Cash flow and income are two terms often used interchangeably, yet they serve different functions in financial planning. Income represents the earnings a person or business receives, be it from a job, investment, or any other source. It's a broader concept. On the other hand, cash flow digs deeper, focusing on the timing and volume of money as it enters and exits an account. Cash flow-based financial planning, therefore, offers a comprehensive view of one's financial situation, shedding light on not just what is earned, but how it is spent, saved, and invested over time. An emphasis on cash flow moves the lens from just counting earnings to understanding the dynamics of money. It's like watching the tides of an ocean; it gives insights into the ebbs and flows, the peaks and troughs. Planning based on cash flow allows individuals and businesses to craft strategies that ensure stability during low tide and capitalize on the high tides, creating a balanced financial ecosystem. The primary purpose of cash flow-based financial planning lies in its ability to offer a snapshot of one's financial health. By dissecting every inflow and outflow, one can identify strengths, vulnerabilities, and areas that need attention. It's like a health check-up but for finances. Such an approach provides a firm foundation upon which future financial strategies can be built. Moreover, forecasting is a pivotal component of financial planning. With an emphasis on cash flow, one can anticipate future financial needs more accurately. Whether it's setting aside funds for an upcoming investment, preparing for potential economic downturns, or planning major life events like purchasing a home or retirement, a cash flow-centric approach paves the way for proactive and informed decision-making. Operating activities encompass the primary, day-to-day transactions of a business or individual. This category usually includes revenue from selling goods or providing services, payments made to suppliers, wages given to employees, and other regular operational expenses. For an individual, it might involve salaries, daily living expenses, and routine financial commitments. The data from operating activities offer insights into everyday financial health, indicating whether core operations generate enough cash to sustain them. Investing activities entail transactions related to the acquisition or disposal of long-term assets. For businesses, this can include purchasing or selling physical assets like machinery, property, or equipment, as well as investments in securities or stakes in other companies. For individuals, this might reflect buying or selling property, stocks, or bonds. By examining investing activities, one can discern how resources are allocated for growth and the long-term financial strategy being pursued. Financing activities encompass all transactions related to an entity's capital and borrowings. This includes activities like procuring loans, issuing or buying back stock, paying dividends, or settling long-term debts. For an individual, this might manifest as taking out mortgages, repaying personal loans, or any other borrowings. Analyzing financing activities provides a clear picture of how a business or individual is leveraging external funding, managing debt, and growing or maintaining their capital structure. This step involves cataloging all avenues from which an individual earns money. Common sources include salaries or wages, interest from savings accounts, dividends from investments, rental income, and returns from side hustles or freelance work. By clearly recognizing all income streams, an individual gains a comprehensive view of their total earning potential within a specific time frame, usually monthly or annually. Here, one must itemize all outflows of money. Fixed expenses remain consistent over time, such as rent, mortgage payments, or insurance premiums. Variable expenses, on the other hand, fluctuate based on usage or consumption, like groceries, entertainment, or utility bills. By distinguishing between these two types of expenses, individuals can determine which costs are obligatory and which ones they have more control over, aiding in effective budgeting. A personal cash flow statement isn't a one-time task. It requires regular scrutiny and updates to reflect any changes in income or expenses. This dynamic approach ensures the statement remains relevant, allowing for more accurate financial decision-making. Periodic revisions can also highlight patterns, helping individuals identify areas of improvement in their financial habits. Short-term cash flow projections focus on imminent financial obligations and opportunities, often spanning weeks to months. This could involve planning for upcoming bills, anticipating irregular expenses like car repairs or medical emergencies, or