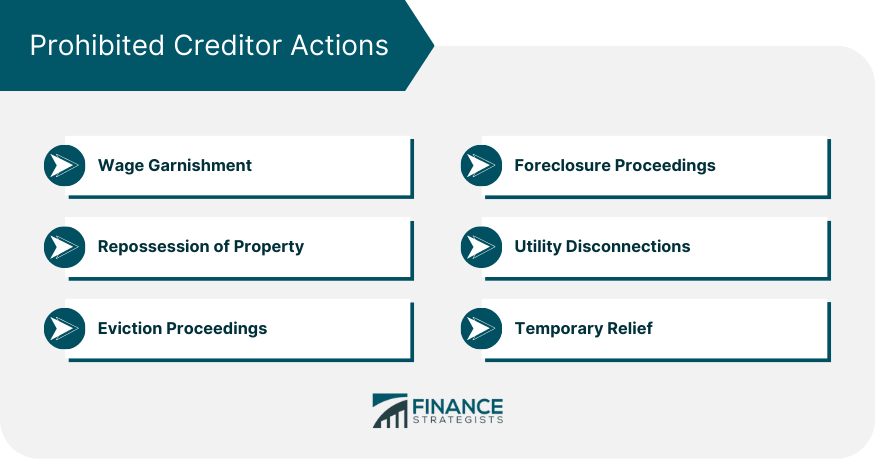

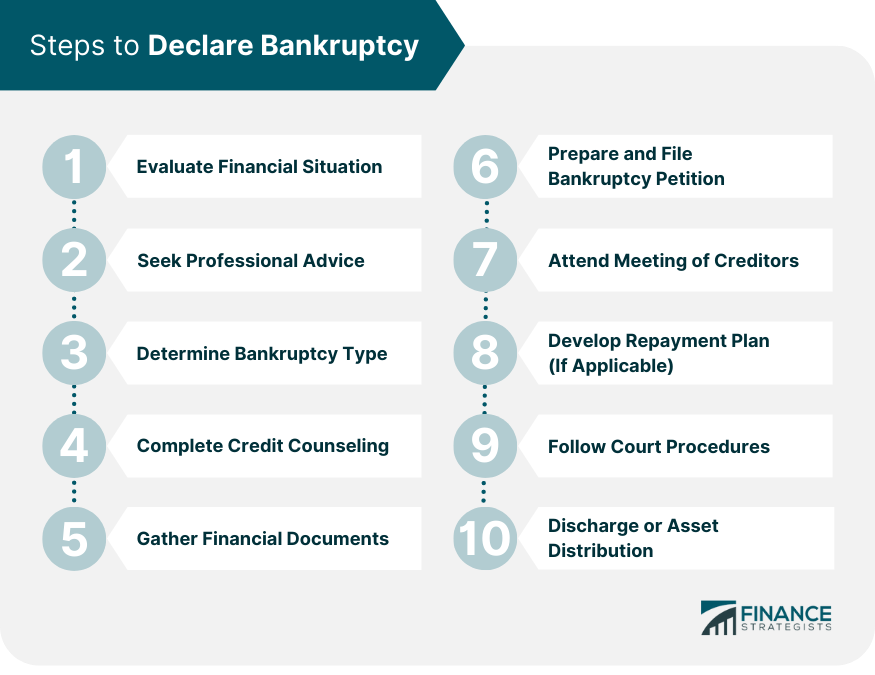

Bankruptcy is a legal status or process in which individuals, businesses, or organizations declare themselves unable to repay their outstanding debts to creditors. It is a means to seek financial relief and protection from legal actions initiated by creditors in order to resolve their financial difficulties. The specific laws and regulations governing bankruptcy vary from country to country, but the overall purpose is to provide a structured framework for managing and resolving outstanding debts. The process of declaring bankruptcy can be complex and may vary depending on the jurisdiction and type of bankruptcy filing. However, here is a general outline of the steps involved: Before proceeding, it is crucial to evaluate your financial situation thoroughly. This evaluation will help you determine if bankruptcy is the right option for you. Make a comprehensive list of all outstanding debts, including credit card balances, medical bills, personal loans, mortgages, and any other financial obligations. Take note of the total amount owed, the interest rates, and the monthly payment requirements. Identify all the properties, vehicles, investments, retirement accounts, and valuable possessions you own. Determine their current market value and consider any outstanding loans or liens associated with these assets. Calculate your monthly income after taxes and deductions. Consider any fluctuating or irregular income you may receive. Evaluating your income will help you understand your ability to repay debts and meet your essential living expenses. Examine your monthly expenses, including housing costs, utility bills, transportation expenses, groceries, healthcare, insurance premiums, and other necessary expenditures. Differentiate between fixed expenses and discretionary spending. When considering bankruptcy, seeking professional advice from a bankruptcy attorney or financial advisor who specializes in bankruptcy is highly recommended. Bankruptcy laws can be complex and vary depending on the jurisdiction. A bankruptcy attorney or financial advisor who specializes in bankruptcy possesses a deep understanding of these laws and stays updated on any changes or developments. Every bankruptcy case is unique, and a professional can provide personalized guidance tailored to your specific needs. They will consider factors such as your income, assets, and debts, as well as any legal or financial challenges you may be facing. Understand the different types of bankruptcy available in your jurisdiction, such as Chapter 7, Chapter 13, or other applicable chapters. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of non-exempt assets to repay creditors. It is suitable for individuals or businesses with limited means to repay debts. Chapter 13 bankruptcy, also known as reorganization bankruptcy, enables individuals with a regular income to create a repayment plan. It is suitable for those who can repay their debts over time. Additional bankruptcy options exist for specific situations, such as Chapter 11 bankruptcy for businesses and Chapter 12 bankruptcy for farmers and fishermen. While not applicable to everyone, knowing these options is crucial for those in unique circumstances. Before filing for bankruptcy, individuals are typically required by most bankruptcy laws to undergo credit counseling from an approved agency. During the counseling session, a certified credit counselor will review your debts, income, expenses, assets, and liabilities. Credit counseling goes beyond evaluating bankruptcy as the sole solution. The purpose is to explore alternative debt relief options that may be suitable for your circumstances. A credit counselor will discuss alternatives such as debt consolidation, debt management plans, negotiation with creditors, or other potential remedies. It is important to select an approved credit counseling agency recognized by the appropriate regulatory bodies. These agencies have met specific standards of professionalism and expertise in providing credit counseling services. Once you have completed the credit counseling session, you will receive a completion certificate. This certificate is necessary when filing for bankruptcy, as it serves as proof of compliance with the credit counseling requirement. When preparing to declare bankruptcy, it is crucial to gather all relevant financial documents. These documents serve as the foundation of your bankruptcy filing and provide essential information to support your financial disclosures. Collect several months' worth of bank statements for all your accounts. This includes checking accounts, savings accounts, and any other financial accounts you hold. Bank statements provide a clear picture of your financial transactions, including deposits, withdrawals, and recurring payments. They help establish the accuracy and completeness of your financial records. Gather copies of your tax returns for the past few years, typically the most recent three to five years. Tax returns serve as vital evidence of your income, deductions, and tax obligations. They provide an overview of your financial situation and are necessary for determining your eligibility for certain bankruptcy chapters, such as Chapter 7 or Chapter 13. Collect your recent pay stubs or other proof of income, such as income statements or profit and loss statements if you are self-employed. These documents demonstrate your regular income and can help determine your ability to repay debts. Gather all loan agreements, debt statements, and credit card statements. This includes mortgages, car loans, student loans, personal loans, and credit card debts. These documents provide a comprehensive list of your outstanding