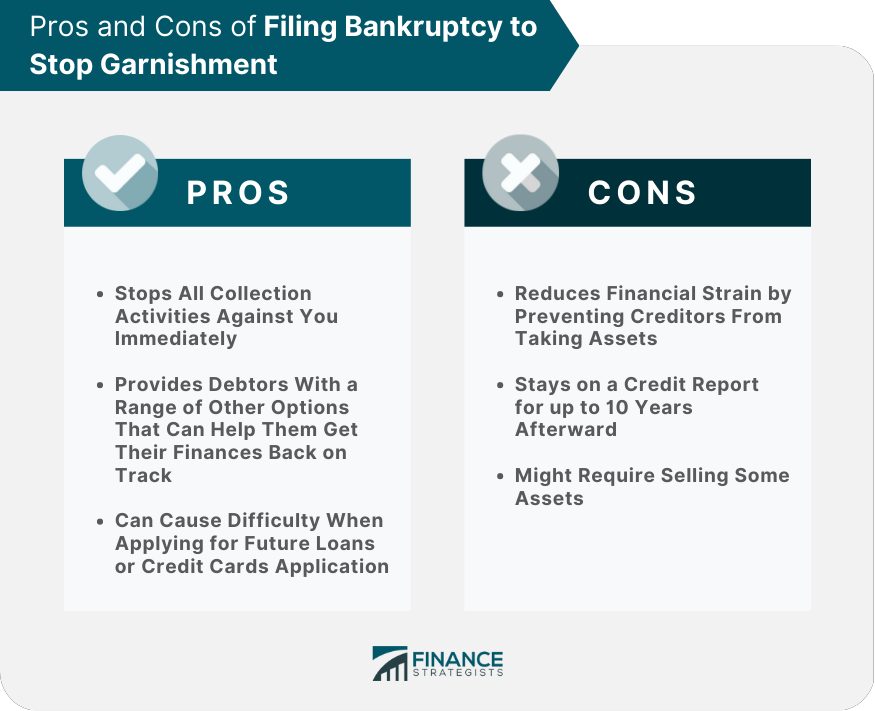

Bankruptcy may be able to stop garnishment by implementing an automatic stay that halts collection attempts and potentially reducing or eliminating the underlying debt. Exceptions are debts over domestic obligations, such as child support. Since these debts are not forgiven in bankruptcy, the garnishment is not stoppable. Garnishment is a legal process used by creditors to collect unpaid debts, whereby funds are taken from an individual's income or property. It is important for those facing such difficulties to fully understand their rights as well as the various options available, such as negotiating with creditors, hiring an attorney, and exploring assistance programs offered by state and federal governments, in order to protect oneself from financial hardship. Additionally, individuals must be aware of relevant state laws when it comes to garnishment in order to ensure compliance with them. Filing for bankruptcy is one of the most common ways to stop creditors from garnishing your wages and other assets. This move can also provide debtors with a range of other options that can help them get their finances back on track. While filing for bankruptcy will stay on your credit report for up to 10 years, it can offer much-needed protection to those facing a difficult financial situation due to overwhelming debts. If you're considering filing for bankruptcy in order to prevent creditors from garnishing your wages, here are the steps you should consider: Before diving into the process of filing for bankruptcy, it is crucial to be aware of some key facts surrounding this process. First and foremost, you must know all legal rights associated with the filing procedure as they may vary depending on the type of bankruptcy (Chapter 7 or Chapter 13) that one is seeking relief under and state laws governing these types of proceedings. Knowing what documents need to be filed, the deadlines associated with each step within this process, and any alternatives available are essential in making an informed decision regarding whether or not filing for bankruptcy is right for you. While bankruptcy may be an effective means of preventing wage garnishment, there are other alternatives that should be considered prior to taking this drastic measure. Things like debt consolidation, creating a budget, and understanding how different payment plans work can all serve as viable paths toward working out arrangements with creditors throughout this process. Thus, it is imperative to properly research these options before making any final decisions surrounding one’s financial situation. Filing for bankruptcy is a complex process, and it is important to get perspective from a legal professional on the best options available. An experienced attorney will be able to offer strategies for obtaining maximum benefits, as well as navigating the legal landscape of wage garnishments, court orders, and other complications that may arise from collections efforts against debtors. Filing for bankruptcy is one of the most common ways to stop creditors from garnishing wages and property, but it has long-term consequences. Before filing bankruptcy, individuals should know their rights, research available alternative options, and consider hiring an attorney to help them maneuver through the process. When facing overwhelming debt, bankruptcy can be a great option for people looking for a way out of their financial struggles. However, not all garnishments can be avoided through filing for bankruptcy, and understanding what types of garnishments are exempt from discharge can be important in determining the right course of action to take when trying to get back on financially-stable footing. Family support payments, sometimes referred to as child support or alimony, cannot be discharged through bankruptcy and will remain due regardless of whether or not an individual has filed for protection against creditors seeking to collect such debts. In some cases, non-support payments could also fall into this category, so it is essential to consider any potential liabilities before making any final decisions regarding filing for bankruptcy. While filing bankruptcy allows one to limit or erase certain debts, there are some that remain due and owing, including taxes, student loan debt, and other loans classified as "non-dischargeable." These creditors can still pursue legal action to collect payment on these obligations. Filing for bankruptcy more than once in a year may provide less relief in terms of protection from creditors and their collection activities. Alternative strategies should be explored to obtain maximum benefit from such filings, as opposed to allowing creditors to gain the upper hand. Garnishment can be an extremely stressful and concerning process for those dealing with creditors collecting debts, especially when finances are already tight and repayment plans seem impossible. The good news is that there are other ways to stop the garnishment, and individuals don’t have to feel helpless in the face of aggressive debt collection activities. Here are some other solutions: One of the most common ways to stop a garnishment is by talking to your creditor and negotiating a payment plan. This can be a time-consuming process as it involves lots of back-and-forth communication. Still, it could be worth it in terms of avoiding further collection activity by the creditor, who may instead agree to set up a more manageable payment plan for you so that you can still keep your property or wages from being taken away from you. If communication with creditors fails, hiring an experienced attorney may be beneficial. They can negotiate on behalf of their clients and determine legal options such as filing a lawsuit or having part of the debt discharged through bankruptcy while avoiding long-term consequences. Applying for financial assistance programs from state or federal governments may provide temporary relief while individuals work out alternative options with creditors, such as borrower's rights reorganization and structuring. These can include negotiation, compromise agreement, and other forms of restructuring, waiver, abrogation, annulment, discharge, expungement, and indemnification. Garnishments can be a stressful process for those facing financial difficulties, but there are ways to stop the garnishment and regain financial control. Negotiating with creditors, hiring an attorney, and exploring the various assistance programs offered by state and federal governments are all viable methods of stopping garnishment. Ultimately, it is important to take the time to educate oneself on the available options in order to create a plan of action that will work best for one’s individual circumstances.Can Bankruptcy Stop Garnishment?