identifying short-term income prospects. By assessing the near-future cash inflows and outflows, individuals can ensure they maintain a positive cash balance and avoid potential financial pitfalls. Looking further ahead, long-term cash flow projections typically encompass several years. This might involve strategies for saving up for significant life events, such as buying a home, funding higher education, or retirement planning. By visualizing cash inflows and outflows over an extended period, individuals can set financial milestones, identify potential investment opportunities, and strategize to achieve long-term financial goals. Metrics are to finance what vital signs are to medicine – they offer a quick assessment of health. The operating cash flow margin is a metric that gauges operational efficiency. By comparing cash flows from operations to total revenues, it highlights the efficiency of core operations in generating cash. A robust margin suggests a business or individual has a steady inflow from their primary activities. Furthermore, it's not just about the absolute value of the metric but its trend over time. A consistently improving operating cash flow margin can be indicative of growing operational efficiency, which can bode well for future financial stability and growth. On the flip side, a declining trend might warrant a closer examination of core activities and strategies. Another crucial metric is the free cash flow yield. It serves as a tool to assess a company's financial flexibility. By comparing free cash flow per share to the company's current share price, it provides an efficiency ratio that can guide investment decisions. A higher yield might suggest that the company is generating a good amount of cash relative to its share price, potentially indicating an undervalued stock. Moreover, in the context of cash flow-based financial planning, comparing this metric with peers in the industry can be illuminating. It allows individuals or businesses to benchmark their financial efficiency against others, spotlighting areas of excellence or those needing improvement. Such comparisons foster informed decision-making and strategic pivots when needed. Understanding the time lag between when money is spent and when it's received is pivotal in financial planning. The cash conversion cycle metric shines a light on this. For businesses, it assesses the time taken between buying raw materials and receiving payment for the finished product. For individuals, it can be tailored to reflect the time between major expenditures and income receipt. Liquidity management finds its roots in the cash conversion cycle. A shorter cycle indicates quicker cash turnarounds, implying that funds are readily available. Conversely, a longer cycle might suggest potential liquidity crunches. By keeping a close eye on this metric, individuals and businesses can craft strategies to ensure they're never caught off guard by a cash shortage. Cash flow-based financial planning brings every financial transaction under scrutiny. This intense focus naturally leads to heightened financial awareness. By mapping out every inflow and outflow, spending patterns become evident. Understanding where the money goes is the first step in crafting a well-informed financial strategy. Moreover, this heightened awareness often leads to the identification of potential savings. It might be a subscription that's no longer needed or a recurring expense that can be minimized. By having a granular view of finances, one can pinpoint areas of excess and trim them, optimizing financial health. Awareness begets insight, and insight paves the way for better decisions. With a clear understanding of cash flows, individuals can reduce financial strain by making well-informed choices. Knowing when a significant inflow is expected, for instance, allows for planning larger expenditures, ensuring they don't disrupt the financial balance. Furthermore, with a clear cash flow map, resources can be allocated more efficiently. It's like directing traffic; knowing where the congestions are and where the paths are clear allows for smoother flow. Similarly, understanding financial bottlenecks and surpluses ensures that funds are channeled effectively, maximizing returns and stability. With a clear view of finances, preparing for uncertainties becomes more straightforward. Establishing an emergency fund, for instance, is a crucial aspect of risk management. Cash flow-based planning can offer insights into how big this fund should be, based on typical monthly expenses and anticipated contingencies. Furthermore, a cash flow-centric approach can also aid in better debt management. By understanding when debts are due, what their interest rates are, and when income is expected, individuals can craft payment strategies that minimize