The Financial Planning Pyramid is a conceptual tool used in the world of finance and personal financial planning to prioritize various financial needs and goals in a hierarchical manner. The base of the pyramid typically emphasizes the establishment of emergency funds and insurance to ensure protection against unforeseen adversities. As one moves up the pyramid, the focus shifts to critical areas such as debt management, which includes strategies for handling credit card debt, student loans, and mortgages. The midsection of the pyramid deals with core investments aimed at steadily building wealth over time using instruments like stocks, bonds, and real estate. The pyramid's apex, being the most risk-tolerant zone, is reserved for speculative investments, which might include newer stock market entries, cryptocurrency, or other high-risk, high-reward assets. The Financial Planning Pyramid, thus, offers individuals a structured approach to organizing and addressing their financial goals in a methodical and strategic manner. The Financial Planning Pyramid is built on the concept of moving from foundational, essential financial needs to more advanced and speculative financial activities as one progresses upwards in the pyramid. By thoroughly understanding each layer and its components, individuals can craft a tailored financial plan that aligns with their current situation, risk tolerance, and long-term goals. Serving as the foundation of a robust financial plan, this layer emphasizes the importance of immediate liquidity and protective measures against unforeseen adversities. This refers to liquid savings typically held in cash or a savings account, which can be easily accessed during emergencies. Ideally, this fund should cover: Medical emergencies Unexpected home or auto repairs Sudden loss of income (e.g., due to job loss) Any unanticipated significant expenses Health Insurance: Covers medical expenses, surgeries, hospital stays, and sometimes even regular check-ups. Life Insurance: Provides financial support to beneficiaries (often family members) in the event of the policyholder's death. Property Insurance: Covers damages to property due to events like fires, theft, or natural disasters. Auto Insurance: For damages to vehicles from accidents or other mishaps. Disability Insurance: Offers income replacement in case the policyholder becomes unable to work due to disability. Long-Term Care Insurance: Assists in covering the costs of services like home care or nursing home stays. Addressing and eliminating financial liabilities, this layer underscores the significance of a debt-free life to foster a healthy financial future. Credit Card Debt: Tackling high-interest credit card debt should be a priority, given its compound nature. Mortgages: Home loans that often come with lower interest rates but are long-term commitments. Refinancing or making extra payments can be strategies to manage and reduce mortgage debts. Student Loans: Especially significant for younger individuals or those in higher education. Consider options like loan consolidation or government forgiveness programs. Auto Loans: For vehicle purchases. Prioritizing higher-interest auto loans can save on total payment amounts. Personal Loans: These are usually unsecured debts taken out for various purposes and can have varied interest rates. Central to wealth accumulation, this layer focuses on strategic placements of funds into diverse assets to achieve steady growth and financial security over time. Stocks: Equity investments in companies that offer potential for growth and dividends. Bonds: Debt securities that pay interest over a fixed term and return the principal at maturity. Mutual Funds: Pooled funds from multiple investors used to purchase a diversified portfolio of stocks, bonds, or other assets. Retirement Accounts: Tax-advantaged accounts designed for long-term savings and investments for retirement. Real Estate: Investing in properties, whether residential, commercial, or land, offers potential for rental income and capital appreciation. Fixed Deposits/Time Deposits: Interest-bearing bank accounts with a fixed term, often safer but with lower returns. At the pyramid's pinnacle, this layer delves into high-risk, high-reward ventures suitable for those with higher risk tolerance and a desire for significant potential returns. Cryptocurrencies: Digital or virtual currencies like Bitcoin, Ethereum, and many others. Highly volatile but with potentially high returns. Emerging Market Stocks: Equities from developing countries that might offer high growth potential but come with increased risks. Venture Capital: Investments in startups or young companies with high growth potential. Commodities: Investing in raw materials like gold, oil, or agricultural products. Foreign Exchange (Forex) Trading: The trading of currencies based on their value fluctuations. Derivatives: Financial contracts like futures, options, or swaps based on the value of underlying assets. Balancing the strengths and potential limitations of the Financial Planning Pyramid can help individuals use