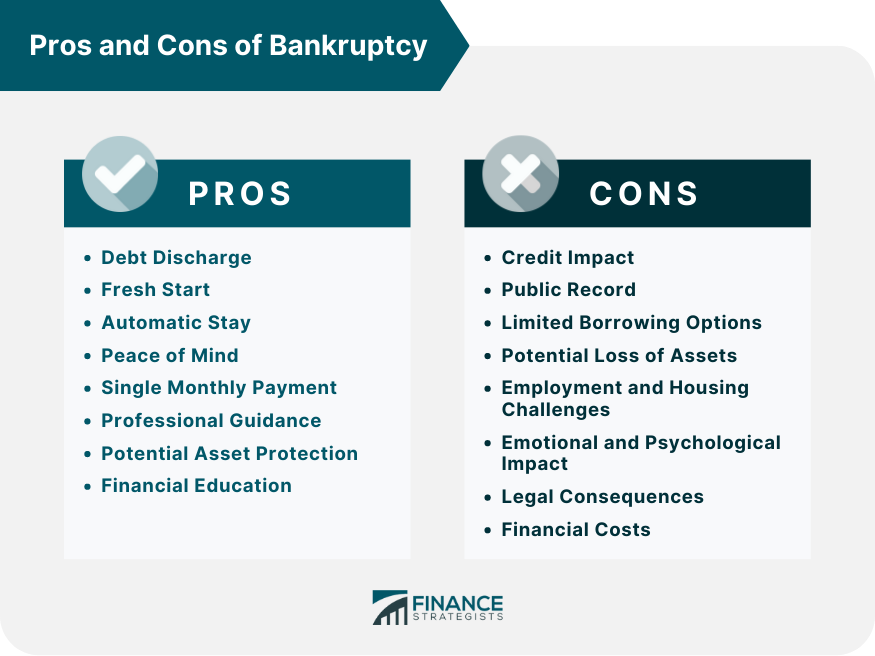

Bankruptcy presents both advantages and disadvantages for individuals and businesses facing overwhelming debt. On the positive side, bankruptcy offers significant benefits, including the discharge of most unsecured debts, providing a fresh start to rebuild financial lives. The automatic stay provision grants immediate protection from creditor actions, alleviating constant financial stress. Consolidating debts into a single monthly payment streamlines repayment, while professional guidance ensures informed decisions throughout the process. Moreover, bankruptcy laws provide potential asset protection and mandate financial education for future financial stability. However, individuals should be aware of the cons, such as the adverse impact on credit scores and the public record of the filing. Limited borrowing options and potential asset liquidation may also pose challenges. The emotional toll and potential restrictions on future filings are crucial considerations when evaluating bankruptcy. One significant advantage of bankruptcy is the discharge of most unsecured debts, such as credit card bills, medical bills, and personal loans. Filing for bankruptcy can provide a fresh start by wiping out these debts and relieving the burden on individuals and businesses. Bankruptcy offers individuals a chance to rebuild their financial lives. By eliminating or restructuring debts, bankruptcy can provide a clean slate to start anew, with the opportunity to develop healthier financial habits and work towards a more secure future. Upon filing for bankruptcy, an automatic stay is enacted, halting most creditor actions, including collection calls, wage garnishments, and lawsuits. This stay provides immediate relief, allowing individuals to focus on the bankruptcy process without the constant harassment from creditors. Dealing with overwhelming debt can cause significant emotional and psychological stress. Bankruptcy provides a sense of relief and peace of mind by eliminating the constant worry of how to meet financial obligations, allowing individuals to focus on rebuilding their lives. Bankruptcy allows individuals to consolidate their debts into a single monthly payment. This streamlines the repayment process, making it more manageable and easier to budget for, as individuals no longer need to juggle multiple payments to various creditors. Navigating the bankruptcy process can be complex and overwhelming. By working with bankruptcy attorneys and financial advisors, individuals can benefit from their expertise, ensuring they make informed decisions and maximize the benefits of bankruptcy. Bankruptcy laws provide exemptions for certain assets, allowing individuals to protect them from liquidation. This ensures that individuals can retain essential possessions, such as their primary residence, necessary vehicles, and personal belongings. Bankruptcy requires individuals to complete credit counseling and financial management courses. These educational resources help individuals gain valuable knowledge and skills to better manage their finances in the future, setting them on a path toward financial stability. One of the significant drawbacks of bankruptcy is its impact on credit scores. A bankruptcy filing remains on credit reports for several years, making it challenging to obtain credit or loans in the immediate aftermath. It can result in higher interest rates and limited borrowing options. Bankruptcy filings become public records, which means they are accessible to anyone who wishes to view them. This lack of privacy can lead to feelings of embarrassment or shame for some individuals. Following bankruptcy, individuals may find it challenging to secure new credit or loans. Lenders may view them as high-risk borrowers, leading to limited borrowing options and higher interest rates. In some cases, bankruptcy may require the liquidation of non-exempt assets to repay creditors. This can result in the loss of valuable possessions, such as secondary properties or luxury items, depending on the bankruptcy chapter filed. Bankruptcy may impact employment prospects, particularly in roles that require financial