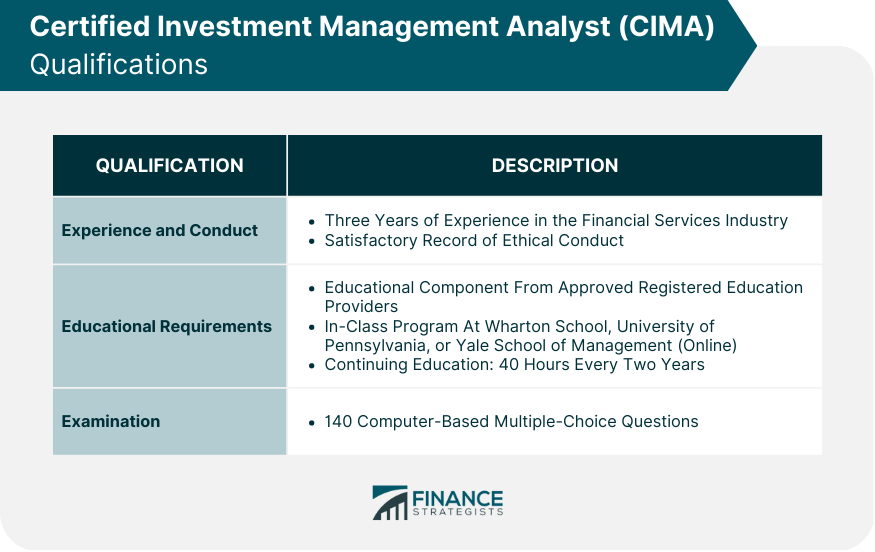

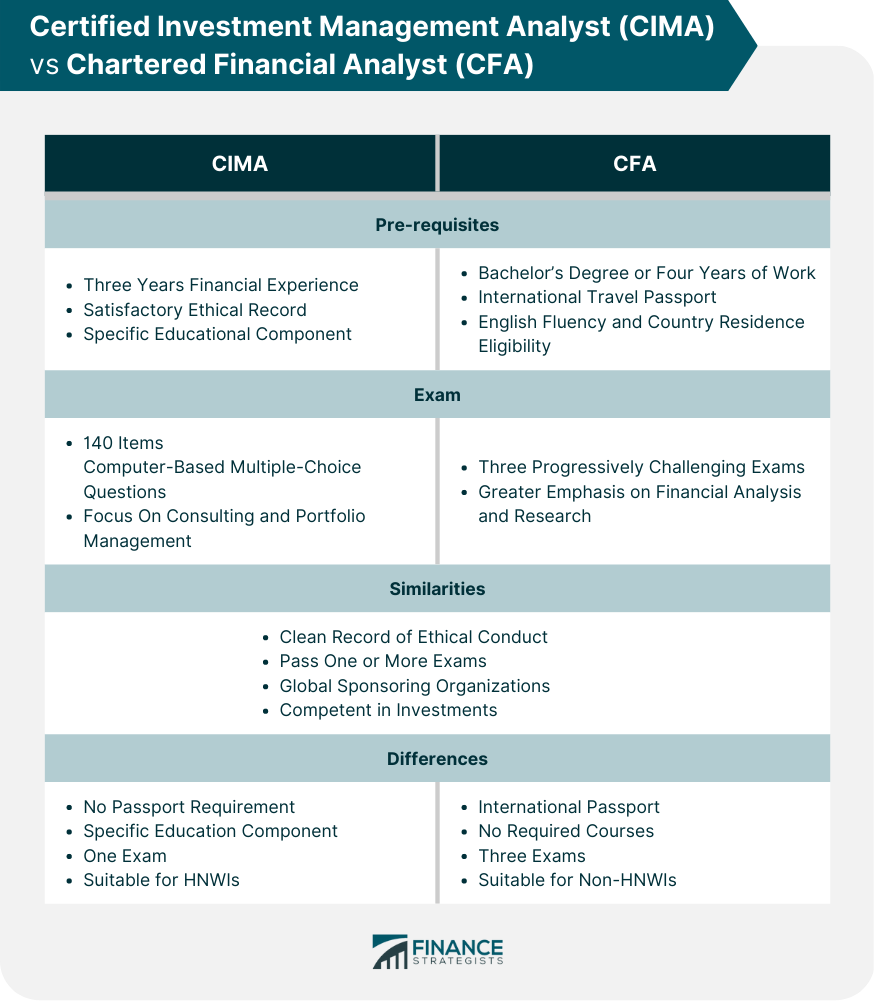

The Certified Investment Management Analyst is a professional certification program designed to provide advanced knowledge and skills in investment management. CIMA certification is considered a mark of excellence in the financial services industry. Those who hold the designation demonstrate expertise in investment consulting, portfolio management, and client service. The certifying body that offers the CIMA designation is the Investments & Wealth Institute. They are a professional association that promotes high standards of professionalism and ethics in the investment management industry. The CIMA program is designed to provide investment professionals with a comprehensive understanding of the investment management process. The designation requires individuals to complete a rigorous course of study that includes coursework, exams, and a minimum of three years of professional experience in the investment management industry. The CIMA designation indicates that an individual has completed a rigorous course of study and has demonstrated expertise in a wide range of investment-related areas, including portfolio management, investment consulting, and client service. Typically, a CIMA will work in a variety of roles in the investment management industry. Some common job responsibilities may include developing investment strategies, managing client portfolios, conducting market research, and providing investment advice to clients. Additionally, CIMA holders may be responsible for managing client relationships, overseeing client service teams, and ensuring that client needs are met in a timely and professional manner. CIMA holders may work in private wealth management and institutional asset management. In private wealth management, CIMA holders may work with high-net-worth individuals (HNWIs) or families, providing investment advice and managing their portfolios. In institutional asset management, CIMA holders may work with large institutional investors. These institutional investors include pension funds, endowments, or foundations, managing their investments and providing investment advice. They also work in investment consulting, where CIMA holders may provide investment advice to a variety of clients. Their consultancy clientele covers individuals, families, and institutions. CIMA holders may opt to work in financial planning and help clients develop comprehensive financial plans that include investment strategies and retirement planning. The CIMA program also emphasizes business strategy, operations, and management, enabling them to make informed decisions about risk assessment and provide advice on the scale of entire corporations or funds. Candidates must have at least three years of experience in the financial services industry, focusing on investment management, consulting, or advisory services. They must have a satisfactory record of ethical conduct, as determined by the Investments & Wealth Institute. They must also complete a specific educational component offered by one of the approved education providers. They are required to attend an in-class program at The Wharton School, University of Pennsylvania, or an online program through Yale School of Management. After completing the educational component, candidates must pass a total of 140 computer-based multiple-choice questions for the Qualification Examination and the Certification Examination at an approved testing center. Maintaining their CIMA designation requires individuals to undergo a continuing education of 40 hours every two years. This ensures that professionals stay up-to-date with the latest developments and adhere to high ethical and professional standards. When it comes to investment management designations, two of the most widely recognized are the CIMA and the Chartered Financial Analyst (CFA). While both designations focus on investment management, they differ in several ways. In terms of prerequisites, the CIMA requires at least three years of financial services experience and a satisfactory record of ethical conduct. On the other hand, the CFA requires a bachelor's degree, or four years of full-time work experience may be substituted for a degree. Additionally, international travel, being fluent in English, and residing in an eligible country is also required for CFAs. Passing the CFA Institute's conduct criteria is also necessary, which examines any past complaints, accusations, or convictions. Both the CIMA and CFA exams are