The Federal Housing Administration (FHA) provides guidelines for individuals seeking to apply for a home loan after filing for Chapter 13 bankruptcy. The FHA requires a minimum waiting period of one year from the bankruptcy discharge date, but this extends to two years if the bankruptcy is dismissed. In terms of credit scores, applicants must have a score of at least 580 for a 3.5% down payment or between 500-580 for a 10% down payment. During the Chapter 13 repayment period, individuals can apply for an FHA loan, given they have made all payments on time for at least one year and have received court trustee approval. Although loan terms and interest rates may vary, with strict financial discipline and credit rebuilding, securing an FHA loan post-bankruptcy is feasible. The FHA guidelines specify a minimum waiting period of one year from the date of the Chapter 13 bankruptcy discharge. However, if the bankruptcy case is dismissed rather than discharged, the waiting period extends to two years. This period allows borrowers to re-establish their creditworthiness. Even after meeting the waiting period, applicants must meet a minimum credit score requirement. FHA guidelines stipulate that applicants must have a credit score of at least 580 to qualify for a loan with a 3.5% down payment. Those with credit scores between 500 and 580 are still eligible but must make a 10% down payment. There are circumstances where the FHA may waive the waiting period. For instance, if the bankruptcy was caused by extenuating circumstances like a significant income drop beyond the borrower's control or a serious illness, the waiting period can be waived. Applicants must provide documentation showing that at least one year of the payout period under the bankruptcy has elapsed and that the payment performance was satisfactory. Moreover, they need to obtain permission from the bankruptcy court to enter into a mortgage transaction. Navigating the FHA loan application process after filing for Chapter 13 bankruptcy involves several key steps: Understand the FHA Guidelines: Post Chapter 13 bankruptcy, it's crucial to familiarize yourself with FHA guidelines, which include a mandatory waiting period, credit score requirements, and other eligibility conditions. Gather Necessary Documentation: This includes your bankruptcy discharge papers, credit reports, payment records, and court trustee approval if you're still in the repayment phase of your bankruptcy. Reach Out to an FHA-Approved Lender: Contact a lender approved by the FHA who will guide you through the application process. They will review your financial situation, perform a credit check, and assess your ability to repay the loan. Submit Loan Application: Provide all the necessary information on your loan application. This includes your personal information, income details, and any additional financial details required by the lender. Loan Closing: Once your loan is approved, you'll move into the loan closing process. Ensure to review all loan terms before finalizing the agreement. Repayment plans are court-ordered arrangements where debtors repay their debts over a specified period. As part of the FHA guidelines, borrowers who are still in the payout period of their Chapter 13 bankruptcy can still apply for an FHA loan, provided they have made all their payments on time for at least one year. Under these guidelines, the court trustee must provide written approval for the loan application, and the borrower must show satisfactory payment performance for at least one year. Manual underwriting is a process where a human underwriter reviews the loan application, as opposed to an automated process. This is particularly useful for borrowers with complex credit histories, including Chapter 13 bankruptcy. For FHA loans, manual underwriting can offer more flexibility. The underwriter can consider factors such as the borrower's overall credit behavior apart from credit scores and the reasons that led to bankruptcy, thus increasing the chances of loan approval. FHA guidelines specify that loans to borrowers post-Chapter 13 bankruptcy must be term loans with a term not exceeding 30 years. They may be fully amortizing or involve a balloon payment. Interest rates for FHA loans post-Chapter 13 bankruptcy are usually higher than conventional loans. The FHA allows lenders to charge an interest rate that is reasonable and customary for the area. However, they are still competitive and can be negotiated based on creditworthiness. One common mistake is overlooking the waiting period. Some applicants attempt to apply for a loan too soon after bankruptcy, resulting in rejection. Always ensure the waiting period has elapsed before applying. Another common mistake is not meeting the minimum credit score requirement. Credit scores play a vital role in loan approval, and a low score can lead to loan denial or less favorable loan terms. Lastly, not having the proper documentation can lead to issues with the loan application. Applicants must have all required documents, including discharge papers, payment records, and court trustee approval. Rebuilding credit is crucial after bankruptcy. Pay bills on time, avoid taking on too much new debt, and maintain a low credit utilization ratio. A larger down payment can increase the chances of loan approval, as it reduces the lender's risk. Maintaining a strict budget can demonstrate financial responsibility and increase the chances of loan approval. HUD-approved counselors can provide valuable guidance on rebuilding credit, budgeting, and navigating the home-buying process post-bankruptcy. Securing an FHA loan after Chapter 13 bankruptcy is indeed possible with the right approach and understanding of the FHA guidelines. A primary requirement includes a one-year waiting period post-discharge, which extends to two years if the bankruptcy is dismissed. Ensuring a credit score of 580 for a 3.5% down payment or between 500-580 for a 10% down payment is critical. With a diligent repayment record, it's possible to apply for an FHA loan even during the repayment period. Manual underwriting can provide an additional layer of flexibility. However, loan terms and interest rates may differ from conventional loans. To enhance the chances of approval, focus on rebuilding credit, saving for a larger down payment, adhering to a stringent budget, and consulting with a HUD-approved counselor. Understanding these requirements and procedures can open the pathway to homeownership after Chapter 13 bankruptcy.FHA Guidelines After Chapter 13 Bankruptcy Overview