debts, including the creditor's name, the outstanding balance, the interest rates, and the terms of repayment. Compile documentation related to your assets, such as real estate properties, vehicles, investments, and valuable possessions. This includes deeds, titles, registrations, and appraisals. These documents establish your ownership and help determine the value of your assets. Prepare financial statements that outline your assets, liabilities, income, and expenses. These statements provide a comprehensive overview of your financial situation. Additionally, consider creating a detailed budget that outlines your monthly income and expenses. Working closely with your bankruptcy attorney, you will compile all the necessary information to complete the petition, ensuring that it accurately reflects your financial situation. Collaborating with your attorney will help streamline the preparation and filing process, ensuring accuracy and compliance with the court's expectations. To prepare the bankruptcy petition, you will need to provide detailed information about your financial situation. This includes assets, liabilities, income and expenses. The petition will typically involve multiple sections, including: This section contains general information about you, such as your name, address, social security number, and other personal details. It declares your intention to file for bankruptcy voluntarily. These schedules provide a detailed breakdown of your assets, liabilities, income, expenses, and other relevant financial information. This section requires you to disclose additional financial details, such as recent financial transactions, income sources, previous bankruptcy filings, and other relevant information. Once the bankruptcy petition is completed and reviewed by your attorney, it is filed with the appropriate bankruptcy court. The petition serves as the formal request to initiate the bankruptcy process. Upon filing the bankruptcy petition, the court will review the submitted documentation and assess your case. The court may schedule a meeting of creditors, also known as a 341 meeting, where creditors have the opportunity to ask questions and review the information provided in the petition. One of the immediate benefits of filing for bankruptcy is the imposition of an automatic stay. The automatic stay is a powerful legal protection that goes into effect as soon as the bankruptcy petition is filed. It provides immediate relief to debtors by halting or preventing creditors from taking further collection actions during the bankruptcy process. The automatic stay acts as a shield, stopping creditors from pursuing collection actions against you. It puts a pause on their ability to continue any ongoing efforts to collect debts, giving you some breathing room to navigate the bankruptcy process without the immediate threat of aggressive collection actions. The automatic stay provides a wide range of protections, restraining creditors from various collection activities. Some common examples of actions that are typically prohibited once the stay is in place include: Wage Garnishment: Creditors are prevented from garnishing your wages or salary to collect outstanding debts. Foreclosure Proceedings: The automatic stay puts a temporary halt on foreclosure proceedings, providing a temporary reprieve from the threat of losing your home or property. Repossession of Property: Creditors are prohibited from repossessing your vehicles, appliances, or other secured collateral during the stay. Utility Disconnections: Utility companies are restricted from disconnecting essential services such as water, electricity, or gas due to outstanding debts. Eviction Proceedings: The automatic stay can temporarily halt eviction proceedings, giving you time to explore potential solutions or negotiate with your landlord. Temporary Relief: A breather during the Bankruptcy Process While the automatic stay offers broad protections, it is essential to be aware that there are exceptions to the stay. Some actions may continue despite the imposition of the stay. For instance: Criminal Proceedings: Criminal cases, such as prosecutions or proceedings related to child support, may not be impacted by the automatic stay. Certain Tax Proceedings: Some tax-related actions, such as audits, assessments, or the issuance of tax deficiency notices, may proceed independently of the automatic stay. Support Obligations: The automatic stay does not prevent the collection of child support or alimony payments. Following the filing of your bankruptcy petition, you will be required to attend a crucial meeting known as the meeting of creditors or the 341 meeting. As the debtor, your attendance at the meeting of creditors is mandatory. It is essential to appear in person, answer questions truthfully, and cooperate fully. Failure to attend the meeting may have serious consequences, including the dismissal of your bankruptcy case. The bankruptcy trustee, appointed by the court to oversee your case, plays a crucial role during the meeting of creditors. They will review your bankruptcy petition, supporting documents, and any additional information you provide. The trustee's objective is to ensure that your bankruptcy filing is accurate, complete, and compliant with the bankruptcy laws. They may ask clarifying questions or seek further details to verify the information you have provided. While you are not required to have your bankruptcy attorney present at the meeting of creditors, it is highly recommended that they attend with you. Your attorney can provide guidance, address any legal concerns, and ensure that your rights are protected throughout the meeting. Following the meeting of creditors, the bankruptcy process will continue as your case