responsibility or trust. Additionally, it can affect renting options, as landlords may view bankruptcy as a red flag when considering potential tenants. Bankruptcy can have a significant emotional toll on individuals. The stigma associated with bankruptcy may lead to feelings of failure, shame, and embarrassment. It is crucial to address the emotional impact and seek support during and after the bankruptcy process. Bankruptcy laws impose restrictions on future bankruptcy filings. Depending on the type of bankruptcy previously filed, individuals may face waiting periods before they can file for bankruptcy again, limiting their options if they encounter financial difficulties in the future. Filing for bankruptcy incurs financial costs, including court filing fees and attorney fees. These expenses can add to the overall financial burden, particularly for individuals already struggling with debt. When considering bankruptcy, it is essential to evaluate several factors: Financial Situation: Assess the severity of the debt and income prospects Debt Type: Differentiate between secured and unsecured debts to determine their treatment in bankruptcy. Future Financial Goals: Evaluate long-term objectives and the impact bankruptcy may have on achieving them. Alternative Debt Relief Options: Explore alternatives such as debt consolidation or negotiation before opting for bankruptcy. Legal Guidance: Seek professional advice from bankruptcy attorneys to understand individual circumstances and navigate the complexities of bankruptcy laws. Bankruptcy offers both pros and cons that individuals and businesses must carefully evaluate before making a decision. The advantages of bankruptcy include the discharge of most unsecured debts, providing a fresh start to rebuild one's financial life, the automatic stay that protects individuals from creditor actions, and the consolidation of debts into a single manageable payment. Additionally, bankruptcy provides access to professional guidance, potential asset protection, and the opportunity to gain financial education. However, it's important to consider the negative aspects, such as the significant impact on credit scores, the public record nature of bankruptcy filings, limited borrowing options, potential loss of assets, employment and housing challenges, and emotional impact. Similarly, it includes legal consequences and associated financial costs. Individuals should carefully weigh these factors before deciding on the bankruptcy process. Individuals should assess their unique financial situation, consider alternative debt relief options, and seek legal guidance before deciding on bankruptcy.Overview of the Pros and Cons of Bankruptcy

Pros of Bankruptcy

Debt Discharge

Fresh Start

Automatic Stay

Peace of Mind

Single Monthly Payment

Professional Guidance

Potential Asset Protection

Financial Education

Cons of Bankruptcy

Credit Impact

Public Record

Limited Borrowing Options

Potential Loss of Assets

Employment and Housing Challenges

Emotional and Psychological Impact

Legal Consequences

Financial Costs

Considerations and Factors to Evaluate

Conclusion

Pros and Cons of Bankruptcy FAQs

The pros of bankruptcy include debt discharge, a fresh start, protection from creditor actions, peace of mind, and the consolidation of debts into a manageable plan.

The cons of bankruptcy include a significant impact on credit scores, bankruptcy filings becoming public records, limited borrowing options, potential loss of assets, and potential employment and housing challenges.

Bankruptcy filings can stay on your credit report for a significant period. Chapter 7 bankruptcy typically stays for ten years, while Chapter 13 bankruptcy stays for seven years.

Bankruptcy laws provide exemptions for certain assets, allowing individuals to retain them during the bankruptcy process. The specific exemptions vary by state.

Yes, there are alternatives to bankruptcy. Debt consolidation, debt management plans, negotiating with creditors, and seeking assistance from credit counseling agencies are some options to manage and reduce debt without filing for bankruptcy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.