it as an effective tool while tailoring it to their specific needs and situations. Structured Approach: The pyramid offers a step-by-step guide, helping individuals prioritize and organize their financial goals in a methodical manner, starting from basic necessities to more advanced financial aspirations. Risk Management: By placing emergency funds and insurance at the base, the pyramid underscores the significance of establishing a safety net against potential financial adversities before taking on higher-risk ventures. Holistic Financial View: It provides a comprehensive picture of one's entire financial landscape, making it easier to identify gaps, redundancies, or areas that may need more attention. Promotes Discipline and Long-Term Planning: By visualizing the journey from foundational needs to speculative investments, individuals are more likely to stay disciplined in their financial decisions. One-Size-Doesn't-Fit-All: While the pyramid provides a general framework, everyone's financial situation is unique. Strictly adhering to the pyramid might not be suitable for everyone's individual circumstances. Potential for Over-Conservatism: If followed too rigidly, there's a risk that individuals might become too conservative, focusing excessively on the base layers and missing out on beneficial financial opportunities in the higher layers. Complexity for Beginners: While the pyramid is designed to simplify financial planning, the multitude of layers and components might overwhelm or confuse financial planning novices. Dynamic Financial Landscape: The financial world is continually evolving with new instruments, technologies, and strategies. The pyramid might need regular revisions to stay relevant and effective. Implementing strategies can help maximize the benefits of the Financial Planning Pyramid, ensuring it serves as an effective roadmap for your financial journey. Tailor its layers to fit your unique financial situation, goals, and risk tolerance. While the pyramid provides a universal structure, each person's financial journey is unique, demanding specific adjustments. By personalizing your approach, you ensure that every financial step aligns with your individual aspirations and lifestyle. It's essential to revisit and realign your financial pyramid periodically to ensure it remains relevant to your current circumstances. As life progresses, certain financial goals may be achieved, new ones might emerge, and priorities can shift. Regular assessments will ensure that your pyramid remains a true reflection of your evolving financial landscape. If you're uncertain about any layer or how to prioritize, consider seeking advice from financial professionals. Financial advisors can provide insights, help you navigate complexities, and tailor the pyramid to your financial landscape. These professionals have the experience and training to foresee potential pitfalls, offer alternatives, and guide you through intricate financial decisions, ensuring your pyramid is both robust and versatile. Stay updated with financial news, attend seminars, or take courses to enhance your understanding of new investment avenues, risk management techniques, and financial strategies. With the rapid evolution of financial instruments and markets, continuous education ensures that you're well-equipped to make informed decisions. This not only boosts your confidence in navigating the pyramid but also empowers you to optimize every financial opportunity.h While the pyramid inherently emphasizes this with its structure, it always assesses potential returns against the risks involved. For instance, before diving deep into the speculative investments layer, ensure you have a strong foundation and are mentally and financially prepared for potential losses. Balancing risk and reward doesn't mean shying away from high-reward opportunities; instead, it's about ensuring you've taken measured steps and have a safety net in place. With this equilibrium, you can explore financial ventures with both ambition and caution. The Financial Planning Pyramid stands as a strategic framework that guides individuals in achieving their financial aspirations with a structured and methodical approach. By recognizing the hierarchy of needs and goals, from establishing emergency funds and insurance to venturing into speculative investments, individuals can tailor their financial plans to their unique circumstances. The pyramid's strengths lie in its structured methodology, promoting risk management by prioritizing foundational layers and offering a comprehensive view of one's financial landscape. However, its limitations include potential inflexibility for diverse situations and the risk of over-conservatism. Regular reassessment, seeking expert advice, and ongoing education empower individuals to navigate complexities. Ultimately, the Financial Planning Pyramid serves not as a rigid formula but as a dynamic tool to guide individuals towards financial success, incorporating prudence, adaptability, and informed decision-making along the journey.What Is a Financial Planning Pyramid?