progresses through the court system. The trustee will review the information obtained during the meeting and any additional documentation provided. They will make recommendations to the court regarding the administration of your case, including the possibility of asset liquidation (Chapter 7) or the confirmation of a repayment plan (Chapter 13). In the context of Chapter 13 bankruptcy, debtors are required to develop a repayment plan that outlines their proposed approach to repay their debts over a specified period of time. This plan must be submitted to the court for approval. When creating a repayment plan, several key elements should be considered: Priority Debts: Certain debts, such as taxes, child support, and mortgage arrears, are considered priority debts and must be paid in full through the repayment plan. Secured Debts: If you have secured debts, such as a car loan or mortgage, you may propose to continue making regular payments or include any arrears in the repayment plan. Unsecured Debts: Unsecured debts, like credit card balances and medical bills, may be paid in full or in part, depending on your disposable income and other factors. In some cases, unsecured debts may be paid at a reduced rate or even discharged entirely, depending on the specifics of your case. Once the repayment plan is drafted, it must be submitted to the court for approval. Your attorney will file the plan and provide supporting documentation that demonstrates its feasibility. After the submission of the repayment plan, a confirmation hearing will be scheduled. During this hearing, the bankruptcy judge will review the plan, consider any objections raised by creditors or the trustee, and determine whether to approve the plan. The judge will assess the feasibility of the plan, ensuring that it provides for the payment of priority and secured debts and is reasonable given your financial circumstances. When filing for bankruptcy, it is crucial to understand and comply with the court procedures that govern the bankruptcy process. Following court procedures involves adhering to the legal requirements set forth by the bankruptcy court and the bankruptcy laws in your jurisdiction. Throughout the bankruptcy process, the court may schedule additional hearings or meetings that you are required to attend. These hearings provide an opportunity for the bankruptcy trustee, creditors, and other relevant parties to discuss specific aspects of your case. Failure to comply with deadlines may result in adverse consequences, including the dismissal of your case. It is essential to carefully review all court orders, notices, and requests for information to ensure that you understand the required actions and deadlines. Failure to comply with court procedures can have serious consequences. The court may dismiss your case, deny the discharge of debts, or take other actions that may adversely affect the outcome of your bankruptcy. The final stages of the bankruptcy process involve either the discharge of debts (Chapter 7) or the completion of the repayment plan (Chapter 13). Additionally, in certain cases, asset liquidation and distribution to creditors may be required. In Chapter 7 bankruptcy, also known as liquidation bankruptcy, the court appoints a trustee to oversee the process. The trustee's primary responsibility is to liquidate non-exempt assets and distribute the proceeds to creditors. As part of the Chapter 7 bankruptcy process, the trustee assesses your assets to determine if any are non-exempt and can be sold to generate funds for your creditors. Non-exempt assets may include luxury items, second homes, valuable collectibles, or significant equity in a property. Upon completion of the asset liquidation process, you may be eligible for a debt discharge. A debt discharge is a court order that releases you from personal liability for certain types of debts, meaning you are no longer obligated to repay them. This discharge applies to most unsecured debts, such as credit card debt, medical bills, and personal loans. However, certain debts are generally not dischargeable, including child support, alimony, most tax debts, student loans (with limited exceptions), and debts arising from fraud or intentional misconduct. Upon successfully completing the repayment plan, you have fulfilled your obligations under Chapter 13 bankruptcy. The bankruptcy court will review your case to ensure that you have made all required payments according to the plan. Bankruptcy is a legal status or process where individuals, businesses, or organizations declare themselves unable to repay their debts. It provides relief and protection from creditor actions to resolve financial difficulties. The process involves evaluating your financial situation, assessing your debts, assets, income, and expenses, and seeking professional advice from a bankruptcy attorney or financial advisor. The type of bankruptcy to file, such as Chapter 7 or Chapter 13, should be determined based on your circumstances. Credit counseling is often required before filing, and gathering financial documents is necessary for the bankruptcy petition. Working with your attorney, you will prepare and file the petition with the court. Upon filing, an automatic stay is imposed, prohibiting creditors from taking collection actions. The meeting of creditors is a mandatory event where the bankruptcy trustee reviews your case. If filing for Chapter 13, a repayment plan must be developed and submitted for court approval. Compliance with court procedures, attending additional hearings, and providing requested documentation are crucial. Finally, the bankruptcy process concludes with either a discharge of debts (Chapter 7) or completion of the repayment plan (Chapter 13).Definition of Bankruptcy

