Chapter 7 Bankruptcy is a legal process that allows an individual or a business to discharge or eliminate the majority of their unsecured debt. This can provide much-needed relief for individuals who find themselves in a cycle of debt they are unable to escape from. The process begins by filing a petition with the bankruptcy court in the district where the debtor resides or where the business operates. The debtor must disclose all their assets, income, and debts to the court, which will then appoint a trustee to oversee the bankruptcy proceedings. This trustee has the power to sell non-exempt assets in order to repay creditors as much as possible. However, certain assets are protected by exemption laws and cannot be sold for the purpose of repaying debt. After the assets are liquidated and the proceeds distributed among creditors, most remaining debt will be discharged. One of the crucial components of qualifying for Chapter 7 bankruptcy is the income limit. This limit is enforced through the "means test," which is a way to ensure that Chapter 7 bankruptcy is available to those who truly can't pay their debts. The means test was introduced in 2005 as part of the Bankruptcy Abuse Prevention and Consumer Protection Act. It's designed to keep high-income individuals from filing for Chapter 7 bankruptcy, instead directing them toward Chapter 13, where they have to pay back some or all of their debts over a three-to-five-year period. The means test compares your current monthly income with your state's median income for a household of your size. Median income figures vary widely from state to state, and your eligibility can depend heavily on where you live. The median income figures are updated periodically, so it's essential to use the most recent figures when considering bankruptcy. To calculate the income limit for Chapter 7 bankruptcy, follow these steps: 1. Sum the gross income from the last six months, including wages, rental income, child support, alimony, pensions, or other regular monthly income. Social Security income doesn't count. 2. Divide the total income by six to get your average monthly income. 3. Multiply the average monthly income by 12 to determine your annual household income. Compare your annual household income to your state's median household income, which can be found on the U.S. Department of Justice's website. If your income is less than your state's median, you meet the Chapter 7 income limit. However, if your income exceeds the state's median, additional considerations come into play. A professional, such as a bankruptcy attorney, can help navigate the complexities of calculating disposable income, which is income after living expenses. Certain living expenses and deductions are deemed allowable. These include: Paycheck deductions like taxes, Social Security payments, insurance, and retirement savings. Child support and alimony payments. Regular living expenses, calculated nationally or regionally, covering food, healthcare, housing, and transportation. Necessary expenses not covered by living expenses like term life insurance, child care, and certain educational costs. Ongoing secured debt payments, such as car and mortgage payments, and tax payments to cover tax debt. Note that wage garnishments are not counted as allowable expenses. It may be beneficial to hire a bankruptcy attorney to assist in this process, and their fees typically range between $1,500 and $2,500. Keep in mind that some monthly expenses, although necessary, will need documentation if audited by the U.S. Bankruptcy Trustee. Failing to meet the income limits for Chapter 7 bankruptcy can lead to your case being dismissed or converted to a Chapter 13 bankruptcy. This is why it's important to understand how the income limits work and what your options might be if you exceed them. If your income is too high and you don't pass the means test, the bankruptcy court could dismiss your Chapter 7 case. This would leave you back at square one, still responsible for all your debts. If you fail the means test for Chapter 7, you may have the option to file for Chapter 13 bankruptcy instead. While Chapter 13 requires you to repay some or all of your debts, it can still offer relief and help you avoid things like foreclosure. Even if your income is above the median, you might still be able to file for Chapter 7 bankruptcy under certain circumstances. These exceptions are designed to ensure that those who truly need the relief offered by Chapter 7 bankruptcy can still access it. The law provides certain exceptions to the means test. For instance, if your debts are not primarily consumer debts or if you are a disabled veteran who incurred your debt while on active duty, you may be exempt from the means test. Even if you fail the means test, you might qualify under the special circumstances clause. This could apply if you have significantly higher than average expenses for necessities or if you recently lost your job. When you file for Chapter 7 bankruptcy, a trustee will be appointed to your case. This individual plays a crucial role in the bankruptcy process, and understanding their role can help you navigate the process more smoothly. The trustee will review your paperwork, sell your nonexempt property, and distribute the proceeds to your creditors. They serve as a sort of intermediary between you and the creditors, ensuring that the process is conducted fairly and transparently. Trustees will carefully evaluate your listed income and expenses to ensure that they are accurate and that you have not tried to conceal assets or income. They may ask you questions or request additional documentation if they believe further clarification is necessary. Filing for Chapter 7 bankruptcy provides a potential avenue for discharging unmanageable debt, but it is a complex process regulated by income limits determined by the means test. It is crucial to understand that the means test compares an individual's current monthly income against the state's median income. However, allowances are made for family size and certain expenses, with special exemptions existing under specific circumstances. If income exceeds the stipulated limit, a debtor might be directed to Chapter 13 bankruptcy or have their case dismissed. The process involves a court-appointed trustee overseeing the asset liquidation and debt discharge, which underscores the importance of accuracy in declaring all income and assets. Given the significance and potential implications of filing for bankruptcy, professional advice from a bankruptcy attorney and financial advisor is strongly recommended to ensure informed decision-making and strategic financial planning for the future.Overview of Chapter 7 Bankruptcy

