Due diligence is a comprehensive and systematic process of investigation, analysis, and evaluation of a business, investment, or transaction. The purpose of due diligence is to identify and assess potential risks, liabilities, and opportunities to ensure informed decision-making and mitigate potential negative outcomes. In business transactions, due diligence plays a crucial role in minimizing risk and maximizing return on investment. It enables parties to make informed decisions, negotiate better deals, and protect their interests by uncovering hidden issues or opportunities that may impact the transaction's success. Financial due diligence focuses on evaluating the financial health and stability of a company. This process involves analyzing financial statements, accounting practices, revenue projections, and historical performance to assess the company's financial condition and future prospects. Legal due diligence deals with reviewing a company's legal and regulatory compliance. This includes examining contracts, licenses, permits, litigation history, and potential legal liabilities to ensure the business is operating within the confines of applicable laws and regulations. The operational due diligence involves evaluating a company's internal processes, management systems, and organizational structure. This process aims to identify operational inefficiencies, bottlenecks, or potential risks that could impact the company's performance and value. Environmental due diligence focuses on identifying potential environmental risks, liabilities, and compliance issues associated with a company's operations. This includes assessing the impact of the company's activities on the environment and ensuring adherence to environmental regulations and standards. Human resources due diligence encompasses the evaluation of a company's workforce, organizational culture, and employment practices. This process involves reviewing employee contracts, compensation structures, benefit programs, and talent management strategies to identify potential risks or areas for improvement. Technology due diligence examines a company's technology infrastructure, systems, and capabilities. This process involves assessing the company's IT assets, cybersecurity measures, data management practices, and technology strategy to ensure the company can meet its business objectives and maintain a competitive advantage. Intellectual property due diligence involves evaluating a company's intellectual property assets, including patents, trademarks, copyrights, and trade secrets. This process aims to identify potential risks, opportunities, and the overall value of a company's intellectual property portfolio. Market and customer due diligence focus on analyzing a company's market position, customer base, and competitive landscape. This process involves assessing market trends, customer demographics, and competitor strategies to identify potential growth opportunities or threats to the company's market share. The due diligence process begins with clearly identifying the objectives of the investigation, such as assessing the company's financial health, identifying potential risks, or uncovering growth opportunities. A multidisciplinary team of experts should be assembled to conduct the due diligence process, including professionals from finance, legal, operations, and other relevant fields. The team should gather initial documentation and information related to the company, including financial statements, legal records, and operational data, to form a basis for the investigation. The team collects relevant data and information from various sources, including interviews, document reviews, and site visits, to gain a comprehensive understanding of the company's operations, finances, and market position. The team analyzes the collected data to identify risks, liabilities, opportunities, and areas for improvement. This may involve financial modeling, legal analysis, operational assessments, and other techniques to evaluate the company's overall health and potential. Based on the analysis and assessment, the team identifies potential risks and opportunities associated with the company or transaction. These findings are crucial for informing decision-making and negotiating the terms of the deal. The due diligence team consolidates its findings into a comprehensive report, highlighting key risks, opportunities, and recommendations for the parties involved. Based on the findings, the team develops recommendations for addressing identified risks, capitalizing on opportunities, and improving the company's overall performance and value. Armed with the due diligence report and recommendations, the parties involved can make informed decisions regarding the transaction, such as renegotiating deal terms, implementing risk mitigation strategies, or walking away from the deal altogether. Company Background and Structure: Understanding the company's background, history, and organizational structure is essential for evaluating its stability and potential for growth. Financial Performance and Projections: Analyzing the company's financial performance and projections is crucial for assessing its financial health and future prospects. Legal and Regulatory Compliance: Ensuring the company is in compliance with relevant laws and regulations helps to mitigate potential legal risks and liabilities. Existing Contracts and Agreements: Reviewing existing contracts and agreements can reveal potential risks, liabilities, or opportunities related to third-party relationships. Market and Competitive Landscape: Understanding the market and competitive landscape is essential for identifying potential growth opportunities or threats to the company's market share. Workforce and Organizational Culture: Evaluating the company's workforce and organizational culture can help identify potential risks or areas for improvement related to employee satisfaction, retention, and productivity. Technology and Infrastructure: Assessing the company's technology and infrastructure can reveal potential risks or opportunities related to IT assets, cybersecurity, and data management practices. Intellectual Property Portfolio: Evaluating the company's intellectual property portfolio can help identify potential risks, opportunities, and the overall value of its intangible assets. Incomplete or Inaccurate Information: One challenge of due diligence is obtaining complete and accurate information, as some data may be unavailable or intentionally withheld. Time and Resource Constraints: Due diligence can be time-consuming and resource-intensive, potentially limiting the depth and scope of the investigation. Bias and Subjectivity: The due diligence process may be influenced by biases and subjectivity, which can impact the accuracy and reliability of the findings. Cultural and Language Barriers: Cultural and language barriers can pose challenges when conducting due diligence, particularly in international transactions. Unforeseen External Factors: External factors, such as economic, political, or environmental changes, can impact a company's performance and value, even after thorough due diligence has been conducted. Establish Clear Objectives and Scope: Define the objectives and scope of the due diligence process to ensure a focused and efficient investigation. Utilize a Multidisciplinary Team: Assemble a team of experts from various disciplines to provide a comprehensive and well-rounded assessment of the company. Verify Information Through Multiple Sources: Cross-check information from multiple sources to ensure the accuracy and reliability of the findings. Maintain Confidentiality and Data Security: Protect the confidentiality and security of sensitive information throughout the due diligence process. Communicate Findings and Recommendations Effectively: Present findings and recommendations in a clear, concise, and actionable manner to inform decision-making and facilitate negotiations. Conducting comprehensive due diligence is essential for making informed decisions, minimizing risk, and maximizing value in business transactions. A thorough due diligence process enables parties to identify potential risks and opportunities, negotiate better deals, and protect their interests. Due diligence should not be considered a one-time event; it is essential to continually monitor and manage risks and opportunities as the business environment evolves. Ongoing due diligence helps businesses adapt to changing market conditions, maintain a competitive edge, and ensure long-term success. As the business landscape continues to evolve, it is crucial for companies and investors to adapt their due diligence processes to address emerging risks, opportunities, and trends. By staying proactive and adapting to change, businesses can make better-informed decisions and optimize their performance and growth.What Is Due Diligence?