How Financial Planning Pyramid Works

Base Layer: Emergency Funds and Insurance

Emergency Funds

Insurance

Second Layer: Debt Management

Third Layer: Core Investments

Fourth Layer: Speculative Investments

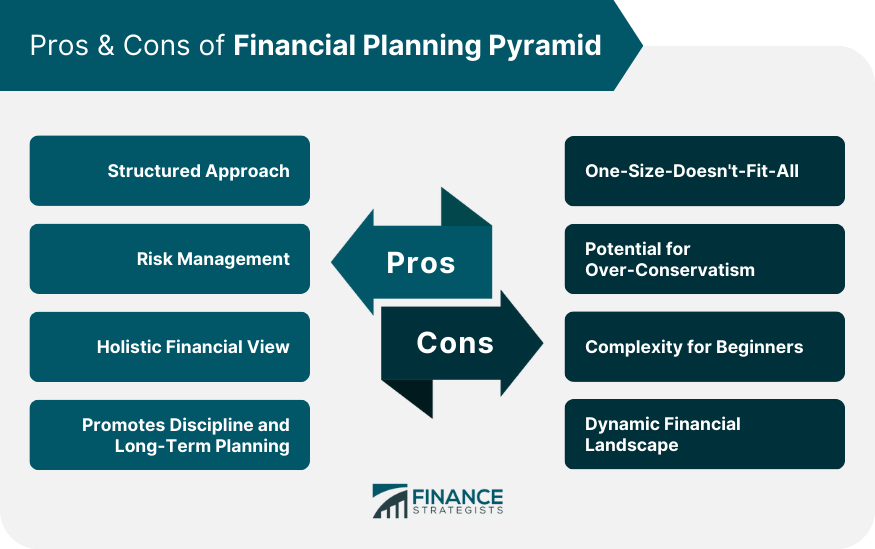

Pros & Cons of Financial Planning Pyramid

Pros

Cons

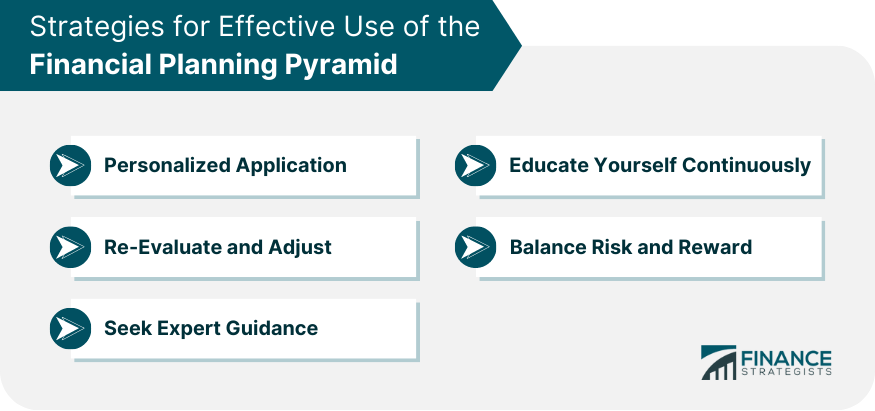

Strategies for Effective Use of the Financial Planning Pyramid

Personalized Application

Re-Evaluate and Adjust

Seek Expert Guidance

Educate Yourself Continuously

Balance Risk and Reward

Conclusion

Financial Planning Pyramid FAQs

The Financial Planning Pyramid is a hierarchical tool used in personal financial planning to prioritize various financial needs and goals, from essentials like emergency funds to speculative investments.

The Financial Planning Pyramid works by structuring financial goals from foundational needs at the base to more advanced and risky activities at the top, providing a step-by-step approach to building a comprehensive financial plan.

The Financial Planning Pyramid consists of four layers: Base Layer: Emergency Funds and Insurance. Second Layer: Debt Management, Third Layer: Core Investments, and Fourth Layer: Speculative Investments.

The pros of the Financial Planning Pyramid include its structured approach, emphasis on risk management through foundational layers, a holistic view of finances, and encouragement of disciplined, long-term planning.

To use the Financial Planning Pyramid effectively, personalize it to your situation and risk tolerance, regularly re-evaluate and adjust it to changing circumstances, seek expert guidance, continuously educate yourself about financial options, and balance risk and reward as you progress through its layers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.