Understanding Income Limits in Chapter 7 Bankruptcy

Importance of the Means Test

Median Income Requirement

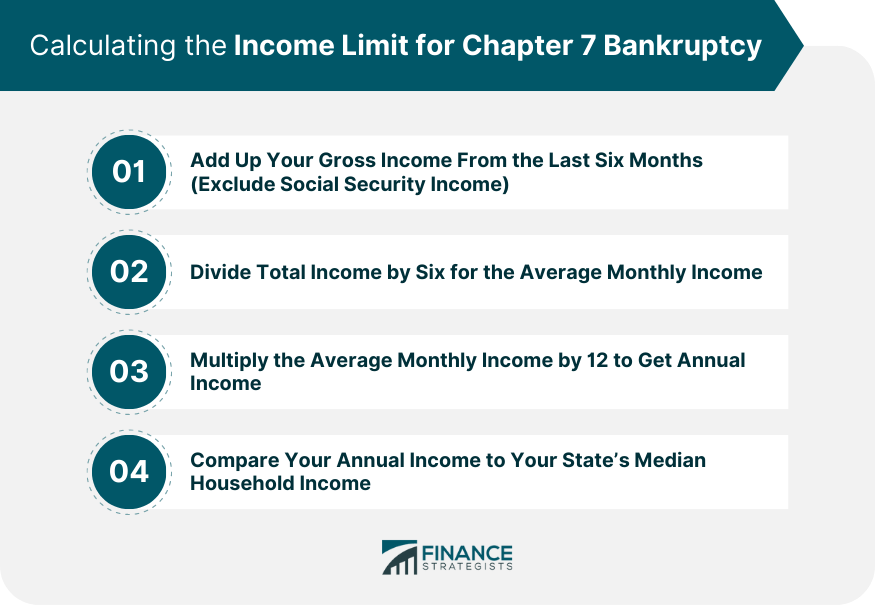

Calculating the Income Limit for Chapter 7 Bankruptcy

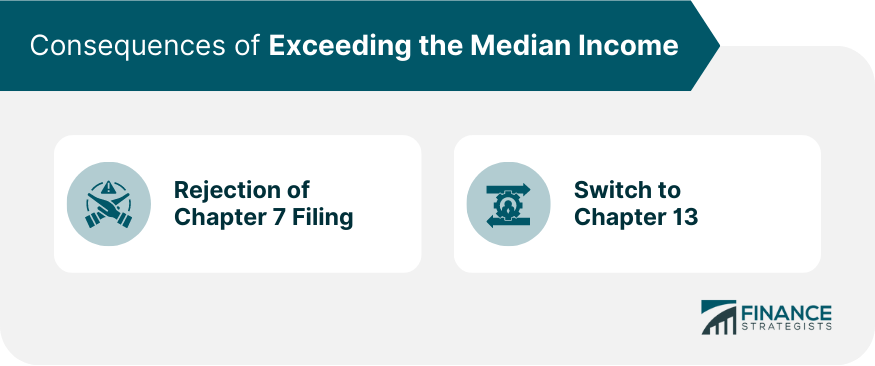

Consequences of Exceeding the Median Income

Possible Rejection of Chapter 7 Bankruptcy Filing

Switching to Chapter 13 as an Alternative

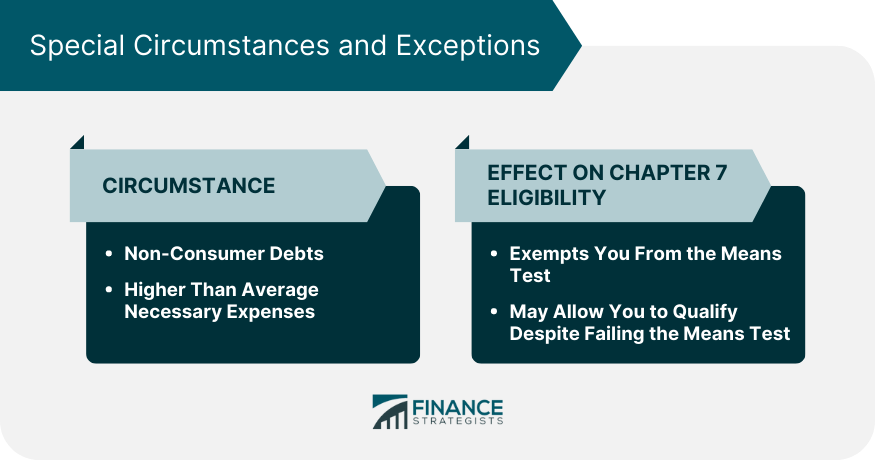

Special Circumstances and Exceptions

Exception Cases Where You Can Still Qualify for Chapter 7

Discussing the Special Circumstances Clause

Understanding the Role of a Bankruptcy Trustee

Bottom Line

Income Limits for Chapter 7 Bankruptcy FAQs

Income limits help determine if you qualify for Chapter 7 bankruptcy through a measure called the means test. If your income is less than or equal to your state's median, you can file.

The means test is a two-step process that compares your average monthly income to your state's median income for a similar-sized household. If your income is higher, allowable expenses are considered.

If your income is above the median, you can still qualify for Chapter 7 through allowable deductions. If you still don't qualify, your case could be converted to Chapter 13 bankruptcy.

Special circumstances refer to situations that allow you to qualify for Chapter 7 even if you fail the means test. This could be due to additional expenses or non-consumer debts.

A bankruptcy attorney can guide you through the complex process of bankruptcy, helping you understand if Chapter 7 is the best option or if other debt-relief options are more suitable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.