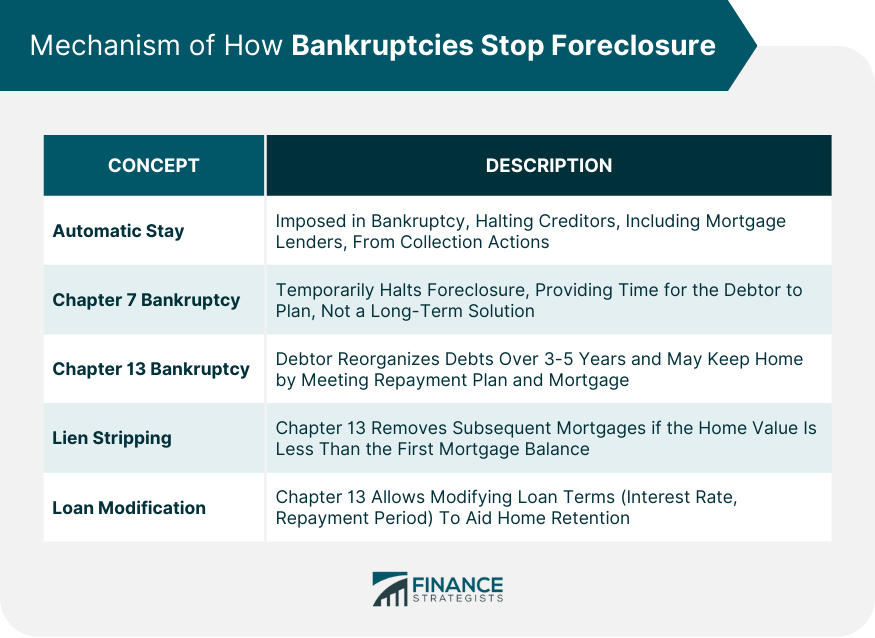

Bankruptcy stops foreclosure by leveraging a legal mechanism known as an "automatic stay." Once an individual files for bankruptcy, the court issues this automatic stay, effectively halting most collection actions by creditors, including the foreclosure process. Two types of bankruptcy can help in this situation: Chapter 7 provides a temporary halt to foreclosure, while Chapter 13 allows a debtor to reorganize their debts and establish a new repayment plan, possibly enabling them to keep their home. There are also provisions like lien stripping and loan modification in bankruptcy that can aid homeowners. However, this process has complexities and challenges, including potential negative impacts on credit scores, and it doesn't guarantee a long-term solution for all homeowners. A thorough understanding of one's financial situation and professional legal advice are crucial before deciding to file for bankruptcy. When a debtor files for bankruptcy, an automatic stay is put in place. This stay, provided by the bankruptcy court, immediately stops most creditors, including mortgage lenders, from pursuing further collection actions. This means that the foreclosure process is effectively halted the moment the debtor files for bankruptcy. Chapter 7 bankruptcy, also known as "liquidation bankruptcy," can temporarily halt the foreclosure process. While it doesn't provide a long-term solution to keeping one's home, it can give the debtor some time to figure out the next steps. Chapter 13 bankruptcy, on the other hand, allows the debtor to reorganize their debts and establish a repayment plan over three to five years. If the debtor can keep up with the new repayment plan and their current mortgage payments, they may be able to keep their home. In a Chapter 13 bankruptcy, lien stripping can come into play. If the debtor has multiple mortgages and the value of their home is less than the balance of the first mortgage, they may strip or remove the second and subsequent mortgages. These stripped debts are then treated as unsecured and can be discharged at the completion of the bankruptcy repayment plan. Under certain circumstances, a debtor might be able to modify their loan during a Chapter 13 bankruptcy. This can result in more favorable terms, such as a reduced interest rate or an extended repayment period, which can help the debtor retain their home. Federal bankruptcy laws govern how individuals and businesses can file for bankruptcy. These laws provide mechanisms, such as automatic stay and debt discharge, which can be used to halt foreclosure. In addition to federal laws, each state has specific laws and regulations related to bankruptcy and foreclosure. These may provide additional protections for homeowners. As such, the effectiveness of using bankruptcy to stop foreclosure can vary significantly by state. Perhaps the most immediate benefit of using bankruptcy to stop foreclosure is the time it buys the debtor. The automatic stay can halt the foreclosure process, giving the debtor some breathing room to either negotiate with the lender or seek alternative housing arrangements. Bankruptcy can help in discharging unsecured debts, such as credit card debts and medical bills. This can free up more income to put towards the mortgage, increasing the chances of keeping the home. In some cases, debtors may be able to keep their homes permanently. This is often possible through Chapter 13 bankruptcy, which allows the debtor to reorganize their debts and establish a repayment plan. While filing for bankruptcy can temporarily halt the foreclosure process, it is not a long-term solution for all homeowners. In particular, those filing under Chapter 7 may still lose their homes if they cannot find a way to catch up on their mortgage payments. Filing for bankruptcy can significantly impact the debtor's credit score, making it more difficult for them to secure loans in the future. This can be a significant downside for those considering this option. The process of filing for bankruptcy and navigating the associated laws and regulations can be complex. There's also the risk that the court may not approve the bankruptcy filing or the proposed repayment plan. Before deciding to file for bankruptcy, it is crucial to thoroughly understand your financial situation. This includes evaluating your income, debts, and assets. It's also essential to consider your long-term financial goals. Filing for bankruptcy can provide immediate relief, but it can also have long-term implications, such as a negative impact on your credit score. Given the complexities involved, it's usually advisable to hire a competent bankruptcy attorney. They can guide you through the process, help you understand the potential implications, and represent your interests in court. To file for bankruptcy, you'll need to prepare several documents. These include lists of your assets, debts, income, and expenses, as well as tax returns and other financial records. Once the documents are ready, you can file your bankruptcy petition with the court. This immediately triggers the automatic stay and stops the foreclosure process. After filing, there are several requirements and procedures to navigate. These include credit counseling, meeting with a bankruptcy trustee, and attending a creditors' meeting. Bankruptcy can provide a powerful tool to halt foreclosure proceedings. This is achieved through an automatic stay, which is issued upon the filing of bankruptcy and pauses most collection activities. Different types of bankruptcy can offer varied relief, with Chapter 7 providing temporary respite and Chapter 13 offering a longer-term solution through debt reorganization. However, leveraging bankruptcy to stop foreclosure isn't without its challenges; it can significantly impact the debtor's credit score, and the process can be legally complex. Therefore, a comprehensive understanding of one's financial situation and professional advice are paramount. Bankruptcy should be seen as a serious decision made with thoughtful consideration of the debtor's current situation and long-term financial goals.How Do Bankruptcies Stop Foreclosure?