interest costs while avoiding penalties. Properly managed debt can even become an asset, offering leverage in various financial strategies. Financial planning is, at its core, goal-oriented. By aligning cash flows with objectives, setting and meeting financial goals becomes more systematic. For instance, if a goal is to purchase a new home in five years, cash flow-based planning can break this down into monthly savings targets, ensuring that when the time comes, the funds are available. Furthermore, these goals aren't just about numbers. They tie into life's broader objectives – be it personal comfort, family needs, or future aspirations. By ensuring that these financial milestones are met, cash flow-based planning contributes to a fulfilling life journey anchored in financial stability. Economies are dynamic, influenced by global events, policy changes, and countless other factors. A robust financial plan needs to factor in these shifts, ensuring stability during economic downturns while capitalizing on booms. Cash flow-based financial planning, with its granular view, offers the tools to adapt to such shifts. For instance, in the face of a recession, a clear understanding of cash flows can guide cost-cutting, prioritize essential expenses, and suggest potential alternative income streams. Conversely, during economic booms, insights from cash flow-based planning can inform investment strategies, ensuring that surplus cash is directed towards avenues that offer the best returns. With a primary focus on cash flows, there's a risk of being overly concerned with liquidity, potentially sidelining long-term growth opportunities. Keeping large cash reserves might offer a sense of security, but it can also mean missed investment chances that could offer substantial future gains. Additionally, an excessive focus on liquidity might make one overly risk-averse. While caution is prudent in financial planning, excessive caution can be as limiting as recklessness. Striking a balance between liquidity and growth-oriented strategies is essential to ensure a well-rounded financial approach. Detailed financial tracking, as is the essence of cash flow-based planning, can be intricate. Gathering every piece of financial data, from daily expenses to occasional income, can be a demanding task. The granularity, while offering insights, also means investing considerable time and effort. Moreover, to remain effective, these cash flow statements demand regular updating and monitoring. Financial landscapes evolve, and a once accurate cash flow projection can quickly become obsolete. Maintaining the precision and relevance of these documents can, over time, become a formidable chore. The future remains, to a large extent, unpredictable. Even the most meticulous cash-flow-based financial planning can't account for every unforeseen expense or overestimated income. A sudden medical emergency, for instance, can disrupt even the most detailed financial forecast. Furthermore, while projections are grounded in historical data and trends, they remain, at their core, educated guesses. External factors, from global economic events to personal life changes, can render these projections inaccurate, calling for adaptive strategies and continuous revisions. Analyzing every financial detail offers insights, but it also poses the risk of "analysis paralysis." With excessive data, decision-making can become daunting, bogged down by myriad variables and possibilities. Instead of facilitating choices, the sheer volume of information can stall them. Moreover, a hyper-analytical approach might sideline spontaneous financial opportunities. While impulse should never guide financial strategies, there's also a place for intuitive decisions grounded in experience and instincts. Over-relying on data might overshadow these instincts, potentially sidelining rewarding ventures. The inherent nature of cash flow-based financial planning is its dependence on historical data. This data provides a blueprint, allowing one to trace financial patterns and make projections. However, relying solely on historical data might not account for unprecedented events or shifts in financial behavior. For instance, a business might have experienced consistent growth over the past decade, but that doesn't insulate it from unforeseen market shifts in the upcoming years. Furthermore, using only past data can sometimes anchor individuals or businesses to repetitive financial behaviors, even if they aren't optimal. This means that if there were any mistakes or inefficiencies in the past, there's a risk they might be carried forward into future strategies. A balanced approach would be to use historical data as a foundation but ensure it's complemented with forward-looking insights and flexibility. Financial landscapes are never static. As