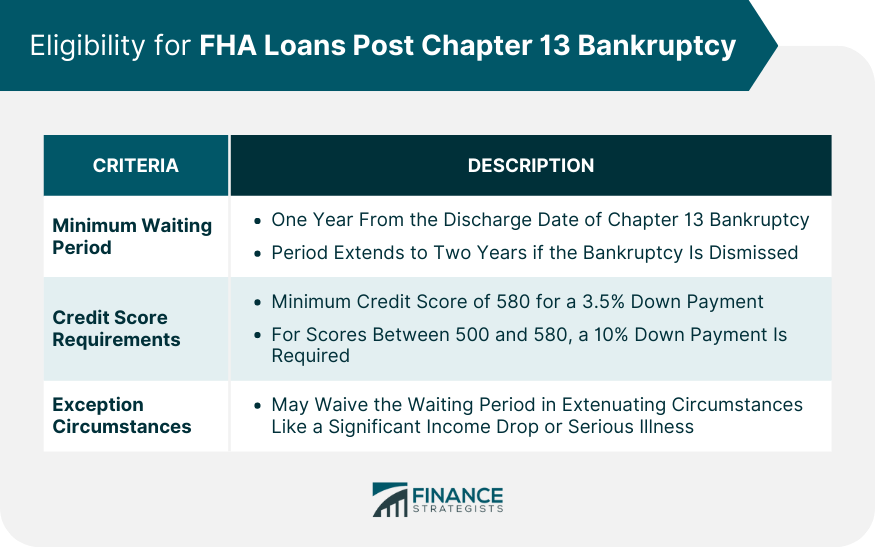

Eligibility for FHA Loans Post Chapter 13 Bankruptcy

Minimum Waiting Period as Per FHA Guidelines After Chapter 13 Bankruptcy

Credit Score Requirements After Chapter 13 Bankruptcy

Exception Circumstances in FHA Guidelines After Chapter 13 Bankruptcy

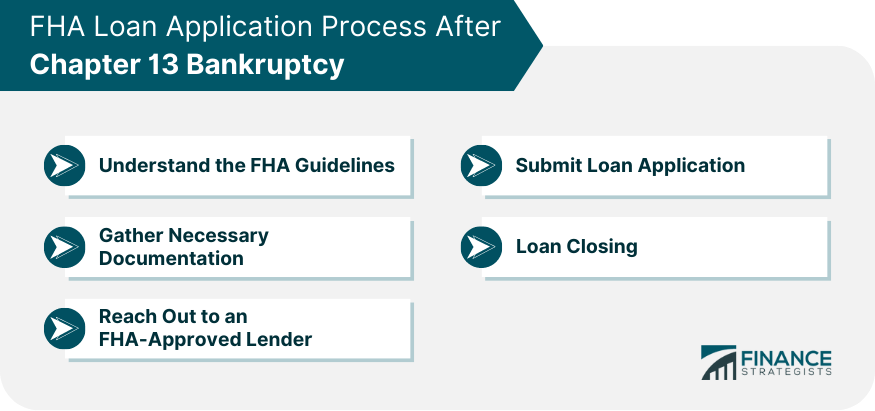

FHA Application Process Post Chapter 13 Bankruptcy

Documentation Required as Per FHA Guidelines After Chapter 13 Bankruptcy

Steps Involved in the FHA Loan Application Process After Chapter 13 Bankruptcy

FHA Guidelines on Repayment Plans

FHA Guidelines on Manual Underwriting

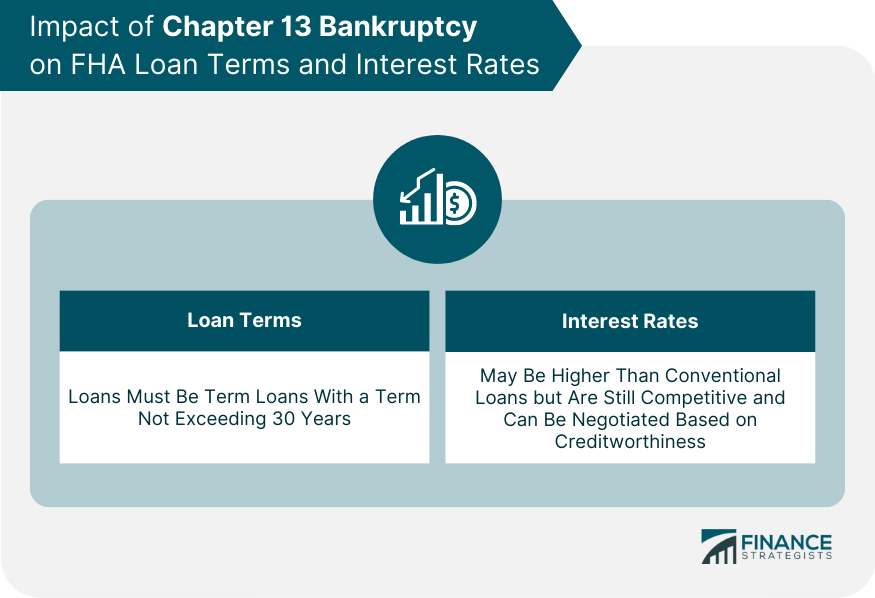

Impact Loan Terms and Interest Rates

Impact on Loan Terms

Impact on Interest Rates

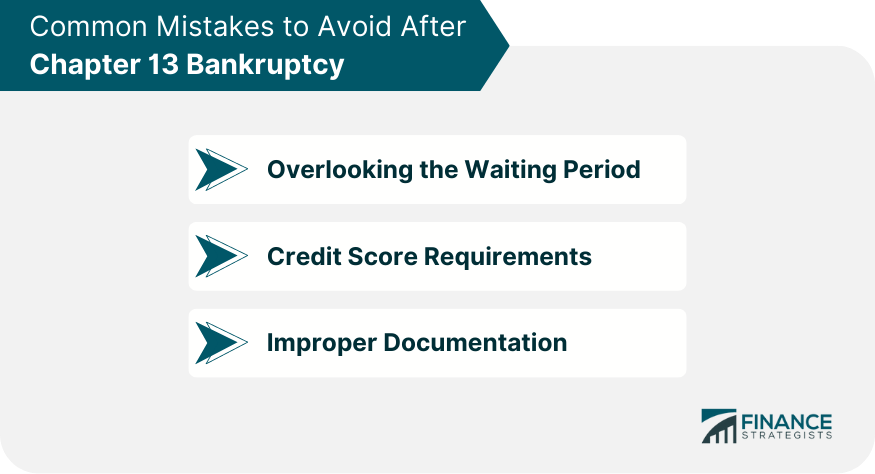

Common Mistakes to Avoid According to FHA Guidelines After Chapter 13 Bankruptcy

Waiting Period

Credit Score Requirements

Improper Documentation

How to Improve Chances of Securing an FHA Loan After Chapter 13 Bankruptcy

Build Credit

Save for a Down Payment

Stick to a Strict Budget

Consult With a HUD-Approved Housing Counselor

Conclusion

FHA Guidelines After Chapter 13 Bankruptcy FAQs

The FHA guidelines stipulate a waiting period of one year from the Chapter 13 bankruptcy discharge date. However, if the bankruptcy is dismissed, the waiting period extends to two years.

FHA guidelines require a minimum credit score of 580 for a 3.5% down payment, for credit scores between 500 and 580, a 10% down payment is required.

Yes, according to FHA guidelines after Chapter 13 bankruptcy, you can apply for a loan during your repayment period, provided you've made all your payments on time for at least one year and received approval from the court trustee.

Manual underwriting allows underwriters to consider various factors beyond credit scores, such as overall credit behavior and the reasons leading to bankruptcy. This provides more flexibility and can increase the chances of loan approval after Chapter 13 bankruptcy.

FHA guidelines specify that loans post-Chapter 13 bankruptcy must not exceed 30 years. The interest rates may be higher than conventional loans but are still competitive and can be negotiated based on creditworthiness.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.