Mechanism of How Bankruptcies Stop Foreclosure

Role of Automatic Stay

Chapter 7 and Chapter 13 Bankruptcies

Process of Lien Stripping

Loan Modification in Bankruptcy

Legal Framework Supporting Bankruptcy as a Means to Stop Foreclosure

Federal Bankruptcy Laws

State-Specific Laws and Regulations

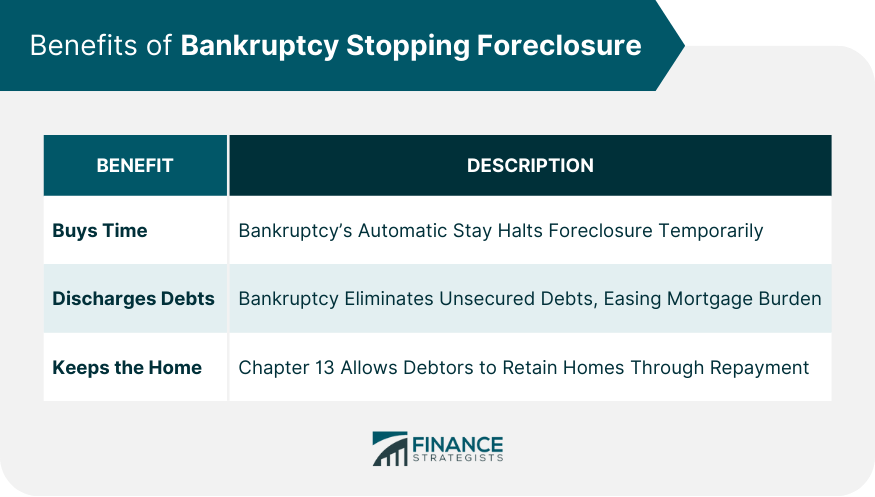

Benefits of Bankruptcy Stopping Foreclosure

Buys Time

Discharges Unsecured Debts

Keeps the Home

Challenges in Bankruptcy Stopping Foreclosure

Temporary Solution Only

Impact on Credit Score

Legal Complexity and Risks

Key Considerations Before Filing for Bankruptcy to Stop Foreclosure

Understand Financial Situation

Analyze Long-Term Goals

Hire a Competent Bankruptcy Attorney

Practical Steps to Filing Bankruptcy to Stop Foreclosure

Prepare Necessary Documents

File Bankruptcy Petition

Navigate Post-filing Requirements and Procedures

Final Thoughts

How Bankruptcies Stop Foreclosure FAQs

The automatic stay is a provision in bankruptcy law that immediately halts most collection actions by creditors, including foreclosure, the moment a debtor files for bankruptcy.

Chapter 7 bankruptcy can temporarily halt the foreclosure process but doesn't provide a long-term solution for keeping one's home. Chapter 13 bankruptcy, however, allows the debtor to reorganize their debts and establish a repayment plan over three to five years, offering a potential long-term solution to retain the home.

Lien stripping is a process in Chapter 13 bankruptcy where a debtor can remove the second and subsequent mortgages if the home's value is less than the balance of the first mortgage. The stripped debts are treated as unsecured and can be discharged at the completion of the bankruptcy repayment plan.

While bankruptcy can halt the foreclosure process temporarily, it may not be a long-term solution for all homeowners. Bankruptcy can significantly impact the debtor's credit score, and the legal process can be complex and risky, with the potential for the court to not approve the bankruptcy filing or proposed repayment plan.

Before deciding to file for bankruptcy, it's crucial to thoroughly understand your financial situation, including income, debts, and assets. Consider your long-term financial goals, as bankruptcy can have long-term implications, like negatively impacting your credit score. Given the legal complexities involved, hiring a competent bankruptcy attorney is usually advisable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.