rigorous, but they differ in their structure and content. The CIMA consists of two exams - the Qualification Exam and the Certification Exam - both of which are computer-based and multiple-choice. The CFA, on the other hand, has three levels of exams that are progressively more challenging and cover a wider range of topics. The CIMA places greater emphasis on consulting and portfolio management, while the CFA is geared more toward financial analysis and research. The two sponsoring organizations, Investments & Wealth Institute and CFA Institute, are global entities. Both designations require individuals to have a clean record of ethical conduct and pass one or more exams. Those with the CIMA designation generally concentrate on investment consulting, while CFA holders often work in investment analysis roles at various financial institutions. Despite their different roles, both CFAs and CIMAs exhibit competence in investments and asset allocation. Compared to the CIMA program, the CFA program is more lenient with regard to educational and work prerequisites. Individuals applying for a CIMA designation must have at least three years of experience as an investment consultant. Those applying for a CFA must have a bachelor's degree or four years of relevant work experience. Another notable difference is that CIMA candidates are not required to have an international travel passport, while CFA candidates are. Additionally, while the CFA program does not require candidates to take any courses, CIMA candidates are required to take a specific educational component. The CFA program consists of three exams, whereas CIMA only requires one five-hour exam. When it comes to financial planning advice for individuals, CFAs are more appropriate, except in the case of clients who have a high net worth. For individuals with high net worth, complex financial challenges, or a need for expert support with portfolio management, hiring a CIMA could be an excellent choice. CIMAs have a deep understanding of various investment strategies, asset allocation, and risk management. One of the primary benefits of hiring a CIMA is their ability to provide customized investment solutions tailored to your specific needs and goals. They can help you navigate the complex world of investing and provide you with a personalized investment plan that fits your unique situation. CIMAs also stay up-to-date on the latest industry trends and can offer valuable insights and recommendations. A CIMA can construct and manage a portfolio on your behalf, potentially achieving outcomes that would be difficult to attain independently. You are collaborating with a highly competent advisor who has committed to advancing their knowledge as an advanced investment consultant. It is essential to review factors such as experience, qualifications, and reputation. Look for someone who has a solid track record of delivering results and who has experience working with clients in a financial situation similar to yours. You can also check their credentials and certifications, as well as any professional affiliations or memberships that they hold. Ensure that the CIMA professional that you choose aligns with your investment philosophy and approach. The CIMA designation is a highly respected credential in the investment management industry, and it demonstrates a commitment to the highest standards of professionalism and expertise. The CIMA designation encompasses topics relevant to the investment management process. They are adept at providing individuals with a comprehensive understanding of the industry and the skills necessary to succeed in this dynamic field. They are highly trained investment professionals who work in a variety of roles within the investment management industry. Their job responsibilities may include developing investment strategies, managing portfolios, conducting market research, and providing investment advice to clients. They may work in a variety of work areas. Obtaining the CIMA certification requires a significant investment of time and effort, including meeting eligibility criteria, completing a pre-course and exclusive education program, passing a certification exam, and completing continuing education requirements. Hiring a CIMA professional can be a wise investment decision for those seeking personalized investment solutions and guidance. By following some simple guidelines and doing research, you can find the right professional who can help you achieve your investment goals.What Is a Certified Investment Management Analyst (CIMA)?