such, any cash flow statement, no matter how meticulously crafted, requires periodic reviews. By regularly revisiting these statements, individuals can ensure they remain accurate, reflecting current income streams, expenses, and financial obligations. Regular monitoring not only keeps the document relevant but also spots financial anomalies or opportunities that might arise. Adjusting to changing financial circumstances is equally vital. Consider scenarios like a sudden salary hike, an unexpected inheritance, or even a job loss. Each of these situations demands a reevaluation of the cash flow statement, ensuring it remains a true reflection of one's financial reality. The ability to adapt in real-time, ensures that financial planning remains a proactive, rather than reactive, exercise. In the age of technology, manual tracking of every financial detail can be overwhelming. Thankfully, various software and tools simplify the process, bringing automation into the mix. ]The benefits of automation are manifold. For one, it reduces the chance of human error. Moreover, automated tools often come with built-in analytics, offering insights that might be missed during manual evaluations. In terms of available financial planning applications, the market is replete with options catering to diverse needs. From personal budget trackers to sophisticated business cash flow analyzers, there's a tool for every requirement. By investing in the right software, one can streamline the financial planning process, making it more efficient and insightful. Not everyone is a financial expert. At times, the intricacies of cash flow-based planning might exceed personal expertise. This is where financial advisors come into play. These professionals, with their depth of knowledge and experience, can offer guidance tailored to individual financial scenarios. They can interpret data, suggest strategies, and offer an external perspective that might be missed in personal evaluations. But when should one consider seeking this professional help? The answer varies. For some, it might be during major life transitions like marriage, childbirth, or retirement planning. For businesses, it could be during expansions, mergers, or any significant financial restructuring. Essentially, any time the financial landscape feels too vast or intricate, bringing in an expert might be a wise decision. The world of finance is ever-evolving, with new strategies, products, and trends emerging continually. For effective cash flow-based financial planning, staying updated is essential. This goes beyond just tracking personal finances. It involves understanding broader financial trends and strategies, and ensuring that planning remains aligned with the best practices of the day. To achieve this, attending workshops and webinars can be invaluable. These platforms offer insights, often from industry experts, bringing to light new developments in the financial world. Regularly participating in such educational platforms ensures that one's financial knowledge remains current, facilitating informed and optimized planning. No matter how meticulously one plans, unpredictability is an inherent part of financial landscapes. Unforeseen medical expenses, sudden home repairs, or unexpected business expenditures can disrupt even the most detailed cash flow plan. To counteract these unpredictable financial events, it's wise to incorporate a buffer in any financial planning. What does this buffer look like? It's essentially a financial cushion, set aside to manage unexpected costs. The size of the buffer might vary based on individual risk appetites and financial obligations, but its presence ensures financial resilience. With this buffer in place, even when faced with unforeseen expenses, one's overall financial strategy remains undisturbed, ensuring stability and peace of mind. Cash flow-based financial planning delves deeper than mere earnings, focusing on the dynamics of money's movement. This method emphasizes the importance of understanding the timing and volume of income and expenses, much like observing oceanic tides. At the heart of this approach is the cash flow statement, a detailed record of financial transactions across various activities. Personal cash flow statements, projections, and key metrics serve as tools to visualize, anticipate, and gauge financial health. While the benefits of this method are vast, from enhanced financial awareness to improved risk management, it also comes with challenges like potential overemphasis on liquidity and the complexities of the process. To effectively navigate this planning approach, best practices include regular monitoring, leveraging technology, seeking expert guidance, continuous financial education, and establishing financial buffers. What Is Cash Flow-Based Financial Planning?