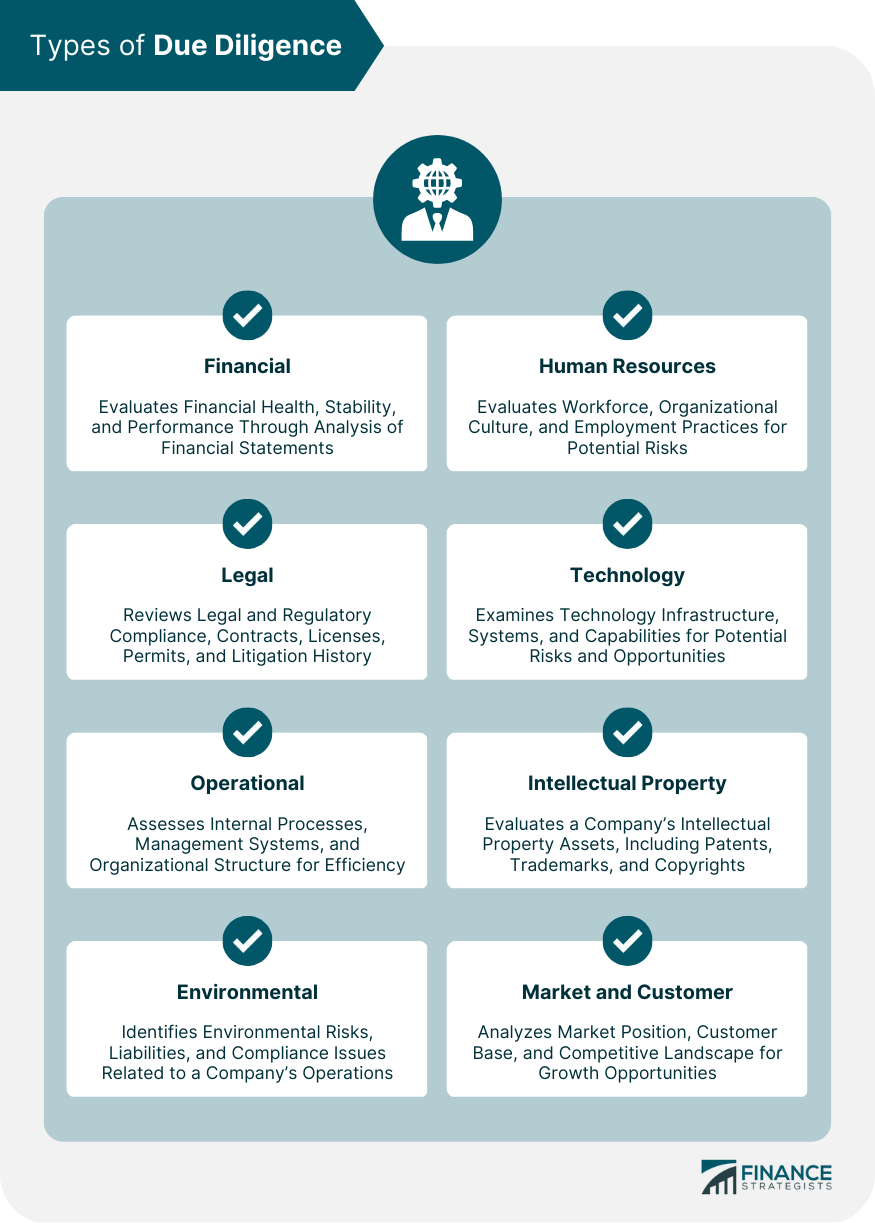

Types of Due Diligence

Financial Due Diligence

Legal Due Diligence

Operational Due Diligence

Environmental Due Diligence

Human Resources Due Diligence

Technology Due Diligence

Intellectual Property Due Diligence

Market and Customer Due Diligence

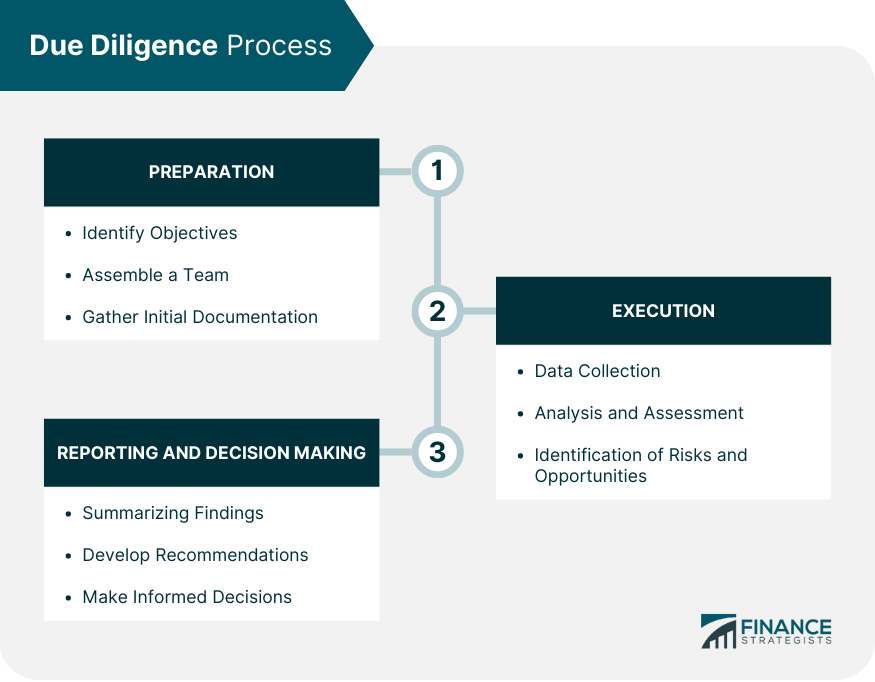

Due Diligence Process

Preparation

Identify Objectives

Assemble a Team

Gather Initial Documentation

Execution

Data Collection

Analysis and Assessment

Identification of Risks and Opportunities

Reporting and Decision Making

Summarizing Findings

Develop Recommendations

Make Informed Decisions

Key Factors to Consider in Due Diligence

Challenges and Limitations of Due Diligence

Best Practices for Effective Due Diligence

Conclusion

Due Diligence FAQs

Due diligence is a comprehensive and systematic process of investigation, analysis, and evaluation of a business, investment, or transaction. It helps identify and assess potential risks, liabilities, and opportunities to ensure informed decision-making and mitigate potential negative outcomes.

There are various types of due diligence, including financial, legal, operational, environmental, human resources, technology, intellectual property, and market and customer due diligence. Each type focuses on a specific aspect of a company's operations or performance.

Key factors to consider in the due diligence process include company background and structure, financial performance and projections, legal and regulatory compliance, existing contracts and agreements, market and competitive landscape, workforce and organizational culture, technology and infrastructure, and intellectual property portfolio.

Some challenges and limitations of conducting due diligence include incomplete or inaccurate information, time and resource constraints, bias and subjectivity, cultural and language barriers, and unforeseen external factors that can impact a company's performance and value.

To ensure effective due diligence, businesses should establish clear objectives and scope, utilize a multidisciplinary team, verify information through multiple sources, maintain confidentiality and data security, and communicate findings and recommendations effectively. Ongoing monitoring and risk management are also essential for adapting to changing business environments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.