What Does a Certified Investment Management Analyst Do?

Certified Investment Management Analyst Qualifications & Requirements

CIMA vs CFA

Pre-requisites

Exam

Similarities

Differences

Should You Hire a Certified Investment Management Analyst?

Final Thoughts

Certified Investment Management Analyst (CIMA) FAQs

The CIMA places greater emphasis on consulting and portfolio management, while the CFA is geared more toward financial analysis and research. Those with the CIMA designation generally concentrate on investment consulting, while CFA holders often work in investment analysis roles at various financial institutions.

Obtaining CIMA certification typically requires a time commitment of 6 to 9 months, during which candidates must complete the necessary coursework and pass the qualifying exams.

CIMA stands for Certified Investment Management Analyst, which is a professional certification awarded by the Investments & Wealth Institute to investment professionals who meet specific education, examination, experience, and ethics requirements. CIMA certification indicates that an individual has advanced knowledge and skills in investment consulting and portfolio management.

The CIMA designation is used to signify that an individual has attained a high level of expertise in the field of investment management and has met rigorous certification standards. It provides evidence that the individual has completed a program designed to enhance their knowledge and skills in investment consulting and portfolio management. Investment professionals may use the CIMA designation to demonstrate their expertise and credibility to clients and employers.

It is recommended that candidates prepare for the CIMA exam through self-study, and it is advised to dedicate around 150 hours for exam preparation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.