Purpose and Importance of Cash Flow-Based Financial Planning

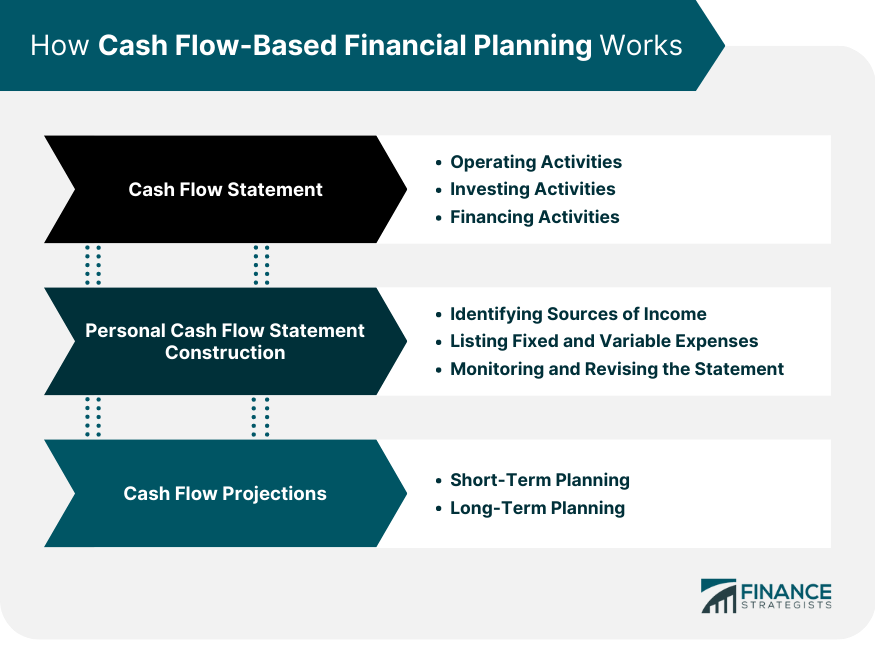

How Cash Flow-Based Financial Planning Works

Cash Flow Statement

Operating Activities

Investing Activities

Financing Activities

Constructing a Personal Cash Flow Statement

Identifying Sources of Income

Listing Fixed and Variable Expenses

Monitoring and Revising the Statement

Utilizing Cash Flow Projections

Short-Term Planning

Long-Term Planning

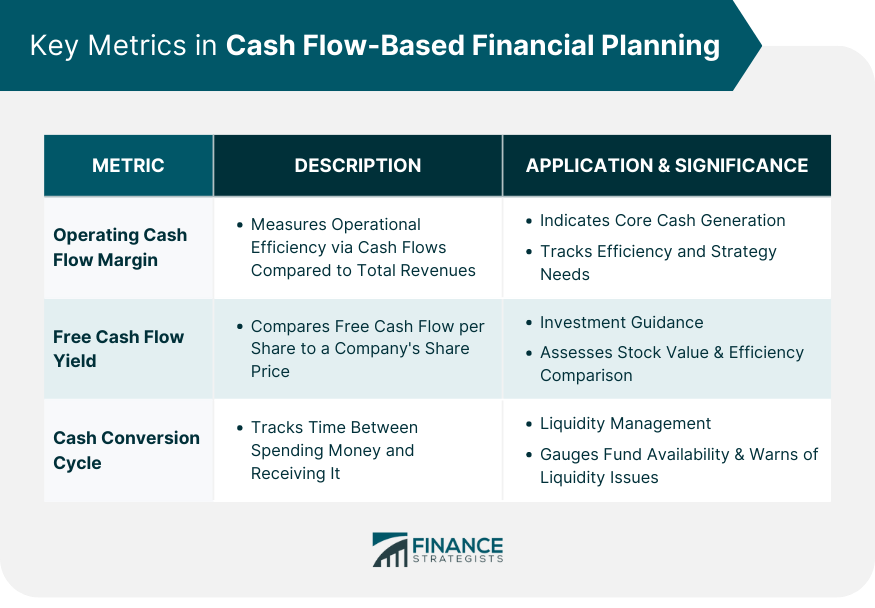

Key Metrics in Cash Flow-Based Financial Planning

Operating Cash Flow Margin

Free Cash Flow Yield

Cash Conversion Cycle

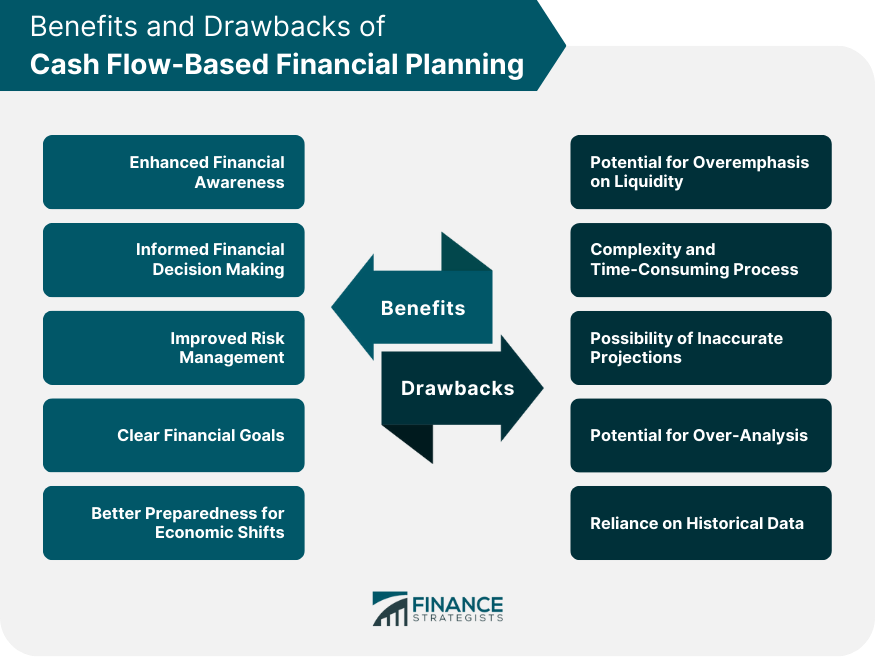

Benefits of Cash Flow-Based Financial Planning

Enhanced Financial Awareness

Informed Financial Decision Making

Improved Risk Management

Clear Financial Goals

Better Preparedness for Economic Shifts

Drawbacks of Cash Flow-Based Financial Planning

Potential for Overemphasis on Liquidity

Complexity and Time-Consuming Process

Possibility of Inaccurate Projections

Potential for Over-Analysis