What Is Garnishment?

Steps to File Bankruptcy to Stop Garnishment

Know Your Filing Rights

Research Available Alternatives

Hire an Attorney Familiar With Bankruptcy Cases

Pros and Cons of Filing Bankruptcy to Stop Garnishment

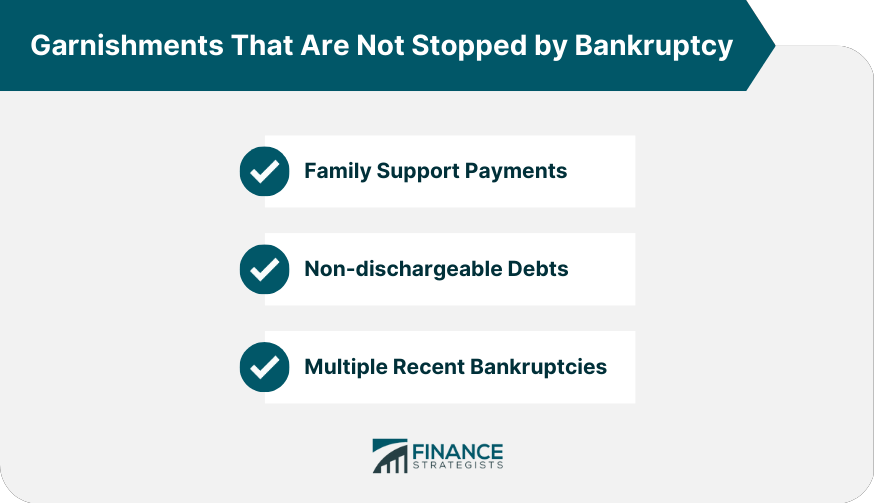

Types of Garnishments That Are Not Stopped by Bankruptcy

Family Support Payments

Non-dischargeable Debts

Multiple Recent Bankruptcies

Other Ways to Stop Garnishment

Negotiating With the Creditor

Hiring an Attorney

Applying for Financial Assistance Programs

The Bottom Line

Can Bankruptcy Stop Garnishment? FAQs

Yes, filing for bankruptcy can stop garnishment in some cases by providing you with immediate protection from creditors and debt collectors. It typically allows individuals to repay or discharge their obligations while avoiding further collection activity.

Both Chapter 7 and Chapter 13 bankruptcies can potentially stop all garnishment activities, but the type of bankruptcy you qualify for will depend on your individual circumstances and situations.

Once a bankruptcy petition is filed, creditors are legally required to stop any attempts at collecting debts, which includes garnishment of wages or other property. Generally speaking, the process should take no longer than about two weeks from the filing date to when the garnishments are stopped.

Yes, you can still file even if your wages are already being garnished, but it is advised that you do so as soon as possible in order to avoid further consequences, such as wage attachment or seizures of the property before the court grants your bankruptcy petition.

If your wages were already being withheld before filing for bankruptcy, then they will be released shortly after the process is complete and once creditors have received notice that the case has been approved by the court. Generally speaking, an individual should expect to receive any outstanding funds within three to five business days after the process has been completed successfully and without additional complications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.