How to Declare Bankruptcy: A Step-by-Step Guide

Evaluate Financial Situation

Assess Debts

Analyze Assets

Evaluate Income

Assess Expenses

Seek Professional Advice

Determine the Type of Bankruptcy

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Other Bankruptcy Options (If Applicable)

Complete Credit Counseling

Assess Financial Situation

Explore Alternatives to Bankruptcy

Choose an Approved Credit Counseling Agency

Earn a Completion Certificate

Gather Financial Documents

Bank Statements

Tax Returns

Pay Stubs and Proof of Income

Loan Agreements and Debt Statements

Asset Documentation

Financial Statements and Budgets

Prepare and File Bankruptcy Petition

Collaborate With a Bankruptcy Attorney

Gather Essential Information

Complete the Bankruptcy Petition

Voluntary Petition

Schedules

Statement of Financial Affairs

File the Bankruptcy Petition

Review and Approval

Automatic Stay

Protection Against Creditor Actions

Prohibited Creditor Actions

Exceptions to the Automatic Stay

Attend the Meeting of Creditors

Bankruptcy Trustee's Role

Legal Representation

Post-Meeting Proceedings

Develop a Repayment Plan (If Applicable):

Submit the Repayment Plan

Follow Court Procedures

Ongoing Compliance

Attending Additional Hearings

Compliance With Deadlines

Consequences of Non-compliance

Discharge or Asset Distribution

Chapter 7 Bankruptcy

Asset Liquidation

Debt Discharge

Completion of the Repayment Plan

Conclusion

How to Declare Bankruptcy FAQs

To declare bankruptcy, you need to evaluate your financial situation, seek professional advice, gather financial documents, prepare and file a bankruptcy petition, attend the meeting of creditors, and follow court procedures. It is recommended to consult with a bankruptcy attorney to navigate the process successfully.

Assessing your financial situation is crucial. Evaluate your debts, assets, income, and expenses to understand the severity of your financial difficulties. Consult with a bankruptcy attorney or financial advisor who specializes in bankruptcy to receive professional advice tailored to your specific circumstances.

The most common types of bankruptcy for individuals are Chapter 7 and Chapter 13. Chapter 7 involves the liquidation of assets, while Chapter 13 involves a repayment plan. The appropriate type of bankruptcy depends on factors such as your income, assets, and ability to repay debts.

Yes, credit counseling is typically required before filing for bankruptcy. It helps evaluate your financial situation, explore alternatives to bankruptcy, and provides education on managing finances. Choose an approved credit counseling agency recognized by the appropriate regulatory bodies.

While it is possible to declare bankruptcy without an attorney, it is highly recommended to seek professional advice. Bankruptcy laws can be complex, and an attorney specialized in bankruptcy can guide you through the process, ensure compliance with court procedures, and protect your rights.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.