Reliance on Historical Data

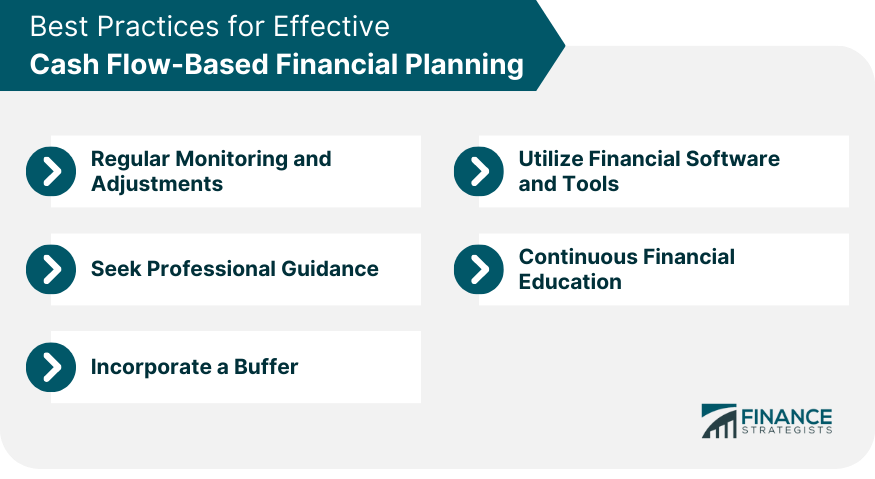

Best Practices for Effective Cash Flow-Based Financial Planning

Regular Monitoring and Adjustments

Utilizing Financial Software and Tools

Seeking Professional Guidance

Continuous Financial Education

Incorporating a Buffer

Final Thoughts

Cash Flow-Based Financial Planning FAQs

It's a method of planning that emphasizes tracking and managing inflows and outflows of money to ensure financial stability and growth.

It offers a clear picture of one's financial health, aids in forecasting future needs, and ensures alignment with financial goals.

Notable metrics include operating cash flow margin, free cash flow yield, and cash conversion cycle.

It enhances financial awareness, informs decisions, improves risk management, sets clear financial goals, and prepares for economic shifts.

Yes, it can lead to an overemphasis on liquidity, complexity, potential for inaccurate projections, over-analysis, and a heavy reliance on historical data.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.